Automotive Ethernet Market

Automotive Ethernet Market Size, Share &Trends Analysis Report by Component (Hardware and Software & Services), by Bandwidth (10 Mbps, 100 Mbps, 1 Gbps, 2.5/5/10 Gbps, and Others), by Vehicle Type (Passenger Vehicle, Commercial Vehicle, and Others), and by Application (Chassis, Infotainment, Powertrain, Driver Assistance, Body & Comfort, and Others) Forecast Period (2023-2029)

Automotive ethernet market is anticipated to grow at a CAGR of 21.8% during the forecast period. An ethernet network with a physical layer customized for usage in the car industry is known as automotive ethernet. The increase in demand for luxury vehicles will propel the growth prospects for the global automotive ethernet market in the upcoming years. There is a considerable increase in the demand for premium vehicles across the globe, owing to the rapidly growing per capita income of the global population. According to Trading Economics, in 2021, BMW was the leading luxury car brand in the US, recording sales of over 336,600 units. The key competitor of the company is Tesla whose sales were recorded at around 313,400 units in 2021.

However, the complexity of migration from conventional in-vehicle connectivity technologies to ethernet is a significant restraint factor in the ethernet industry. The automotive ethernet market faces obstacles such as interoperability among components and application computability, as well as a proliferation of security threats.

Segmental Outlook

The global automotive ethernet market is segmented based on the component, bandwidth, vehicle type, and application. Based on the component, the market is segmented into hardware and software & services. Based on the bandwidth, the market is sub-segmented into 10 Mbps, 100 Mbps, 1 Gbps, 2.5/5/10 Gbps, and others. Based on the vehicle type, the market is segmented into passenger vehicle, commercial vehicle, and others. Further, based on the application, the market is sub-segmented into chassis, infotainment, powertrain, driver assistance, body & comfort, and others. Among these, the Among the bandwidth, the 1 Gbps sub-segment is anticipated to hold a significant share of the global automotive ethernet market, owing to the rising demand for high-speed connectivity in cars.

Driver Assistance Sub-Segment is Anticipated to Hold Prominent Share in the Global Automotive Ethernet Market

Among the application, the driver assistance sub-segment is anticipated to hold a prominent share of the global automotive ethernet market, owing to the increasing demand for advanced driver assistance systems (ADAS). There is a significant increase in the demand for autonomous driving which requires HD maps with road-based information such as signs, sizes, and others. For uninterrupted working of these HD maps, ethernet is required to transfer data stored in sensors. Furthermore, government regulations revolving around safety and security are also major drivers for the growth of automotive ethernet. While many of these systems are embedded in current models of cars, some of them will become mandatory as they contribute towards road safety. For instance, in March 2021, the European Commission announced a new rule to make Intelligent Speed Assistance (ISA) mandatory for all newly manufactured light vehicles starting in 2020.

Regional Outlooks

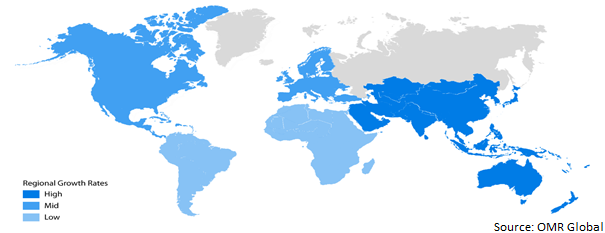

The global automotive ethernet market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for particular region or country level as per the requirement. Among these, Europe and North America is anticipated to dominate the global automotive ethernet market across the globe due to the strong presence of several key players such as Broadcom Inc., Marvell Technology Group Ltd., and others.

Global Automotive Ethernet Market Growth, by Region 2023-2029

The Asia-Pacific Region is Expected to Hold a considerable Share of the Global Automotive Ethernet Market

Among all regions, the Asia-Pacific region is expected to hold a considerable share of the global automotive ethernet market over the forecast period. The primary factor bolstering the growth of the regional market growth include the growing consumption and demand for connected and autonomous vehicles. Countries including India, China, Japan, South Korea, and others had witnessed faster growth of Gross Domestic Product (GDP) over the past few years, which directly increases the purchase of passenger vehicles across the region. Thus, the increased production of passenger vehicles is another factor spurring the regional market growth. Furthermore, several major automakers such as Mercedes Benz, Ford, and others are planning to expand their presence, manufacturing capacity, and output in nations including India, which will further bolster the market growth in the Asia-Pacific. For instance, in May 2019, MG (Morris Garages) Motor unveiled the Hector in India. It is India’s first internet car with more than 50 connected features. It has also expanded its network to 250 outlets by September 2020.

Market Players Outlook

The major companies serving the global automotive ethernet market include Aukua Systems, Broadcom Inc., Cadence Design Systems, Inc, Keysight Technologies, Marvell Semiconductor, Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in February 2020, NXP Electronics, a supplier of automotive semiconductors introduced a "multi-gigabit ethernet switch". The switch was created to assist automakers in providing the high-speed network required for fully integrated linked vehicles. Such a product improvement may potentially further fuel the growth of the component segment during the forecast period.

The Report Covers

- Market value data analysis of 2023 and forecast to 2029.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automotive ethernet market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Automotive Ethernet Market by Component

4.1.1. Hardware

4.1.2. Software & Services

4.2. Global Automotive Ethernet Market by Bandwidth

4.2.1. 10 Mbps

4.2.2. 100 Mbps

4.2.3. 1 Gbps

4.2.4. 2.5/5/10 Gbps

4.2.5. Others

4.3. Global Automotive Ethernet Market by Vehicle Type

4.3.1. Passenger Car

4.3.2. Commercial Vehicles

4.3.3. Others

4.4. Global Automotive Ethernet Market by Application

4.4.1. Chassis

4.4.2. Infotainment

4.4.3. Powertrain

4.4.4. Driver Assistance

4.4.5. Body and Comfort

4.4.6. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Aukua Systems

6.2. Broadcom Inc.

6.3. Cadence Design Systems, Inc.

6.4. Keysight Technologies

6.5. Marvell Semiconductor, Inc.

6.6. Marvell Technology Group Ltd.

6.7. Microchip Technology Inc.

6.8. Molex

6.9. NXP Semiconductors N. V.

6.10. Texas Instruments Inc.

6.11. Vector Informatik GmbH

1. GLOBAL AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2029 ($ MILLION)

2. GLOBAL HARDWARE FOR AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

3. GLOBAL SOFTWARE & SERVICES FOR AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

4. GLOBAL AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY BANDWIDTH, 2021-2029 ($ MILLION)

5. GLOBAL AUTOMOTIVE ETHERNET OF 10 MBPS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

6. GLOBAL AUTOMOTIVE ETHERNET OF 100 MBPS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

7. GLOBAL AUTOMOTIVE ETHERNET OF 1 GBPS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

8. GLOBAL AUTOMOTIVE ETHERNET OF 2.5/5/10 GBPS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

9. GLOBAL AUTOMOTIVE ETHERNET OF OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

10. GLOBAL AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2029 ($ MILLION)

11. GLOBAL AUTOMOTIVE ETHERNET FOR PASSENGER VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

12. GLOBAL AUTOMOTIVE ETHERNET FOR COMMERCIAL VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

13. GLOBAL AUTOMOTIVE ETHERNET FOR OTHER VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

14. GLOBAL AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2029 ($ MILLION)

15. GLOBAL AUTOMOTIVE ETHERNET FOR CHASSIS VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

16. GLOBAL AUTOMOTIVE ETHERNET FOR INFOTAINMENT VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

17. GLOBAL AUTOMOTIVE ETHERNET FOR POWERTRAIN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

18. GLOBAL AUTOMOTIVE ETHERNET FOR DRIVER ASSISTANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

19. GLOBAL AUTOMOTIVE ETHERNET FOR BODY AND COMFORT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

20. GLOBAL AUTOMOTIVE ETHERNET FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

21. GLOBAL AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2029 ($ MILLION)

22. NORTH AMERICAN AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2029 ($ MILLION)

23. NORTH AMERICAN AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2029 ($ MILLION)

24. NORTH AMERICAN AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY BANDWIDTH, 2021-2029 ($ MILLION)

25. NORTH AMERICAN AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2029 ($ MILLION)

26. NORTH AMERICAN AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2029 ($ MILLION)

27. EUROPEAN AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2029 ($ MILLION)

28. EUROPEAN AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2029 ($ MILLION)

29. EUROPEAN AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY BANDWIDTH, 2021-2029 ($ MILLION)

30. EUROPEAN AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2029 ($ MILLION)

31. EUROPEAN AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2029 ($ MILLION)

32. ASIA-PACIFIC AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2029 ($ MILLION)

33. ASIA-PACIFIC AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2029 ($ MILLION)

34. ASIA-PACIFIC AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY BANDWIDTH, 2021-2029 ($ MILLION)

35. ASIA-PACIFIC AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2029 ($ MILLION)

36. ASIA-PACIFIC AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2029 ($ MILLION)

37. REST OF THE WORLD AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2029 ($ MILLION)

38. REST OF THE WORLD AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2029 ($ MILLION)

39. REST OF THE WORLD AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY BANDWIDTH, 2021-2029 ($ MILLION)

40. REST OF THE WORLD AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2029 ($ MILLION)

41. REST OF THE WORLD AUTOMOTIVE ETHERNET MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2029 ($ MILLION)

1. GLOBAL AUTOMOTIVE ETHERNET MARKET SHARE BY COMPONENT, 2021 VS 2029 (%)

2. GLOBAL HARDWARE FOR AUTOMOTIVE ETHERNET MARKET SHARE BY REGION, 2021 VS 2029 (%)

3. GLOBAL SOFTWARE & SERVICES FOR AUTOMOTIVE ETHERNET MARKET SHARE BY REGION, 2021 VS 2029 (%)

4. GLOBAL AUTOMOTIVE ETHERNET MARKET SHARE BY BANDWIDTH, 2021 VS 2029 (%)

5. GLOBAL AUTOMOTIVE ETHERNET OF 10 MBPS MARKET SHARE BY REGION, 2021 VS 2029 (%)

6. GLOBAL AUTOMOTIVE ETHERNET OF 100 MBPS MARKET SHARE BY REGION, 2021 VS 2029 (%)

7. GLOBAL AUTOMOTIVE ETHERNET OF 1 GBPS MARKET SHARE BY REGION, 2021 VS 2029 (%)

8. GLOBAL AUTOMOTIVE ETHERNET OF 2.5/5/10 GBPS MARKET SHARE BY REGION, 2021 VS 2029 (%)

9. GLOBAL AUTOMOTIVE ETHERNET OF OTHER BANDWIDTHS MARKET SHARE BY REGION, 2021 VS 2029 (%)

10. GLOBAL AUTOMOTIVE ETHERNET MARKET SHARE BY VEHICLE TYPE, 2021 VS 2029 (%)

11. GLOBAL AUTOMOTIVE ETHERNET FOR PASSENGER VEHICLE MARKET SHARE BY REGION, 2021 VS 2029 (%)

12. GLOBAL AUTOMOTIVE ETHERNET FOR COMMERCIAL VEHICLE MARKET SHARE BY REGION, 2021 VS 2029 (%)

13. GLOBAL AUTOMOTIVE ETHERNET FOR OTHER VEHICLES MARKET SHARE BY REGION, 2021 VS 2029 (%)

14. GLOBAL AUTOMOTIVE ETHERNET MARKET SHARE BY APPLICATION, 2021 VS 2029 (%)

15. GLOBAL AUTOMOTIVE ETHERNET FOR CHASSIS MARKET SHARE BY REGION, 2021 VS 2029 (%)

16. GLOBAL AUTOMOTIVE ETHERNET FOR INFOTAINMENT MARKET SHARE BY REGION, 2021 VS 2029 (%)

17. GLOBAL AUTOMOTIVE ETHERNET FOR POWERTRAIN MARKET SHARE BY REGION, 2021 VS 2029 (%)

18. GLOBAL AUTOMOTIVE ETHERNET FOR DRIVER ASSISTANCE MARKET SHARE BY REGION, 2021 VS 2029 (%)

19. GLOBAL AUTOMOTIVE ETHERNET FOR BODY AND COMFORT MARKET SHARE BY REGION, 2021 VS 2029 (%)

20. GLOBAL AUTOMOTIVE ETHERNET FOR OTHER APPLICATIONS MARKET SHARE BY REGION, 2021 VS 2029 (%)

21. GLOBAL AUTOMOTIVE ETHERNET MARKET SHARE BY REGION, 2021 VS 2029 (%)

22. US AUTOMOTIVE ETHERNET MARKET SIZE, 2021-2029 ($ MILLION)

23. CANADA AUTOMOTIVE ETHERNET MARKET SIZE, 2021-2029 ($ MILLION)

24. UK AUTOMOTIVE ETHERNET MARKET SIZE, 2021-2029 ($ MILLION)

25. FRANCE AUTOMOTIVE ETHERNET MARKET SIZE, 2021-2029 ($ MILLION)

26. GERMANY AUTOMOTIVE ETHERNET MARKET SIZE, 2021-2029 ($ MILLION)

27. ITALY AUTOMOTIVE ETHERNET MARKET SIZE, 2021-2029 ($ MILLION)

28. SPAIN AUTOMOTIVE ETHERNET MARKET SIZE, 2021-2029 ($ MILLION)

29. REST OF EUROPE AUTOMOTIVE ETHERNET MARKET SIZE, 2021-2029 ($ MILLION)

30. INDIA AUTOMOTIVE ETHERNET MARKET SIZE, 2021-2029 ($ MILLION)

31. CHINA AUTOMOTIVE ETHERNET MARKET SIZE, 2021-2029 ($ MILLION)

32. JAPAN AUTOMOTIVE ETHERNET MARKET SIZE, 2021-2029 ($ MILLION)

33. SOUTH KOREA AUTOMOTIVE ETHERNET MARKET SIZE, 2021-2029 ($ MILLION)

34. REST OF ASIA-PACIFIC AUTOMOTIVE ETHERNET MARKET SIZE, 2021-2029 ($ MILLION)

35. REST OF THE WORLD AUTOMOTIVE ETHERNET MARKET SIZE, 2021-2029 ($ MILLION)