Automotive Financing Services Market

Automotive Financing Services Market Size, Share & Trends Analysis by Vehicle Condition (New Vehicles, Used Vehicles), by Provider (OEMs, Banks, Others), by Vehicle Type (Passenger Vehicles, Commercial Vehicles), and Forecast Period (2025-2035)

Industry Overview

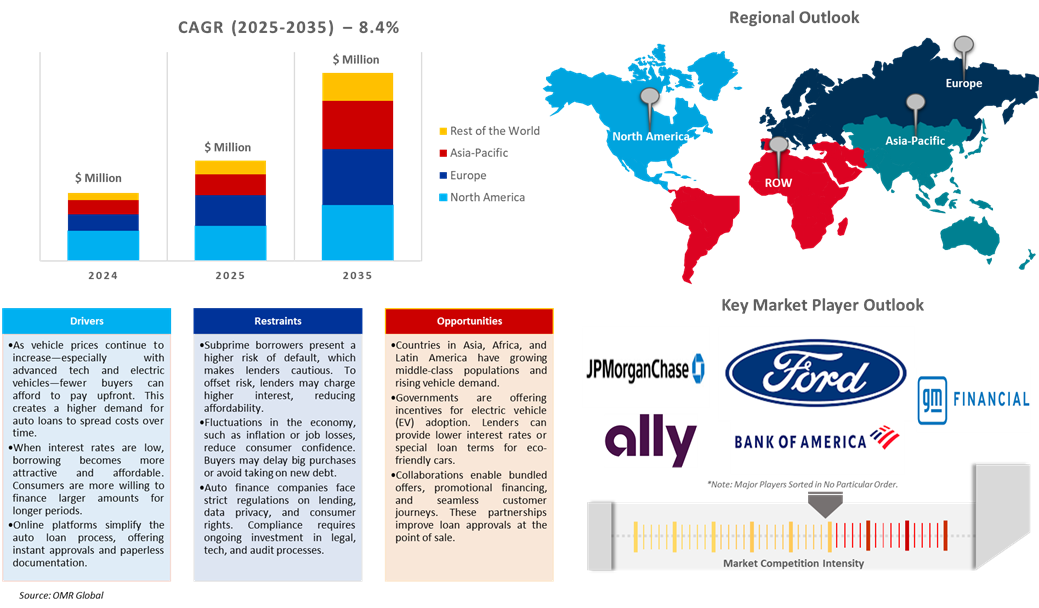

Global automotive financing services market was valued at $295.13 billion in 2024 and is projected to reach $473.86 billion by 2030, and $717.33 billion by 2035 with a growing CAGR of 8.4% during the forecast period (2025-2035). Automobiles are expensive products that a middle- or lower-income person cannot purchase with a single payment. Thus, the financing institutes provide a buy now, pay later facility to vehicle purchasers with simple interest rates. The growing vehicle sales (including agricultural, transportation, and other vehicles) are the major driving factor for the automotive financing services market. Online financing services are expected to drive the market during the forecast period with the rising mobile and internet penetration across the globe. The hassle-free, quick, and without guarantee financing services are the emerging trends in the market that attract most customers. Market players are offering a variety of such services which can satisfy these varying needs of customers. Financing services with consultancy are gaining popularity, which can recommend the best vehicle that suits their requirement. The rising trend of cab services, EVs, and autonomous vehicles will generate new opportunities for the automotive financing services market shortly. The increasing R&D investments for electric and autonomous vehicles are expected to drive the growth of the market during the forecast period.

Market Dynamics

Increasing prices of automotive

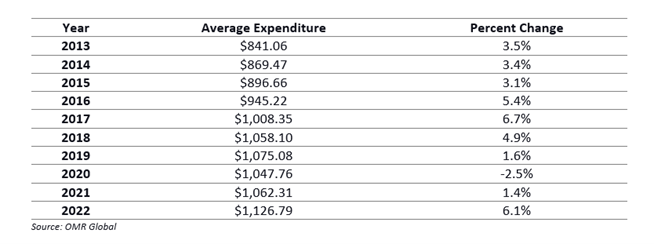

The prices of automobiles in past years have increased significantly due to various reasons such as rising costs of raw materials like steel, aluminum, and lithium (critical for EV batteries) have pushed manufacturing expenses higher. Automakers are also incorporating more advanced technology, safety features, and electrification components, also there is rising inflation which contributes to increasing auto prices. In the US, the price of new cars has increased due to higher production costs. The average price of a new vehicle was up 4.2% year-over-year in January 2023. This has fueled demand for used cars, with average prices tracking around 30% above pre-pandemic levels. With the increase in the prices, the consumer is looking toward the finance options to afford the vehicle of his choice. Additionally, the average auto insurance expenditure increased 6.1% to $1,127 in 2022 from $1,062 in 2021, according to the National Association of Insurance Commissioners. In 2022, the average expenditure was highest in Florida ($1,625), followed by Louisiana ($1,558), and New York ($1,549).

Average Expenditures for Auto Insurance, 2013-2022

Market Segmentation

- Based on the vehicle condition, the market is segmented into new vehicles and used vehicles.

- Based on the provider, the market is segmented into OEMs, banks, and others.

- Based on the vehicle type, the market is segmented into passenger vehicles and commercial vehicles.

The New Vehicles Segment Holds the Major Share in the Global Automotive Financing Services Market

Based on vehicle condition, the new vehicles hold the major share in the automotive financing services market as most of the used vehicles are purchased without financing. However, now used vehicles are gaining popularity amongst customers, and its market is expected to witness the fastest growth during the forecast period. Innovations in vehicle technology, particularly connected cars and advanced safety systems, are increasing demand for financing options to cover their higher prices. Similarly, modern safety technologies, such as automatic braking and lane-keeping assistance, enhance vehicle appearance. As consumers seek these high-tech options, lenders need to provide flexible financing solutions to make these vehicles more accessible and affordable for buyers.

The bank segment holds a prominent share in Automotive Financing Services.

Based on the provider, the bank segment holds a prominent share in the market as banks are more reliable than other service providers and also offer financing at lower interest rates. Banks offer a variety of financing options, such as leases, loans, and subscription services, allowing banks to effectively meet the different needs and preferences of their customers. Leases are ideal for consumers who prefer lower monthly payments and the opportunity to drive new vehicles every few years without the commitment of ownership. By providing tailored solutions, banks enhance customer satisfaction and expand their market reach, encourage loyalty, and increase overall revenue.

Regional Outlook

The global automotive financing services market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and the Rest of Asia-Pacific), Asia-Pacific (India, China, Japan, and Rest of Asia-Pacific), and the Rest of the World (the Middle East and Africa, and Latin America).

Asia-Pacific Contributes a Prominent Share in the Global Automotive Financing Services Market.

The Asia-Pacific region holds a prominent share in the automotive financing services market, as the region is the hub of automotive manufacturing. According to the OICA, around 44.3 million vehicles were produced in the Asia-Pacific region in 2020, which is around 57.0% of global vehicle production. China, Japan, and India are the major contributors to the regional market. The supportive government subsidies for production as well as the purchase of automotive vehicles are the major driving factors for the growth of the automotive financing services market in the region. Used cars are expected to grow fastest in the region, due to their increasing demand. North America and the European regions follow Asia-Pacific in market share. The sales of luxury cars are the major driver in the market of North America and Europe.

Market Players Outlook

The key players in the automotive financing services market contribute significantly by providing different types of services and increasing their geographical presence across the globe. The key players in the market include Ally Finanacial Inc., Bank of America, N.A., Ford Motor Company, General Motors Financial Company, Inc., JPMorgan Chase & Co., and others. The market players are considerably contributing to market growth by adopting various strategies, including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market.

Recent Developments

- In February 2023, Solifi partnered with One Auto API to enhance its DataDirect vehicle data services in the UK. This collaboration introduces a pay-per-use platform that provides retail, fleet, dealer, and insurance customers with streamlined access to comprehensive vehicle data from multiple sources via a single API. The partnership aims to improve real-time data usage for accurate and informed vehicle decisions to provide customers with better financing options.

- In March 2022, CIG Motors partnered with Polaris Bank for auto ownership. The company has introduced ‘Easy Buy’, an affordable vehicle finance scheme meant to make vehicle acquisition and ownership easier for customers.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automotive financing services market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Automotive Financing Services Market Sales Analysis – Vehicle Condition | Provider | Vehicle Type ($ Million)

• Automotive Financing Services Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Automotive Financing Services Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Automotive Financing Services Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Automotive Financing Services Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Automotive Financing Services Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Automotive Financing Services Market Revenue and Share by Manufacturers

• Automotive Financing Services Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Ally Finanacial Inc.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Bank of America, N.A.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Ford Motor Company

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. General Motors Financial Company, Inc.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Automotive Financing Services Market Sales Analysis by Vehicle Condition ($ Million)

5.1. New Vehicles

5.2. Used Vehicles

6. Global Automotive Financing Services Market Sales Analysis by Provider ($ Million)

6.1. OEMs

6.2. Banks

6.3. Others

7. Global Automotive Financing Services Market Sales Analysis by Vehicle Type ($ Million)

7.1. Passenger Vehicles

7.2. Commercial Vehicles

8. Regional Analysis

8.1. North American Automotive Financing Services Market Sales Analysis – Vehicle Condition | Provider | Vehicle Type | Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Automotive Financing Services Market Sales Analysis – Vehicle Condition | Provider | Vehicle Type | Country ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Automotive Financing Services Market Sales Analysis – Vehicle Condition | Provider | Vehicle Type | Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Automotive Financing Services Market Sales Analysis – Vehicle Condition | Provider | Vehicle Type | Country ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Bajaj Auto Credit Ltd.

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. BMW Financial Services

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. BNP Paribas SA

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Capital One Financial Corp.

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. HDFC Securities Ltd

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Honda Federal Credit Union

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. Industrial and Commercial Bank of China (Asia) Limited.

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. JPMorgan Chase & Co.

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Mahindra Finance

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. Mercedes-Benz Financial Services

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Mitsubishi HC Capital Asia Pacific Pte. Ltd.

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. Nissan Motor Acceptance Company LLC

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. Santander Consumer USA Inc.

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Standard Bank Group Ltd.

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Tata Motors Finance Ltd.

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. TD Bank Group

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. Toyota Financial Services.

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Volkswagen Group of America, Inc.

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. Volvo Financial Services

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. Wells Fargo.

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

1. Global Automotive Financing Services Market Research And Analysis By Vehicle Condition, 2024-2035 ($ Million)

2. Global New Vehicles Financing Services Market Share Analysis By Region, 2024-2035 ($ Million)

3. Global Used Vehicles Financing Services Market Share Analysis By Region, 2024-2035 ($ Million)

4. Global Automotive Financing Services Market Research And Analysis By Provider, 2024-2035 ($ Million)

5. Global Automotive Financing Services By OEMs Market Share Analysis By Region, 2024-2035 ($ Million)

6. Global Automotive Financing Services By Banks Market Share Analysis By Region, 2024-2035 ($ Million)

7. Global Automotive Financing Services By Others Market Share Analysis By Region, 2024-2035 ($ Million)

8. Global Automotive Financing Services Market Research And Analysis By Vehicle Type, 2024-2035 ($ Million)

9. Global Passenger Vehicles Financing Services Market Share Analysis By Region, 2024-2035 ($ Million)

10. Global Commercial Vehicles Financing Services Market Share Analysis By Region, 2024-2035 ($ Million)

11. Global Automotive Financing Services Market Research And Analysis By Geography, 2024-2035 ($ Million)

12. North American Automotive Financing Services Market Research And Analysis By Country, 2024-2035 ($ Million)

13. North American Automotive Financing Services Market Research And Analysis By Vehicle Condition, 2024-2035 ($ Million)

14. North American Automotive Financing Services Market Research And Analysis By Provider, 2024-2035 ($ Million)

15. North American Automotive Financing Services Market Research And Analysis By Vehicle Type, 2024-2035 ($ Million)

16. European Automotive Financing Services Market Research And Analysis By Country, 2024-2035 ($ Million)

17. European Automotive Financing Services Market Research And Analysis By Vehicle Condition, 2024-2035 ($ Million)

18. European Automotive Financing Services Market Research And Analysis By Provider, 2024-2035 ($ Million)

19. European Automotive Financing Services Market Research And Analysis By Vehicle Type, 2024-2035 ($ Million)

20. Asia-Pacific Automotive Financing Services Market Research And Analysis By Country, 2024-2035 ($ Million)

21. Asia-Pacific Automotive Financing Services Market Research And Analysis By Vehicle Condition, 2024-2035 ($ Million)

22. Asia-Pacific Automotive Financing Services Market Research And Analysis By Provider, 2024-2035 ($ Million)

23. Asia-Pacific Automotive Financing Services Market Research And Analysis By Vehicle Type, 2024-2035 ($ Million)

24. Rest Of The World Automotive Financing Services Market Research And Analysis By Vehicle Condition, 2024-2035 ($ Million)

25. Rest Of The World Automotive Financing Services Market Research And Analysis By Provider, 2024-2035 ($ Million)

26. Rest Of The World Automotive Financing Services Market Research And Analysis By Vehicle Type, 2024-2035 ($ Million)

1. Global Automotive Financing Services Market Share By Vehicle Condition, 2024 Vs 2035 (%)

2. Global New Vehicles Financing Services Market Share Analysis By Region, 2024 Vs 2035 (%)

3. Global Used Vehicles Financing Services Market Share Analysis By Region, 2024 Vs 2035 (%)

4. Global Automotive Financing Services Market Share By Provider, 2024 Vs 2035 (%)

5. Global Automotive Financing Services By OEMs Market Share Analysis By Region, 2024 Vs 2035 (%)

6. Global Automotive Financing Services By Banks Market Share Analysis By Region, 2024 Vs 2035 (%)

7. Global Automotive Financing Services By Others Market Share Analysis By Region, 2024 Vs 2035 (%)

8. Global Automotive Financing Services Market Share By Vehicle Type, 2024 Vs 2035 (%)

9. Global Passenger Vehicles Financing Services Market Share Analysis By Region, 2024 Vs 2035 (%)

10. Global Commercial Vehicles Financing Services Market Share Analysis By Region, 2024 Vs 2035 (%)

11. Global Passenger Vehicles Market Region By Geography, 2024 Vs 2035 (%)

12. Global Commercial Vehicles Market Region By Geography, 2024 Vs 2035 (%)

13. Global Automotive Financing Services Market Share By Geography, 2024 Vs 2035 (%)

14. US Automotive Financing Services Market Size, 2024-2035 ($ Million)

15. Canada Automotive Financing Services Market Size, 2024-2035 ($ Million)

16. UK Automotive Financing Services Market Size, 2024-2035 ($ Million)

17. France Automotive Financing Services Market Size, 2024-2035 ($ Million)

18. Germany Automotive Financing Services Market Size, 2024-2035 ($ Million)

19. Italy Automotive Financing Services Market Size, 2024-2035 ($ Million)

20. Spain Automotive Financing Services Market Size, 2024-2035 ($ Million)

21. Rest Of Europe Automotive Financing Services Market Size, 2024-2035 ($ Million)

22. India Automotive Financing Services Market Size, 2024-2035 ($ Million)

23. China Automotive Financing Services Market Size, 2024-2035 ($ Million)

24. Japan Automotive Financing Services Market Size, 2024-2035 ($ Million)

25. South Korea Automotive Financing Services Market Size, 2024-2035 ($ Million)

26. ASEAN Economies Automotive Financing Services Market Size, 2024-2035 ($ Million)

27. Rest Of Asia-Pacific Automotive Financing Services Market Size, 2024-2035 ($ Million)

28. Rest Of The World Automotive Financing Services Market Size, 2024-2035 ($ Million)

FAQS

The size of the Automotive Financing Services market in 2024 is estimated to be around $295.13 billion.

Asia-Pacific holds the largest share in the Automotive Financing Services market.

Leading players in the Automotive Financing Services market include Ally Finanacial Inc., Bank of America, N.A., Ford Motor Company, General Motors Financial Company, Inc., JPMorgan Chase & Co., and others.

Automotive Financing Services market is expected to grow at a CAGR of 8.4% from 2025 to 2035.

The automotive financing services market is driven by rising vehicle prices, digital lending platforms, and growing demand for flexible, EV-friendly financing solutions.