Automotive Motors Market

Global Automotive Motors Market Size, Share & Trends Analysis Report by Type (Brushless DC Motor & Stepper Motor, Brushed DC Motor, AC Induction Motor, and Others), By Vehicle Type (Passenger Vehicles, Commercial Vehicles, and Electric Vehicles), By Distribution Channel (OEM and Aftermarket) Forecast, 2020-2026

The global automotive motors market is projected to grow at a significant CAGR of around 8.5% during the forecast period. The key factors that drive the global automotive motors market include the increased need for safety features and convenience. The automotive motors are highly utilized for applications such as the HVAC system, electric power steering, power windows, and side mirrors among others. Thus, with the increase in the demand for these applications, the market is projected to witness an upsurge over the forecast period. Further, the increased demand for the vehicles is directly proportional to the sales of automotive motors, thus, this in turn will drive the growth of the global automotive motors market. Moreover, the rapid advancements in vehicles along with their electrification also drives the growth of the market. However, the higher costs and fluctuating prices of motors are likely to challenge the market growth. Besides, a negative impact of COVID-19 on the automotive industry and so the automotive motor market is also witnessed in 2020 all across the globe, which is also restricting market growth.

Segmental Outlook

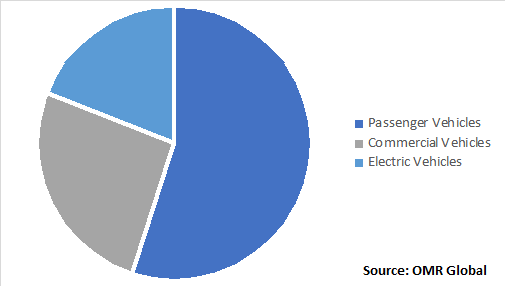

The global automotive motors market has been segmented into type, vehicle type, and distribution channel. Based on the type, the market has been sectioned as brushless dc motor & stepper motor, brushed dc motor, ac induction motor, and others. By vehicle type, the market is segmented into passenger vehicles, commercial vehicles, and electric vehicles. Commercial vehicles segment is further sub-segmented into light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and others. Whereas, the electric vehicles segment is further sub-segmented into battery electric vehicles (BEVs), plug-in electric vehicles (PEVs), and hybrid electric vehicles (HEVs). Based on the distribution channel, the market is segmented as OEM and aftermarket.

Electric Vehicle Segment to Register Significant Market Growth

Amongst the vehicle type segment, the electric vehicles segment is estimated to show significant growth over the forecast period. The electric vehicles segment is sub-segmented into battery electric vehicles (BEVs), plug-in electric vehicles (PEVs), and hybrid electric vehicles (HEVs). The segmental growth of the market is accredited to the rising adoption of electric vehicles globally. The need for clean energy and the need to cut carbon emissions from internal combustion engines has led to the development of new drive systems. The development of hybrid cars has greatly reduced the emission level of vehicles. The purely electrical vehicles can be 100% clean and their deployment is of great importance. Therefore, these vehicles replace the internal combustion engine in conventional cars and automobiles with electric motors. Hence, the need for highly improved motors that can perform optimally is likely to increase in the near future.

Global Automotive Motors Market, by Vehicle Type 2019 (%)

Regional Outlook

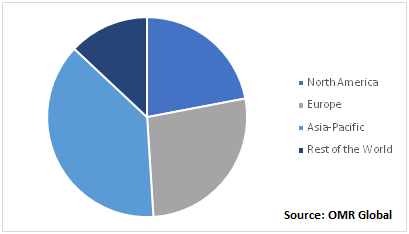

The global automotive motors market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. Asia-Pacific region is estimated to grow significantly during the forecast period. The regional growth of the market is accredited to several campaigns, initiatives, and government subsidies encouraging the adoption of an electric vehicle. Economies such as China, India, Japan, and South Korea are fueling the industry growth of the regional market. Additionally, initiatives such as EV30@30 are also driving the rapid adoption of EVs across the major economies of Asia-Pacific. Further, the European region is also likely to witness a significant growth rate over the forecast period attributing to the high expenditure by the government as well as private organizations for the adoption of electric vehicles. The region has a well-developed infrastructure and has witnessed the huge adoption of advanced products for comfort and convenience, thereby, this drives the growth of the market over the forecast period.

Global Automotive Motors Market, by Region 2019 (%)

Market Players Outlook

The prominent players functioning in the global automotive motors market include Siemens AG, Nidec Corp., Robert Bosch GmbH, Continental AG, Johnson Electric Holdings Ltd., Mahle GmbH, Mitsubishi Electric Corp., and among others. These are the key companies adopting several organic and inorganic growth strategies such as product launches & developments, partnerships, agreements, and acquisitions to strengthen their product portfolios and maintain a competitive position in the global automotive motors market. For instance, in January 2020, BorgWarner announced to acquire Delphi Technologies in an all-stock transaction for around $3.3 billion. With this acquisition, the company is likely to strengthen its power electronics products, capabilities, and scale.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automotive motors market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Siemens AG

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Tesla Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Continental AG

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Robert Bosch GmbH

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Valeo SA

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Automotive Motors Market by Type

5.1.1. Brushless DC Motor&Stepper Motor

5.1.2. Brushed DC Motor

5.1.3. AC Induction Motor

5.1.4. Others

5.2. Global Automotive Motors Market by Vehicle Type

5.2.1. Passenger Vehicles

5.2.2. Commercial Vehicles

5.2.2.1. Light Commercial Vehicles (LCVs)

5.2.2.2. Heavy Commercial Vehicles (HCVs)

5.2.2.3. Others (Buses & Coaches)

5.2.3. Electric Vehicles

5.2.3.1. Battery Electric Vehicles (BEVs)

5.2.3.2. Plug-in Electric Vehicles (PEVs)

5.2.3.3. Hybrid Electric Vehicles (HEVs)

5.3. Global Automotive Motors Market by Distribution Channel

5.3.1. OEM

5.3.2. Aftermarket

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ABB Ltd.

7.2. Borgwarner Inc.

7.3. Brose Fahrzeugteile SE & Co. KG

7.4. Buhler Motor GmbH

7.5. BYD Auto Co., Ltd.

7.6. Continental AG

7.7. Denso Corp.

7.8. Inmotion Technologies AB

7.9. Johnson Electric Holdings Ltd.

7.10. Mabuchi Motors Co. Ltd

7.11. Magna International Inc.

7.12. Magneti Marelli S.p.A.

7.13. Mahle GmbH

7.14. Mitsuba Corp.

7.15. Mitsubishi Electric Corp.

7.16. Nidec Corp.

7.17. Ricardo Plc

7.18. Robert Bosch GmbH

7.19. Siemens AG

7.20. Tesla Inc.

7.21. Toshiba Corp.

7.22. Valeo SA

7.23. Yamaha Motor Co.

1. GLOBAL AUTOMOTIVE MOTORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL BRUSHLESS DC &STEPPER MOTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL BRUSHED DC MOTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL AC INDUCTION MOTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL AUTOMOTIVE MOTORS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

7. GLOBAL PASSENGER VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL COMMERCIAL VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL COMMERCIAL VEHICLES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

10. GLOBAL LIGHT COMMERCIAL VEHICLES (LCVS) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL HEAVY COMMERCIAL VEHICLES (HCVS) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL OTHERS (BUSES & COACHES)MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL ELECTRIC VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL ELECTRIC VEHICLES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

15. GLOBAL BATTERY ELECTRIC VEHICLES (BEVS) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

16. GLOBAL PLUG-IN ELECTRIC VEHICLES (PEVS) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

17. GLOBAL HYBRID ELECTRIC VEHICLES (HEVS) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

18. GLOBAL AUTOMOTIVE MOTORS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNELS, 2019-2026 ($ MILLION)

19. GLOBAL OEM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

20. GLOBAL AFTER MARKET MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

21. GLOBAL AUTOMOTIVE MOTORS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

22. NORTH AMERICAN AUTOMOTIVE MOTORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

23. NORTH AMERICAN AUTOMOTIVE MOTORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

24. NORTH AMERICAN AUTOMOTIVE MOTORS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

25. NORTH AMERICAN AUTOMOTIVE MOTORS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNELS, 2019-2026 ($ MILLION)

26. EUROPEAN AUTOMOTIVE MOTORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

27. EUROPEAN AUTOMOTIVE MOTORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

28. EUROPEAN AUTOMOTIVE MOTORS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

29. EUROPEAN AUTOMOTIVE MOTORS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNELS, 2019-2026 ($ MILLION)

30. ASIA-PACIFIC AUTOMOTIVE MOTORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

31. ASIA-PACIFIC AUTOMOTIVE MOTORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

32. ASIA-PACIFIC AUTOMOTIVE MOTORS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

33. ASIA-PACIFIC AUTOMOTIVE MOTORS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNELS, 2019-2026 ($ MILLION)

34. REST OF THE WORLD AUTOMOTIVE MOTORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

35. REST OF THE WORLD AUTOMOTIVE MOTORS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

36. REST OF THE WORLD AUTOMOTIVE MOTORS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNELS, 2019-2026 ($ MILLION)

1. GLOBAL AUTOMOTIVE MOTORS MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL AUTOMOTIVE MOTORS MARKET SHARE BY VEHICLE TYPE, 2019 VS 2026 (%)

3. GLOBAL AUTOMOTIVE MOTORS MARKET SHARE BY DISTRIBUTION CHANNELS, 2019 VS 2026 (%)

4. GLOBAL AUTOMOTIVE MOTORS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US AUTOMOTIVE MOTORS MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA AUTOMOTIVE MOTORS MARKET SIZE, 2019-2026 ($ MILLION)

7. UK AUTOMOTIVE MOTORS MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE AUTOMOTIVE MOTORS MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY AUTOMOTIVE MOTORS MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY AUTOMOTIVE MOTORS MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN AUTOMOTIVE MOTORS MARKET SIZE, 2019-2026 ($ MILLION)

12. REST OF EUROPE AUTOMOTIVE MOTORS MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA AUTOMOTIVE MOTORS MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA AUTOMOTIVE MOTORS MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN AUTOMOTIVE MOTORS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC AUTOMOTIVE MOTORS MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD AUTOMOTIVE MOTORS MARKET SIZE, 2019-2026 ($ MILLION)

18. GLOBAL BRUSHLESS DC MOTOR & STEPPER MOTOR MARKET SHARE BY REGION, 2019 VS 2026 (%)

19. GLOBAL BRUSHED DC MOTOR MARKET SHARE BY REGION, 2019 VS 2026 (%)

20. GLOBAL AC INDUCTION MOTOR MARKET SHARE BY REGION, 2019 VS 2026 (%)

21. GLOBAL OTHERS MOTOR MARKET SHARE BY REGION, 2019 VS 2026 (%)

22. GLOBAL PASSENGER VEHICLES MARKET SHARE BY REGION, 2019 VS 2026 (%)

23. GLOBAL COMMERCIAL VEHICLES MARKET SHARE BY REGION, 2019 VS 2026 (%)

24. GLOBAL ELECTRIC VEHICLES MARKET SHARE BY REGION, 2019 VS 2026 (%)

25. GLOBAL OEM AUTOMOTIVE MOTOR MARKET SHARE BY REGION, 2019 VS 2026 (%)

26. GLOBAL AFTERMARKET AUTOMOTIVE MOTOR MARKET SHARE BY REGION, 2019 VS 2026 (%)