Autonomous Farm Equipment Market

Global Autonomous Farm Equipment Market Size, Share & Trends Analysis Report by Types (Tractors, Harvesters, Tiller, and Seed Drill) By Applications (Agriculture, Horticulture, Animal husbandry, and Others) Forecast Period (2022-2028). Update Available - Forecast 2025-2035

The global autonomous farm equipment market is anticipated to grow at a significant CAGR of around 10.2% during the forecast period. The primary factor driving the growth of autonomous farm equipment market is increase in demand for autonomous equipment such as tractors for agriculture applications. The autonomous tractor plant the crops with no human interaction. Technology such as the Trimble BX992 and similar equipment allow for remote control use and monitoring of farm equipment. Major companies in the market are focused towards bringing innovative solutions in autonomous agriculturefield. For instance, in January 2022, John Deere revealed a fully autonomous tractor, which combines Deere’s 8R tractor, GPS guidance system and other advanced technologies. It is expected to be available to farmers by the end of 2022.

Apart from these, the penetration of GPS technology in agriculture sector for real time tracking, route location, and others will increase the demand for autonomous farm equipment during the forecast period. Advantages offered by the automation of farm equipment such as long-term resolutions for heavy and complex operations, low wear and maintenance costs, no operating emissions and noise levels are extremely low makes them high in demand for agriculture, horticulture, animal husbandry, and other applications, which in turn aids in makret

Impact of COVID-19 Pandemic on Global Autonomous Farm Equipment Market

The COVID-19 pandemic has spread to almost every country on the globe. It has adversely affected the autonomous farm equipment market. Due to COVID-19 government across the globe was forced to impose strict lockdown and travel restrictions. It has slowed down the logistics and production abilities of various companies. Owing to strict travel regulations there was shortage of labor which created a challenge for farmers for completing their field work. Covid-19 had negative impact on the farming in first half of 2020, owing to which farmers are inclined towards autonomous farming equipment and this has given rise in the demand for such equipment. Hence, during the period of COVID-19 the production was restricted but it has given the opportunity for growth of autonomous farm equipment market post COVID-19.

Segmental Outlook

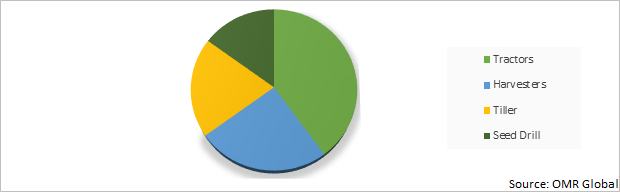

The global autonomous farm equipment market is segmented based on the types and applications. Based on the types, the market is sub-segmented into tractors, harvesters, tiller, and seed drill. Based on the applications, the market is sub-segmented into the agriculture, horticulture, animal husbandry, and others (spraying and fertilizing). Out of types segment, tractors are anticipated to hold the major share in global autonomous farm equipment market.

Global Autonomous Farm Equipment Market Share by Types, 2021 (%)

The Tractors Holds the Major Share in the Global Autonomous Farm Equipment Market.

Autonomous tractors carry innovative systems and sensors that an efficient driverless vehicle owns. Farmers can experience the influence of technology during work by implementing the advanced tractors in farming. The widespread usage of tractors with innovative technologies will fuel the growth of the market. For instance, in September 2021, John Deere launched 8R Series tractors for tyre pressure control system equipped with independent link suspension (ILS). This assists in continually monitoring and adjusting tyre pressure with the push of a button. Constant innovation in farm equipment will lead to improved efficiency in field as well as on road. The improved performance in farming due to such tractors can promote the growth of autonomous farm equipment market.

Regional Outlooks

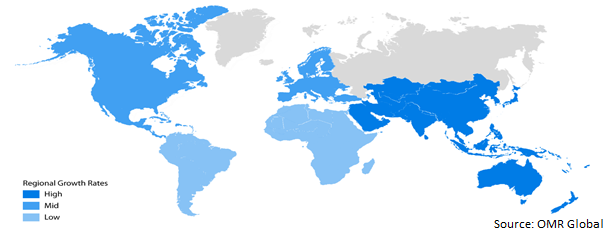

The global autonomous farm equipment market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). Amon these, Europe autonomous farm equipment market is forecast to register notable growth during the forecast period. The presence of multinational companies and numerous SMEs in the Europe is key factor, the region has strong agricultural machinery industry. According to CEMA, a total of approximately 177,000 tractors were registered across Europe in 2018. Of these registrations, 39,784 tractors were under 50 hp and, consequently, 137,503 above 50 hp. This lead to the growth of the market.

Global Autonomous Farm Equipment Market Growth, by Region 2022-2028

The Asia-Pacific Region Holds the Significant Share in the Global Autonomous Farm Equipment Market.

The Asia-Pacific region is anticipated to hold significant share in global autonomous farm equipment market due to lack of farming labor in that region. The demand for autonomous farm equipment is projected to rise in Japan due to rising challeneges of workforce. Market players in this sector are stressing on improving the solutions and introducing new features in equipment and resolve the challenge of labour shortage. For instance, in February 2021, Yanmar Agribusiness acknowledged the improvements in its tractor series which can operate as full or partial autonomous. The upgraded autonomous tractor uses a multi-frequency antenna for stable connection and enhanced accuracy for safer and efficient tractor. The new tractor provides efficiency and accuracy in farming owing to which the market is expected to grow during forecast period.

Market Players Outlook

The major companies serving the global autonomous farm equipment market include AGCO Corp., AgJunction Inc., Agrobot, CLAAS Group, Clearpath Robotics Inc., Deere & Co., Ecorobotix SA, ISEKI & CO., LTD., KUBOTA Corp., Mahindra & Mahindra Ltd. and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in March 2020, Raven Industries Inc. entered into a contract to acquire DOT Technology Corp. as a part of its dedication to self-directed agriculture solutions. DOT is the creator of the “Dot Power Platform”, which is an autonomous unit with the ability to couple with a wide range of implements, that are critical to agricultural production and provide various solutions to farmers Ag retailers. With this partnership various farming solutions are expected to be developed in future, which will result in growing trend of using farming equipment.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global autonomous farm equipment market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Autonomous Farm Equipment Market

• Recovery Scenario of Global Autonomous Farm Equipment Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Autonomous Farm Equipment Market by Types

4.1.1. Tractors

4.1.2. Harvesters

4.1.3. Tiller

4.1.4. Seed Drill

4.2. Global Autonomous Farm Equipment Market by Applications

4.2.1. Agriculture

4.2.2. Horticulture

4.2.3. Animal husbandry

4.2.4. Others (Spraying and Fertilizing)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AGCO Corp.

6.2. AgJunction Inc.

6.3. Agrobot

6.4. CLAAS Group

6.5. Clearpath Robotics Inc.

6.6. Deere & Co.

6.7. Ecorobotix SA

6.8. ISEKI & CO.,LTD.

6.9. KUBOTA Corp.

6.10. Mahindra & Mahindra Ltd.

6.11. Naïo Technologies

6.12. Raven Industries, Inc.

6.13. Small Robot Co.

6.14. Trimble Inc.

6.15. Yanmar Holdings Co., Ltd.

6.16. Zimeno Inc Dba Monarch Tractor

1. GLOBAL AUTONOMOUS FARM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPES, 2021-2028 ($ MILLION)

2. GLOBAL TRACTORS IN AUTONOMOUS FARM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL HARVESTERS IN AUTONOMOUS FARM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL TILLER INAUTONOMOUS FARM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL SEED DRILL INAUTONOMOUS FARM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL AUTONOMOUS FARM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2021-2028 ($ MILLION)

7. GLOBAL AUTONOMOUS FARM EQUIPMENT FOR AGRICULTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL AUTONOMOUS FARM EQUIPMENT FOR HORTICULTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL AUTONOMOUS FARM EQUIPMENT FOR ANIMAL HUSBANDRY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL AUTONOMOUS FARM EQUIPMENT FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL AUTONOMOUS FARM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

12. NORTH AMERICAN AUTONOMOUS FARM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

13. NORTH AMERICAN AUTONOMOUS FARM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPES, 2021-2028 ($ MILLION)

14. NORTH AMERICAN AUTONOMOUS FARM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2021-2028 ($ MILLION)

15. EUROPEAN AUTONOMOUS FARM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. EUROPEAN AUTONOMOUS FARM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPES, 2021-2028 ($ MILLION)

17. EUROPEAN AUTONOMOUS FARM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC AUTONOMOUS FARM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC AUTONOMOUS FARM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPES, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC AUTONOMOUS FARM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2021-2028 ($ MILLION)

21. REST OF THE WORLD AUTONOMOUS FARM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22. REST OF THE WORLD AUTONOMOUS FARM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPES, 2021-2028 ($ MILLION)

23. REST OF THE WORLD AUTONOMOUS FARM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL AUTONOMOUS FARM EQUIPMENT MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL AUTONOMOUS FARM EQUIPMENT MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL AUTONOMOUS FARM EQUIPMENT MARKET, 2022-2028 (%)

4. GLOBAL AUTONOMOUS FARM EQUIPMENT MARKET SHARE BY TYPES, 2021 VS 2028 (%)

5. GLOBAL TRACTORS IN AUTONOMOUS FARM EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL HARVESTERS IN AUTONOMOUS FARM EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL TILLER INAUTONOMOUS FARM EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL SEED DRILL INAUTONOMOUS FARM EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL AUTONOMOUS FARM EQUIPMENT MARKET SHARE BY APPLICATIONS, 2021 VS 2028 (%)

10. GLOBAL AUTONOMOUS FARM EQUIPMENT IN AGRICULTURE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL AUTONOMOUS FARM EQUIPMENT IN HORTICULTURE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL AUTONOMOUS FARM EQUIPMENT IN ANIMAL HUSBANDRY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL AUTONOMOUS FARM EQUIPMENT IN OTHER APPLICATIONS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL AUTONOMOUS FARM EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. US AUTONOMOUS FARM EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

16. CANADA AUTONOMOUS FARM EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

17. UK AUTONOMOUS FARM EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

18. FRANCE AUTONOMOUS FARM EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

19. GERMANY AUTONOMOUS FARM EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

20. ITALY AUTONOMOUS FARM EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

21. SPAIN AUTONOMOUS FARM EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

22. REST OF EUROPE AUTONOMOUS FARM EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

23. INDIA AUTONOMOUS FARM EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

24. CHINA AUTONOMOUS FARM EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

25. JAPAN AUTONOMOUS FARM EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

26. SOUTH KOREA AUTONOMOUS FARM EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

27. REST OF ASIA-PACIFIC AUTONOMOUS FARM EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF THE WORLD AUTONOMOUS FARM EQUIPMENT MARKET SIZE, 2021-2028 ($ MILLION)