Battery Production Machine Market

Battery Production Machine Market Size, Share & Trends Analysis Report by Machine Type (Coating and Drying, Slitting, Electrode Stacking, Assembly and Handling, Formation and Testing and Others, by Battery Type (Nickel Cobalt Aluminum (NCA), Nickel Manganese Cobalt (NMC), Lithium Iron Phosphate (LFP) and by Application (Automotive, Renewable energy, Industrial) Forecast Period (2024-2031)

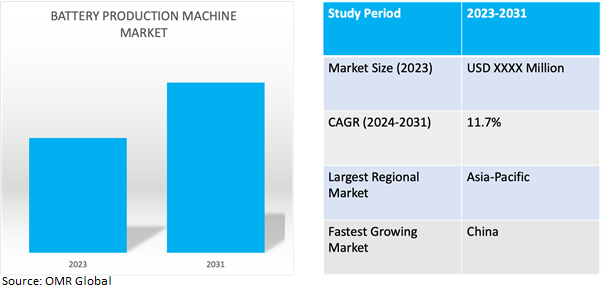

Battery production machine market is anticipated to grow at a significant CAGR of 11.7% during the forecast period (2024-2031). The battery production machine market is witnessing rapid growth, fueled by the global surge in demand for electric vehicles (EVs), energy storage systems (ESS), and portable electronics. This demand necessitates advancements in battery manufacturing technology to enhance efficiency, reduce costs, and improve quality. Key drivers include government initiatives promoting clean energy adoption and the rise of renewable energy sources.

Market Dynamics

Electric Vehicle Boom Propels Lithium-Ion Battery Demand

According to the International Energy Agency, the demand for automotive lithium-ion (Li-ion) batteries surged by 65.0% to reach 550 GWh in 2022, up from 330 GWh in 2021. This boost was primarily fueled by the growing popularity of electric passenger cars, which saw a 55.0% increase in new registrations. In China, demand for vehicle batteries grew by over 70.0%, paralleled by an 80.0% rise in electric car sales, although the expanding presence of plug-in hybrid electric vehicles (PHEVs) moderated the increase in battery demand. In the United States, despite electric car sales increasing by only 55.0%, battery demand for vehicles grew by around 80.0%. The average battery size for battery electric cars in the US grew by approximately 7.0% in 2022, maintaining a 40.0% lead over the global average. This is attributed to the prevalence of SUVs in US electric car sales and manufacturers' efforts to extend all-electric driving ranges. Global sales of battery electric vehicles (BEVs) and PHEVs are surpassing those of hybrid electric vehicles (HEVs), resulting in increased demand for larger batteries.

Increasing Demand and Tech Advancements Drive Aircraft Battery Market

Globally, Aircraft production drives the demand for aircraft batteries due to the growing need for air travel. Lightweight batteries are sought after to reduce aircraft weight, leading to improved fuel efficiency and performance. For instance, in November 2023, rising demand for lightweight batteries and technological advancements resulted in more efficient and powerful batteries, expanding their use in various aircraft systems. Additionally, increased investments in the aircraft industry stimulate the development of new aircraft models, boosting the demand for batteries.

Market Segmentation

Our in-depth analysis of the global battery production machine market includes the following segments by machine type, by battery type, and by application:

- Based on machine type, the market is sub-segmented into coating & drying, slitting, electrode stacking, assembly & handling, formation & testing machines and others.

- Based on battery type, the market is sub-segmented into nickel cobalt aluminium (NCA), nickel manganese cobalt (NMC) and lithium iron phosphate (LFP).

- Based on application, the market is sub-segmented into automotive, renewable energy and industrial.

Automotive Application is Projected to Emerge as the Largest Segment

Based on the application, the global battery production machine market is sub-segmented into automotive, renewable energy and industrial. The automotive sector, propelled by environmental awareness and government initiatives, drives demand for lithium-ion batteries, widely used in electric vehicles (EVs) including BEVs, HEVs, PHEVs, and two-wheelers. These batteries, preferred for their high energy density, cater to diverse vehicle types like passenger cars, commercial vehicles, trucks, buses, and motorcycles.

Drying & Coating Holds Considerable Share in the Global Market

The presence of key players in this segment has made significant contribution to the high share of this market segment. For instance, Dürr Group has broadened its offerings in the growing sector of battery electrode production technology, incorporating an efficient and sustainable approach for the future. In November 2023, Dürr formed a partnership with the US coating provider LiCAP Technologies, enhancing its expertise in electrode production. The collaboration enables Dürr to offer both wet and advanced dry coating technologies, providing significant cost and energy savings, as well as reduced CO2 emissions. Additionally, this process is adaptable for the production of future solid-state batteries.

Regional Outlook

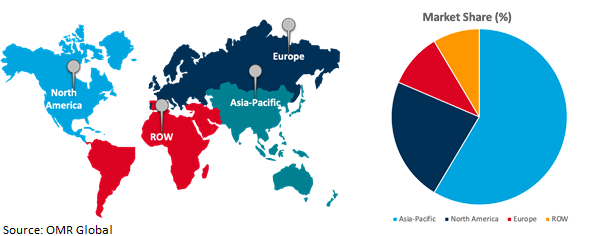

The global battery production machine market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific countries to invest in the Battery Production Machine Market

- China is the key investor in battery production machine based products around the globe.

- India's growing information technology sector is driving the expansion of the battery equipment manufacturing industry.

Global Battery Production Machine Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share owing to the presence of rising demand for lithium-ion batteries by abundant raw materials and the presence of major battery and production machine manufacturers. By 2030, an estimated 256 giga factories will be operational, with China dominating manufacturing capacity. Additionally, increasing research and development efforts across various countries in the region contribute to market growth. China, specifically, serves as a global hub for battery manufacturing, benefiting from ample raw materials like graphite and lithium. The country also plays a significant role as a supplier to the automotive, energy storage, and consumer electronics industries, fueled by investments in the electric vehicle market.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global battery production machine market include Wuxi Lead Intelligent Equipment Co., Ltd. , Shenzhen Yinghe Technology Co., Ltd., Hitachi, Ltd. , Schuler Group , and Durr Group and Others. The market players are increasingly focusing on business expansion and product development by applying strategies such as increasing production facilities and mergers. In November 2023, Toshiba Corp. unveils a cobalt-free 5V-class lithium-ion battery, mitigating performance-degrading gas emissions from side reactions, suitable for diverse applications from power tools to electric vehicles. By eliminating cobalt and reducing nickel content, Toshiba addresses cost and supply chain concerns, while achieving superior resource conservation. Combining the new cathode with a niobium titanium oxide (NTO) anode yields a high-voltage pouch battery with rapid 80% charging in 5 minutes, robust power performance, and extended lifespan, ideal for industrial and electric vehicle use.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Battery Production Machine market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Dürr AG

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Hitachi, Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Nordson Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Battery Production Machine Market by Machine Type

4.1.1. Coating & Drying

4.1.2. Slitting

4.1.3. Electrode Stacking

4.1.4. Assembly & Handling

4.1.5. Formation & Testing Machines

4.1.6. Others (Mixing, Calendaring)

4.2. Global Battery Production Machine Market by Battery Type

4.2.1. Nickel Cobalt Aluminum (NCA)

4.2.2. Nickel Manganese Cobalt (NMC)

4.2.3. Lithium Iron Phosphate (LFP)

4.3. Global Battery Production Machine Market by Application

4.3.1. Automotive

4.3.2. Renewable energy

4.3.3. Industrial

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ACI Alloys, Inc.

6.2. Allan Chemical Corp.

6.3. American Elements Corp.

6.4. Easpring Material Tech

6.5. Green Eco-Manufacture

6.6. GROB-WERKE GmbH & Co. KG

6.7. Guangdong Brunp recycling Technology Co., Ltd

6.8. Guangdong Lyric Robot Automation Co. Ltd.

6.9. Hunter Chemical

6.10. Manz AG

6.11. Noah Tech

6.12. Panasonic Energy Co., Ltd.

6.13. Rosendahl Nextrom GmbH

6.14. Schuler AG

6.15. SHENZHEN YINGHE TECHNOLOGY CO. LTD.

6.16. The Bühler Holding AG

6.17. TORAY ENGINEERING Co., Ltd.

6.18. Wuxi Lead Intelligent Equipment Co. Ltd.

6.19. Xiamen Tmax Battery Equipments Ltd.

1. GLOBAL BATTERY PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY MACHINE TYPE, 2023-2031 ($ MILLION)

2. GLOBAL BATTERY COATING & DRYING PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL BATTERY SLITTING PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL BATTERY ELECTRODE STACKING PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL BATTERY ASSEMBLY & HANDLING PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL BATTERY FORMATION & TESTING MACHINES PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL OTHER MACHINE TYPE BATTERY PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL BATTERY PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

9. GLOBAL NICKEL COBALT ALUMINUM (NCA) BATTERY PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL NICKEL MANGANESE COBALT (NMC) BATTERY PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL LITHIUM IRON PHOSPHATE (LFP) BATTERY PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL BATTERY PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

13. GLOBAL BATTERY PRODUCTION MACHINE FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL BATTERY PRODUCTION MACHINE FOR RENEWABLE ENERGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL BATTERY PRODUCTION MACHINE MARKET FOR INDUSTRIAL RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL BATTERY PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. NORTH AMERICAN BATTERY PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. NORTH AMERICAN BATTERY PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY MACHINE TYPE, 2023-2031 ($ MILLION)

19. NORTH AMERICAN BATTERY PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE ,2023-2031 ($ MILLION)

20. NORTH AMERICAN BATTERY PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

21. EUROPEAN BATTERY PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. EUROPEAN BATTERY PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY MACHINE TYPE, 2023-2031 ($ MILLION)

23. EUROPEAN BATTERY PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

24. EUROPEAN BATTERY PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC BATTERY PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

26. ASIA-PACIFICBATTERY PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY MACHINE TYPE, 2023-2031 ($ MILLION)

27. ASIA-PACIFICBATTERY PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY BATTERY TYPE, 2023-2031 ($ MILLION)

28. ASIA-PACIFICBATTERY PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

29. REST OF THE WORLD BATTERY PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

30. REST OF THE WORLD BATTERY PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY MACHINE TYPE, 2023-2031 ($ MILLION)

31. REST OF THE WORLD BATTERY PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY BATTERY, 2023-2031 ($ MILLION)

32. REST OF THE WORLD BATTERY PRODUCTION MACHINE MARKET RESEARCH AND ANALYSIS BY APPLCATION, 2023-2031 ($ MILLION)

1. GLOBAL BATTERY PRODUCTION MACHINE MARKET SHARE BY MACHINE TYPE, 2023 VS 2031 (%)

2. GLOBAL BATTERY COATING & DRYING PRODUCTION MACHINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL BATTERY SLITTING PRODUCTION MACHINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL BATTERY ELECTRODE STACKING PRODUCTION MACHINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL BATTERY ASSEMBLY AND HANDLING PRODUCTION MACHINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL BATTERY FORMATION AND TESTING MACHINES PRODUCTION MACHINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL OTHER MACHINE TYPE BATTERYPRODUCTION MACHINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL BATTERY PRODUCTION MACHINE MARKET SHAREBY BATTERY TYPE, 2023 VS 2031 (%)

9. GLOBAL NICKEL COBALT ALUMINUM (NCA) BATTERY PRODUCTION MACHINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBALNICKEL MANGANESE COBALT (NMC) BATTERY PRODUCTION MACHINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL LITHIUM IRON PHOSPHATE (LFP) BATTERY PRODUCTION MACHINE MARKET SHAREBY REGION, 2023 VS 2031 (%)

12. GLOBAL BATTERY PRODUCTION MACHINE MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

13. GLOBAL BATTERY PRODUCTION FOR AUTOMOTIVE MACHINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL BATTERY PRODUCTION FOR RENEWABLE ENERGY MACHINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL BATTERY PRODUCTION FOR INDUSTRIAL MACHINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL BATTERY PRODUCTION MACHINE SHARE BY REGION, 2023 VS 2031 (%)

17. US BATTERY PRODUCTION MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

18. CANADA BATTERY PRODUCTION MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

19. UK BATTERY PRODUCTION MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

20. FRANCE BATTERY PRODUCTION MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

21. GERMANY BATTERY PRODUCTION MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

22. ITALY BATTERY PRODUCTION MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

23. SPAIN BATTERY PRODUCTION MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF EUROPE BATTERY PRODUCTION MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

25. INDIA BATTERY PRODUCTION MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

26. CHINA BATTERY PRODUCTION MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

27. JAPAN BATTERY PRODUCTION MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

28. SOUTH KOREA BATTERY PRODUCTION MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

29. REST OF ASIA-PACIFIC BATTERY PRODUCTION MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

30. LATIN AMERICA BATTERY PRODUCTION MACHINE MARKET SIZE, 2023-2031 ($ MILLION)

31. MIDDLE EAST AND AFRICA BATTERY PRODUCTION MACHINE MARKET SIZE, 2023-2031 ($ MILLION)