Metering Pumps Market

Metering Pumps Market Size, Share & Trends Analysis Report by Type (Diaphragm Pumps, Piston/Plunger Pumps, and Other Types), by End Use Industry (Water Treatment, Petrochemicals, & Oil & Gas, Chemical Processing, Pharmaceuticals, Food & Beverages, Pulp & Paper, Automotive, Textile, and Other End-Use Industries), and by Pump Drive (Motor-driven, Pneumatic-driven, Solenoid-driven, and Other Pump drives) Forecast Period (2025-2035)

Industry Overview

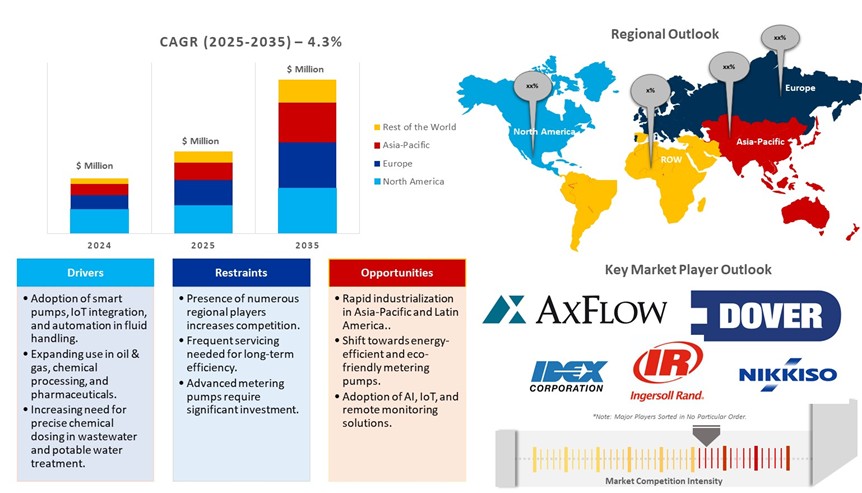

Metering pumps market size was $6,750 million in 2024 and is projected to grow to $10,747 million by 2035, witnessing a CAGR of 4.3% during the forecast period (2025-2035). The metering pumps market is growing rapidly due to increasing demand from end-use industries such as water-treatment, petrochemicals-and-oil & gas, chemical processing, pharmaceuticals, paper-&-pulp, textiles, automotive, and food & beverages. Furthermore, growing stringent regulations for wastewater treatment by government bodies such as the UN World Water Development and Environmental Protection Agency (EPA) will drive market growth.

Market Dynamics

Growing Demand for Metering Pumps in the Water Treatment

The increasing demand for wastewater treatment in pharmaceutical, oil & gas, and chemical manufacturing industries is contributing to the industry's growth. These industries require accurate fluid handling for various applications to achieve error-free results, and these pumps help to regulate the flow of disinfectants, pH adjusters, and coagulants in municipal and industrial water treatment systems. Additionally, water and wastewater treatment facilities and their industries will grow and, in turn, generate demand for metering pumps. According to the Environmental Protection Agency, the U.S. Bipartisan Infrastructure Law of 2021 commits substantial funds towards upgrading water infrastructure, with $55 billion specifically for drinking water, wastewater, and stormwater systems. From this, an amount of $15 billion is directed towards lead pipe replacement specifically. The law further funds larger improvements to water treatment plants and the inclusion of advanced metering pump systems.

Industrial Automation and Process Optimization in Metering Pumps Market

The integration of automation and process optimization in chemical processing industries, the oil & gas sector, food & beverages, and pharmaceutical industries has increased focus towards automated and AI-enabled metering pumps to enhance productivity and reduce operational costs. For instance, Idex Corp. offers AI-powered CM- Compact Diaphragm Pump for precise and controlled measuring and AI-enabled predictive maintenance, resulting in minimized unplanned downtimes. This pump has a maximum flow capacity of 30 m³/h (130 GPM) and up to 2.5 MPa (362 psi) pressure. Metering pump demand remains on the rise as technologies such as microprocessors, computers, PLCs (Programmable Logic Controllers), and flow proportioning systems facilitate intelligent control of chemical dosing in pharmaceutical operations. These technologies are instrumental in automating precision, improving efficiency, and maintaining accuracy are important drivers of the popularity of metering pumps in an industry where reliability and precision cannot be compromised.

Market Segmentation

- Based on type, the market is segmented into diaphragm pumps, piston/plunger pumps, and other types.

- Based on end-use industry, the market is segmented into water treatment, petrochemicals, & oil & gas, chemical processing, pharmaceuticals, food & beverages, pulp & paper, automotive, textile, and other end-use industries.

- Based on pump drive, the market is segmented into motor-driven, pneumatic-driven, solenoid-driven, and other pump drives.

Water treatment is the largest market share in the Metering Pumps Market

The growing demand for clean and fresh water is a major stimulus for the market of metering pumps. Rapid industrialization, urban expansion, and climate change have intensified the pressure on existing water treatment infrastructure, necessitating upgrades and expansions to ensure a safe and sustainable water supply. Government agencies and international organizations, such as the World Health Organization (WHO) and the US Environmental Protection Agency (EPA), are implementing stringent regulations to enhance water treatment and wastewater management. This, in turn, is boosting the demand for metering pumps, which play a crucial role in chemical dosing, pH control, and disinfection processes. For instance, the European Union revised its urban wastewater treatment directive, the updated regulations aim to enhance the protection of human health and the environment by reducing harmful urban wastewater discharges, ensuring cleaner rivers, lakes, groundwater, and coastal waters across Europe, This directive will create benefits of around $7.1 billion annually by 2040, and this will be a major driving factor for the metering pumps market.

Regional Outlook

The metering pumps market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing demand for Metering pumps in the Asia Pacific

The expanding chemical processing and mining business in Asian-Pacific emerging economies such as India and China is a key driver for the metering pump market. According to the European Sealing Association, the mining industry faced a major downturn following the oil price collapse of 2014, exacerbating an ongoing long-term shift in operations. Over the years, mining activities have increasingly moved to developing nations in Asia and South America, reducing growth opportunities in developed regions such as Europe and North America. This trend has further impacted the oil & gas and chemical processing industries, where investment and expansion have shifted towards emerging markets, leading to declining prospects in established economies.

North America Region Dominates the Market with Major Share

The metering pump market in North America is expanding, driven by key industry segments across the region. As per the European Sealing Association (ESA), in the power industry, the US and China dominate installed megawatts of power generation, impacting the demand for high-precision metering pumps, and in refining industries, the strong dominance of the US will emerge with metering pumps demand. Additionally, the US focuses on new pipeline projects, power plant construction, and increased infrastructure spending that will further increase metering pump demand. The new administration's commitment to upgrading water and wastewater treatment facilities is expected to boost demand for high-precision dosing pumps in municipal and industrial applications. For instance, the Hydraulic Institute has standards and programs to support the clean water pump regulations and accelerate the adoption of energy-efficient pumping solutions.

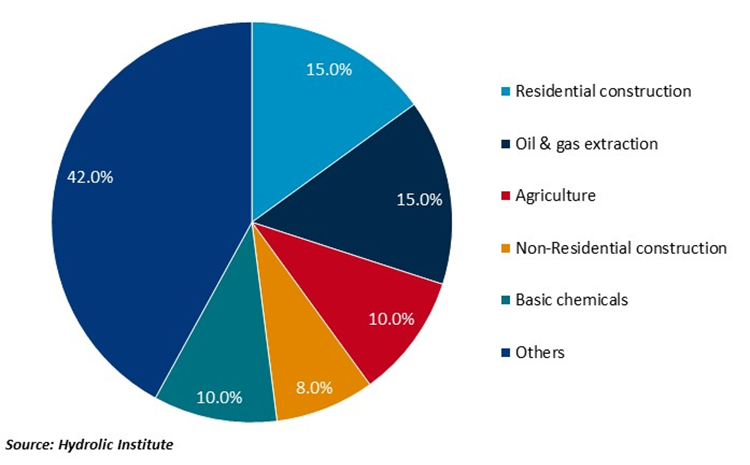

Metering Pumps' share of End-use industries in the U.S.

Market Players Outlook

The major companies operating in the global metering pumps market include IDEX Corporation, Milton Roy Group (Ingersoll Rand, Inc.), Nikkiso Co., Ltd., PSG Dover, and SPX FLOW Inc. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In January 2025, KNF launched a new OEM liquid diaphragm pump series. The FM 50 has been engineered to provide high precision and reliability for challenging applications. The new KNF FM 50 provides a flow rate of 100-500 ml/min with an exceptionally high set point accuracy of +/- 2% and an extremely linear pump characteristic. The flow rate is linear, with a back pressure of up to 1 bar (rel.).

- In August 2022, Atlas Copco completed the acquisition of LEWA GmbH and subsidiaries, and Geveke B.V. and subsidiaries, for a total enterprise value of $724.6 million. LEWA is a manufacturer of a diaphragm metering pump, process pump, and complete metering system. Most of the businesses acquired have been incorporated into the power and flow division of the Atlas Copco Power Technique business area, while some have been included in the service division of the Compressor Technique business area.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global metering pumps market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Metering Pumps Market Sales Analysis – Type| End-use Industry| Pump Drive ($ Million)

• Metering Pumps Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Metering Pumps Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Metering Pumps Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For the Global Metering Pumps Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For the Global Metering Pumps Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Metering Pumps Market Revenue and Share by Manufacturers

• Metering Pumps Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. IDEX Corporation

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Milton Roy (Ingersoll Rand, Inc.)

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Nikkiso Co., Ltd.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. PSG Dover

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. SPX FLOW, Inc.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Metering Pumps Market Sales Analysis By Type ($ Million)

5.1. Diaphragm Pumps

5.2. Piston/Plunger Pumps

5.3. Other Pumps

6. Global Metering Pumps Market Sales Analysis By End-Use Industry ($ Million)

6.1. Water Treatment

6.2. Petrochemicals and & Oil & Gas

6.3. Chemical Processing

6.4. Pharmaceuticals

6.5. Food & Beverages

6.6. Pulp & Paper

6.7. Automotive

6.8. Textile

6.9. Other End-use Industries

7. Global Metering Pumps Market Sales Analysis By Pump Drive ($ Million)

7.1. Motor Driven

7.2. Pneumatic Driven

7.3. Solenoid Driven

7.4. Other Pump Drives

8. Regional Analysis

8.1. North American Metering Pumps Market Sales Analysis – Type | End-Use Industry | Pump Drive ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Metering Pumps Market Sales Analysis – Type | End-Use Industry | Pump Drive ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Metering Pumps Market Sales Analysis – Type | End-Use Industry | Pump Drive ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And others)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Metering Pumps Market Sales Analysis – Type | End-Use Industry | Pump Drive ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Blue-White Industries, Ltd.

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. Diener Precision Pumps Ltd. (Acrotec Group)

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. IWAKI EUROPE GmbH

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. IDEX Corporation

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. KNF Group

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. LEWA GmbH

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. Lutz-Jesco GmbH

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. Madden Pump

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. McFarland Pumps

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. Milton Roy (Ingersoll Rand, Inc.)

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. NETZSCH Group

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. Nippon Pillar Packing Co., Ltd.

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. NOV Group

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Orbray Co., Ltd.

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. ProMinent GmbH

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. PSG Dover

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. Plast-O-Matic Valves, Inc.

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Service Filtration Corp.

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. SPX FLOW, Inc.

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. Stenner Pump Company

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

9.21. Tohkemy Corp.

9.21.1. Quick Facts

9.21.2. Company Overview

9.21.3. Product Portfolio

9.21.4. Business Strategies

9.22. Verder International B.V.

9.22.1. Quick Facts

9.22.2. Company Overview

9.22.3. Product Portfolio

9.22.4. Business Strategies

9.23. White Knight Fluid Handling Inc. (A Graco Company)

9.23.1. Quick Facts

9.23.2. Company Overview

9.23.3. Product Portfolio

9.23.4. Business Strategies

9.24. Yamada Corp.

9.24.1. Quick Facts

9.24.2. Company Overview

9.24.3. Product Portfolio

9.24.4. Business Strategies

9.25. Zenith Pumps

9.25.1. Quick Facts

9.25.2. Company Overview

9.25.3. Product Portfolio

9.25.4. Business Strategies

1. Global Metering Pumps Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global Diaphragm Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Piston/Plunger Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Other Metering Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Metering Pumps Market Research And Analysis By End-Use Industry 2024-2035 ($ Million)

6. Global Metering Pumps For Water Treatment Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Metering Pumps For Petrochemicals, & Oil & Gas Market Research And Analysis By Region, 2024-2035 ($ Million

8. Global Metering Pumps For Chemical Processing Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Metering Pumps For Pharmaceuticals Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Metering Pumps For Food & Beverages Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Metering Pumps For Pulp & Paper Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Metering Pumps For Automotive Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Metering Pumps For Textile Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Metering Pumps For Other End Use Industries Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Metering Pumps Market Research And Analysis By Pump Drive 2024-2035 ($ Million)

16. Global Motor-Driven Metering Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global Pneumatic-Driven Metering Pumps Market Research And Analysis By Region, 2024-2035 ($ Million

18. Global Solenoid-Driven Metering Pumps Market Research And Analysis By Region, 2024-2035 ($ Million

19. Global Other Pump Drives Metering Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

20. Global Metering Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

21. North American Metering Pumps Market Research And Analysis By Country, 2024-2035 ($ Million)

22. North American Metering Pumps Market Research And Analysis By Type, 2024-2035 ($ Million)

23. North American Metering Pumps Market Research And Analysis By End-Use Industry 2024-2035 ($ Million)

24. North American Metering Pumps Market Research And Analysis By Pump Drive, 2024-2035 ($ Million)

25. European Metering Pumps Market Research And Analysis By Country, 2024-2035 ($ Million)

26. European Metering Pumps Market Research And Analysis By Type, 2024-2035 ($ Million)

27. European Metering Pumps Market Research And Analysis By End-Use Industry 2024-2035 ($ Million)

28. European Metering Pumps Market Research And Analysis By Pump Drive, 2024-2035 ($ Million)

29. Asia-Pacific Metering Pumps Market Research And Analysis By Country, 2024-2035 ($ Million)

30. Asia-Pacific Metering Pumps Market Research And Analysis By Type, 2024-2035 ($ Million)

31. Asia-Pacific Metering Pumps Market Research And Analysis By End-Use Industry 2024-2035 ($ Million)

32. Asia-Pacific Metering Pumps Market Research And Analysis By Pump Drive, 2024-2035 ($ Million)

33. Rest Of The World Metering Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

34. Rest Of The World Metering Pumps Market Research And Analysis By Type, 2024-2035 ($ Million)

35. Rest Of The World Metering Pumps Market Research And Analysis By End-Use Industry, 2024-2035 ($ Million)

36. Rest Of The World Metering Pumps Market Research And Analysis By Pump Drive, 2024-2035 ($ Million)

1. Global Metering Pumps Market Share By Type, 2024 Vs 2035 (%)

2. Global Diaphragm Pumps Market Share By Region, 2024 Vs 2035 (%)

3. Global Piston/Plunger Pumps Services Market Share By Region, 2024 Vs 2035 (%)

4. Global Other Metering Pumps Market Share By Region, 2024 Vs 2035 (%)

5. Global Metering Pumps Market Share By End-Use Industry, 2024 Vs 2035 (%)

6. Global Metering Pumps For Water Treatment Market Share By Region, 2024-2035 ($ Million)

7. Global Metering Pumps For Petrochemicals, & Oil & Gas Market Share By Region, 2024-2035 $ Million)

8. Global Metering Pumps For Chemical Processing Market Share By Region, 2024-2035 ($ Million)

9. Global Metering Pumps For Pharmaceuticals Market Share By Region, 2024-2035 ($ Million)

10. Global Metering Pumps For Food & Beverages Market Share By Region, 2024-2035 ($ Million)

11. Global Metering Pumps For Pulp & Paper Market Share By Region, 2024-2035 ($ Million)

12. Global Metering Pumps For Automotive Market Share By Region, 2024-2035 ($ Million)

13. Global Metering Pumps For Textile Market Share By Region, 2024-2035 ($ Million

14. Global Metering Pumps For Other End-use Industries Market Share By Region, 2024-2035 ($ Million

15. Global Metering Pumps Market Share By Pump Drive 2024-2035 ($ Million)

16. Global Motor-Driven Metering Pumps Market Share By Region, 2024-2035 ($ Million)

17. Global Pneumatic-Driven Metering Pumps Market Share By Region, 2024-2035 ($ Million

18. Global Solenoid-Driven Metering Pumps Market Share By Region, 2024-2035 ($ Million

19. Global Other Pump Drives Metering Pumps Market Share By Region, 2024-2035 ($ Million

20. Global Metering Pumps Market Share By Region, 2024 Vs 2035 (%)

21. US Metering Pumps Market Size, 2024-2035 ($ Million)

22. Canada Metering Pumps Market Size, 2024-2035 ($ Million)

23. UK Metering Pumps Market Size, 2024-2035 ($ Million)

24. France Metering Pumps Market Size, 2024-2035 ($ Million)

25. Germany Metering Pumps Market Size, 2024-2035 ($ Million)

26. Italy Metering Pumps Market Size, 2024-2035 ($ Million)

27. Spain Metering Pumps Market Size, 2024-2035 ($ Million)

28. Rest Of Europe Metering Pumps Market Size, 2024-2035 ($ Million)

29. India Metering Pumps Market Size, 2024-2035 ($ Million)

30. China Metering Pumps Market Size, 2024-2035 ($ Million)

31. Japan Metering Pumps Market Size, 2024-2035 ($ Million)

32. South Korea Metering Pumps Market Size, 2024-2035 ($ Million)

33. Australia & New Zealand Metering Pumps Market Size, 2024-2035 ($ Million)

34. ASEAN Countries Metering Pumps Market Size, 2024-2035 ($ Million)

35. South Korea Metering Pumps Market Size, 2024-2035 ($ Million)

36. Rest Of Asia-Pacific Metering Pumps Market Size, 2024-2035 ($ Million)

37. Latin America Metering Pumps Market Size, 2024-2035 ($ Million)

38. Middle East And Africa Metering Pumps Market Size, 2024-2035 ($ Million)

FAQS

The size of the Metering Pumps market in 2024 is estimated to be around $6,750 million.

North America holds the largest share in the Metering Pumps market.

Leading players in the Metering Pumps market include IDEX Corporation, Milton Roy Group (Ingersoll Rand, Inc.), Nikkiso Co., Ltd., PSG Dover, and SPX FLOW Inc.

Metering Pumps market is expected to grow at a CAGR of 4.3% from 2025 to 2035.

Rising demand for accurate fluid dosing in water treatment, chemicals, and pharmaceuticals is driving metering pumps market growth.