Medical Device Contract Manufacturing Market

Medical Device Contract Manufacturing Market Size, Share & Trends Analysis Report by Device Type (IVD Devices, Diagnostic Imaging Devices, Cardiovascular Devices, Drug Delivery Devices, Endoscopy Devices, Ophthalmology Devices, Orthopedic Devices, Dental Devices and Others). and by Services (Device Development & Manufacturing Services, Quality Management Services and Packaging & Assembly Services). Forecast Period (2024-2031).

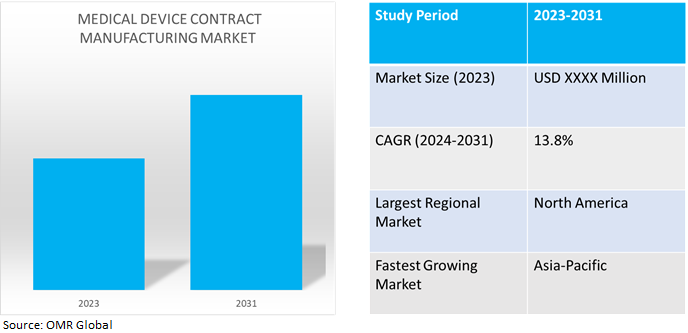

Medical device contract manufacturing market is anticipated to grow at a significant CAGR of 13.8% during the forecast period (2024-2031). The market growth is attributed to the increasing demand for smaller, more intricate medical devices, such as wearable technologies and minimally invasive surgical instruments drive the growth of the market. According to the World Health Organization (WHO), an estimated 2 million different kinds of medical devices on the global market, are categorized into more than 7000 generic device groups. The increasing use of digital technology and connected devices to improve health outcomes and healthcare delivery.

Market Dynamics

Outsourcing Medical Device Manufacturing

Reducing the number of suppliers employed by OEMs results in fewer systems and procedures being used, which raises the overall quality of the completed medical device. By lowering audits, purchase orders, and shipping and receiving operations, they also save costs. When a single-source supplier integrates vertically, they can fully comprehend and address any manufacturing and design flaws before a product is released into the market. OEMs can concentrate on their core skills and maintain their agility for the future when they can manage all those things with less time and money. Manufacturers seeking to outsource can save a lot of money by working with global component suppliers. Additionally, having a global presence helps component suppliers manage supply chain problems and possibly shorten lead times, giving OEMs more assurance.

Increasing Demand for Connected Medical Devices

Connected medical devices are essential to remotely monitoring a patient's health. By easily facilitating the exchange of medical information between patients and healthcare providers, these devices are genuinely transforming the healthcare sector. Patients and healthcare practitioners can now communicate more effectively via the development of digital technologies. Apps for smartphones that track and produce vital data include oxygen levels and connected blood pressure devices. The majority of linked devices are designed with a variety of features, including high-resolution imaging and real-time monitoring. Healthcare practitioners use the data they collect from linked medical devices to provide patients with timely treatment. Their access to increasingly valuable information is being made possible by the advancements in telemedicine, digital health, and medical devices.

Market Segmentation

Our in-depth analysis of the global medical device contract manufacturing market includes the following segments by device type and services.

- Based on device type, the market is sub-segmented into IVD devices, diagnostic imaging devices, cardiovascular devices, drug delivery devices, endoscopy devices, ophthalmology devices, orthopedic devices, dental devices, and others (patient monitoring devices).

- Based on services, the market is sub-segmented into device development & manufacturing services, quality management services, and packaging & assembly services.

Drug Delivery Devices is Projected to Emerge as the Largest Segment

Based on the device type, the global medical device contract manufacturing market is sub-segmented into IVD devices, diagnostic imaging devices, cardiovascular devices, drug delivery devices, endoscopy devices, ophthalmology devices, orthopedic devices, dental devices, and others (patient monitoring devices). Among these drug delivery devices sub-segment is expected to hold the largest share of the market. The primary factors supporting the segment's growth include the increased demand for automated injection devices leveraging its expertise in medical device engineering. An auto injector (or auto-injector) is a medical device designed to deliver a dose of a particular drug. For instance, in December 2022, Terumo Corp. introduced “G-Lasta® Subcutaneous Injection 3.6 mg BodyPod”, a drug-device combination product co-developed with Kyowa Kirin Co., Ltd. G-Lasta® Subcutaneous Injection 3.6 mg BodyPod is a combination product of an automated injection device and G-Lasta®.

Device Development & Manufacturing Services Sub-segment to Hold a Considerable Market Share

Based on services, the global medical device contract manufacturing market is sub-segmented into device development & manufacturing services, quality management services, and packaging & assembly services. Among these, the device development & manufacturing services sub-segment is expected to hold a considerable share of the market. The segmental growth is attributed to the increasing operations for manufacturing CT machines, cath lab equipment, ultrasound scanners, patient monitoring solutions, ECG machines, and ventilators. With equipped automated testers to assess the performance of the medical devices. For instance, in April 2022, Wipro GE Healthcare, a leading global medical technology and digital solutions introduced its new manufacturing facility in Bengaluru, India, under the Indian government’s production-linked incentive (PLI) scheme. The new plant, Wipro GE Medical Device Manufacturing factory (MDM), is aligned with the National Agenda of ‘Atmanirbhar Bharat’ and further boost local manufacturing of medical devices in India. The company has invested a little over INR 100.0 crore ($1000.0 million) in this facility.

Regional Outlook

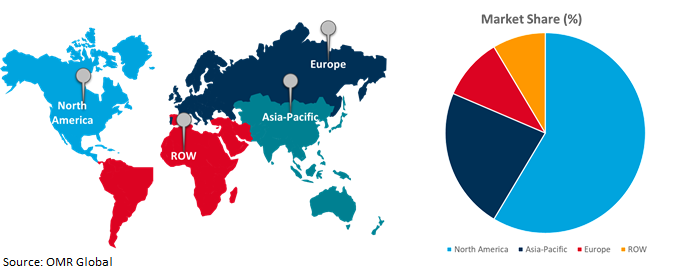

The global medical device contract manufacturing market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Medical Device Contract Manufacturing in Asia-Pacific

- The growing demand for IVD devices, diagnostic imaging devices, cardiovascular devices, drug delivery devices, and endoscopy devices accelerates the market for medical device contract manufacturing in countries such as India, China, and Japan.

- According to the National Medical Devices Policy, in 2022 India will become one of the top 5 global medical devices manufacturing hubs by 2047 and be home to the top 25 MedTech $ billion companies. The approach paper estimates that the country capture a 10-12% share of the global medical devices market sector by 2047.

Global Medical Device Contract Manufacturing Market Growth by Region 2024-2031

North America Holds Major Market Share

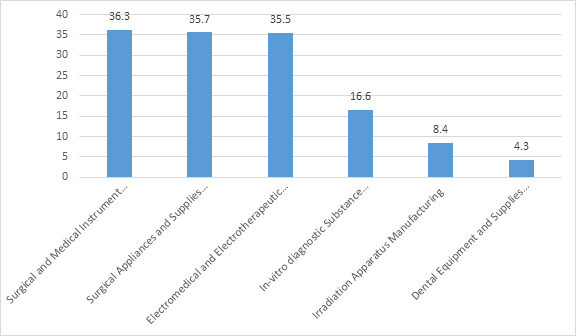

Among all the regions, North America holds a significant share owing to numerous prominent companies and medical device contract manufacturing providers. The growth is attributed to increasing demand for surgical and medical instrument manufacturing. According to the International Trade Administration (ITA), in 2022, surgical and medical instrument manufacturing had the highest sales, value of shipments, or revenue (approximately $36.3 billion), followed by surgical appliance and supplies manufacturing ($35.7 billion). Additionally, the Government conducts assessments of the US public health industrial base supply chain, which informs requirements to design, build, and sustain long-term capabilities in the US to manufacture supplies and devices for public health emergencies. For instance, in March 2023, the US FDA sought $7.2 billion to protect and advance public health by enhancing food safety and advancing medical products. The US FDA used an $11.6 million increase toward improving the medical device supply chain and shortage programs. The budget allows the FDA to expand efforts to work proactively with medical device companies, healthcare providers, device distributors, and patients to enhance resiliency in the supply chain of critical medical devices and prevent shortages of critical devices that most often impact vulnerable populations.

Sales, Value of Shipments, or Revenue for Medical Devices Subsectors, 2020 ($billion)

Source: U.S. Census Bureau’s Annual Survey of Manufactures (ASM) 2022

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global medical device contract manufacturing market include Boston Scientific Corp., General Electric Company, Hitachi High-Tech Corp., Koninklijke Philips N.V., and Siemens AG, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in March 2023, Medtronic and NVIDIA collaborated to build an AI platform for medical devices. Integrating NVIDIA technology into Medtronic’s real-time AI endoscopy device to help improve patient care and outcomes. The NVIDIA Holoscan and IGX platform makes software-defined medical devices possible by enabling developers to efficiently train and validate AI models within the Cosmo Innovation Center.

Recent Development

- In February 2024, Philips introduced Philips Image Guided Therapy Mobile C-arm System 9000 Zenition 90 Motorized, designed to help surgeons deliver high-quality care to more patients. The new mobile C-arm medical device with expanded capabilities is designed to meet complex vascular needs and a range of clinical procedures such as cardiac interventions, pain management, and urology.

- In February 2022, Siemens Healthineers invested about €60.0 million ($64.9 million) through 2025 to expand and upgrade its location at Kemnath in Bavaria. To enable the manufacture of radiotherapy devices from Varian at Kemnath in the future, a completely new production line installed in the production area.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global medical device contract manufacturing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Boston Scientific Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. General Electric Company

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Hitachi High-Tech Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

Recent Developments

3.5. Koninklijke Philips N.V.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Siemens AG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Medical Device Contract Manufacturing Market by Device Type

4.1.1. IVD Devices

4.1.2. Diagnostic Imaging Devices

4.1.3. Cardiovascular Devices

4.1.4. Drug Delivery Devices

4.1.5. Endoscopy Devices

4.1.6. Ophthalmology Devices

4.1.7. Orthopedic Devices

4.1.8. Dental Devices

4.1.9. Others (Patient Monitoring Devices)

4.2. Global Medical Device Contract Manufacturing Market by Services

4.2.1. Device Development & Manufacturing Services

4.2.2. Quality Management Services

4.2.3. Packaging & Assembly Services

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Baxter International Inc.

6.2. Benchmark Electronics, Inc.

6.3. Cadence, Inc.

6.4. Cardinal Health, Inc.

6.5. Celestica Inc.

6.6. Cirtec Medical

6.7. Edwards Lifesciences Corp.

6.8. Flex Ltd.

6.9. Fresenius Medical Care AG

6.10. Freudenberg Medical

6.11. Geratherm Medical AG

6.12. Integer Holdings Corp

6.13. Jabil Inc.

6.14. Johnson & Johnson Services, Inc.

6.15. Kimball Electronics, Inc.

6.16. Medtronic plc

6.17. Nordson Corp

6.18. Nortech Systems, Inc.

6.19. Plexus Corp.

6.20. Sanmina Corp.

6.21. SMC Ltd.

6.22. TE Connectivity Ltd.

6.23. Teleflex Inc.

6.24. Terumo Corp.

1. GLOBAL MEDICAL DEVICE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BYDEVICE TYPE,2023-2031 ($ MILLION)

2. GLOBALMEDICAL IVD DEVICE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBALMEDICAL DIAGNOSTIC IMAGING DEVICE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBALMEDICAL CARDIOVASCULAR DEVICE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBALMEDICAL DRUG DELIVERY DEVICE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBALMEDICAL ENDOSCOPY DEVICE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBALMEDICAL OPHTHALMOLOGY DEVICE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBALMEDICAL DENTAL DEVICE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBALOTHER MEDICAL DEVICE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL MEDICAL DEVICE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICES,2023-2031 ($ MILLION)

11. GLOBAL MEDICAL DEVICE DEVELOPMENT & CONTRACT MANUFACTURINGSERVICESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL MEDICAL DEVICE CONTRACT QUALITY MANAGEMENT MANUFACTURINGSERVICESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL MEDICAL DEVICEPACKAGING & ASSEMBLY MANUFACTURINGSERVICESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL MEDICAL DEVICE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN MEDICAL DEVICE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN MEDICAL DEVICE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BYDEVICE TYPE,2023-2031 ($ MILLION)

17. NORTH AMERICAN MEDICAL DEVICE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICES,2023-2031 ($ MILLION)

18. EUROPEAN MEDICAL DEVICE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN MEDICAL DEVICE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BYDEVICE TYPE,2023-2031 ($ MILLION)

20. EUROPEAN MEDICAL DEVICE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICES,2023-2031 ($ MILLION)

21. ASIA-PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. ASIA-PACIFICMEDICAL DEVICE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BYDEVICE TYPE,2023-2031 ($ MILLION)

23. ASIA-PACIFICMEDICAL DEVICE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICES,2023-2031 ($ MILLION)

24. REST OF THE WORLD MEDICAL DEVICE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

25. REST OF THE WORLD MEDICAL DEVICE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BYDEVICE TYPE,2023-2031 ($ MILLION)

26. REST OF THE WORLD MEDICAL DEVICE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICES,2023-2031 ($ MILLION)

1. GLOBAL MEDICAL DEVICE CONTRACT MANUFACTURING MARKET SHARE BYDEVICE TYPE,2023 VS 2031 (%)

2. GLOBAL MEDICAL IVD DEVICE CONTRACT MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL MEDICAL DIAGNOSTIC IMAGINGDEVICE CONTRACT MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL MEDICAL CARDIOVASCULAR DEVICE CONTRACT MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL MEDICAL DRUG DELIVERYDEVICE CONTRACT MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL MEDICAL ENDOSCOPY DEVICE CONTRACT MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL MEDICAL OPHTHALMOLOGYDEVICE CONTRACT MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL MEDICAL ORTHOPEDIC DEVICE CONTRACT MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL MEDICAL DENTAL DEVICE CONTRACT MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL OTHER MEDICAL DEVICE CONTRACT MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL MEDICAL DEVICE CONTRACT MANUFACTURINGMARKET SHAREBY SERVICES,2023 VS 2031 (%)

12. GLOBAL MEDICAL DEVICE DEVELOPMENT & CONTRACT MANUFACTURINGSERVICESMARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL MEDICAL DEVICE CONTRACT QUALITY MANAGEMENT MANUFACTURING SERVICESMARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL MEDICAL DEVICE PACKAGING & ASSEMBLY MANUFACTURING SERVICESMARKET SHARE BY REGION, 2023 VS 2031 (%)

15. US MEDICAL DEVICE CONTRACT MANUFACTURINGMARKET SIZE, 2023-2031 ($ MILLION)

16. CANADA MEDICAL DEVICE CONTRACT MANUFACTURINGMARKET SIZE, 2023-2031 ($ MILLION)

17. UK MEDICAL DEVICE CONTRACT MANUFACTURINGMARKET SIZE, 2023-2031 ($ MILLION)

18. FRANCE MEDICAL DEVICE CONTRACT MANUFACTURINGMARKET SIZE, 2023-2031 ($ MILLION)

19. GERMANY MEDICAL DEVICE CONTRACT MANUFACTURINGMARKET SIZE, 2023-2031 ($ MILLION)

20. ITALY MEDICAL DEVICE CONTRACT MANUFACTURINGMARKET SIZE, 2023-2031 ($ MILLION)

21. SPAIN MEDICAL DEVICE CONTRACT MANUFACTURINGMARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF EUROPE MEDICAL DEVICE CONTRACT MANUFACTURINGMARKET SIZE, 2023-2031 ($ MILLION)

23. INDIA MEDICAL DEVICE CONTRACT MANUFACTURINGMARKET SIZE, 2023-2031 ($ MILLION)

24. CHINA MEDICAL DEVICE CONTRACT MANUFACTURINGMARKET SIZE, 2023-2031 ($ MILLION)

25. JAPAN MEDICAL DEVICE CONTRACT MANUFACTURINGMARKET SIZE, 2023-2031 ($ MILLION)

26. SOUTH KOREA MEDICAL DEVICE CONTRACT MANUFACTURINGMARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF ASIA-PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURINGMARKET SIZE, 2023-2031 ($ MILLION)

28. LATIN AMERICAMEDICAL DEVICE CONTRACT MANUFACTURINGMARKET SIZE, 2023-2031 ($ MILLION)

29. MIDDLE EAST AND AFRICAMEDICAL DEVICE CONTRACT MANUFACTURINGMARKET SIZE, 2023-2031 ($ MILLION)