Biocatalysis and Biocatalysts Market

Biocatalysis and Biocatalysts Market Size, Share and Trends Analysis Report by Type (Hydrolases, Oxidoreductases, Transferases, Others) and by Application (Food and Beverages, Cleaning Agents, Biofuel Production, Agriculture and Feed, Biopharmaceuticals and Others) Forecast Period (2023-2030)

Biocatalysis and biocatalysts market is anticipated to grow at a CAGR of 6.9% during the forecast period. The biocatalysis and biocatalysts market growth is increasing by the rapid expansion of the biopharmaceutical industry mainly due to the increasing demand for biopharmaceuticals and food manufacturing market across the region. Due to easier access to enzymes and the capacity to modify those enzymes to satisfy the requirements of industrial processes, the use of biocatalysis in the biopharmaceutical business is growing at a profitable rate. Biocatalysts are currently used in the production of pharmaceuticals or their intermediates such as antibiotics, statins, and enantiomerically pure building blocks, and other. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), the US, European and Japan markets held 64.4%, 16.8%, and 6.0% respectively during the period 2016-2021. In 2022, the Australian government announced it would invest $132 billion in 2022–23, increasing to $140 billion in 2025–26, with a total commitment of $537 billion over the next four years in the Health and Medical Industry Growth Plan to drive a new era of better health care in Australia.

Segmental Outlook

The global biocatalysis and biocatalysts market is segmented based on the type, and application. Based on the type, the market is segmented into hydrolases, oxidoreductases, transferases and others. Based on the application, the market is sub-segmented into food and beverages, cleaning agents, biofuel production, agriculture and feed, biopharmaceuticals and others. Among the type, the hydrolases sub-segment is anticipated to hold a considerable share of the market, due to the increase in utilization of hydrolases in starch processing and the biofuel industry for saccharification and starch liquefaction.

The Biopharmaceuticals Sub-Segment is Anticipated to Hold Prominent Share in the Global Biocatalysis and Biocatalysts Market

Among the application, the biopharmaceuticals sub-segment is expected to hold a prominent share of the global biocatalysis and biocatalysts market across the globe. The biopharmaceutical industry’s revenue is increasing yearly due to rapid demand for the drugs used for manufacturing pharmaceutical products. In past years, the Chinese pharma industry has been on the top in terms of growth rate. The consumption of pharmaceutical products is growing due to changes in clinical practices and increasing chronic and aging-related issues. The demand for pharmaceutical products is also increasing in developing countries such as India, China, and Brazil, among others owing to the emergence of COVID-19 variants, lifestyle diseases, and an aging population. Biocatalysts are used in the manufacturing processes of antibiotics to treat such diseases. And the market for biocatalysts is expanding along with the global pharmaceutical sector. The rapid growth of the biopharmaceutical industry, which is primarily driven by rising demand for pharmaceuticals and food Manufacturer industries, is a major driver of the market growth for biocatalysis and biocatalysts. Due to easier access to enzymes and the capacity to modify those enzymes to satisfy the requirements of industrial processes, the use of biocatalysis in the pharmaceutical business is growing at a profitable rate. Biocatalysts are currently in the production of pharmaceuticals or their intermediates such as antibiotics, statins, and enantiomerically pure building blocks, and more.In April 2022, IBSRELA NHE3 inhibitor for the treatment of irritable bowel syndrome with constipation (IBS-C) in adults, has been made available by Ardelyx. The first Ardelyx product receive approval from the US Food and Drug Administration is IBSRELA.

Regional Outlook

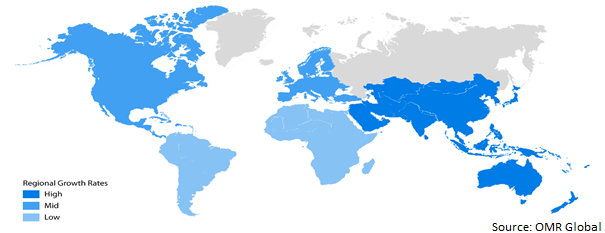

The global biocatalysis and biocatalysts market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East andAfrica, and Latin America). Among these, the Europe region is projected to experience considerable growth in the biocatalysis and biocatalysts market.This may be as a result of the strict policy laws in a number of European nations to increase the use of sustainable raw materials instead of fossil fuels and lower greenhouse gas (GHG) emissions.

Global Biocatalysis and Biocatalysts Market Growth, by Region 2023-2030

The North America Region is Expected to Hold Fastest Growing Share in the Global Biocatalysis And Biocatalysts Market

Among all regions, the North America region is anticipated to emerge as the fastest-growing regional market over the forecast period. The region is expected to witness significant growth due number of applications, such as the production of cheese, vinegar, and wine, the leavening of bread, the brewing of beer, and others, biocatalyst is widely employed to help with food processing. In these processes, enzymes help to save energy and resources, as well as improve the overall efficiency. According to the US Department of Agriculture, US. agriculture sector extends the farm business to include a range of farm-related industries. In 2021, agriculture, food, and related industries contributed 5.4% to US gross domestic product and provided 10.5% of U.S. employment; Americans' expenditures on food amount to 12% of household budgets on average. Thus, with the rising food and beverage industry, the demand for biocatalysis and biocatalysts in the country will also increase, which is anticipated to further drive the biocatalysis and biocatalysts market in North America during the forecast period.

Market Players Outlook

The major companies serving the global biocatalysis and biocatalysts market include Unilever PLC, EnginZyme AB, Arzeda Corporation, Ingenza, Zymtronix Catalytic Systems Inc, Debut Biotechnology, Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, and product launches, to stay competitive in the market. For instance, in October 2022, Ginkgo Bioworks partnered with Merck to use engineered enzymes as biocatalysts for Merck's active pharmaceutical ingredient manufacturing programs.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global biocatalysis and biocatalysts market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight AND Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Biocatalysis and Biocatalysts Market by Type

4.1.1. Hydrolases

4.1.2. Oxidoreductases

4.1.3. Transferases

4.1.4. Others

4.2. Global Biocatalysis and Biocatalysts Market by Application

4.2.1. Food and Beverages

4.2.2. Biofuel Production

4.2.3. Agriculture and Feed

4.2.4. Biopharmaceuticals

4.2.5. Cleaning Agents

4.2.6. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AB Enzymes

6.2. Afton Chemical

6.3. Amano Enzyme Inc.

6.4. Arzeda Corporation

6.5. BASF SE

6.6. Chr Hansen Holding A/S

6.7. Codexis Inc.

6.8. Debut Biotechnology, Inc.

6.9. DSM

6.10. DuPont de Nemours, Inc.

6.11. Dyadic International, Inc.

6.12. EnginZyme AB

6.13. Ingenza

6.14. Lonza Group Ltd.

6.15. Novozymes

6.16. Piramal Enterprises Ltd.

6.17. RP Management LLC

6.18. Soufflet Agro Rus, LLC

6.19. Unilever PLC

6.20. Zymtronix Catalytic Systems Inc

1. GLOBAL BIOCATALYSIS AND BIOCATALYSTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

2. GLOBAL HYDROLASES BIOCATALYSIS AND BIOCATALYSTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL OXIDOREDUCTASES BIOCATALYSIS AND MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL TRANSFERASES BIOCATALYSIS AND BIOCATALYSTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL OTHERS BIOCATALYSIS AND BIOCATALYSTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL BIOCATALYSIS AND BIOCATALYSTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

7. GLOBAL BIOCATALYSIS AND BIOCATALYSTS MARKET IN FOOD AND BEVERAGES, MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL BIOCATALYSIS AND BIOCATALYSTS IN CLEANING AGENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL BIOCATALYSIS AND BIOCATALYSTS IN BIOFUEL PRODUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL BIOCATALYSIS AND BIOCATALYSTS IN AGRICULTURE AND FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL BIOCATALYSIS AND BIOCATALYSTS IN BIOPHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL BIOCATALYSIS AND BIOCATALYSTS IN OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL BIOCATALYSIS AND BIOCATALYSTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. NORTH AMERICAN BIOCATALYSIS AND BIOCATALYSTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

15. NORTH AMERICAN BIOCATALYSIS AND BIOCATALYSTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

16. NORTH AMERICAN BIOCATALYSIS AND BIOCATALYSTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

17. EUROPEAN BIOCATALYSIS AND BIOCATALYSTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

18. EUROPEAN BIOCATALYSIS AND BIOCATALYSTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

19. EUROPEAN BIOCATALYSIS AND BIOCATALYSTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

20. ASIA-PACIFIC BIOCATALYSIS AND BIOCATALYSTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

21. ASIA-PACIFIC BIOCATALYSIS AND BIOCATALYSTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

22. ASIA-PACIFIC BIOCATALYSIS AND BIOCATALYSTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

23. REST OF THE WORLD BIOCATALYSIS AND BIOCATALYSTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

24. REST OF THE WORLD BIOCATALYSIS AND BIOCATALYSTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

25. REST OF THE WORLD BIOCATALYSIS AND BIOCATALYSTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

1. GLOBAL BIOCATALYSIS AND BIOCATALYSTS MARKET SHARE BY TYPE, 2022 VS 2030 (%)

2. GLOBAL HYDROLASES BIOCATALYSIS AND BIOCATALYSTS MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL OXIDOREDUCTASES BIOCATALYSIS AND BIOCATALYSTS MARKET SHARE ANALYSIS BY REGION, 2021-2028 (%)

4. GLOBAL TRANSFERASES BIOCATALYSIS AND BIOCATALYSTS MARKET SHARE ANALYSIS BY REGION, 2022 VS 2030 (%)

5. GLOBAL OTHERS BIOCATALYSIS AND BIOCATALYSTS MARKET SHARE ANALYSIS BY REGION, 2022 VS 2030 (%)

6. GLOBAL BIOCATALYSIS AND BIOCATALYSTS MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

7. GLOBAL BIOCATALYSIS AND BIOCATALYSTS MARKET IN FOOD AND BEVERAGES, MARKET SHARE ANALYSIS BY REGION, 2022 VS 2030 (%)

8. GLOBAL BIOCATALYSIS AND BIOCATALYSTS IN CLEANING AGENTS MARKET SHARE ANALYSIS BY REGION, 2022 VS 2030 (%)

9. GLOBAL BIOCATALYSIS AND BIOCATALYSTS IN BIOFUEL PRODUCTION MARKET SHARE ANALYSIS BY REGION, 2022 VS 2030 (%)

10. GLOBAL BIOCATALYSIS AND BIOCATALYSTS IN AGRICULTURE AND FEED MARKET SHARE ANALYSIS BY REGION, 2022 VS 2030 (%)

11. GLOBAL BIOCATALYSIS AND BIOCATALYSTS IN BIOPHARMACEUTICALS MARKET SHARE ANALYSIS BY REGION, 2022 VS 2030 (%)

12. GLOBAL BIOCATALYSIS AND BIOCATALYSTS IN OTHERS MARKET SHARE ANALYSIS BY REGION, 2022 VS 2030 (%)

13. GLOBAL OTHER TECHNOLOGIES IN BIOCATALYSIS AND BIOCATALYSTS MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. GLOBAL BIOCATALYSIS AND BIOCATALYSTS MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. US BIOCATALYSIS AND BIOCATALYSTS MARKET SIZE, 2022-2030 ($ MILLION)

16. CANADA BIOCATALYSIS AND BIOCATALYSTS MARKET SIZE, 2022-2030 ($ MILLION)

17. UK BIOCATALYSIS AND BIOCATALYSTS MARKET SIZE, 2022-2030 ($ MILLION)

18. FRANCE BIOCATALYSIS AND BIOCATALYSTS MARKET SIZE, 2022-2030 ($ MILLION)

19. GERMANY BIOCATALYSIS AND BIOCATALYSTS MARKET SIZE, 2022-2030 ($ MILLION)

20. ITALY BIOCATALYSIS AND BIOCATALYSTS MARKET SIZE, 2022-2030 ($ MILLION)

21. SPAIN BIOCATALYSIS AND BIOCATALYSTS MARKET SIZE, 2022-2030 ($ MILLION)

22. REST OF EUROPE BIOCATALYSIS AND BIOCATALYSTS MARKET SIZE, 2022-2030 ($ MILLION)

23. INDIA BIOCATALYSIS AND BIOCATALYSTS MARKET SIZE, 2022-2030 ($ MILLION)

24. CHINA BIOCATALYSIS AND BIOCATALYSTS MARKET SIZE, 2022-2030 ($ MILLION)

25. JAPAN BIOCATALYSIS AND BIOCATALYSTS MARKET SIZE, 2022-2030 ($ MILLION)

26. SOUTH KOREA BIOCATALYSIS AND BIOCATALYSTS MARKET SIZE, 2022-2030 ($ MILLION)

27. REST OF ASIA-PACIFIC BIOCATALYSIS AND BIOCATALYSTS MARKET SIZE, 2022-2030 ($ MILLION)

28. REST OF THE WORLD BIOCATALYSIS AND BIOCATALYSTS MARKET SIZE, 2022-2030 ($ MILLION)