Biofertilizers Market

Global Biofertilizers Market Size, Share & Trends Analysis Report, By Type (Nitrogen Fixing, Phosphate Solubilizing, and Others), By Crop Type (Cereals and Grains, Oil Seeds and Pulses, Fruits and Vegetables, and Others), By Application (Soil Treatment and Seed Treatment) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global biofertilizers market is estimated to grow at a CAGR of nearly 11.0% during the forecast period. Rising demand for organic farming and increasing government initiatives for sustainable farming practices are primarily contributing to the growth of the market. Organic farming has been witnessing potential growth across the countries. As per the Eurostat, in the EU, the total area under organic farming is constantly increasing, covering 13.4 million hectares of agricultural land in 2018. EU organic area grew by 70% in the last ten years. In 2018, organic area consists of 7.5% of total EU agricultural land.

Austria, Estonia, and Sweden have the largest share of the organic area across EU countries. In 2018, the share of the total organic area in the total utilized agricultural area in Austria, Estonia, and Sweden was 24.1%, 20.6%, and 20.3%, respectively. Favorable government initiatives to promote innovation in organic farming has been reported in the region. For instance, the European Commission launched the European innovation partnership for agricultural productivity and sustainability (EIP-AGRI) in 2012. This initiative aims to connect farmers and researchers to accelerate innovation, consist of the focused group which concentrates on novel approaches to organic farming. The rising innovation in organic farming will eventually lead to the development of biofertilizers as it is an essential component of organic farming.

Biofertilizers has a vital role in organic farming to maintain soil fertility and sustainability for long-term by mobilizing fixed macro and micronutrients, fixing atmospheric dinitrogen, or convert insoluble phosphorus in the soil into forms available to plants, which, in turn, enhances their efficiency and availability. Due to the environmental impact and cost of chemical fertilizers, there is a rising inclination of farmers towards biofertilizers. Therefore, organic manure is considered as a feasible option for farmers to enhance productivity per unit area. The market has significant opportunity owing to the increasing partnerships for the development of novel biofertilizers.

Market Segmentation

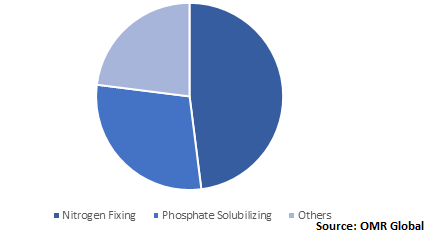

The global biofertilizers market is classified into type, crop type, and application. Based on type, the market is classified into nitrogen fixing, phosphate solubilizing, and others. Based on crop type, the market is classified into cereals and grains, oil seeds and pulses, fruits and vegetables, and others. Based on application, the market is classified into soil treatment and seed treatment.

Nitrogen fixing is anticipated to hold significant share in the market

Nitrogen class of biofertilizers fixes nitrogen symbiotically and enables to correct the level of nitrogen in the soil. Nitrogen is a major nutrient required for the growth of the plant. Plants require a less amount of nitrogen for their growth. The need for nitrogen level depends on types of crops. Some crops need less amounts of nitrogen for their growth, however, some crops need more nitrogen for their growth. Additionally, the type of soil is also a key factor that determines the type of biofertilizers required for the crop. For instance, Rhizobium is required for the legume crops and Azotobacteria is used for the non-legume crops. Likewise, Acetobacter is utilized to grow sugarcane, while blue-green algae are required to grow rice. It signifies nearly all the crops requires different kinds of nitrogen fixing biofertilizers based on their needs.

Global Biofertilizers Market Share by Type, 2019 (%)

Regional Outlook

The global biofertilizers market is segmented into four major regions, including North America, Europe, Asia-Pacific, and Rest of the World (RoW). Asia-Pacific is estimated to hold significant share in the market owing to the rising organic farm area across Australia, China, and India. In addition, increasing government initiatives for organic farming is further boosting the demand for biofertilizers in the region. In 2015, Indian government launched Paramparagat Krishi Vikas Yojana (PKVY) which is intended to support and promote organic farming, which leads to the improvement of soil health. The objective of the initiative is to promote organic farming among rural youth/ farmers/ consumers/ traders and distribute new technologies in organic farming. This, in turn, is offering an opportunity for the considerable demand for biofertilizers to augment the nutrients of host plants while applied to plant surface, seeds, or soil by inhabiting the rhizosphere of the plant.

Global Biofertilizers Market Growth, by Region 2020-2026

Market Players Outlook

The major players in the market include Novozymes A/S, Bayer AG, Kiwa Bio-Tech Products Group Corp., Agrinos, and National Fertilizers Ltd. The strategies adopted by the market players include mergers and acquisitions, product launches, and partnerships and collaborations to expand market share and gain a competitive advantage. For instance, in February 2020, Kiwa Bio-Tech Products Group Corp. entered into a strategic cooperation agreement with Fudan Science and Technology Park and Xibaokun Agricultural Technology Co., Ltd. Under the agreement, all these parties will focus on developing markets for water remediation and soil remediation centering on the Yangtze River Delta. Water resource restoration and soil remediation are the focus in 2020 for Kiwa’s increased growth. Kiwa expects that the combined efforts of all parties, the products and core technology of the company’s Coupling Microbial Activation Remediation Technology (CMA) will rapidly occupy the soil remediation and water remediation market in China.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global biofertilizers market. Based on the availability of data and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Novozymes A/S

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Bayer AG

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Kiwa Bio-Tech Products Group Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Agrinos

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. National Fertilizers Ltd.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Biofertilizers Market by Type

5.1.1. Nitrogen Fixing

5.1.2. Phosphate Solubilizing

5.1.3. Others

5.2. Global Biofertilizers Market by Crop Type

5.2.1. Cereals and Grains

5.2.2. Oil Seeds and Pulses

5.2.3. Fruits and Vegetables

5.2.4. Others

5.3. Global Biofertilizers Market by Application

5.3.1. Soil Treatment

5.3.2. Seed Treatment

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Agrinos

7.2. ASB Grünland Helmut Aurenz GmbH

7.3. Australian Bio Fert Pty Ltd.

7.4. Bayer AG

7.5. Biomax Naturals

7.6. Criyagen Agri & Biotech Private Ltd.

7.7. Gujarat State Fertilizers & Chemicals Ltd.

7.8. IPL Biologicals Ltd.

7.9. Kan Biosys Pvt. Ltd.

7.10. Kiwa Bio-Tech Products Group Corp.

7.11. Lallemand Inc.

7.12. Madras Fertilizers Ltd.

7.13. Mapleton Agri Biotec Pty Ltd.

7.14. National Fertilizers Ltd.

7.15. Novozymes A/S

7.16. Rashtriya Chemicals and Fertilizers Ltd.

7.17. Rizobacter Argentina SA

7.18. SOM Phytopharma (India) Ltd.

7.19. Symborg Corporate, SL

7.20. T. Stanes & Co., Ltd.

7.21. United Phosphorus Ltd.

7.22. Univar Solutions Inc.

1. GLOBAL BIOFERTILIZERS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL NITROGEN FIXING BIOFERTILIZERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL PHOSPHATE SOLUBILIZING BIOFERTILIZERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL OTHER BIOFERTILIZERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL BIOFERTILIZERS MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2019-2026 ($ MILLION)

6. GLOBAL BIOFERTILIZERS IN CEREAL AND GRAINS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL BIOFERTILIZERS IN OIL SEEDS AND PULSES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL BIOFERTILIZERS IN FRUITS AND VEGETABLES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL BIOFERTILIZERS IN OTHER CROP TYPES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL BIOFERTILIZERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

11. GLOBAL BIOFERTILIZERS IN SOIL TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL BIOFERTILIZERS IN SEED TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL BIOFERTILIZERS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN BIOFERTILIZERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. NORTH AMERICAN BIOFERTILIZERS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

16. NORTH AMERICAN BIOFERTILIZERS MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2019-2026 ($ MILLION)

17. NORTH AMERICAN BIOFERTILIZERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

18. EUROPEAN BIOFERTILIZERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

19. EUROPEAN BIOFERTILIZERS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

20. EUROPEAN BIOFERTILIZERS MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2019-2026 ($ MILLION)

21. EUROPEAN BIOFERTILIZERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC BIOFERTILIZERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC BIOFERTILIZERS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC BIOFERTILIZERS MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2019-2026 ($ MILLION)

25. ASIA-PACIFIC BIOFERTILIZERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

26. REST OF THE WORLD BIOFERTILIZERS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

27. REST OF THE WORLD BIOFERTILIZERS MARKET RESEARCH AND ANALYSIS BY CROP TYPE, 2019-2026 ($ MILLION)

28. REST OF THE WORLD BIOFERTILIZERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL BIOFERTILIZERS MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL BIOFERTILIZERS MARKET SHARE BY CROP TYPE, 2019 VS 2026 (%)

3. GLOBAL BIOFERTILIZERS MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

4. GLOBAL BIOFERTILIZERS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US BIOFERTILIZERS MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA BIOFERTILIZERS MARKET SIZE, 2019-2026 ($ MILLION)

7. UK BIOFERTILIZERS MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE BIOFERTILIZERS MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY BIOFERTILIZERS MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY BIOFERTILIZERS MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN BIOFERTILIZERS MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE BIOFERTILIZERS MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA BIOFERTILIZERS MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA BIOFERTILIZERS MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN BIOFERTILIZERS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC BIOFERTILIZERS MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD BIOFERTILIZERS MARKET SIZE, 2019-2026 ($ MILLION)