Biomethane Market

Biomethane Market Size, Share & Trends Analysis Report by Production Process (Anaerobic Digestion & Fermentation and Thermal Gasification), by Feedstock (Energy Crops, Agriculture Residues & Animal Manure and Municipal Waste), by Distribution Mode (Pipeline Injection, Compressed Natural Gas, and Liquified Natural Gas), and by Application (Transportation, Power Generation, and Industrial) Forecast Period (2024-2031)

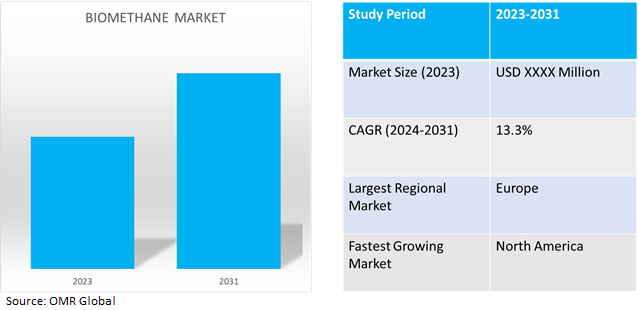

Biomethane market is anticipated to grow at a significant CAGR of 13.3% during the forecast period (2024-2031). The growing adoption of renewable energy and sustainability goals, increasing demand for biomethane as a vehicle fuel, and government incentives and policies are the key factors supporting the growth of the market globally. The increasing technological advancement in anaerobic digestion & fermentation and thermal gasification results in an increase in the production of biomethane. According to the World Biogas Association (WBA), in January 2024, combined global biogas and biomethane production increased 17.0% from 2017 to over 1.6 ExaJoules in 2022. The most growth in Europe and North America in the near term with India and China in the longer term. Almost half of current global biogas production is based in Europe, another 21.0% is produced in China, followed by the US (12.0%) and India (9.0%).

Market Dynamics

Increasing demand for biomethane in heat & supply and renewable fuel production

The rising demand for biomethane includes producing sustainable fuel for the transportation sector and providing heat and electricity for buildings and industries. Increasing adoption of biomethane in generating electricity in combined heat and power (CHP) plants, with applications in industrial operations, district heating, and power generation. The integration of biomethane potential as a viable alternative to natural gas, allowing a seamless transition to a cleaner and renewable energy source.

Increasing utilization of organic waste materials for biomethane production

The synthesis of biomethane from organic waste components has great potential and could be beneficial to the existing energy mix. Additionally, organic waste fractions could be utilized in conjunction with their use in the production of biomethane for nutrient recovery, specifically the recovery of N and P. For instance, according to the European Biogas Association (EBA), in December 2022, organic municipal solid waste is the second biggest source of biomethane production in Europe. Biodegradable bioplastics could represent 8.0 – 10.0% of organic municipal solid waste in the coming years.

Market Segmentation

Our in-depth analysis of the global biomethane market includes the following segments by offering, deployment mode, application and vertical:

- Based on production process, the market is sub-segmented into anaerobic digestion & fermentation and thermal gasification.

- Based on feedstock, the market is sub-segmented into energy crops, agriculture residues & animal manure and municipal waste.

- Based on distribution mode, the market is sub-segmented into pipeline injection, compressed natural gas and liquified natural gas.

- Based on application, the market is sub-segmented into transportation, power generation and industrial.

Power Generation is Projected to Emerge as the Largest Segment

Based on the application, the global biomethane market is sub-segmented into transportation, power generation and industrial. Among these, the power generation sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the growing adoption of biomethane as a clean and sustainable energy source for electricity production. With its renewable nature and minimal environmental impact, biomethane offers a comprehensive solution to the growing focus of governments and energy stakeholders on lowering carbon emissions in the power industry. Biomethane is a flexible and readily available fuel for power generation owing to advances in anaerobic digestion and gas upgrading technology, which allow for a smooth integration into the current natural gas infrastructure.

Municipal Waste Sub-segment to Hold a Considerable Market Share

Based on the feedstock, the global biomethane market is sub-segmented into energy crops, agriculture residues & animal manure and municipal waste. Among these, the municipal wastesub-segment is expected to hold a considerable share of the market. The major factor supporting segment growth is the increasing adoption of biomethane production from anaerobically digested food scraps, wastewater, and other organic wastes. Biomethane can be generated through waste sources like landfills and wastewater, and can also prevent methane emissions from manure management systems.

Regional Outlook

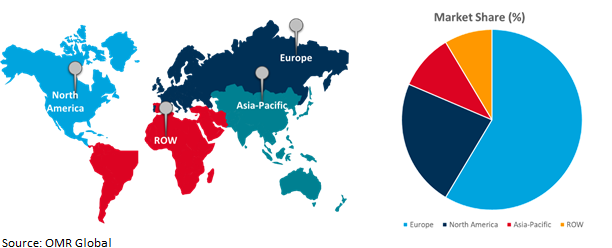

The global biomethane market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

An increasing number of manure-based anaerobic digesters in North America

- According to the US Department of Energy, in May 2022, About 330 anaerobic digester systems were operating at commercial livestock farms in the US.

- US Environmental Protection Agency, in 2022, energy generation from manure-based anaerobic digesters was approximately 2.42 million megawatt-hours (MWh) equivalent.

Global Biomethane Market Growth by Region 2024-2031

Europe Holds Major Market Share

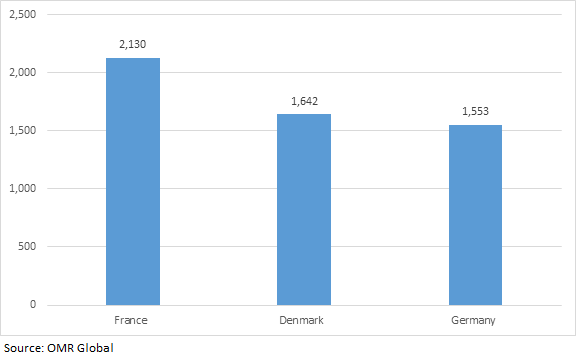

Among all the regions, Europe holds a significant share owing to an increase in biomethane production facilities. According to the European Biogas Association (EBA), in April 2023, Europe reached a total of 1,322biomethane-producing facilities. The increasing demand for biomethane in buildings, industry, transport and agriculture drives the growth of the biomethane market. For instance, in March 2022, According to the ecostarsrl, Europe produced around 15,8 billion cubic meters of biogas and around 2,43 billion cubic meters of biomethane yearly, according to a 2021 report of the European Biogas Association and by 2030 the continent should produce 35 billion cubic meters of biomethane /year to cover the entire gas demand.

European Top Three Countries Biomethane Production in 2021 (Gigawatt hours (GWh)

Source:Bioenergy Association of Ukraine (UABIO)

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global biomethane market include Air Liquide Energies, ENGIE SA, Eni S.p.A., MVVEnergie AG, Wärtsilä Corp.,among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Development

- In October 2023, DWS and MEAG acquired Weltec, a German biomethane producer. Weltec owns and operates five biomethane and four biogas plants across Germany and, under DWS and MEAG’s ownership, plans to invest in significantly increasing biomethane production volumes across its portfolio.

- In July 2023, Interstellar Technologies Inc. announced to utilized of biomethane derived from livestock manure for microsatellite launch vehicle ‘ZERO’. Liquid biomethanea biogas produced from underutilized livestock manure in Hokkaido, is supplied by Air Water Hokkaido Inc., a industrial gas company.

- In January 2023, Arkema signed an agreement with ENGIE for the supply of 300 GWh/year of renewable biomethane in France. This supply agreement of 300 GWh/year of renewable biomethane with ENGIE, and ongoing energy efficiency projects enable Arkemato further reduce very significantly the carbon footprint of its bio-based high-performanceRilsan® polyamide 11 and Pebax® Rnew® elastomers.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global biomethane market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Air Liquide Energies

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. ENGIE SA

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Eni S.p.A.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Biomethane Market by Production Process

4.1.1. Anaerobic Digestion & Fermentation

4.1.2. Thermal Gasification

4.2. Global Biomethane Market by Feedstock

4.2.1. Energy Crops

4.2.2. Agriculture Residues & Animal Manure

4.2.3. Municipal Waste

4.3. Global Biomethane Market by Distribution Mode

4.3.1. Pipeline Injection

4.3.2. Compressed Natural Gas

4.3.3. Liquified Natural Gas

4.4. Global Biomethane Market by Application

4.4.1. Transportation

4.4.2. Power Generation

4.4.3. Industrial

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Biogas Products Ltd.

6.2. BIOKRAFT INTERNATIONAL AB

6.3. bmp greengasGmbH

6.4. CNG Fuels Ltd.

6.5. Evo Energy Technologies

6.6. Future Biogas Ltd.

6.7. Greenlane Renewables Inc.

6.8. IES Biogas

6.9. MBPSolutions

6.10. MVVEnergieAG

6.11. PlanET Biogas Group GmbH

6.12. TOTALENERGIES GAS MOBILITY B.V.

6.13. Veolia Water Solutions &Technologies

6.14. VerbioSE

6.15. WärtsiläCorp.

6.16. WELTECBIOPOWER GMBH

1. GLOBAL BIOMETHANE MARKET RESEARCH AND ANALYSIS BY PRODUCTION PROCESS,2023-2031 ($ MILLION)

2. GLOBAL ANAEROBIC DIGESTION & FERMENTATION BASED BIOMETHANE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL THERMAL GASIFICATION BASED BIOMETHANE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL BIOMETHANE MARKET RESEARCH AND ANALYSIS BY FEEDSTOCK,2023-2031 ($ MILLION)

5. GLOBAL BIOMETHANE VIA ENERGY CROPS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL BIOMETHANE VIA AGRICULTURE RESIDUES & ANIMAL MANURE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL BIOMETHANE VIA MUNICIPAL WASTEMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL BIOMETHANE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION MODE,2023-2031 ($ MILLION)

9. GLOBAL BIOMETHANEPIPELINE INJECTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL BIOMETHANECOMPRESSED NATURAL GASMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL BIOMETHANELIQUIFIED NATURAL GASMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL BIOMETHANE MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

13. GLOBAL BIOMETHANE FOR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL BIOMETHANE FOR POWER GENERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL BIOMETHANE FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL BIOMETHANE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. NORTH AMERICAN BIOMETHANE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. NORTH AMERICAN BIOMETHANE MARKET RESEARCH AND ANALYSIS BY PRODUCTION PROCESS,2023-2031 ($ MILLION)

19. NORTH AMERICAN BIOMETHANE MARKET RESEARCH AND ANALYSIS BY FEEDSTOCK,2023-2031 ($ MILLION)

20. NORTH AMERICAN BIOMETHANE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION MODE,2023-2031 ($ MILLION)

21. NORTH AMERICAN BIOMETHANE MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

22. EUROPEAN BIOMETHANE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. EUROPEAN BIOMETHANE MARKET RESEARCH AND ANALYSIS BY PRODUCTION PROCESS, 2023-2031 ($ MILLION)

24. EUROPEAN BIOMETHANE MARKET RESEARCH AND ANALYSIS BY FEEDSTOCK,2023-2031 ($ MILLION)

25. EUROPEAN BIOMETHANE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION MODE,2023-2031 ($ MILLION)

26. EUROPEAN BIOMETHANE MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

27. ASIA-PACIFIC BIOMETHANE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

28. ASIA-PACIFICBIOMETHANE MARKET RESEARCH AND ANALYSIS BY PRODUCTION PROCESS,2023-2031 ($ MILLION)

29. ASIA-PACIFICBIOMETHANE MARKET RESEARCH AND ANALYSIS BY FEEDSTOCK,2023-2031 ($ MILLION)

30. ASIA-PACIFICBIOMETHANE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION MODE,2023-2031 ($ MILLION)

31. ASIA-PACIFICBIOMETHANE MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

32. REST OF THE WORLD BIOMETHANE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

33. REST OF THE WORLD BIOMETHANE MARKET RESEARCH AND ANALYSIS BY PRODUCTION PROCESS, 2023-2031 ($ MILLION)

34. REST OF THE WORLD BIOMETHANE MARKET RESEARCH AND ANALYSIS BY FEEDSTOCK,2023-2031 ($ MILLION)

35. REST OF THE WORLD BIOMETHANE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION MODE,2023-2031 ($ MILLION)

36. REST OF THE WORLD BIOMETHANE MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

1. GLOBAL BIOMETHANE MARKET SHARE BY PRODUCTION PROCESS,2023 VS 2031 (%)

2. GLOBAL ANAEROBIC DIGESTION & FERMENTATION BASED BIOMETHANE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL THERMAL GASIFICATION BASED BIOMETHANESERVICEMARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL BIOMETHANE MARKET SHAREBY FEEDSTOCK,2023 VS 2031 (%)

5. GLOBAL BIOMETHANE VIA ENERGY CROPSMARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL BIOMETHANE VIA AGRICULTURE RESIDUES & ANIMAL MANUREMARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL BIOMETHANE VIA MUNICIPAL WASTEMARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL BIOMETHANE MARKET SHAREBY DISTRIBUTION MODE,2023 VS 2031 (%)

9. GLOBAL BIOMETHANEPIPELINE INJECTIONMARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL BIOMETHANECOMPRESSED NATURAL GASMARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL BIOMETHANELIQUIFIED NATURAL GASMARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL BIOMETHANE MARKET SHAREBY APPLICATION,2023 VS 2031 (%)

13. GLOBAL BIOMETHANE FOR TRANSPORTATIONMARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL BIOMETHANE FOR POWER GENERATIONMARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL BIOMETHANE FOR INDUSTRIALMARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL BIOMETHANE MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. US BIOMETHANE MARKET SIZE, 2023-2031 ($ MILLION)

18. CANADA BIOMETHANE MARKET SIZE, 2023-2031 ($ MILLION)

19. UK BIOMETHANE MARKET SIZE, 2023-2031 ($ MILLION)

20. FRANCE BIOMETHANE MARKET SIZE, 2023-2031 ($ MILLION)

21. GERMANY BIOMETHANE MARKET SIZE, 2023-2031 ($ MILLION)

22. ITALY BIOMETHANE MARKET SIZE, 2023-2031 ($ MILLION)

23. SPAIN BIOMETHANE MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF EUROPE BIOMETHANE MARKET SIZE, 2023-2031 ($ MILLION)

25. INDIA BIOMETHANE MARKET SIZE, 2023-2031 ($ MILLION)

26. CHINA BIOMETHANE MARKET SIZE, 2023-2031 ($ MILLION)

27. JAPAN BIOMETHANE MARKET SIZE, 2023-2031 ($ MILLION)

28. SOUTH KOREA BIOMETHANE MARKET SIZE, 2023-2031 ($ MILLION)

29. REST OF ASIA-PACIFIC BIOMETHANE MARKET SIZE, 2023-2031 ($ MILLION)

30. LATIN AMERICABIOMETHANE MARKET SIZE, 2023-2031 ($ MILLION)

31. MIDDLE EAST AND AFRICABIOMETHANE MARKET SIZE, 2023-2031 ($ MILLION)