Hydrogen Hub Market

Hydrogen Hub Market Size, Share & Trends Analysis Report by Source (Blue Hydrogen, Grey Hydrogen, and Green Hydrogen), by Technology (Steam Methane Reforming, Partial Oxidation (POX), Auto Thermal Reforming, Coal Gasification, and Electrolysis), and by Application (Petroleum Refinery, Hydrogen Fuel Cell, Transportation, Ammonia Production, Methanol Production, Power Generation, and Others) Forecast Period (2025-2035)

Industry Overview

Hydrogen hub market was valued at $2.2 billion in 2024 and is projected to reach $13.8 billion in 2035, growing at a CAGR of 18.0% during the forecast period (2025–2035). A hydrogen hub is an integrated system linking hydrogen producers, consumers, and infrastructure to enable inexpensive transportation and cost savings in a region or cluster. It relies on it for decarbonization, economic growth and prosperity, energy security, and energy innovation and diversification of supply, lowers emissions in difficult-to-electrify end-use sectors, and generates local economic impacts. Hydrogen hubs substitute fossil fuels in steelmaking, chemical manufacturing, petroleum refining, fuel cell vehicle power, grid stability, enabling heating, energy distribution, and facilitating global trade. In addition, regions capable of renewable energy, such as solar, wind, and hydroelectric power, are fueling market growth in low-cost green hydrogen production.

- In May 2025, India's Ministry of New & Renewable Energy emphasized its strategic capabilities and vision for renewable energy and the production of green hydrogen at the World Hydrogen Summit 2025. India has installed more than 223 GW of renewable energy, which is one of the world's fastest-growing markets. The National Green Hydrogen Mission, initiated in 2023, targets achieving energy independence by 2047 and becoming net-zero emissions by 2070. India has progressed strongly in the development of green hydrogen, with 862,000 TPA capacity, as well as pilot initiatives in steel, mobility, and shipping.

Market Dynamics

Increasing Number of Hydrogen Projects Drives Significant Expansion in Hydrogen Hubs

The significant expansion in hydrogen Hubs, with the number of projects reaching final investment decisions doubling over the past year. According to the International Energy Agency (IEA), in October 2024, the Global Hydrogen Review 2024 shows that the number of projects that have reached final investment decision has doubled in the past 12 months, which would increase global production of low-emissions hydrogen fivefold by 2030. Globally, 20 gigawatts (GW) of electrolyser capacity have advanced to the point of final investment decision. By the end of this decade, overall production will exceed 50 million tonnes annually if all stated projects are carried out globally. China is responsible for more than 40.0% of the more than 6 GW of electrolyser capacity that reached a final investment decision in the last year.

Decarbonization and Energy Transition

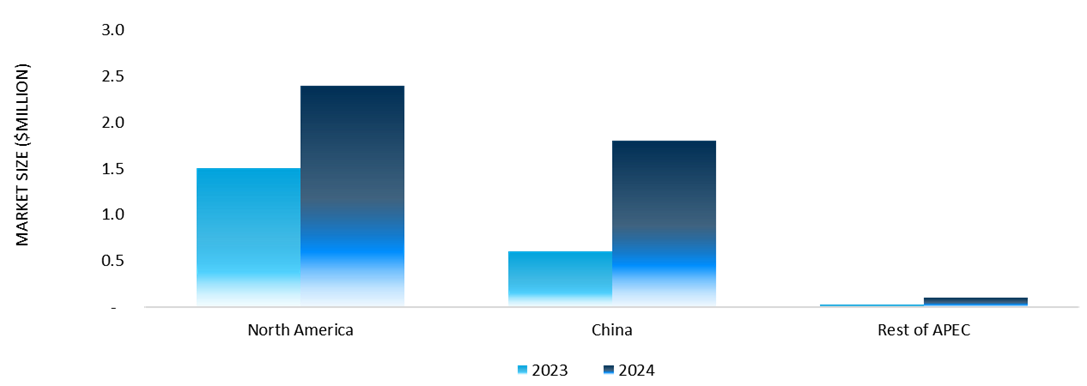

The growing global demand for low-carbon, renewable hydrogen is driving market growth in industries such as heavy industry, shipping, and aviation, promoting decarbonization and energy transition. In 2024, the APEC region was a leader in capacity for low-carbon hydrogen production at 4.2 million tons per year, a 68% boost from the past year. China's renewable-based hydrogen leads the way at 1.8 Mt/yr, followed by North America's natural-gas-with-CCS projects at 1.6 Mt/yr, with these two economies driving the region's hydrogen developments. Despite this improvement, production expense, technological advancement, and unexpected long-term demand difficulties persist, causing some projects to be delayed or removed.

Projected Annual H2 Production Capacity by 2030 (Million Tonnes Of H2)

Source: APERC Hydrogen Report Org.

Market Segmentation

- Based on the source, the market is segmented into blue hydrogen, grey hydrogen, and green hydrogen.

- Based on technology, the market is segmented into steam methane reforming, partial oxidation (POX), auto thermal reforming, coal gasification, and electrolysis.

- Based on the application, the market is segmented into petroleum refinery, hydrogen fuel cell, transportation, ammonia production, methanol production, power generation, and others.

Green Hydrogen: A Key Segment in Market Growth

Green hydrogen is a clean energy source that is promising, produced by the dissociation of water into hydrogen and oxygen using wind or solar electricity, as compared to grey or blue hydrogen, which is produced using the burning of fossil fuels. Countries are creating national hydrogen strategies, providing subsidies, and establishing regulatory frameworks for enabling hydrogen hubs, thereby fueling market growth. For instance, in January 2025, India initiated its maiden $21.6 billion first green hydrogen hub, with a vision to build 20 GW of renewable energy projects and generate 1,500 tons daily of green hydrogen and 7,500 tons daily of green hydrogen derivatives. They produce 1,500 tonnes of green hydrogen and 7,500 tonnes of derivatives of green hydrogen every day. The hub is anticipated to generate $2.1 billion in associated investment when it is developed in the state of Andhra Pradesh. The majority of the second hub will be finished by 2032, while the first hub is expected to be finished in 2027.

Regional Outlook

The global hydrogen hub market is further divided by region, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Clean Hydrogen's Commercial Adoption in North America

Governments in developed countries are making strategic efforts to accelerate the commercial-scale deployment of low-cost, clean hydrogen, fostering a national network of hydrogen producers, consumers, and infrastructure to advance the production, storage, delivery, and utilization of clean hydrogen with zero or near-zero carbon emissions. For instance, in November 2024, the US Department of Energy (DOE) announced award commitments of up to $2.2 billion for two Regional Clean Hydrogen Hubs (H2Hubs) aimed at expediting the commercial-scale deployment of low-cost, clean hydrogen, an energy product that can be generated with zero or near-zero carbon emissions. The goal of the Bipartisan Infrastructure Law is to assist the production, storage, delivery, and end-use of clean hydrogen while establishing a nationwide network of producers, consumers, and connecting infrastructure.

Asia-Pacific Maintains Strong Market Position

Asia-Pacific holds a significant share, owing to the market growth is primarily driven by Strategic partnerships among energy companies, technology providers, and governments, coupled with higher investment in research and development, is fueling the transformation of India's hydrogen hubs sector. For instance, in March 2025, Accelera by Cummins and GAIL (India) Ltd., a Maharatna CPSE of MoPNG and India's national natural gas company, entered into a memorandum of understanding (MOU) to jointly develop green hydrogen and zero-emission technologies in India. The partnership utilizes Accelera's hydrogen generation technology capability and GAIL's existing natural gas infrastructure to pursue business opportunities in hydrogen production, blending, transportation, and storage. This strategic alliance comes after Accelera had provided a 10-megawatt (MW) proton exchange membrane (PEM) electrolyzer system. Accelera's two PEM HyLYZER-1000 electrolyzer units generate 4.3 tons of green hydrogen daily, which is being mixed with natural gas to fuel GAIL's in-house operations. This combined effort is ensuring optimal use of hydrogen as a source of clean energy and enabling sustainable economic growth, and empowering India's position in global energy transition.

Market Players Outlook

The major companies operating in the global hydrogen hub market include Air Liquide, Air Products and Chemicals, Inc., Linde PLC, NTPC Ltd., and Reliance Industries Ltd., among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In May 2024, GAIL commissioned its maiden green hydrogen plant in Madhya Pradesh to generate high-purity hydrogen for captive consumption and retail sales. The plant, with the 10MW PEM electrolyzer as the power source, has a capacity of 4.3 tons per day. GAIL is also installing 20 MW of solar panels in the area of Vijaipur, indicating its focus on eco-friendly energy options.

- In November 2023, A memorandum of understanding was signed by Next Hydrogen Solutions Inc. and GE Vernova's Power Conversion business to combine Next Hydrogen's electrolysis technology with GE Vernova's power systems products in order to produce green hydrogen. Hydrogen is produced by electrolysing water molecules to split into hydrogen and oxygen, a process that requires a significant quantity of dependable and effective electricity.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global hydrogen hub market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

- Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Global Hydrogen Hub Market Sales Analysis – Source | Technology | Application ($ Million)

- Hydrogen Hub Market Sales Performance of Top Countries

- Research Methodology

- Primary Research Approach

- Secondary Research Approach

- Market Snapshot

- Market Overview and Insights

- Scope of the Study

- Analyst Insight & Current Market Trends

- Key Hydrogen Hub Market Trends

- Market Recommendations

- Market Determinants

- Market Drivers

- Drivers For Global Hydrogen Hub Market: Impact Analysis

- Market Pain Points and Challenges

- Restraints For Global Hydrogen Hub Market: Impact Analysis

- Market Opportunities

- Opportunities For Global Hydrogen Hub Market: Impact Analysis

- Market Drivers

- Competitive Landscape

- Competitive Dashboard – Hydrogen Hub Market Revenue and Share by Manufacturers

- Hydrogen Hub Comparison Analysis

- Top Market Player Ranking Matrix

- Key Company Analysis

- Air Liquide

- Overview

- Source Portfolio

- Financial Analysis (Subject to Data Availability)

- SWOT Analysis

- Business Strategy

- Air Products and Chemicals, Inc.

- Overview

- Source Portfolio

- Financial Analysis (Subject to Data Availability)

- SWOT Analysis

- Business Strategy

- Linde PLC

- Overview

- Source Portfolio

- Financial Analysis (Subject to Data Availability)

- SWOT Analysis

- Business Strategy

- NTPC Ltd.

- Overview

- Source Portfolio

- Financial Analysis (Subject to Data Availability)

- SWOT Analysis

- Business Strategy

- Reliance Industries Ltd.

- Overview

- Source Portfolio

- Financial Analysis (Subject to Data Availability)

- SWOT Analysis

- Business Strategy

- Air Liquide

- Key Company Analysis

- Top Winning Strategies by Market Players

- Merger and Acquisition

- Source Launch

- Partnership And Collaboration

- Global Hydrogen Hub Market Sales Analysis by Source ($ Million)

- Blue hydrogen

- Grey Hydrogen

- Green Hydrogen

- Global Hydrogen Hub Market Sales Analysis by Technology ($ Million)

- Steam Methane Reforming

- Partial Oxidation (POX)

- Auto Thermal Reforming

- Coal Gasification

- Electrolysis

- Global Hydrogen Hub Market Sales Analysis by Application ($ Million)

- Petroleum Refinery

- Hydrogen Fuel Cell

- Transportation

- Ammonia Production

- Methanol Production

- Power Generation

- Others

- Regional Analysis

- North American Hydrogen Hub Market Sales Analysis – Source | Technology | Application ($ Million)

- Macroeconomic Factors for North America

- United States

- Canada

- European Hydrogen Hub Market Sales Analysis – Source | Technology | Application ($ Million)

- Macroeconomic Factors for Europe

- UK

- Germany

- Italy

- Spain

- France

- Russia

- Rest of Europe

- Asia-Pacific Hydrogen Hub Market Sales Analysis – Source | Technology | Application ($ Million)

- Macroeconomic Factors for Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

- Rest of Asia-Pacific

- Rest of the World Hydrogen Hub Market Sales Analysis – Source | Technology | Application ($ Million)

- Macroeconomic Factors for the Rest of the World

- Latin America

- Middle East and Africa

- Company Profiles

- Aberdeen Hydrogen Energy Ltd.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Adani Group

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Air Liquide

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Air Products and Chemicals, Inc.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Aranca

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Bharat Petroleum Corp. Ltd. (BPCL)

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- BP p.l.c.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- GAIL Ltd.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Hamburg Green Hydrogen GmbH & Co.KG

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Hygenco Green Energies Pvt Ltd.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- JSW Energy Ltd

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Larsen & Toubro Ltd.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Linde PLC

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- National Grid PLC

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- NTPC Ltd.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Plug Power Inc.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Reliance Industries Ltd.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Siemens AG

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Aberdeen Hydrogen Energy Ltd.

1. Global Hydrogen Hub Market Research and Analysis By Source, 2024-2035 ($ Million)

2. Global Blue Hydrogen Hub Market Research and Analysis By Region, 2024-2035 ($ Million)

3. Global Grey Hydrogen Hub Market Research and Analysis By Region, 2024-2035 ($ Million)

4. Global Green Hydrogen Hub Market Research and Analysis By Region, 2024-2035 ($ Million)

5. Global Hydrogen Hub Market Research and Analysis By Technology, 2024-2035 ($ Million)

6. Global Steam Methane Reforming Based Hydrogen Hub Market Research and Analysis By Region, 2024-2035 ($ Million)

7. Global Partial Oxidation (POX) Based Hydrogen Hub Market Research and Analysis By Region, 2024-2035 ($ Million)

8. Global Auto Thermal Reforming Based Hydrogen Hub Market Research and Analysis By Region, 2024-2035 ($ Million)

9. Global Coal Gasification Based Hydrogen Hub Market Research and Analysis By Region, 2024-2035 ($ Million)

10. Global Electrolysis Based Hydrogen Hub Market Research and Analysis By Region, 2024-2035 ($ Million)

11. Global Hydrogen Hub Market Research and Analysis By Application, 2024-2035 ($ Million)

12. Global Hydrogen Hub For Petroleum Refinery Market Research and Analysis By Region, 2024-2035 ($ Million)

13. Global Hydrogen Hub For Hydrogen Fuel Cell Market Research and Analysis By Region, 2024-2035 ($ Million)

14. Global Hydrogen Hub For Transportation Market Research and Analysis By Region, 2024-2035 ($ Million)

15. Global Hydrogen Hub For Ammonia Production Market Research and Analysis By Region, 2024-2035 ($ Million)

16. Global Hydrogen Hub For Methanol Production Market Research and Analysis By Region, 2024-2035 ($ Million)

17. Global Hydrogen Hub For Power Generation Market Research and Analysis By Region, 2024-2035 ($ Million)

18. Global Hydrogen Hub For Other Application Market Research and Analysis By Region, 2024-2035 ($ Million)

19. Global Hydrogen Hub Market Research and Analysis By Region, 2024-2035 ($ Million)

20. North American Hydrogen Hub Market Research and Analysis By Country, 2024-2035 ($ Million)

21. North American Hydrogen Hub Market Research and Analysis By Source, 2024-2035 ($ Million)

22. North American Hydrogen Hub Market Research and Analysis By Technology, 2024-2035 ($ Million)

23. North American Hydrogen Hub Market Research and Analysis By Application, 2024-2035 ($ Million)

24. European Hydrogen Hub Market Research and Analysis By Country, 2024-2035 ($ Million)

25. European Hydrogen Hub Market Research and Analysis By Source, 2024-2035 ($ Million)

26. European Hydrogen Hub Market Research and Analysis By Technology, 2024-2035 ($ Million)

27. European Hydrogen Hub Market Research and Analysis By Application, 2024-2035 ($ Million)

28. Asia-Pacific Hydrogen Hub Market Research and Analysis By Country, 2024-2035 ($ Million)

29. Asia-Pacific Hydrogen Hub Market Research and Analysis By Source, 2024-2035 ($ Million)

30. Asia-Pacific Hydrogen Hub Market Research and Analysis By Form, 2024-2035 ($ Million)

31. Asia-Pacific Hydrogen Hub Market Research and Analysis By Application, 2024-2035 ($ Million)

32. Rest Of The World Hydrogen Hub Market Research and Analysis By Region, 2024-2035 ($ Million)

33. Rest Of The World Hydrogen Hub Market Research and Analysis By Source, 2024-2035 ($ Million)

34. Rest Of The World Hydrogen Hub Market Research and Analysis By Technology, 2024-2035 ($ Million)

35. Rest Of The World Hydrogen Hub Market Research and Analysis By Application, 2024-2035 ($ Million)

1. Global Hydrogen Hub Market Share By Source, 2024 Vs 2035 (%)

2. Global Blue Hydrogen Hub Market Share By Region, 2024 Vs 2035 (%)

3. Global Grey Hydrogen Hub Market Share By Region, 2024 Vs 2035 (%)

4. Global Green Hydrogen Hub Market Share By Region, 2024 Vs 2035 (%)

5. Global Hydrogen Hub Market Share By Technology, 2024 Vs 2035 (%)

6. Global Steam Methane Reforming Based Hydrogen Hub Market Share By Region, 2024 Vs 2035 (%)

7. Global Partial Oxidation (Pox) Based Hydrogen Hub Market Share By Region, 2024 Vs 2035 (%)

8. Global Auto Thermal Reforming Based Hydrogen Hub Market Share By Region, 2024 Vs 2035 (%)

9. Global Coal Gasification Based Hydrogen Hub Market Share By Region, 2024 Vs 2035 (%)

10. Global Electrolysis Based Hydrogen Hub Market Share By Region, 2024 Vs 2035 (%)

11. Global Hydrogen Hub Market Share By Application, 2024 Vs 2035 (%)

12. Global Hydrogen Hub For Petroleum Refinery Market Share By Region, 2024 Vs 2035 (%)

13. Global Hydrogen Hub For Hydrogen Fuel Cell Market Share By Region, 2024 Vs 2035 (%)

14. Global Hydrogen Hub For Transportation Market Share By Region, 2024 Vs 2035 (%)

15. Global Hydrogen Hub For Ammonia Production Market Share By Region, 2024 Vs 2035 (%)

16. Global Hydrogen Hub For Methanol Production Market Share By Region, 2024 Vs 2035 (%)

17. Global Hydrogen Hub For Power Generation Market Share By Region, 2024 Vs 2035 (%)

18. Global Hydrogen Hub For Other Application Market Share By Region, 2024 Vs 2035 (%)

19. US Hydrogen Hub Market Size, 2024-2035 ($ Million)

20. Canada Hydrogen Hub Market Size, 2024-2035 ($ Million)

21. UK Hydrogen Hub Market Size, 2024-2035 ($ Million)

22. France Hydrogen Hub Market Size, 2024-2035 ($ Million)

23. Germany Hydrogen Hub Market Size, 2024-2035 ($ Million)

24. Italy Hydrogen Hub Market Size, 2024-2035 ($ Million)

25. Spain Hydrogen Hub Market Size, 2024-2035 ($ Million)

26. Russia Hydrogen Hub Market Size, 2024-2035 ($ Million)

27. Rest Of Europe Hydrogen Hub Market Size, 2024-2035 ($ Million)

28. India Hydrogen Hub Market Size, 2024-2035 ($ Million)

29. China Hydrogen Hub Market Size, 2024-2035 ($ Million)

30. Japan Hydrogen Hub Market Size, 2024-2035 ($ Million)

31. South Korea Hydrogen Hub Market Size, 2024-2035 ($ Million)

32. Australia And New Zealand Hydrogen Hub Market Size, 2024-2035 ($ Million)

33. Asean Economies Hydrogen Hub Market Size, 2024-2035 ($ Million)

34. Rest Of Asia-Pacific Hydrogen Hub Market Size, 2024-2035 ($ Million)

35. Latin America Hydrogen Hub Market Size, 2024-2035 ($ Million)

36. Middle East And Africa Hydrogen Hub Market Size, 2024-2035 ($ Million)

FAQS

The size of the Hydrogen Hub market in 2024 is estimated to be around $2.2 billion.

Asia-Pacific holds the largest share in the Hydrogen Hub market.

Leading players in the Hydrogen Hub market include Air Liquide, Air Products and Chemicals, Inc., Linde PLC, NTPC Ltd., and Reliance Industries Ltd., among others.

Hydrogen Hub market is expected to grow at a CAGR of 18.0% from 2025 to 2035.

The Hydrogen Hub Market is growing due to increasing investments in clean energy, government initiatives for decarbonization, and rising adoption of hydrogen as a sustainable fuel source.