Biostimulants Market

Biostimulants Market Size, Share & Trends Analysis Report by Active Ingredient (Amino Acids, Humic Substances, Microbial Amendments, Minerals and Vitamins, Seaweed Extracts, and Other Active Ingredients), by Product Type (Acid-Based, Extract-Based, and Other Product Types), by Crop Type (Flowers and Ornamentals, Fruits and Vegetables, Grains and Cereals, Pulses and Oilseeds, and Other Crops), and by Application (Foliar Treatment, Seed Treatment, and Soil Treatment), Forecast Period (2025-2035)

Industry Overview

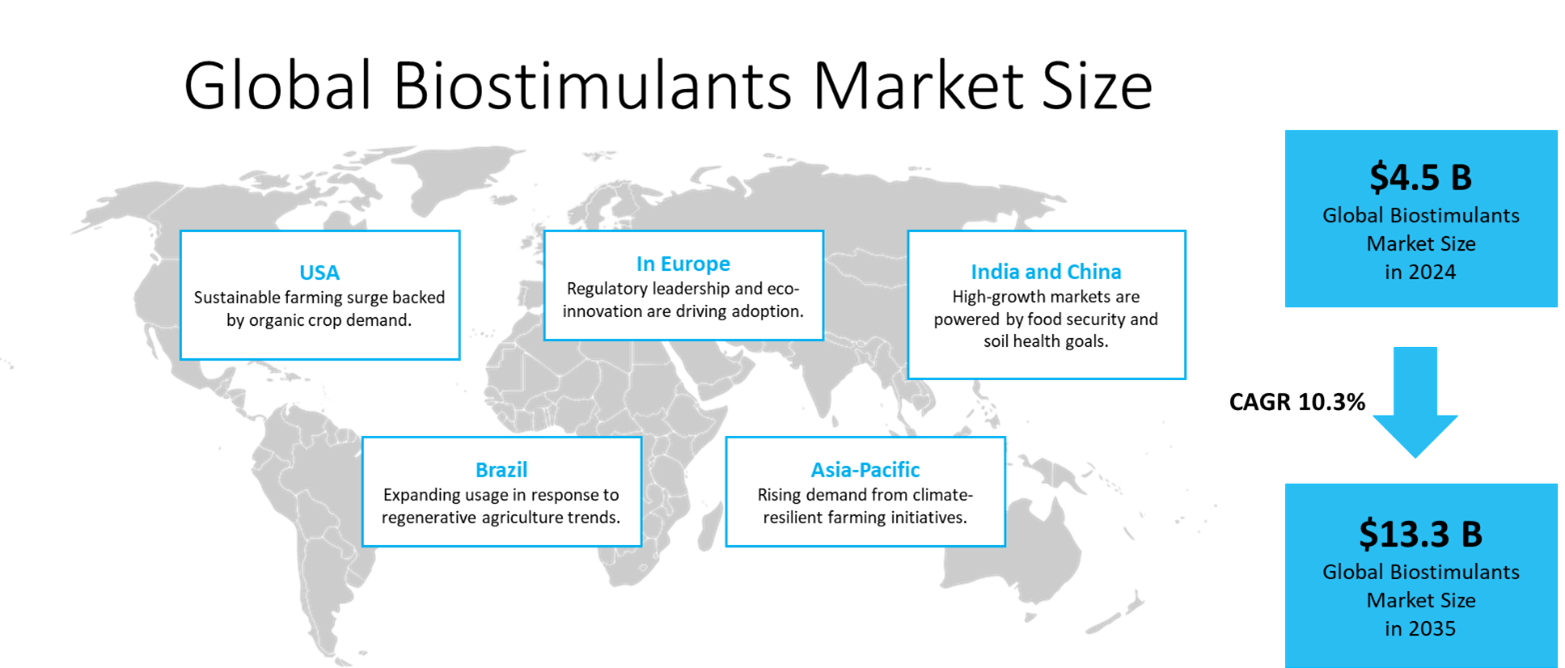

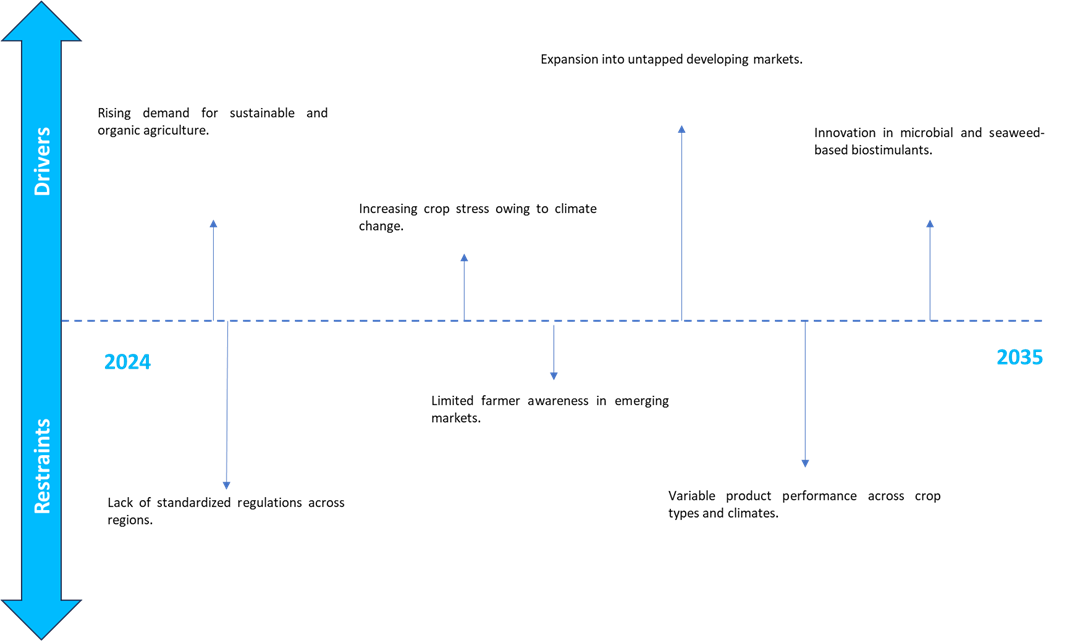

Biostimulants market was valued at $4.5 billion in 2024 and is projected to reach $13.3 billion by 2035, growing at a CAGR of 10.3% during the forecast period (2025-2035). The market for biostimulants is growing as farmers seek environmentally friendly methods to enhance crop resilience and growth. These formulations enhance plants' physiological responses to specific environmental stressors such as drought and salinity, while optimizing nutrient uptake and efficiency. Market demand is further fueled by growing regulatory support for environmentally friendly agriculture. Increasing international adoption of biostimulants is driven by the rising emphasis on reducing chemical fertilizer dependence, while innovations in formulation technologies are significantly enhancing product efficacy. According to the European Biostimulants Industry Council (EBIC), producers of biostimulants reinvest 3–10% of their turnover in R&D that can take up to 10 years to bring new products to market. This represents a significant investment, particularly in the absence of robust protections against replication and reverse engineering of the product.

Market Dynamics

Integration with Precision Agriculture

As precision agriculture technologies are increasingly integrated, the market for biostimulants is expanding. Farmers can apply biostimulants more precisely and effectively by utilizing data-driven insights and advanced monitoring tools. This focused strategy reduces waste and its negative effects on the environment while improving crop health. Real-time adjustments made possible by precision agriculture increase the overall efficacy of biostimulant treatments. This enables farmers to maximize input efficiency and achieve improved yield outcomes. For instance, UPL Ltd. develops advanced biostimulant solutions specifically designed for seamless integration into precision agriculture systems.

Customization and Crop-Specific Formulations

The biostimulants market is expanding due to rising demand for crop-specific and condition-tailored solutions that address diverse agronomic requirements. Customized formulations improve overall efficacy by addressing specific plant needs, such as stress tolerance or nutrient deficiencies. Farmers can more effectively maximize crop health and raise yields with this focused approach. Advancements in biotechnology and formulation science are enabling manufacturers to develop targeted biostimulant solutions tailored to specific crop needs. These innovations enhance plant vigor and resilience, supporting the wider integration of biostimulants across diverse agricultural practices.

Market Segmentation

- Based on the active ingredient, the market is segmented into amino acids, humic substances, microbial amendments, minerals and vitamins, seaweed extracts, and other active ingredients.

- Based on the product type, the market is segmented into acid-based, extract-based, and other product types.

- Based on the crop type, the market is segmented into flowers and ornamentals, fruits and vegetables, grains and cereals, pulses and oilseeds, and other crops.

- Based on the application, the market is segmented into foliar treatment, seed treatment, and soil treatment.

Seaweed Extracts Segment to Lead the Market with the Largest Share

The growing application of seaweed extracts in agriculture has a major impact on the market expansion for biostimulants. Natural bioactive compounds found in these extracts are well known for promoting plant growth, enhancing nutrient uptake, and fortifying resistance to environmental stress. Seaweed-based solutions are being used by farmers to improve soil health and increase crop yield. Their suitability for organic farming practices contributes to their growing appeal, particularly in markets that prioritize exports. Their efficacy in a variety of crops and climates has been confirmed by ongoing research. For instance, A Canadian company, Acadian Plant Health, provides biostimulants based on seaweed extract, which are widely used in agricultural practices around the world to increase plant productivity.

Foliar Treatment: A Key Segment in Market Growth

Foliar application has emerged as a key driver in the biostimulants market owing to its rapid action and targeted delivery. By applying products directly to the foliage, plants can absorb nutrients and active compounds more efficiently, leading to accelerated physiological responses. This method is particularly effective under environmental conditions that limit root absorption, and works for timely interventions during critical growth phases, supporting improved crop development. Foliar application is an economical option for farmers as it lowers nutrient losses and improves input efficiency. Its widespread adoption is further encouraged by its simplicity of use and compatibility with standard spraying equipment. This method is particularly popular for high-value crops where accuracy and speed are crucial. For instance, a variety of foliar biostimulants are available from the Italian company Biolchim S.p.A., offering products that increase plant vitality and enhance overall yield quality.

Regional Outlook

The global biostimulants market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Improved Agricultural Output in Asia Pacific

The Asia Pacific biostimulants market is growing, resulting in improved agricultural output while working through environmental issues. Rising population pressures and the decline in arable land are driving farmers to adopt yield-enhancing solutions that maintain soil health and minimize long-term degradation. For instance, India and China, among other governments, are now promoting sustainable agriculture through subsidies and incentives. Farmer awareness relates to the long-term sustainability benefits of biostimulants is creating a space for market expansion. There is a greater investment in agritech and rural extension services that are making biostimulant products more obtainable. The shift toward organic and residue-free farming practices, particularly in export-oriented agricultural economies, further accelerating the adoption of alternative crop enhancement strategies. Changing climate norms and erratic rainfall cycles are increasing farmer adoption of biostimulants to ensure crop resilience. For instance, UPL Ltd. of India has a large biostimulant product portfolio to support local crop requirements and conditions.

Europe Region Dominates the Market with Major Share

European biostimulants market is growing, driven by the region's focus on efficiencies in sustainable agriculture. Increased government regulations support this area, such as the EU's initiative to encourage organic farming and limit the use of chemical inputs is encouraging the usage of biostimulants in agricultural practices. Farmers in Europe are increasingly shifting towards adopting a biologically based approach to improve crop performance and soil health. Consumer preferences for organic and clean-label food products are playing a significant role in shaping demand for biostimulant-based agricultural inputs. There is a strong base of research facilities that can support innovation in a region's plant health solutions. Partnerships between agritech companies and research organizations are leading to a focus on the biostimulants area. For instance, Valagro S.P.A., an Italy-based company, is a prominent provider offering ERGER, ACTIWAVE, and KENDAL a comprehensive portfolio of plant biostimulant solutions. The company's product is positioned as a biostimulant designed to enhance nutrient utilization and support consistent crop performance across varying environmental conditions.

Market Players Outlook

The major companies operating in the global biostimulants market include BASF SE, FMC Corp., UPL Ltd., Valagro S.p. A. (Syngenta Crop Protection AG) and Yara International ASA, among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In January 2025, Syngenta and the pioneering artificial intelligence (AI) company TraitSeq are combining forces to use the full power of AI for the development of innovative, high-performance biostimulants. The development of such biostimulants fits in Syngenta’s efforts to support farmers' transition to regenerative practices and its commitment to sustainability. Syngenta’s recently launched Portfolio Sustainability Framework (PSF) rates Syngenta’s products for sustainability and stakeholder alignment into 3 tiers.

- In March 2024, Bioiberica introduced probiotic biostimulant Terra-Sorb SymBiotic for the optimization of fertilization. It is a product with multiple benefits for farmers, namely improving soil fertility, improving efficiency of nutrient absorption and production, among others. The latest Terra-Sorb formulations feature Bioiberica’s proprietary priming technology, developed to select and condition beneficial microorganisms for sustainable agricultural use. These products include Bacillus velezensis PH023, a distinct microbial strain identified for its exceptional tolerance to temperature and salinity extremes.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global biostimulants market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Biostimulants Market Sales Analysis – Active Ingredient | Product Type | Crop Type | Application | ($ Million)

• Biostimulants Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Biostimulants Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Biostimulants Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For the Global Biostimulants Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For the Global Biostimulants Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Biostimulants Market Revenue and Share by Manufacturers

• Biostimulants Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. BASF SE

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. FMC Corp.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. UPL Ltd.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Valagro S.p. A. (Syngenta Crop Protection AG)

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Yara International ASA

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Biostimulants Market Sales Analysis by Active Ingredient ($ Million)

5.1. Amino Acids

5.2. Humic Substances

5.3. Microbial amendments

5.4. Minerals and Vitamins

5.5. Other active ingredients

5.6. Seaweed Extracts

6. Global Biostimulants Market Sales Analysis by Product Type ($ Million)

6.1. Acid-Based

6.2. Extract-Based

6.3. Other Product Types

7. Global Biostimulants Market Sales Analysis by Crop Type ($ Million)

7.1. Flowers and Ornamentals

7.2. Fruits and Vegetables

7.3. Grains and Cereals

7.4. Other Crops

7.5. Pulses and Oilseeds

8. Global Biostimulants Market Sales Analysis by Application ($ Million)

8.1. Foliar Treatment

8.2. Seed Treatment

8.3. Soil Treatment

9. Regional Analysis

9.1. North American Biostimulants Market Sales Analysis – Active Ingredient | Product Type | Crop Type | Application| Country ($ Million)

• Macroeconomic Factors for North America

9.1.1. United States

9.1.2. Canada

9.2. European Biostimulants Market Sales Analysis – Active Ingredient | Product Type | Crop Type | Application| Country ($ Million)

• Macroeconomic Factors for Europe

9.2.1. UK

9.2.2. Germany

9.2.3. Italy

9.2.4. Spain

9.2.5. France

9.2.6. Russia

9.2.7. Rest of Europe

9.3. Asia-Pacific Biostimulants Market Sales Analysis – Active Ingredient | Product Type | Crop Type | Application| Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

9.3.7. Rest of Asia-Pacific

9.4. Rest of the World Biostimulants Market Sales Analysis – Active Ingredient | Product Type | Crop Type | Application| Country ($ Million)

• Macroeconomic Factors for the Rest of the World

9.4.1. Latin America

9.4.2. Middle East and Africa

10. Company Profiles

10.1. ADAMA Group

10.1.1. Quick Facts

10.1.2. Company Overview

10.1.3. Product Portfolio

10.1.4. Business Strategies

10.2. AGLUKON Spezialduenger GmbH & Co. KG

10.2.1. Quick Facts

10.2.2. Company Overview

10.2.3. Product Portfolio

10.2.4. Business Strategies

10.3. Agricen

10.3.1. Quick Facts

10.3.2. Company Overview

10.3.3. Product Portfolio

10.3.4. Business Strategies

10.4. AgriTecno Fertilizantes S.L.

10.4.1. Quick Facts

10.4.2. Company Overview

10.4.3. Product Portfolio

10.4.4. Business Strategies

10.5. Aminocore Deutschland GmbH

10.5.1. Quick Facts

10.5.2. Company Overview

10.5.3. Product Portfolio

10.5.4. Business Strategies

10.6. Aphea.Bio NV

10.6.1. Quick Facts

10.6.2. Company Overview

10.6.3. Product Portfolio

10.6.4. Business Strategies

10.7. Axeb Biotech S.L.

10.7.1. Quick Facts

10.7.2. Company Overview

10.7.3. Product Portfolio

10.7.4. Business Strategies

10.8. BASF SE

10.8.1. Quick Facts

10.8.2. Company Overview

10.8.3. Product Portfolio

10.8.4. Business Strategies

10.9. Bioiberica S.A.U.

10.9.1. Quick Facts

10.9.2. Company Overview

10.9.3. Product Portfolio

10.9.4. Business Strategies

10.10. Biolchim S.p.A.

10.10.1. Quick Facts

10.10.2. Company Overview

10.10.3. Product Portfolio

10.10.4. Business Strategies

10.11. Devi Cropscience Pvt Ltd

10.11.1. Quick Facts

10.11.2. Company Overview

10.11.3. Product Portfolio

10.11.4. Business Strategies

10.12. FMC Corp.

10.12.1. Quick Facts

10.12.2. Company Overview

10.12.3. Product Portfolio

10.12.4. Business Strategies

10.13. Futureco Bioscience

10.13.1. Quick Facts

10.13.2. Company Overview

10.13.3. Product Portfolio

10.13.4. Business Strategies

10.14. Gowan Company, L.L.C.

10.14.1. Quick Facts

10.14.2. Company Overview

10.14.3. Product Portfolio

10.14.4. Business Strategies

10.15. Haifa Group

10.15.1. Quick Facts

10.15.2. Company Overview

10.15.3. Product Portfolio

10.15.4. Business Strategies

10.16. Hello Nature, Inc.

10.16.1. Quick Facts

10.16.2. Company Overview

10.16.3. Product Portfolio

10.16.4. Business Strategies

10.17. ILSA S.p. A.

10.17.1. Quick Facts

10.17.2. Company Overview

10.17.3. Product Portfolio

10.17.4. Business Strategies

10.18. Kelp Products International

10.18.1. Quick Facts

10.18.2. Company Overview

10.18.3. Product Portfolio

10.18.4. Business Strategies

10.19. Koppert

10.19.1. Quick Facts

10.19.2. Company Overview

10.19.3. Product Portfolio

10.19.4. Business Strategies

10.20. LawrieCo Pty Ltd.

10.20.1. Quick Facts

10.20.2. Company Overview

10.20.3. Product Portfolio

10.20.4. Business Strategies

10.21. MAFA Bioscience S.A.

10.21.1. Quick Facts

10.21.2. Company Overview

10.21.3. Product Portfolio

10.21.4. Business Strategies

10.22. Omnia Specialties Pty

10.22.1. Quick Facts

10.22.2. Company Overview

10.22.3. Product Portfolio

10.22.4. Business Strategies

10.23. Rallis India Ltd.

10.23.1. Quick Facts

10.23.2. Company Overview

10.23.3. Product Portfolio

10.23.4. Business Strategies

10.24. SICIT Group S.p.A.

10.24.1. Quick Facts

10.24.2. Company Overview

10.24.3. Product Portfolio

10.24.4. Business Strategies

10.25. Sustainable Agro Solutions, S.A.U. (manvert)

10.25.1. Quick Facts

10.25.2. Company Overview

10.25.3. Product Portfolio

10.25.4. Business Strategies

10.26. Toopi Organics

10.26.1. Quick Facts

10.26.2. Company Overview

10.26.3. Product Portfolio

10.26.4. Business Strategies

10.27. UPL Ltd.

10.27.1. Quick Facts

10.27.2. Company Overview

10.27.3. Product Portfolio

10.27.4. Business Strategies

10.28. Valagro S.p. A. (Syngenta Crop Protection AG)

10.28.1. Quick Facts

10.28.2. Company Overview

10.28.3. Product Portfolio

10.28.4. Business Strategies

10.29. Yara International ASA

10.29.1. Quick Facts

10.29.2. Company Overview

10.29.3. Product Portfolio

10.29.4. Business Strategies

1. Global Biostimulants Market Research And Analysis By Active Ingredient, 2024–2035 ($ Million)

2. Global Biostimulants Amino Acids Market Research And Analysis By Region, 2024–2035 ($ Million)

3. Global Biostimulants Humic Substances Market Research And Analysis By Region, 2024–2035 ($ Million)

4. Global Biostimulants Microbial Amendments Market Research And Analysis By Region, 2024–2035 ($ Million)

5. Global Biostimulants Minerals And Vitamins Market Research And Analysis By Region, 2024–2035 ($ Million)

6. Global Biostimulants Seaweed Extracts Market Research And Analysis By Region, 2024–2035 ($ Million)

7. Global Other Active Ingredients Biostimulants Market Research And Analysis By Region, 2024–2035 ($ Million)

8. Global Biostimulants Market Research And Analysis By Product Type, 2024–2035 ($ Million)

9. Global Acid-Based Biostimulants Market Research And Analysis By Region, 2024–2035 ($ Million)

10. Global Extract-Based Biostimulants Market Research And Analysis By Region, 2024–2035 ($ Million)

11. Global Other Biostimulants Product Type Market Research And Analysis By Region, 2024–2035 ($ Million)

12. Global Biostimulants Market Research And Analysis By Crop Type, 2024–2035 ($ Million)

13. Global Flowers And Ornamentals Biostimulants Market Research And Analysis By Region, 2024–2035 ($ Million)

14. Global Fruits And Vegetables Biostimulants Market Research And Analysis By Region, 2024–2035 ($ Million)

15. Global Grains And Cereals Biostimulants Market Research And Analysis By Region, 2024–2035 ($ Million)

16. Global Pulses And Oilseeds Biostimulants Market Research And Analysis By Region, 2024–2035 ($ Million)

17. Global Other Crops Type Biostimulants Market Research And Analysis By Region, 2024–2035 ($ Million)

18. Global Biostimulants Market Research And Analysis By Application, 2024–2035 ($ Million)

19. Global Biostimulants For Foliar Treatment Market Research And Analysis By Region, 2024–2035 ($ Million)

20. Global Biostimulants For Seed Treatment Market Research And Analysis By Region, 2024–2035 ($ Million)

21. Global Biostimulants For Soil Treatment Market Research And Analysis By Region, 2024–2035 ($ Million)

22. Global Biostimulants Market Research And Analysis By Region, 2024–2035 ($ Million)

23. North American Biostimulants Market Research And Analysis By Country, 2024–2035 ($ Million)

24. North American Biostimulants Market Research And Analysis By Active Ingredient, 2024–2035 ($ Million)

25. North American Biostimulants Market Research And Analysis By Product Type, 2024–2035 ($ Million)

26. North American Biostimulants Market Research And Analysis By Crop Type, 2024–2035 ($ Million)

27. North American Biostimulants Market Research And Analysis By Application, 2024–2035 ($ Million)

28. European Biostimulants Market Research And Analysis By Country, 2024–2035 ($ Million)

29. European Biostimulants Market Research And Analysis By Active Ingredient, 2024–2035 ($ Million)

30. European Biostimulants Market Research And Analysis By Product Type, 2024–2035 ($ Million)

31. European Biostimulants Market Research And Analysis By Crop Type, 2024–2035 ($ Million)

32. European Biostimulants Market Research And Analysis By Application, 2024–2035 ($ Million)

33. Asia-Pacific Biostimulants Market Research And Analysis By Country, 2024–2035 ($ Million)

34. Asia-Pacific Biostimulants Market Research And Analysis By Active Ingredient, 2024–2035 ($ Million)

35. Asia-Pacific Biostimulants Market Research And Analysis By Product Type, 2024–2035 ($ Million)

36. Asia-Pacific Biostimulants Market Research And Analysis By Crop Type, 2024–2035 ($ Million)

37. Asia-Pacific Biostimulants Market Research And Analysis By Application, 2024–2035 ($ Million)

38. Rest Of The World Biostimulants Market Research And Analysis By Region, 2024–2035 ($ Million)

39. Rest Of The World Biostimulants Market Research And Analysis By Active Ingredient, 2024–2035 ($ Million)

40. Rest Of The World Biostimulants Market Research And Analysis By Product Type, 2024–2035 ($ Million)

41. Rest Of The World Biostimulants Market Research And Analysis By Crop Type, 2024–2035 ($ Million)

42. Rest Of The World Biostimulants Market Research And Analysis By Application, 2024–2035 ($ Million)

1. Global Biostimulants Market Share By Active Ingredient, 2024 Vs 2035 (%)

2. Global Biostimulants Amino Acids Market Share By Region, 2024 Vs 2035 (%)

3. Global Biostimulants Humic Substances Market Share By Region, 2024 Vs 2035 (%)

4. Global Biostimulants Microbial Amendments Market Share By Region, 2024 Vs 2035 (%)

5. Global Biostimulants Minerals And Vitamins Market Share By Region, 2024 Vs 2035 (%)

6. Global Biostimulants Seaweed Extracts Market Share By Region, 2024 Vs 2035 (%)

7. Global Other Active Ingredients Biostimulants Market Share By Region, 2024 Vs 2035 (%)

8. Global Biostimulants Market Share By Product Type, 2024 Vs 2035 (%)

9. Global Acid-Based Biostimulants Market Share By Region, 2024 Vs 2035 (%)

10. Global Extract-Based Biostimulants Market Share By Region, 2024 Vs 2035 (%)

11. Global Other Biostimulants Product Type Market Share By Region, 2024 Vs 2035 (%)

12. Global Biostimulants Market Share By Crop Type, 2024 Vs 2035 (%)

13. Global Flowers And Ornamentals Biostimulants Market Share By Region, 2024 Vs 2035 (%)

14. Global Fruits And Vegetables Biostimulants Market Share By Region, 2024 Vs 2035 (%)

15. Global Grains And Cereals Biostimulants Market Share By Region, 2024 Vs 2035 (%)

16. Global Pulses And Oilseeds Biostimulants Market Share By Region, 2024 Vs 2035 (%)

17. Global Other Crops Biostimulants Market Share By Region, 2024 Vs 2035 (%)

18. Global Biostimulants Market Share By Application, 2024 Vs 2035 (%)

19. Global Biostimulants For Foliar Treatment Market Share By Region, 2024 Vs 2035 (%)

20. Global Biostimulants For Seed Treatment Market Share By Region, 2024 Vs 2035 (%)

21. Global Biostimulants For Soil Treatment Market Share By Region, 2024 Vs 2035 (%)

22. Global Biostimulants Market Share By Region, 2024 Vs 2035 (%)

23. US Biostimulants Market Size, 2024–2035 ($ Million)

24. Canada Biostimulants Market Size, 2024–2035 ($ Million)

25. UK Biostimulants Market Size, 2024–2035 ($ Million)

26. France Biostimulants Market Size, 2024–2035 ($ Million)

27. Germany Biostimulants Market Size, 2024–2035 ($ Million)

28. Italy Biostimulants Market Size, 2024–2035 ($ Million)

29. Spain Biostimulants Market Size, 2024–2035 ($ Million)

30. Russia Biostimulants Market Size, 2024–2035 ($ Million)

31. Rest Of Europe Biostimulants Market Size, 2024–2035 ($ Million)

32. India Biostimulants Market Size, 2024–2035 ($ Million)

33. China Biostimulants Market Size, 2024–2035 ($ Million)

34. Japan Biostimulants Market Size, 2024–2035 ($ Million)

35. South Korea Biostimulants Market Size, 2024–2035 ($ Million)

36. Australia And New Zealand Biostimulants Market Size, 2024–2035 ($ Million)

37. ASEAN Economies Biostimulants Market Size, 2024–2035 ($ Million)

38. Rest Of Asia-Pacific Biostimulants Market Size, 2024–2035 ($ Million)

39. Latin America Biostimulants Market Size, 2024–2035 ($ Million)

40. Middle East And Africa Biostimulants Market Size, 2024–2035 ($ Million)

FAQS

The size of the Biostimulants market in 2024 is estimated to be around $4.5 billion.

Europe holds the largest share in the Biostimulants market.

Leading players in the Biostimulants market include BASF SE, FMC Corp., UPL Ltd., Valagro S.p. A. (Syngenta Crop Protection AG) and Yara International ASA, among others.

Biostimulants market is expected to grow at a CAGR of 10.3% from 2025 to 2035.

The growth of the Biostimulants Market is driven by increasing demand for sustainable agriculture and enhanced crop productivity.