Blockchain in Retail Market

Blockchain in Retail Market Size, Share & Trends Analysis Report by Application (Compliance Management, Smart Contract, Supply Chain & Inventory Management, Transaction Management, Automated Customer Service, and Identity Management) Forecast Period (2023-2030)

Blockchain in retail market is anticipated to grow at a significant CAGR of 78.5% during the forecast period. Transparency, security, and payment efficiency are the key benefits of using blockchain in retail industry. The growing adoption of blockchain in retail owing to its offered benefits is a key factor driving the growth of the global blockchain in retail market. The huge investments in blockchain technology in retail sector is further contributing to the market growth. For instance, in April 2023, Cosmose Artificial Intelligence (AI), which has developed a platform that uses AI analytics to track in-store foot traffic and engage with shoppers online, has received an undisclosed investment from NEAR Foundation, the non-profit arm of blockchain protocol NEAR, valuing the company at $500 million. With the new investment, it will focus on the Web3 ecosystem with the aim of creating seamless experiences for shoppers and increasing sales for retailers. The pair are building a payment system that allows users to shop with crypto at low transaction fees.

Segmental Outlook

The global blockchain in retail market is segmented based on product type. Based on application, the market is segmented into compliance management, smart contract, supply chain & inventory management, transaction management, automated customer service, and identity management. Supply chain and inventory management hold major share in the global market. The increasing retail theft drives the blockchain technology demand in the retail sector for supply chain management. For instance, according to the data from the National Retail Federation's 2022 Retail Security Survey, retail losses from stolen goods increased to $94.5 billion in 2021, up from $90.8 billion in 2020.

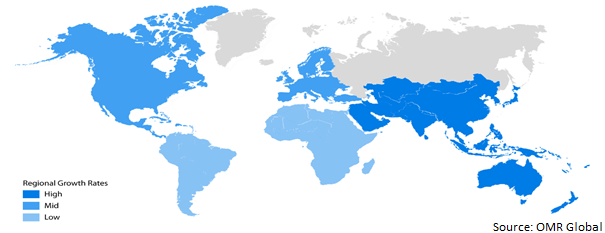

Regional Outlook

The global blockchain in retail market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Among these, Asia-Pacific is anticipated to exhibit highest growth in the global blockchain in retail market. The growing adoption of blockchain technology by key retailers across the region is a key factor driving the growth of the regional market. For instance, in February 2018, China’s largest online and brick and mortar retailer JD.com announced the first four startups for its Al Catapult Blockchain incubation. The Beijing-based program, which has seen candidates from as far afield as Australia and the UK, aims to use the company’s vast Chinese infrastructure to arrive at new applications of Blockchain and AI.

Global Blockchain in Retail Market Growth by Region 2023-2030

The North America Region Held Considerable Share in the Global Blockchain in retail Market

North America held a considerable share in the global blockchain in retail market. In North America, the US held a major market share in the regional market. Walmart, De Beers Group, American Express, Carrefour, P&G and Wallgreens, and Denim Deal are the major retailers of US from different sectors that uses blockchain technology in their operations. Walmart Canada used blockchain to tackle possibly the most widespread and persistent problem associated with logistics and transportation – managing enormous amounts of invoices and payments within the network of freight carriers. The high adoption of blockchain technology in retail sector of the region is a key contributor to the high share of this regional market.

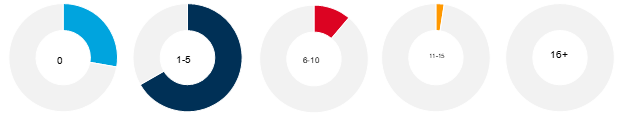

Enhancement of loyalty program by key players is further contributing to the regional market. According to a study by Oracle, 71.0% of US consumers are active in at least one to five loyalty programs per month and 56.0% have at least one loyalty rewards program app on their phone. Most importantly, 62.0% of consumers are willing to choose one brand over another because of its loyalty program. Blockchain implementation can enable retail companies to create a decentralized system where loyalty points can be spent across multiple brands and retail segments. With blockchain in retail, all participants of the loyalty network including brands, loyalty program administrators, and customers can interact in a trustful system while keeping their privacy intact.

Number of Active Loyalty Program Among US Consumers

Market Players Outlook

The major companies serving the global blockchain in retail market include SAP SE, IBM Corp., Oracle Corp., Microsoft Corp., Amazon Web Services, Inc. among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in December 2022, Lowe's introduced a new solution, developed in its Innovation labs division, designed to combat retail theft in an invisible way to consumers through the use of the blockchain and RFID chips. The new Project Unlock technology combines IoT sensors and low-cost RFID chips to activate power tools at the point of purchase while creating a publicly accessible, secure, and anonymized record of legitimate purchases on the blockchain.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global blockchain in retail market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.3. Key Findings

2.4. Recommendations

2.5. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Amazon Web Services, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. IBM Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Microsoft Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Oracle Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. SAP SE

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Blockchain in Retail Market by Application

4.1.1. Compliance Management

4.1.2. Smart Contract

4.1.3. Supply Chain & Inventory Management

4.1.4. Transaction Management

4.1.5. Automated Customer Service

4.1.6. Identity Management

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Accenture PLC

6.2. Auxesis Services & Technologies (P) Ltd.

6.3. BigchainDB GmbH

6.4. Bitfury Holdings Inc.

6.5. BitPay Inc.

6.6. Blockchain Foundry Inc.

6.7. BlockVerifyy

6.8. Capgemini SE

6.9. Cisco Systems Inc.

6.10. Cognizant Technology Solutions Corp.

6.11. Coinbase Inc.

6.12. Infosys Ltd.

6.13. Project Provenance Ltd.

6.14. Provenance Ltd.

6.15. Reply SA

6.16. TCS Ltd.

6.17. Walmart Inc.

1. GLOBAL BLOCKCHAIN IN RETAIL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

2. GLOBAL BLOCKCHAIN IN RETAIL FOR COMPLIANCE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL BLOCKCHAIN IN RETAIL FOR SMART CONTRACT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL BLOCKCHAIN IN RETAIL FOR SUPPLY CHAIN & INVENTORY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL BLOCKCHAIN IN RETAIL FOR TRANSACTION MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL BLOCKCHAIN IN RETAIL FOR AUTOMATED CUSTOMER SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL BLOCKCHAIN IN RETAIL FOR IDENTITY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL BLOCKCHAIN IN RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. NORTH AMERICAN BLOCKCHAIN IN RETAIL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

10. NORTH AMERICAN BLOCKCHAIN IN RETAIL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

11. EUROPEAN BLOCKCHAIN IN RETAIL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

12. EUROPEAN BLOCKCHAIN IN RETAIL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

13. ASIA-PACIFIC BLOCKCHAIN IN RETAIL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

14. ASIA-PACIFIC BLOCKCHAIN IN RETAIL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

15. REST OF THE WORLD BLOCKCHAIN IN RETAIL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

16. REST OF THE WORLD BLOCKCHAIN IN RETAIL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

1. GLOBAL BLOCKCHAIN IN RETAIL MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

2. GLOBAL BLOCKCHAIN IN RETAIL FOR COMPLIANCE MANAGEMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL BLOCKCHAIN IN RETAIL FOR SMART CONTRACT MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL BLOCKCHAIN IN RETAIL FOR SUPPLY CHAIN & INVENTORY MANAGEMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL BLOCKCHAIN IN RETAIL FOR TRANSACTION MANAGEMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL BLOCKCHAIN IN RETAIL FOR AUTOMATED CUSTOMER SERVICE MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL BLOCKCHAIN IN RETAIL FOR IDENTITY MANAGEMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL BLOCKCHAIN IN RETAIL MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. US BLOCKCHAIN IN RETAIL MARKET SIZE, 2022-2030 ($ MILLION)

10. CANADA BLOCKCHAIN IN RETAIL MARKET SIZE, 2022-2030 ($ MILLION)

11. UK BLOCKCHAIN IN RETAIL MARKET SIZE, 2022-2030 ($ MILLION)

12. FRANCE BLOCKCHAIN IN RETAIL MARKET SIZE, 2022-2030 ($ MILLION)

13. GERMANY BLOCKCHAIN IN RETAIL MARKET SIZE, 2022-2030 ($ MILLION)

14. ITALY BLOCKCHAIN IN RETAIL MARKET SIZE, 2022-2030 ($ MILLION)

15. SPAIN BLOCKCHAIN IN RETAIL MARKET SIZE, 2022-2030 ($ MILLION)

16. REST OF EUROPE BLOCKCHAIN IN RETAIL MARKET SIZE, 2022-2030 ($ MILLION)

17. INDIA BLOCKCHAIN IN RETAIL MARKET SIZE, 2022-2030 ($ MILLION)

18. CHINA BLOCKCHAIN IN RETAIL MARKET SIZE, 2022-2030 ($ MILLION)

19. JAPAN BLOCKCHAIN IN RETAIL MARKET SIZE, 2022-2030 ($ MILLION)

20. SOUTH KOREA BLOCKCHAIN IN RETAIL MARKET SIZE, 2022-2030 ($ MILLION)

21. REST OF ASIA-PACIFIC BLOCKCHAIN IN RETAIL MARKET SIZE, 2022-2030 ($ MILLION)

22. REST OF THE WORLD BLOCKCHAIN IN RETAIL MARKET SIZE, 2022-2030 ($ MILLION)