Blockchain In Supply Chain Finance Market

Blockchain In Supply Chain Finance Market Size, Share & Trends Analysis Report by Product Type (IT Solution, FinTech, Bank, Consulting, Exchange, and Other) and by Application (Cross-border Payment, Trade Finance, Digital Currency, Identity Management, and Others) Forecast Period (2023-2030)

Blockchain in the supply chain finance market is anticipated to grow at a considerable CAGR of 42.3% during the forecast period. The growth of the market is attributed to factors such as increased transparency, efficiency, and security offered by blockchain technology in supply chain finance. Further advancements in technology and the need for streamlined financial processes are anticipated to fuel the demand for blockchain in supply chain finance solutions. The growth of the market is attributed to various benefits offered by blockchain technology such as Total visibility for all transaction participants. Better control of complex transactions involving multiple parties. Improved logistics and timing. Automated actions reduce the need for manpower. Also, the growing adoption of blockchain technology in a financial institution is anticipated to propel the growth of the market. For instance, in April 2023, Citi India completed its first blockchain-enabled Letter of Credit (LC) transaction on Contour for its client Cummins India Limited (Cummins), a diversified industrial manufacturing company. The transaction is a first for both Cummins and Citi India on Contour, as Citi continues to advance its trade digitization efforts and further enhance the client experience. Contour is a global digital trade finance network, powered by blockchain technology, that enables multiple parties - banks, corporates, and logistic partners - to collaborate seamlessly and securely in real-time on a single platform.

Segmental Outlook

The global Blockchain In Supply Chain Finance market is segmented based on its Product Type and Application. Based on Product Type, the market is segmented into IT Solutions, FinTech, Bank, Consulting, Exchange, and Others. Based on Application, the market is categorized into cross-border payment, trade finance, digital currency, identity management, and others. Among these segments, trade finance is anticipated to hold a prominent market share, driven by the need for secure and efficient tracking of transactions throughout the supply chain.

Among The Product Type Solution Is Anticipated To Register Significant Growth

Among the product type segment, it solution sub-segment is anticipated to register significant growth for the forecast period. The growth of the IT solution sub-segment is attributed to factors such as the increased adoption of blockchain technology by enterprises to optimize supply chain finance operations, improve transparency, and reduce fraud.

Regional Outlooks

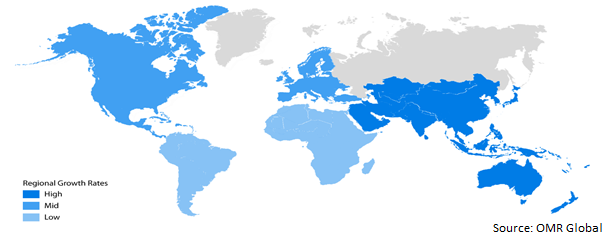

The global blockchain in the supply chain finance market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, the Europe market is anticipated to cater to a prominent growth over the forecast period. However, the Asia-Pacific region is projected to experience considerable growth in the blockchain in the supply chain finance market.

Global Blockchain In Supply Chain Finance Market Growth, by Region 2023-2030

The North American Region is anticipated to Hold a Significant Share in the Global Blockchain In Supply Chain Finance Market

Among these regions, the North America region is anticipated to account for a significant share of the blockchain in the supply chain finance market during the forecast period. The growth of the blockchain in the supply chain finance market in the region is attributed to the presence of a large number of market players which an important role in the advancement and accessibility of the technology in the region. For instance, Amazon Web Services Inc., eLayaway, Inc., Oracle Corp., and Ripple Labs Inc. are headquartered in the US. These market players are pushing aggressively for the adoption of blockchain technology in the finance sector. For instance, in July 2022, New Street Tech, partnered with Federal Bank to test blockchain tech for MSME loans. The co-lending product will be launched on New Street Tech's Mifix Platform and will be tested in partnership with the federal bank.

Market Players Outlook

The major companies serving the global Blockchain In the Supply Chain Finance market include IBM Corporation, Ripple Labs Inc., Rubix by Deloitte, Accenture plc, Distributed Ledger Technologies (DLT), Oklink, Nasdaq Linq, Oracle Corporation, Amazon Web Services Inc. (AWS), Citigroup Inc., layaway, Inc., HSBC Holdings plc, Ant Group Co., Ltd., JD Digits, Qihoo 360 Technology Co. Ltd., Tencent Holdings Limited, Baidu, Inc., Huawei Technologies Co., Ltd., Bitspark Limited, and SAP SE. These market players are considerably contributing to the market growth by adopting various strategies, including collaborations, partnerships, and product launches, to enhance their market presence and cater to the growing demand for Blockchain In Supply Chain Finance solutions. For instance, in June 2022, Blockchain firm SETL was acquired by Turkish fintech Colendi. The transaction would bring together two firms that have been operating in different spaces within the blockchain and financial services market.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global blockchain in supply chain finance market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Accenture plc

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. IBM Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Oracle Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. SAP SE

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Tencent Holdings Ltd

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Blockchain In Supply Chain Finance Market by Product Type

4.1.1. IT Solution

4.1.2. FinTech

4.1.3. Bank

4.1.4. Consulting

4.1.5. Exchange

4.1.6. Other

4.2. Global Blockchain In Supply Chain Finance Market by Application

4.2.1. Cross-border Payment

4.2.2. Trade Finance

4.2.3. Digital Currency

4.2.4. Identity Management

4.2.5. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Amazon Web Services Inc. (AWS)

6.2. Ant Group Co., Ltd. (Ant Financial)

6.3. Baidu, Inc.

6.4. Bitspark Ltd.

6.5. Citigroup Inc. (Citi Bank)

6.6. Distributed Ledger Technologies (DLT)

6.7. eLayaway, Inc.

6.8. HSBC Holdings plc

6.9. Huawei Technologies Co., Ltd.

6.10. JD Digits (formerly JD Financial)

6.11. Nasdaq Linq

6.12. Oklink

6.13. Oracle Corp.

6.14. Qihoo 360 Technology Co. Ltd.

6.15. Ripple Labs Inc.

6.16. Rubix by Deloitte

1. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022-2030 ($ MILLION)

2. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE OF IT SOLUTION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE OF FINTECH MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE OF BANK MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE OF CONSULTING FINTECH MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE OF EXCHANGE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE OF OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

9. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE FOR CROSS-BORDER PAYMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE FOR TRADE FINANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE FOR DIGITAL CURRENCY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET FOR IDENTITY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET FOR OTHER APPLICATIONSS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. NORTH AMERICAN BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

16. NORTH AMERICAN BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022-2030 ($ MILLION)

17. NORTH AMERICAN BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

18. EUROPEAN BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

19. EUROPEAN BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022-2030 ($ MILLION)

20. EUROPEAN BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

21. ASIA-PACIFIC BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

22. ASIA-PACIFIC BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022-2030 ($ MILLION)

23. ASIA-PACIFIC BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

24. REST OF THE WORLD BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

25. REST OF THE WORLD BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022-2030 ($ MILLION)

26. REST OF THE WORLD BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

1. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET SHARE BY PRODUCT TYPE, 2022 VS 2030 (%)

2. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE OF IT SOLUTION MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE OF FINTECH MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE OF BANK BY MARKET SHARE REGION, 2022 VS 2030 (%)

5. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE OF CONSULTING BY MARKET SHARE REGION, 2022 VS 2030 (%)

6. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE OF EXCHANGE BY MARKET SHARE REGION, 2022 VS 2030 (%)

7. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE OF OTHER BY MARKET SHARE REGION, 2022 VS 2030 (%)

8. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

9. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE FOR CROSS-BORDER PAYMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE FOR TRADE FINANCE MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE FOR DIGITAL CURRENCY MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE FOR IDENTITY MANAGEMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE FOR OTHER APPLICATIONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. GLOBAL BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. US BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET SIZE, 2022-2030 ($ MILLION)

16. CANADA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET SIZE, 2022-2030 ($ MILLION)

17. UK BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET SIZE, 2022-2030 ($ MILLION)

18. FRANCE BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET SIZE, 2022-2030 ($ MILLION)

19. GERMANY BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET SIZE, 2022-2030 ($ MILLION)

20. ITALY BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET SIZE, 2022-2030 ($ MILLION)

21. SPAIN BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET SIZE, 2022-2030 ($ MILLION)

22. REST OF EUROPE BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET SIZE, 2022-2030 ($ MILLION)

23. INDIA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET SIZE, 2022-2030 ($ MILLION)

24. CHINA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET SIZE, 2022-2030 ($ MILLION)

25. JAPAN BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET SIZE, 2022-2030 ($ MILLION)

26. SOUTH KOREA BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET SIZE, 2022-2030 ($ MILLION)

27. REST OF ASIA-PACIFIC BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET SIZE, 2022-2030 ($ MILLION)

28. REST OF THE WORLD BLOCKCHAIN IN SUPPLY CHAIN FINANCE MARKET SIZE, 2022-2030 ($ MILLION)