Box Truck Market

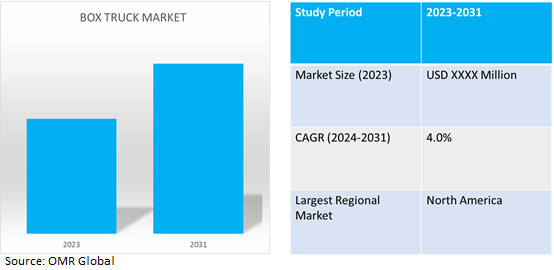

Box Truck Market Size, Share & Trends Analysis Report by Product (Light-duty, Medium-duty, and Heavy-duty), by Fuel (Gasoline, Diesel, Electric, and Hybrid), and by Application (Commercial and Industrial) Forecast Period (2024-2031) Update Available - Forecast 2025-2035

Box truck market is anticipated to grow at a CAGR of 4.0% during the forecast period (2024-2031). Box Truck is a a single-unit vehicle with a fully or partially enclosed space with a roof and at least three sides designed for transporting cargo or payload, excluding the driver and passengers. The demand for box truck for both personal and commercial purposes, including transport of a variety of cargo, including food, clothing, building materials, gasoline, and automobiles is contributing to industry growth.

Market Dynamics

Increasing demand for e-commerce industry

The rapid growth of online shopping has resulted in a surge in the number of shipments that require delivery. This generates the need for delivery trucks, particularly those capable of navigating metropolitan areas and reaching individual customers' doorsteps. These trucks' mobility and compact size allow them to function successfully in urban settings. They are perfect for the last mile of deliveries because they can maneuver through confined spaces, heavy traffic, and small streets with ease. Due to these considerations, the market is growing and manufacturers are being forced to innovate and change to meet the ever-changing demands of last-mile delivery and e-commerce. For instance, in October 2023, Amazon invested in Rivian's production facility specifically for electric vans including box trucks. The company plans to have at least 100,000 electric delivery vans on the road by 2030. This demonstrates Amazon's dedication to energizing its delivery team and expanding its capacity in order to satisfy the soaring demand from the e-commerce industry.

Introduction of extended battery range for EV box truck

The box truck industry is experiencing significant expansion due to customization, which satisfies a variety of needs, boosts productivity, offers advantages over competitors, and protects investment. For instance, in January 2024, Ram introduced the new Ram ProMaster electric van (EV) with a targeted range of up to 162 miles from a standard 110 kWh battery pack in city driving. The new Ram ProMaster EV is the brand’s first available fully electrified vehicle. Ram ProMaster EV cargo van features up to 3,020 pounds of payload while the delivery configuration offers 2,030 pounds of payload. The standard Telematics Module enables nearly 50 functions solutions for effortless customization on ProMaster, including Firmware Over the Air (FOTA) updates, 4G LTE Wi-Fi hotspot, and Apps Over the Air (AOTA). This initiative is intended to address the varied requirements of businesses operating in the construction, e-commerce, and other sectors.

Market Segmentation

Our in-depth analysis of the global Box Truck market includes the following segments by product, fuel, and application:

- Based on product, the market is sub-segmented into light-duty, medium-duty, and heavy-duty.

- Based on fuel, the market is bifurcated into gasoline, diesel, electric, and hybrid.

- Based on application, the market is augmented into commercial and industrial.

Diesel Segment is Projected to Emerge as the Largest Segment

Based on fuel, the global box truck market is sub-segmented into gasoline, diesel, electric, and hybrid. Among these, the diesel sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes reliability and high torque that diesel engines provides to commercial sector promoting trust. They are often cheaper than electric or hybrid vehicles, making them attractive for cost-conscious enterprises. Diesel engines also offer better fuel economy, reducing operational expenses.

Commercial Sub-segment to Hold a Considerable Market Share

Commercial businesses include industries such as logistics, retail, delivery services, and more. This versatility allows for a broader range of use cases, from moving raw materials and equipment to delivering finished goods and products. This widespread demand increases the overall market share of the commercial segment. Box trucks are a popular choice for commercial applications because of their many advantages, which include better fuel efficiency, cheaper maintenance costs, and easier delivery routes. These vehicles are regularly used by commercial companies for routine operations, which leads to high utilization and the requirement to replace or grow fleets. The commercial segment's ongoing market activity is fueled by this quick turnover.

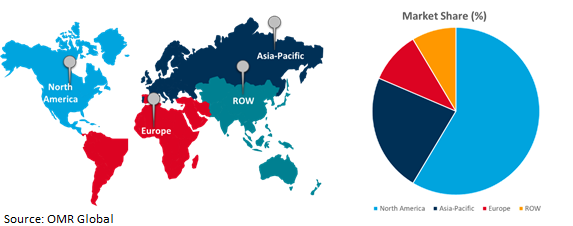

Regional Outlook

The global box truck market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific countries to invest in box truck market

- India’s growing e-commerce industry is driving demand for efficient transportation solutions which is increasing demand for box trucks.

- China is witnessing rapid urbanization and infrastructure development which is propelling investment in this market.

Global Box Truck Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the presence of rapidly growing logistics and transportation industry which have raised the need for product delivery to metropolitan areas. These vehicles move goods to businesses, residential areas, and distribution centers, that is why they are crucial to urban logistics. The industry could change if self-driving technology is incorporated into vehicles, opening up possibilities for improved efficiency, safety, and cost savings. Self-driving technologies are being investigated by manufacturers and logistics companies in the United States in an effort to enhance fleet operations and address labor shortages. In general, the North American market has a favorable growth environment due to the emergence of e-commerce, growing emphasis on sustainability, and developments in electric and autonomous technology.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global Box Truck market include Daimler Truck AG, General Motors, TRATON GROUP, Ford Motor Company, Hino Motors, Ltd., and Hertz Corporation, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in March 2024, Morgan Truck Body has acquired Fourgons Transit, a van manufacturer based in Laval, Que., establishing its 14th production site in North America. Transit’s expertise and leadership in van manufacturing and customer service in Canada confirms their commitment to providing van innovations to customers in North America

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global box truck market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. FCA Group

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Ford Motor Company

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. General Motors Co.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Box Truck Market by Product

4.1.1. Light-duty

4.1.2. Medium-duty

4.1.3. Heavy-duty

4.2. Global Box Truck Market by Fuel

4.2.1. Gasoline

4.2.2. Diesel

4.2.3. Electric

4.2.4. Hybrid

4.3. Global Box Truck Market by Application

4.3.1. Commercial

4.3.2. Industrial

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Daimler Truck AG

6.2. Ford Motors Co.

6.3. Hino Motors, Ltd.

6.4. Isuzu Motors India Private Limited

6.5. Iveco s.p.A.

6.6. Mitsubishi Corp.

6.7. Morgan Corp.

6.8. PACCAR, Inc.

6.9. Volvo Group

6.10. TRATON GROUP (Volkswagen AG)

1. GLOBAL BOX TRUCK MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL LIGHT-DUTY BOX TRUCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL MEDIUM-DUTY BOX TRUCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL HEAVY-DUTY BOX TRUCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL BOX TRUCK MARKET RESEARCH AND ANALYSIS BY FUEL, 2023-2031 ($ MILLION)

6. GLOBAL GASOLINE BOX TRUCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL DIESEL BOX TRUCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL ELECTRIC BOX TRUCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL HYBRID BOX TRUCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL BOX TRUCK MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

11. GLOBAL BOX TRUCK FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL BOX TRUCK FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL BOX TRUCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN BOX TRUCK MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN BOX TRUCK MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

16. NORTH AMERICAN BOX TRUCK MARKET RESEARCH AND ANALYSIS BY FUEL, 2023-2031 ($ MILLION)

17. NORTH AMERICAN BOX TRUCK MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. EUROPEAN BOX TRUCK MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN BOX TRUCK MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

20. EUROPEAN BOX TRUCK MARKET RESEARCH AND ANALYSIS BY FUEL, 2023-2031 ($ MILLION)

21. EUROPEAN BOX TRUCK MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC BOX TRUCK MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC BOX TRUCK MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC BOX TRUCK MARKET RESEARCH AND ANALYSIS BY FUEL, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC BOX TRUCK MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

26. REST OF THE WORLD BOX TRUCK MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD BOX TRUCK MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

28. REST OF THE WORLD BOX TRUCK MARKET RESEARCH AND ANALYSIS BY FUEL, 2023-2031 ($ MILLION)

29. REST OF THE WORLD BOX TRUCK MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL BOX TRUCK MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL LIGHT-DUTY BOX TRUCK MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL MEDIUM-DUTY BOX TRUCK MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL HEAVY-DUTY BOX TRUCK MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL BOX TRUCK MARKET SHARE BY FUEL, 2023 VS 2031 (%)

6. GLOBAL GASOLINE BOX TRUCK MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL DIESEL BOX TRUCK MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL ELECTRIC BOX TRUCK MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL HYBRID BOX TRUCK MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL BOX TRUCK MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

11. GLOBAL BOX TRUCK FOR COMMERCIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL BOX TRUCK FOR INDUSTRIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL BOX TRUCK MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US BOX TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA BOX TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

16. UK BOX TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE BOX TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY BOX TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY BOX TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN BOX TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE BOX TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA BOX TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA BOX TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN BOX TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA BOX TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC BOX TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA BOX TRUCK MARKET SIZE, 2023-2031 ($ MILLION)

28. MIDDLE EAST AND AFRICA BOX TRUCK MARKET SIZE, 2023-2031 ($ MILLION)