Cold Chain Market

Global Cold Chain Market Size, Share & Trends Analysis Report by Application (Fruits & Vegetable, Bakery & Confectionery, Dairy & Frozen Desserts, Meat, Fish, and Seafood, Drugs & Pharmaceuticals, Others) Forecast Period 2020-2026

The cold chain market is projected to grow at a considerable CAGR of more than 10% during the forecast period (2020-2026). Technological advancements in the packaging, processing, and storage of perishable food products is a key factor anticipated to drive the growth of the global cold chain market. Radiofrequency identification, IoT, and mobile racking are the key technologies that are highly being adopted in the cold chain industry. The increase in the global trade of the perishable food products and medicines along with the cohesive government policies for the development of infrastructure for cold chain facilities are the major aspects that are promoting the growth of the cold chain market across the globe.

The presence of food safety regulations, such as the Food Safety & Standards Act 2006 that requires the organizations to regulate their manufacturing, storage distribution, sale and import, to ensure availability of safe and wholesome food for human consumption. Food Safety Modernization Act (FSMA) is another act that requires increased attention of the manufacturers toward the construction of cold storage warehouse. The presence of such acts across the globe is creating the demand for the cold chain market across the globe. The increasing adoption of cutting-edge technologies to meet the increasing demand for food safety, in the processed foods sector is anticipated to offer considerable opportunities for the growth of the cold chain market. Lack of uniform infrastructure, packaging failure, hardware failure, and lack of equipment are some factors that may restrain the growth of the cold chain market.

Segmental Outlook

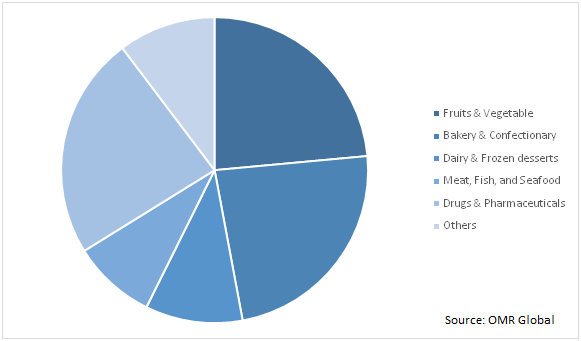

The cold chain market is segmented on the basis of application. Based on the application, the cold chain market is segmented into fruits & vegetables, bakery & confectionery, dairy & frozen desserts, meat, fish, and seafood, drugs & pharmaceuticals, and others. Storage of dairy and frozen desserts is anticipated to be a key application of the cold chain which in turn is driving the growth of this market segment. The considerable growth in the demand for fresh dairy products owing to the increase in the income level is further anticipated to drive the growth of this market growth.

Global Cold Chain Market Share by Application, 2019 (%)

Regional Outlook

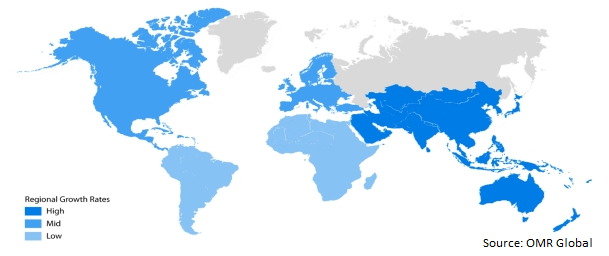

The global cold chain market is further segmented on the basis of geography including North America, Europe, Asia-Pacific, and Rest of the World. North America is anticipated to hold a major market share in the global market during the forecast period. The considerable presence of cold storage warehouses along with the presence of end-user industry is a key factor contributing towards the high share of the market in the region.

Global Cold Chain Market Growth, by Region 2020-2026

Asia-Pacific will augment with the significant growth rate in the cold chain market

According to the Indian Brand Equity Foundation (IBEF), the Indian pharmaceutical sector industry supplies over 50% of the global demand for various vaccines, 40% of the generic demand in the US and 25% of all medicine in UK. Vaccines such as polio and TB require the presence of temperature-controlled environments ranging from the point of production to final distribution. The considerable presence of the pharmaceutical industry in India is creating demand for the cold chain market in the region. In addition, the significant growth in the dairy and dessert industry is further contributing to the high growth of the market in the region.

Market Players Outlook

The key players of cold chain market include CWT Pte Ltd., Swire Cold Chain Logistics (Shanghai) Co. Ltd., Americold Logistics LLC, VersaCold International Corp., Agro Merchants Group LLC, Burris Logistics Inc., Nichirei Corp., JWD Group Inc., Orient Overseas (International) Ltd., Lineage Logistics Holdings LLC, XPO Logistics Inc., and so on. These players are actively adopting growth strategies such as merger & acquisition, partnership, collaboration, strategic agreement, and new product launches in order to enhance their market share. For instance, in May 2020, Lineage Logistics, LLC, provider of temperature-controlled logistics solutions had acquired Henningsen Cold Storage Co. With this acquisition, the company aims to expand its US facility network along with strengthening its presence in the Pacific Northwest, with the addition of 14 facilities across North Dakota Pennsylvania, Washington, Idaho, Oregon, and Oklahoma.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cold chain market. Based on the availability of data, information related to the products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Lineage Logistics Holding, LLC

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Americold Logistics, LLC

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. The United States Cold Storage, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Agro Merchants Group, LLC

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. New Cold Advanced Cold Logistics

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Cold Chain Market by Application

5.1.1. Fruits & Vegetable

5.1.2. Bakery & Confectionary

5.1.3. Dairy & Frozen desserts

5.1.4. Meat, Fish, and Seafood

5.1.5. Drugs & Pharmaceuticals

5.1.6. Others

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Agro Merchants Group, LLC

7.2. Al Rai Logistica K.S.C.

7.3. AIT Worldwide Logistics, Inc.

7.4. Americold Logistics, LLC

7.5. Berlinger & Co. AG

7.6. Burris Logistics, Inc.

7.7. Cardinal Health, Inc.

7.8. Coldman Logistics Pvt. Ltd.

7.9. Conestoga Cold Storage

7.10. Congebec Logistics, Inc.

7.11. CWT Pte, Ltd.

7.12. Henningsen Cold Chain Co.

7.13. JWD Group, Inc.

7.14. Lineage Logistics Holdings, LLC

7.15. New Cold Advanced Cold Logistics

7.16. Nichirei Corp.

7.17. Orient Overseas (International), Ltd.

7.18. Preffered Freezer Services

7.19. Swire Cold Chain Logistics (Shanghai) Co. Ltd.

7.20. Tippmann Group

7.21. The United States Cold Storage, Inc.

7.22. VersaCold International Corp.

7.23. XPO Logistics, Inc.

1. GLOBAL COLD CHAIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

2. GLOBAL FRUITS & VEGETABLE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL BAKERY & CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL DAIRY & FROZEN DESSERTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL MEAT, FISH, AND SEAFOOD MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL DRUGS & PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. NORTH AMERICA COLD CHAIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

9. NORTH AMERICAN COLD CHAIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

10. EUROPE COLD CHAIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

11. EUROPE COLD CHAIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

12. ASIA-PACIFIC COLD CHAIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

13. ASIA-PACIFIC COLD CHAIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

14. REST OF THE WORLD COLD CHAIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL COLD CHAIN MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

2. GLOBAL COLD CHAIN MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

3. THE US COLD CHAIN MARKET SIZE, 2019-2026 ($ MILLION)

4. CANADA COLD CHAIN MARKET SIZE, 2019-2026 ($ MILLION)

5. UK COLD CHAIN MARKET SIZE, 2019-2026 ($ MILLION)

6. FRANCE COLD CHAIN MARKET SIZE, 2019-2026 ($ MILLION)

7. GERMANY COLD CHAIN MARKET SIZE, 2019-2026 ($ MILLION)

8. ITALY COLD CHAIN MARKET SIZE, 2019-2026 ($ MILLION)

9. SPAIN COLD CHAIN MARKET SIZE, 2019-2026 ($ MILLION)

10. ROE COLD CHAIN MARKET SIZE, 2019-2026 ($ MILLION)

11. INDIA COLD CHAIN MARKET SIZE, 2019-2026 ($ MILLION)

12. CHINA COLD CHAIN MARKET SIZE, 2019-2026 ($ MILLION)

13. JAPAN COLD CHAIN MARKET SIZE, 2019-2026 ($ MILLION)

14. REST OF ASIA-PACIFIC COLD CHAIN MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF THE WORLD COLD CHAIN MARKET SIZE, 2019-2026 ($ MILLION)