Collaborative Robots Market

Collaborative Robots Market Size, Share & Trends Analysis Report, By Payload Capacity(Up to 5 KG, From 6 KG to 10 KG, and Above 10 KG), By Application (Assembling and Dissembling, Material Handling, Sealing/Dispensing, Welding and Finishing, Quality Testing, Processing, and Others), By End-Use Industry (Automotive, Electronics, Food & Beverage, Metal & Machinery, Healthcare, Retail & E-Commerce, Aerospace, and Others) and Forecast, 2019-2025

The global collaborative robots market is estimated to grow at a CAGR of 47% during the forecast period. The major factors contributing to the growth of the market include the rising demand for industrial robots and emerging demand in small and medium enterprises. Rising demand for industrial robots was reported across the globe, which in turn, is driving the growth of the market. For instance, as per the International Federation of Robotics (IFR), between 2018 and 2021, it is estimated that almost 2.1 million new industrial robots will be installed in factories across the globe. This represents a growth in industrial automation process across the industries, such as automotive, electronics, and metal to increase productivity and save time and cost.

Collaborative robots or cobots are a new form of industrial automation. These are smaller and more dexterous industrial robotic arms which aim to create collaboration between human and machine without requiring complex programming or external safety infrastructure. These robots are ideal to perform repetitive and unergonomic tasks and flexible operations. They can quickly integrate and programmed with considerable ease, which makes them more profitable in settings where the robot has to conduct multiple tasks. The sale of cobots is low as compared to other industrial robots as it is a young robotics technology.

However, the demand for cobots is expected to emerge significantly during the forecast period owing to the rising focus on the development of high payload capacity collaborative robots and the availability of funding for the development of collaborative robots. In addition, collaborative robots minimize the risk of injury owing to its lightweight, feature rounded designs with force-limitations. Cobots are easy to use and can learn quickly as compared to industrial robots that require advanced programming skills. These robots are cost-effective than industrial robots and can provide a much quicker ROI owing to faster implementation and cost-saving benefits.

Segmentation

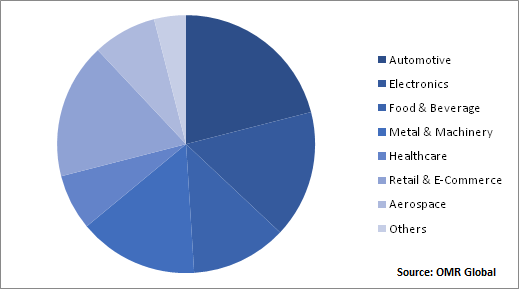

The global collaborative robots market is segmented based on payload capacity, application, and end-use industry. Based on payload capacity, the market is classified into up to 5 KG, from 6 KG to 10 KG, and above 10 KG. Based on application, the market is classified into assembling and dissembling, material handling, sealing/dispensing, welding and finishing, quality testing, processing, and other applications. Based on end-use industry, the market is classified into automotive, electronics, food & beverage, metal & machinery, healthcare, retail & e-commerce, aerospace, and others.

Collaborative Robots Finds Its Significant Applications in the Automotive Industry

Emerging demand for robotic solutions in the automotive industry is the major factor driving the demand for collaborative robots in the automotive operations. As per IFR, the estimated annual supply of industrial robots in the automotive industry has increased from 103,000 units in 2016 to 116,000 in 2018. This, in turn, contributes to the demand for collaborative robots in automotive manufacturing. There are certain automobile companies focusing on installation of collaborative robots in their operations. For instance, PSA Group, Europe’s second-largest car manufacturer, is using Universal Robots’ UR10 collaborative robots. The company used collaborative robots to enhance its factory performance, improve worker ergonomics, reduce costs, and boost profit margins. These robots are considered as safe to work with humans on the same assembly tasks. Thus, increasing stringent workers’ safety regulations are pushing automotive manufacturers to install collaborative robots in their everyday operations.

Global Collaborative Robots Market Share by End-Use Industry, 2018 (%)

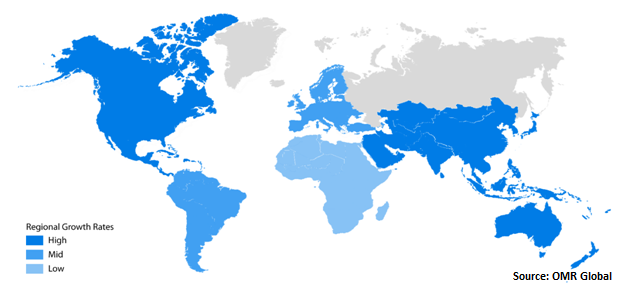

Regional Outlook

Geographically, the global collaborative robots market is segmented into North America, Europe, Asia-Pacific, and RoW. In 2018, Europe is estimated to hold a significant share in the market owing to the rising focus on industrial automation coupled with the favorable government initiatives for Industry 4.0. For instance, in February 2017, the government of Italy launched the National Industry 4.0 plan in order to boost the investment in new technology, and R&D programs. The country has allocated around $3.9 billion for the National Industry 4.0 plan. This supports the adoption of intelligent factory solutions and thereby drives the growth of the market in the country.

Global Collaborative Robots Market Growth, by Region 2019-2025

Asia-Pacific is expected to show considerable growth during the forecast period

Asia-Pacific is offering enormous opportunity for the growth of the market, owing to the rising focus on industrialization coupled with Made in China (MIC) 2025 and Make in India initiative, which aims to modernize the industrial operations and leverage productivity. Further, the presence of some key players, such as FANUC Corp. and Kawasaki Heavy Industries, Ltd. is primarily supporting todrive the market growth in the region. Increasing R&D centers and manufacturing facilities by multinational companies and expansion of retail and e-commerce companies will likely encourage the demand for collaborative robots in the region.

Competitive Landscape

The major players in the market include KUKA AG, FANUC Corp., Universal Robots A/S, ABB Ltd., and Kawasaki Heavy Industries Ltd. These companies are adopting strategies, including mergers and acquisitions, partnerships and collaborations, and product launches to increase their market share. For instance, in September 2019, Universal Robots A/S launched new heavy-duty payload cobot UR16e which boasts 16 KG (35 lbs) payload capability. With this introduction, the company extends its offerings of cobot products that will enable the company to expand its share in the market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global collaborative robots market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. KUKA AG

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. FANUC Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Universal Robots A/S

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. ABB Ltd.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Kawasaki Heavy Industries, Ltd.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Collaborative Robots Market by Payload Capacity

5.1.1. Up to 5 KG

5.1.2. From 6 KG to 10 KG

5.1.3. Above 10 KG

5.2. Global Collaborative Robots Market by Application

5.2.1. Assembling and Dissembling

5.2.2. Material Handling

5.2.3. Sealing/Dispensing

5.2.4. Welding and Finishing

5.2.5. Quality Testing

5.2.6. Processing

5.2.7. Others (Die-Casting and Molding)

5.3. Global Collaborative Robots Market by End-Use Industry

5.3.1. Automotive

5.3.2. Electronics

5.3.3. Food & Beverage

5.3.4. Metal & Machinery

5.3.5. Healthcare

5.3.6. Retail& E-Commerce

5.3.7. Aerospace

5.3.8. Others (Furniture & Equipment and Plastics & Polymers)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ABB Ltd.

7.2. AUBO Robotics USA

7.3. Comau S.p.A.

7.4. Denso Wave Inc.

7.5. Energid Technologies Corp.

7.6. Epson America, Inc.

7.7. F&P Robotics AG

7.8. FANUC Corp.

7.9. Festo SE & Co. KG

7.10. FlexLink Holding AB

7.11. HAHN Group

7.12. Kawasaki Heavy Industries, Ltd.

7.13. KUKA AG

7.14. Locus Robotics

7.15. MABI Robotic AG

7.16. OMRON Corp.

7.17. Precise Automation, Inc.

7.18. Quanta Storage Inc

7.19. Robert Bosch GmbH

7.20. Robotiq Inc.

7.21. Robotnik Automation S.L.L.

7.22. Universal Robots A/S

7.23. Vecna Robotics, Inc.

7.24. Yaskawa Electric Corp.

1. GLOBAL COLLABORATIVE ROBOTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

2. GLOBAL COLLABORATIVE ROBOTS UP TO 5 KG MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL COLLABORATIVE ROBOTS FROM 6 KG TO 10 KG MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL COLLABORATIVE ROBOTS ABOVE 10 KG MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL COLLABORATIVE ROBOTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

6. GLOBAL COLLABORATIVE ROBOTS IN ASSEMBLING AND DESSEMBLING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL COLLABORATIVE ROBOTS IN MATERIAL HANDLINGMARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL COLLABORATIVE ROBOTS IN SEALING/DISPENSINGMARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL COLLABORATIVE ROBOTS IN WELDING AND FINISHING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL COLLABORATIVE ROBOTS IN QUALITY TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL COLLABORATIVE ROBOTS IN PROCESSING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL COLLABORATIVE ROBOTS IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL COLLABORATIVE ROBOTS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2018-2025 ($ MILLION)

14. GLOBAL COLLABORATIVE ROBOTS IN AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

15. GLOBAL COLLABORATIVE ROBOTS IN ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

16. GLOBAL COLLABORATIVE ROBOTS IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

17. GLOBAL COLLABORATIVE ROBOTS IN METAL & MACHINERY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

18. GLOBAL COLLABORATIVE ROBOTS IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

19. GLOBAL COLLABORATIVE ROBOTS IN RETAIL & E-COMMERCE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

20. GLOBAL COLLABORATIVE ROBOTS IN AEROSPACE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

21. GLOBAL COLLABORATIVE ROBOTS IN OTHER END-USE INDUSTRIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

22. GLOBAL COLLABORATIVE ROBOTS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

23. NORTH AMERICAN COLLABORATIVE ROBOTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

24. NORTH AMERICAN COLLABORATIVE ROBOTS MARKET RESEARCH AND ANALYSIS BY PAYLOAD CAPACITY, 2018-2025 ($ MILLION)

25. NORTH AMERICAN COLLABORATIVE ROBOTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

26. NORTH AMERICAN COLLABORATIVE ROBOTS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2018-2025 ($ MILLION)

27. EUROPEAN COLLABORATIVE ROBOTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

28. EUROPEAN COLLABORATIVE ROBOTS MARKET RESEARCH AND ANALYSIS BY PAYLOAD CAPACITY, 2018-2025 ($ MILLION)

29. EUROPEAN COLLABORATIVE ROBOTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

30. EUROPEAN COLLABORATIVE ROBOTS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2018-2025 ($ MILLION)

31. ASIA-PACIFIC COLLABORATIVE ROBOTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

32. ASIA-PACIFIC COLLABORATIVE ROBOTS MARKET RESEARCH AND ANALYSIS BY PAYLOAD CAPACITY, 2018-2025 ($ MILLION)

33. ASIA-PACIFIC COLLABORATIVE ROBOTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

34. ASIA-PACIFIC COLLABORATIVE ROBOTS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2018-2025 ($ MILLION)

35. REST OF THE WORLD COLLABORATIVE ROBOTS MARKET RESEARCH AND ANALYSIS BY PAYLOAD CAPACITY, 2018-2025 ($ MILLION)

36. REST OF THE WORLD COLLABORATIVE ROBOTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

37. REST OF THE WORLD COLLABORATIVE ROBOTS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2018-2025 ($ MILLION)

1. GLOBAL COLLABORATIVE ROBOTS MARKET SHARE BY PAYLOAD CAPACITY, 2018 VS 2025 (%)

2. GLOBAL COLLABORATIVE ROBOTS MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL COLLABORATIVE ROBOTS MARKET SHARE BY END-USE INDUSTRY, 2018 VS 2025 (%)

4. GLOBAL COLLABORATIVE ROBOTS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US COLLABORATIVE ROBOTS MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA COLLABORATIVE ROBOTS MARKET SIZE, 2018-2025 ($ MILLION)

7. UK COLLABORATIVE ROBOTS MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE COLLABORATIVE ROBOTS MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY COLLABORATIVE ROBOTSMARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY COLLABORATIVE ROBOTS MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN COLLABORATIVE ROBOTS MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE COLLABORATIVE ROBOTS MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA COLLABORATIVE ROBOTS MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA COLLABORATIVE ROBOTS MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN COLLABORATIVE ROBOTS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC COLLABORATIVE ROBOTS MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD COLLABORATIVE ROBOTS MARKET SIZE, 2018-2025 ($ MILLION)