Commercial Seaweeds Market

Global Commercial Seaweeds Market Size, Share & Trends Analysis Report by Type (Red Seaweeds, Brown Seaweeds, and Green Seaweeds), By Form (Liquid, Powder, and Flakes), By Application (Human Food, Animal Feed, Agriculture, Pharmaceutical, and Others), forecast period (2020-2026)

The commercial seaweeds market is anticipated to grow at a CAGR of 9.5% during the forecast period. Seaweeds are species of marine plants and algae. Seaweeds are found naturally or grown in the ocean as well as in rivers, lakes, and other water bodies for commercial purposes. Seaweeds contain various vitamins, minerals, and fiber, and some species of seaweeds are also widely used in the food & beverage industry. This is anticipated to significantly drive the commercial seaweed market during the forecast period.

However, seaweed extraction in excessive amounts can harm marine life which is expected to restraint the growth of the commercial seaweed market. Moreover, strict regulation on the farming and extraction of seaweeds across the globe will also hamper the commercial seaweed market growth during the forecast period. However, usage of the seaweeds as a source for renewable energy can provide a significant opportunity to the commercial seaweed industry in the near future.

Segmental Outlook

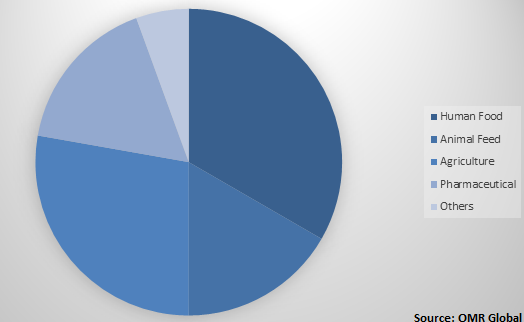

The global commercial seaweeds market is segmented based on the type, form, and application. Based on the type, the market is sub-segmented into red seaweeds, brown seaweeds, and green seaweeds. On the basis of form, the market is sub-segmented into liquid, powder, and flakes. Further, by application, the market is divided into human food, animal feed, agriculture, pharmaceutical, and others.

The pharmaceutical segment will be the fastest-growing segment by application

The pharmaceutical segment is anticipated to grow with the fastest CAGR in the commercial seaweeds market owing to its increasing application in drug manufacturing. Various substances isolated from seaweeds are being used by pharmaceutical companies for the development of new drugs including anticoagulants, anticancer, antivirals, and many more. Moreover, seaweeds are also rich in bioactive compounds including polysaccharides, pigments, phlorotannins, peptides, minerals, and vitamins hence they are used in a wide variety of applications in pharmaceutical. This is anticipated to significantly drive the growth of the pharmaceutical segment in the market.

Global Commercial Seaweeds Market Share by Application, 2019 (%)

Regional Outlooks

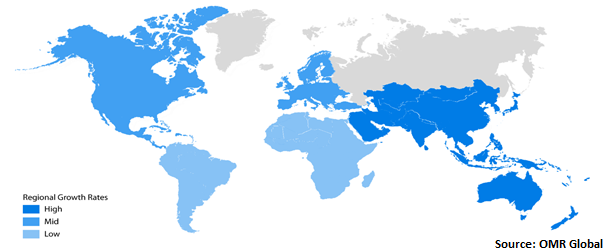

The global commercial seaweeds market is further segmented based on geography including North America, Europe, Asia-Pacific, and the Rest of the World. Significant growth in the developed economies of North America and Europe can be witnessed due to the migration of people from Asian countries; thus increasing demand for seaweeds among people. Moreover, the increasing adoption of seaweeds by the food industryas feed additives in these regions is also expected to provide considerable growth to the region.

Global Commercial Seaweeds Market Growth, by Region 2020-2026

Asia-Pacific will hold the largest market share in the commercial seaweeds market

Asia-Pacific is anticipated to hold the largest market share in the commercial seaweeds market owing to the presence of significant seaweed producing countries such as China, Japan, South Korea, and the Philippines. The seaweeds are being consumed in China and Japan since the 5th- 6th century in the form of food as well as traditional medicines. Hence, the deep penetration of seaweeds is expected to provide considerable market share to the region. Moreover, the increasing adoption of seaweeds as a food product across the region owing to its health benefits will contribute to the growth of the market during the forecast period.

Market Players Outlook

The key players of the commercial seaweeds market include Algaia, Cargill, Inc., DuPont de Nemours, Inc., Gelymar S.A, Irish Seaweeds, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including merger, and acquisition, collaborations with government, funding to the start-ups, and new product launches to stay competitive in the market.

Recent Activity

- In May 2019, Gelymar S.A expanded its production facility to double with an investment of $15 million. The company is engaged in exhibiting sustainable carrageenan lines including new textural solutions for dairy, nutrition beverages, vegan products, and dressings.

- In April 2018, Algaia signed an agreement with Arles Agroalimentaire. The agreement was intended to the commercialization of the company’s alginates in France. The deal is marked as a new step in Algaia’s commercial development.

- In July 2018, Cargill launched a carrageenan extract known as Satiagel Seabrid. With this launch, the company is expanding its Seabrid portfolio. Satiagel Seabrid is intended for use as a texturizing solution in creamy dairy desserts.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Commercial seaweeds market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. DuPont de Nemours, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Cargill, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. CP Kelco U.S., Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Gelymar S.A

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Acadian Seaplants Ltd.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Commercial Seaweeds Market by Type

5.1.1. Red Seaweeds

5.1.2. Brown Seaweeds

5.1.3. Green Seaweeds

5.2. Global Commercial Seaweeds Market by Form

5.2.1. Liquid

5.2.2. Powder

5.2.3. Flakes

5.3. Global Commercial Seaweeds Market by Application

5.3.1. Human Food

5.3.2. Animal Feed

5.3.3. Agriculture

5.3.4. Pharmaceutical

5.3.5. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Acadian Seaplants Ltd.

7.2. Algaia SA

7.3. ATSEA Technologies

7.4. Biostadt India Ltd.

7.5. Cargill, Inc.

7.6. Compania Espanola de Algas Marinas SA (CEAMSA)

7.7. COMPO EXPERT GmbH

7.8. CP Kelco U.S., Inc. (J.M. HUBER)

7.9. Dalian Kowa Foods Co. Ltd.

7.10. DuPont de Nemours, Inc.

7.11. Gelymar S.A

7.12. Indigrow Ltd.

7.13. Irish Seaweeds

7.14. Mara Seaweed (Celtic Sea Spice Co. Ltd.)

7.15. MARUTOKU NORI Co., Ltd.

7.16. Nagai Nori Co., Ltd.

7.17. Qingdao Seawin Biotech Group Co., Ltd.

7.18. Seasol International Pty. Ltd.

7.19. Stan Chem Industrial Ltd.

7.20. Taokaenoi Food & Marketing PCL

7.21. THE CORNISH SEAWEED Co. Ltd.

1. GLOBAL COMMERCIAL SEAWEEDS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL RED SEAWEEDS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL BROWN SEAWEEDS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL GREEN SEAWEEDS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL COMMERCIAL SEAWEEDS MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

6. GLOBAL LIQUID MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL POWDER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL FLAKES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL COMMERCIAL SEAWEEDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

10. GLOBAL HUMAN FOOD MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL ANIMAL FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL AGRICULTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL PHARMACEUTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

15. GLOBAL COMMERCIAL SEAWEEDS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN COMMERCIAL SEAWEEDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. NORTH AMERICAN COMMERCIAL SEAWEEDS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

18. NORTH AMERICAN COMMERCIAL SEAWEEDS MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

19. NORTH AMERICAN COMMERCIAL SEAWEEDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

20. EUROPEAN COMMERCIAL SEAWEEDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. EUROPEAN COMMERCIAL SEAWEEDS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

22. EUROPEAN COMMERCIAL SEAWEEDS MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

23. EUROPEAN COMMERCIAL SEAWEEDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC COMMERCIAL SEAWEEDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

25. ASIA-PACIFIC COMMERCIAL SEAWEEDS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

26. ASIA-PACIFIC COMMERCIAL SEAWEEDS MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

27. ASIA-PACIFIC COMMERCIAL SEAWEEDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

28. REST OF THE WORLD COMMERCIAL SEAWEEDS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

29. REST OF THE WORLD COMMERCIAL SEAWEEDS MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

30. REST OF THE WORLD COMMERCIAL SEAWEEDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL COMMERCIAL SEAWEEDS MARKET SHARE BY TYPE, 2019 VS 2026(%)

2. GLOBAL COMMERCIAL SEAWEEDS MARKET SHARE BY FORM, 2019 VS 2026(%)

3. GLOBAL COMMERCIAL SEAWEEDS MARKET SHARE BY APPLICATION, 2019 VS 2026(%)

4. GLOBAL COMMERCIAL SEAWEEDS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026(%)

5. US COMMERCIAL SEAWEEDS MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA COMMERCIAL SEAWEEDS MARKET SIZE, 2019-2026 ($ MILLION)

7. UK COMMERCIAL SEAWEEDS MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE COMMERCIAL SEAWEEDS MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY COMMERCIAL SEAWEEDS MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY COMMERCIAL SEAWEEDS MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN COMMERCIAL SEAWEEDS MARKET SIZE, 2019-2026 ($ MILLION)

12. REST OF EUROPE COMMERCIAL SEAWEEDS MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA COMMERCIAL SEAWEEDS MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA COMMERCIAL SEAWEEDS MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN COMMERCIAL SEAWEEDS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC COMMERCIAL SEAWEEDS MARKET SIZE, 2019-2026 ($ MILLION)