Construction Adhesives Market

Construction Adhesives Market Size, Share & Trends Analysis Report by Resin Type (Acrylic, Polyurethanes, Polyvinyl Acetate, Epoxy, and Others), by Technology (Water Based, Solvent Based, and Reactive), and by Application (Residential, Commercial, and Industrial) Forecast Period (2023-2030)

Construction adhesives market is anticipated to grow at a CAGR of 2.6% during the forecast period owing to increase in housing and construction projects, rising government spending on public infrastructure and commercial buildings, renovation of old buildings and rising smart city projects. Additionally, rising income levels have increased the demand for home decoration and construction. The availability of various designs, surface textures, and patterns for trendy upholstery, such as wallpapers, is expected to propel the growth of the global construction adhesives market. A number of recent innovations from across the globe show governments and civil society collaborate to move the construction industry forward. For instance, in 2019, a Circular Viaduct was developed in collaboration between the Netherlands government and the private sector. Elements of this viaduct could be disassembled, moved and reused, extending product lifecycles. The viaduct was one of many efforts designed to help halve the country’s use of natural resources by 2030 and achieve a fully circular economy by 2050. The speed and scale of urbanization brings accelerated demand for affordable housing, viable infrastructure including transport systems and basic services.

Segmental Outlook

The global construction adhesives market is segmented based on the resin type, technology and application. Based on the resin type, the market is sub-segmented into acrylic, polyurethanes, polyvinyl acetate, epoxy and others. Based on, technology, the market is sub-segmented into water based, solvent based and reactive. Based on, application, the market is sub-segmented into residential, commercial and industrial. Among the technology, the water based sub-segment is anticipated to hold a considerable share of the market owing to higher moisture resistance compared to other adhesives. Water-based adhesives can be applied using several dispersion methods, including spray and roll dispersion, and, with the right formulation and viscosity.

Residential Sub-Segment is Anticipated to Hold a Prominent Share in the Global Construction adhesives Market

Among the application, residential is anticipated to hold a prominent share of the market. In residential construction, adhesives have several application areas such as carpet laying, laminating countertops, installing flooring, crown molding, drywall and wallpapering. They are also used in a variety of applications to bond various materials such as concrete, wood, metal, plastic, and others. The use of adhesives can reduce the usage of screws and help in weatherproofing the house. Since there is a growth of Tier 2 and Tier 3 cities across the Asian Countries such as India, China, there is a huge surge in the housing demands in these cities and the urbanization in these countries driving the residential real estate. Not only India and China but in the US also residential segment have been on the rise in recent years. The US has been a desirable destination for foreign home buyers. It offers a stable political environment, better infrastructure, and access to some of the best educational institutions across the globe.

US New Residential Construction in October, 2023

| Building Permits | 1,487,000 |

| Housing Starts | 1,372,000 |

| Housing Completions | 1,410,000 |

Source: U.S. Census Bureau, HUD, 2023

Regional Outlook

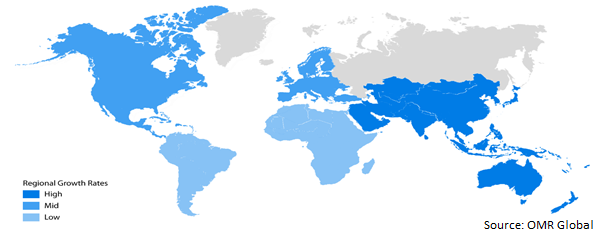

The global construction adhesives market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). Among these, the North America regional market is expected to grow considerably over the forecast period due factors such as increasing demand for residential construction and increased consumer expenditure on home furnishings. Infrastructural development in the US and Canada will lead to the demand for construction adhesives in the country and the region. The US is home to some of the most ambitious megaprojects. For instance, in May 2019, the Related Santa Clara Mixed-Use Development Project started which is currently underway, covering 240.0 acres with a variety of commercial, residential, and retail properties. At an estimated $8.0 billion, Related Santa Clara will be the largest mixed-use private project in Silicon Valley.

Global Construction Adhesives Market Growth, by Region 2023-2030

Asia-Pacific is Expected to Hold a Prominent Share in the Global Construction adhesives

Asia-Pacific is dominating the construction adhesives market over the forecast period owing to growing building & construction activities in the emerging countries of the region, easy access to resources, and increasing disposable income in countries such as China, India, and Indonesia. In FY23, India’s residential property market witnessed with the value of home sales reaching an all-time high of $42 billion, marking a robust 48% year-on-year increase. The volume of sales also showed a strong growth trajectory, with a 36% rise to 379,095 units sold. Additionally, growth in this market is also driven by foreign investments owing to cheap labour and accessible raw materials. China is the largest construction market globally. According to International Trade Administration, overall investment in new infrastructure in China during the 14th Five-Year Plan period (2021-2025) will reach roughly $ 4.2 trillion. Government support has been key in construction growth of China. Infrastructure spending has had a huge role to play in China’s meteoric economic rise. For instance, in August 2022, the Chinese government announced approximately $1 trillion of investment in infrastructure megaprojects, providing a boost to construction and related activities.

Market Players Outlook

The major companies serving the global construction adhesives market include 3M Co., The Dow Chemical Co., and H.B. Fuller Co., among others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in July 2023, H.B. Fuller, announced acquisition of XCHEM International LLC, an adhesives manufacturer in the United Arab Emirates (UAE) that offers a wide range of specialty adhesives and coatings for industrial and infrastructure applications in the fast-growing construction markets of the Middle East and Northern Africa. With customers in more than 25 countries and a team of 90 employees, XCHEM International will operate within H.B. Fuller’s CA global business unit.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global construction adhesives market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.3. By Segments

1.4. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.3. Key Findings

2.4. Recommendations

2.5. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. 3M Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. The Dow Chemical Co.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. H.B. Fuller Co.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Construction Adhesives Market by Resin Type

4.1.1. Acrylic

4.1.2. Polyurethanes

4.1.3. Polyvinyl Acetate

4.1.4. Epoxy

4.1.5. Others (Phenolic Resins, UV Resin)

4.2. Global Construction Adhesives Market by Technology

4.2.1. Water Based

4.2.2. Solvent Based

4.2.3. Reactive

4.3. Global Construction Adhesives Market by Application

4.3.1. Residential

4.3.2. Commercial

4.3.3. Industrial

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Allfasteners

6.2. Arkema

6.3. AVERY DENNISON CORPORATION

6.4. BASF SE

6.5. Benson Polymers

6.6. Bostik

6.7. DAP Global Inc.

6.8. Franklin International

6.9. Gorilla Glue, Inc.

6.10. Henkel AG & Co. KGaA

6.11. Hexcel Corporation

6.12. Huntsman International LLC

6.13. Illinois Tool Works Inc

6.14. Master Bond Inc.

6.15. Sika AG

1. GLOBAL CONSTRUCTION ADHESIVES MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2022-2030 ($ MILLION)

2. GLOBAL CONSTRUCTION ADHESIVES OF ACRYLIC MARKET RESEARCH AND ANALYSIS BY REGION 2022-2030 ($ MILLION)

3. GLOBAL CONSTRUCTION ADHESIVES OF POLYURETHANCES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL CONSTRUCTION ADHESIVES OF POLYVINYL ACETATE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL CONSTRUCTION ADHESIVES OF EPOXY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL CONSTRUCTION ADHESIVES OF OTHER RESIN TYPES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL CONSTRUCTION ADHESIVES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

8. GLOBAL WATER BASED CONSTRUCTION ADHESIVES MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

9. GLOBAL SOLVENT BASED CONSTRUCTION ADHESIVES MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

10. GLOBAL REACTIVE CONSTRUCTION ADHESIVES MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

11. GLOBAL CONSTRUCTION ADHESIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

12. GLOBAL CONSTRUCTION ADHESIVES FOR RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION 2022-2030 ($ MILLION)

13. GLOBAL CONSTRUCTION ADHESIVES FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION 2022-2030 ($ MILLION)

14. GLOBAL CONSTRUCTION ADHESIVES FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION 2022-2030 ($ MILLION)

15. GLOBAL CONSTRUCTION ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

16. NORTH AMERICAN CONSTRUCTION ADHESIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

17. NORTH AMERICAN CONSTRUCTION ADHESIVES MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2022-2030 ($ MILLION)

18. NORTH AMERICAN CONSTRUCTION ADHESIVES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

19. NORTH AMERICAN CONSTRUCTION ADHESIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030

20. EUROPEAN CONSTRUCTION ADHESIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

21. EUROPEAN CONSTRUCTION ADHESIVES MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2022-2030 ($ MILLION)

22. EUROPEAN CONSTRUCTION ADHESIVES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

23. EUROPEAN CONSTRUCTION ADHESIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

24. ASIA-PACIFIC CONSTRUCTION ADHESIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

25. ASIA-PACIFIC CONSTRUCTION ADHESIVES MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2022-2030 ($ MILLION)

26. ASIA-PACIFIC CONSTRUCTION ADHESIVES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

27. ASIA-PACIFIC CONSTRUCTION ADHESIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

28. REST OF THE WORLD CONSTRUCTION ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

29. REST OF THE WORLD CONSTRUCTION ADHESIVES MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2022-2030 ($ MILLION)

30. REST OF THE WORLD CONSTRUCTION ADHESIVES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

31. REST OF THE WORLD CONSTRUCTION ADHESIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

1. GLOBAL CONSTRUCTION ADHESIVES MARKET SHARE BY RESIN TYPE, 2022 VS 2030 (%)

2. GLOBAL CONSTRUCTION ADHESIVES OF ACRYLIC MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL CONSTRUCTION ADHESIVES OF POLYURETHANES MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL CONSTRUCTION ADHESIVES OF POLYVINYL ACETATE MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL CONSTRUCTION ADHESIVES OF EPOXY MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL CONSTRUCTION ADHESIVES OF OTHER RESIN TYPES MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL CONSTRUCTION ADHESIVES MARKET SHARE BY TECHNOLOGY, 2022 VS 2030 (%)

8. GLOBAL WATER BASED CONSTRUCTION ADHESIVES MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL SOLVENT BASED CONSTRUCTION ADHESIVES MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL REACTIVE CONSTRUCTION ADHESIVES MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL CONSTRUCTION ADHESIVES MARKET SHARE BY APPLICATION, 2022 VS 2030 ($ MILLION)

12. GLOBAL CONSTRUCTION ADHESIVES FOR RESIDENTIAL MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL CONSTRUCTION ADHESIVES FOR COMMERCIAL MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. GLOBAL CONSTRUCTION ADHESIVES FOR INDUSTRIAL MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. GLOBAL CONSTRUCTION ADHESIVES MARKET SHARE BY REGION, 2022 VS 2030 (%)

16. US CONSTRUCTION ADHESIVES MARKET SIZE, 2022-2030 ($ MILLION)

17. CANADA CONSTRUCTION ADHESIVES MARKET SIZE, 2022-2030 ($ MILLION)

18. UK CONSTRUCTION ADHESIVES MARKET SIZE, 2022-2030 ($ MILLION)

19. FRANCE CONSTRUCTION ADHESIVES MARKET SIZE, 2022-2030 ($ MILLION)

20. GERMANY CONSTRUCTION ADHESIVES MARKET SIZE, 2022-2030 ($ MILLION)

21. ITALY CONSTRUCTION ADHESIVES MARKET SIZE, 2022-2030 ($ MILLION)

22. SPAIN CONSTRUCTION ADHESIVES MARKET SIZE, 2022-2030 ($ MILLION)

23. REST OF EUROPE CONSTRUCTION ADHESIVES MARKET SIZE, 2022-2030 ($ MILLION)

24. INDIA CONSTRUCTION ADHESIVES MARKET SIZE, 2022-2030 ($ MILLION)

25. CHINA CONSTRUCTION ADHESIVES MARKET SIZE, 2022-2030 ($ MILLION)

26. JAPAN CONSTRUCTION ADHESIVES MARKET SIZE, 2022-2030 ($ MILLION)

27. SOUTH KOREA CONSTRUCTION ADHESIVES MARKET SIZE, 2022-2030 ($ MILLION)

28. REST OF ASIA-PACIFIC CONSTRUCTION ADHESIVES MARKET SIZE, 2022-2030 ($ MILLION)

29. REST OF THE WORLD CONSTRUCTION ADHESIVES MARKET SIZE, 2022-2030 ($ MILLION)