Dairy Blends Market

Dairy Blends Market Size, Share & Trends Analysis Report by Type (Dairy Mixtures, Dairy/Nondairy ingredients, Dairy as functional ingredient, Dairy as carrier and Others (Combinations, dairy/protein derivatives and dairy/non-dairy fat components)), by Form (Spreadable, Powder and Liquid), and by Application (Food (Ice cream, Butter & Cheese spreadable, Confectionery, Bakery and Yogurt), Infant formula, Beverages and Others (Cocoa preparations and Chocolate)) Forecast Period (2024-2031)

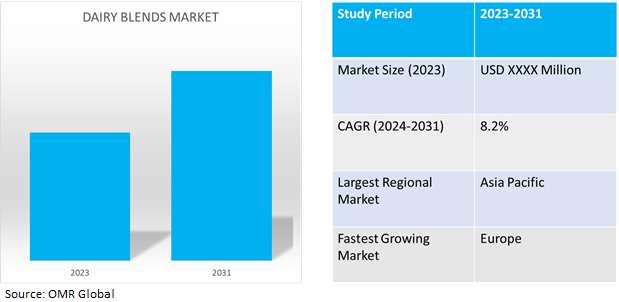

Dairy blends market is anticipated to grow at a considerable CAGR of 8.2% during the forecast period (2024-2031). Dairy Blend is a combination of dairy products that are combined and mixed to produce a particular type of product. It is frequently used in food business to attain a harmony of taste, texture, and usability.

Market Dynamics

The availability of a variety of flavors is driving market expansion

Dairy blends are available in a variety of flavors used in producing different foods and beverages. Spreads and toppings for baked foods like bread are made from liquid dairy mixes. These blends may be mixed with flavorings, sugar, or salt, according on the preferences and tastes of the customers. As a result, manufacturers are focusing on providing innovative flavored dairy blends. Rise in demand for different flavors is expected to drive up demand.

Rise in demand of dairy mixtures as an alternative for dairy products

Dairy mixtures are an alternative to regular dairy products like whole milk. They have none of the harmful fats and all the essential nutritional advantages when combined with other protein sources. In addition, businesses in the bakery industry will be forced to use dairy mixes in order to satisfy health-conscious customers. Due to this advantage, consumers who struggle with obesity and high cholesterol are now more likely to purchase the dairy blend products and it is causing a rise in the demand for dairy mixtures in the market.

Market Segmentation

Our in-depth analysis of the global dairy blends market includes the following segments by type, form, and application:

- Based on type, the market is sub-segmented into dairy mixtures, dairy/nondairy ingredients, dairy as functional ingredient, dairy as carrier and others (combinations, dairy/protein derivatives and dairy/non-dairy fat components).

- Based on form, the market is bifurcated into energy spreadable, powder and liquid.

- Based on application, the market is segmented into food (ice cream, butter & cheese spreadable, confectionery, bakery and yogurt), infant formula, beverages and others (cocoa preparations and chocolate).

Dairy Mixtures is Projected to Emerge as the Largest Sub-Segment

Due to the low cost of products provided by the dairy processing facilities, the use of dairy blend products by hotel & restaurants, fast food chains, quick service restaurants, and other food outlets has significantly increased. As the cost of the food is lower, low-cost dairy mix goods help to obtain a competitive edge. This raises the profit margin and lowers expenses. Affordable dairy blends are now readily available in the market, street food vendors have begun to use butter and cheese mixes for the majority of their menu items.Furthermore, the dairy blends have a lower fat content than original butter, which will have more chances for the dairy blends market to expand in the years to come.

Baking and Confectionery Sub-segment to Hold a Considerable Market Share

The baking and confectionery industry held the major market share. Spreadable powdered blends are used in both cakes and bread. These mixes can be used to make a wide variety of cake topping. These mixes are perfect substitutes for the traditional milk and butter.Manufacturers cater to consumer preferences by providing customized dairy blends with different nutritional values. As demand of health-conscious consumers is increasing will lead to a rise in demand of dairy blends in the bakery goods market.

Regional Outlook

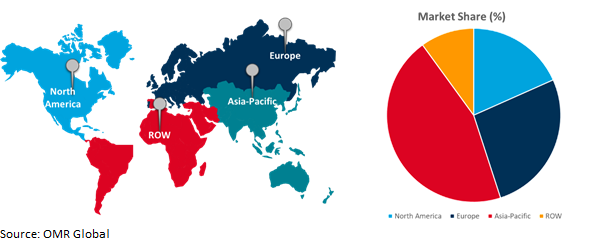

The global dairy blends market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

European Countries are Investing in Dairy Blends

- Rising rates of fertilization in the European market have increased demand for baby food and formula.

- Price of dairy blends is lower than that of dairy products.

- Dairy blends provide a better substitute for butter and removes most of the fat. These trends are causing the market growth in Europe market.

Global Dairy Blends Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific dairy blend market is driven by the population growth of working women as well as the rate of urbanization in China and India. Many people have busy schedules and find it difficult to have time for meal preparation for their infants.There is a growing need for baby formula and food. Dairy blends have become a popular alternative to traditional infant feeds like rice and oatmeal since they take less time to prepare. They also provide a number of vital nutrients that promote the health of the infant. The dairy blends have a lower cost, easyto storage, and have a longer shelf life as compared to alternatives like milk and butter. Thus, the growing demand for a variety of dairy blends isincreasing the market size and boosting the dairy blends sales in Asia-Pacific region.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global dairy blends market include Cargill, Inc., Kraft Heinz, Fonterra Co-Operative Group Ltd., Galloway Company, Inc., Abbott, and Hormel Foods Corp., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in January 2024, Pineland Farms Dairy expanded its product portfolio from cheese into milk, ice cream mixes and dairy blends.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global dairy blends market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Cargill, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Kerry Group plc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Kraft Heinz

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Dairy Blends Market by Type

4.1.1. Dairy Mixtures

4.1.2. Dairy/Nondairy ingredients

4.1.3. Dairy as functional ingredient

4.1.4. Dairy as carrier

4.1.5. Others (Combinations, dairy/protein derivatives and dairy/non-dairy fat components)

4.2. Global Dairy Blends Market by Form

4.2.1. Spreadable

4.2.2. Powder

4.2.3. Liquid

4.3. Global Dairy Blends Market by Application

4.3.1. Food (Ice cream, Butter & Cheese spreadable, Confectionery, Bakery and Yogurt)

4.3.2. Infant formula

4.3.3. Beverages

4.3.4. Others (Cocoa preparations and Chocolate)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin Ameica

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. AAK AB

6.2. Abbott Laboatoies

6.3. Advanced Food Products LLC

6.4. Agropur

6.5. All American Foods

6.6. Cape Food Ingredients

6.7. Dohler GmbH

6.8. Fonterra Co-Operative Group Ltd.

6.9. Frieslandcampina

6.10. Galloway Company, Inc.

6.11. Hormel Foods Corp.

6.12. Intermix Australia Pty Ltd.

1. GLOBAL DAIRY BLENDSMARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL DAIRY BLENDS FOR MIXTURESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL DAIRY BLENDS FOR DAIRY/NONDAIRY INGREDIENTSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL DAIRY BLENDS FOR FUNCTIONAL INGREDIENTMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL DAIRY BLENDS FOR CARRIERMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL DAIRY BLENDS FOR OTHERSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL DAIRY BLENDS MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

8. GLOBAL SPREADABLEDAIRY BLENDSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL POWDER DAIRY BLENDS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL LIQUID DAIRY BLENDS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL DAIRY BLENDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

12. GLOBAL DAIRY BLENDS FOR FOODMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL DAIRY BLENDS FOR INFANT FORMULAMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL DAIRY BLENDS FOR BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL DAIRY BLENDSFOR OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL DAIRY BLENDSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. NORTH AMERICAN DAIRY BLENDSMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. NORTH AMERICAN DAIRY BLENDSMARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

19. NORTH AMERICAN DAIRY BLENDSMARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

20. NORTH AMERICAN DAIRY BLENDSMARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

21. EUROPEAN DAIRY BLENDSMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. EUROPEAN DAIRY BLENDSMARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

23. EUROPEAN DAIRY BLENDSMARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

24. EUROPEAN DAIRY BLENDSMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC DAIRY BLENDSMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

26. ASIA-PACIFICDAIRY BLENDSMARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

27. ASIA-PACIFICDAIRY BLENDSMARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

28. ASIA-PACIFICDAIRY BLENDSMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

29. REST OF THE WORLD DAIRY BLENDSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

30. REST OF THE WORLD DAIRY BLENDSMARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

31. REST OF THE WORLD DAIRY BLENDSMARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

32. REST OF THE WORLD DAIRY BLENDSMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL DAIRY BLENDSMARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL DAIRY BLENDS FOR DAIRY MIXTURESMARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL DAIRY BLENDS DAIRY/NONDAIRY INGREDIENTSMARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL DAIRY BLENDS FOR FUNCTIONAL INGREDIENTMARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL DAIRY BLENDS FOR CARRIERMARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL DAIRY BLENDS FOR OTHER TYPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL DAIRY BLENDS MARKET SHAREBY FORM, 2023 VS 2031 (%)

8. GLOBAL SPREADABLE DAIRY BLENDS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL POWDER DAIRY BLENDS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL LIQUID DAIRY BLENDSMARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL DAIRY BLENDS MARKET SHAREBY APPLICATION, 2023 VS 2031 (%)

12. GLOBAL DAIRY BLENDS FOR FOOD MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL DAIRY BLENDS FOR INFANT FORMULA MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL DAIRY BLENDS BEVERAGES MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL DAIRY BLENDS OTHER APPLICATIONS SMARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL DAIRY BLENDSMARKET SHARE BY REGION, 2023 VS 2031 (%)

17. US DAIRY BLENDSMARKET SIZE, 2023-2031 ($ MILLION)

18. CANADA DAIRY BLENDSMARKET SIZE, 2023-2031 ($ MILLION)

19. UK DAIRY BLENDSMARKET SIZE, 2023-2031 ($ MILLION)

20. FRANCE DAIRY BLENDSMARKET SIZE, 2023-2031 ($ MILLION)

21. GERMANY DAIRY BLENDSMARKET SIZE, 2023-2031 ($ MILLION)

22. ITALY DAIRY BLENDSMARKET SIZE, 2023-2031 ($ MILLION)

23. SPAIN DAIRY BLENDSMARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF EUROPE DAIRY BLENDSMARKET SIZE, 2023-2031 ($ MILLION)

25. INDIA DAIRY BLENDSMARKET SIZE, 2023-2031 ($ MILLION)

26. CHINA DAIRY BLENDSMARKET SIZE, 2023-2031 ($ MILLION)

27. JAPAN DAIRY BLENDSMARKET SIZE, 2023-2031 ($ MILLION)

28. SOUTH KOREA DAIRY BLENDSMARKET SIZE, 2023-2031 ($ MILLION)

29. REST OF ASIA-PACIFIC DAIRY BLENDSMARKET SIZE, 2023-2031 ($ MILLION)

30. LATIN AMERICADAIRY BLENDSMARKET SIZE, 2023-2031 ($ MILLION)

31. MIDDLE EAST AND AFRICADAIRY BLENDSMARKET SIZE, 2023-2031 ($ MILLION)