Monosodium Glutamate (MSG) Market

Monosodium Glutamate (MSG) Market Size, Share & Trends Analysis Report by Application (Preservatives, Additives, Acidity Regulators and Flavor Enhancers), by Sales Channel (B2B and B2C (Supermarket and Online Stores)), and by End-user (Food Processing and Service Industry, Cosmetics Industry, Livestock and Pet Food Industry and Others (Retail sector)) Forecast Period (2024-2031)

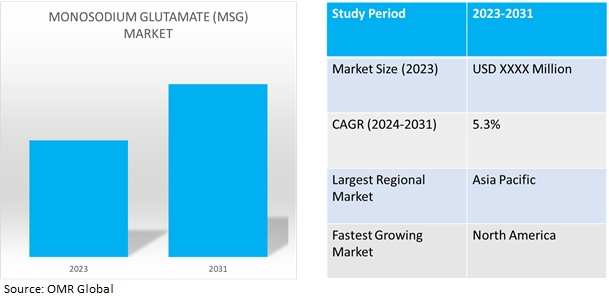

Monosodium glutamate (MSG) market is anticipated to grow at a considerable CAGR of 5.3% during the forecast period (2024-2031). Monosodium glutamate (MSG) is widely used to intensify and enhance flavors in sauces, broths, soups and other food items. The developing food industries and the rising demand for ready-to-eat food products are the main factors driving the market's expansion.

Market Dynamics

Mass production of Monosodium Glutamate

Mass production of MSG is a key trend in the global market. Fermentation is a low-cost method of producing large quantities. It is used as a food ingredient and taste enhancer for a wide range of dishes, such as cheeses, baked goods, sauces, and milk and meat products. It is also a dairy component that extends the shelf life and enhances the flavor of dairy products.

Rising demand and technological advancement

Natural sources of MSG are used in clean-label products, which are becoming more popular as customers demand the clarity of the ingredients. Health-conscious consumers are catered to by reduced-sodium MSG varieties. MSGs are becoming more integrated into food items with a focus on health. Modern technology makes it possible to create spice blends with MSG that have a variety of flavor profiles. The demand for MSG is driven by the growing popularity of fusion cuisine, and the expansion of online retail and direct-to-consumer channels increases the accessibility of MSG-infused goods. A growing trend is the use of ethical and sustainable manufacturing methods, as well as customized flavors that let customers customize their meals to their own preferences.

Market Segmentation

Our in-depth analysis of the global monosodium glutamate (MSG) market includes the following segments by application, sales channel, and end-user:

- Based on application, the market is sub-segmented into preservatives, additives, acidity regulators and flavor enhancers.

- Based on sales channel, the market is bifurcated into b2b and b2c (supermarket and online stores).

- Based on end-user, the market is augmented into food processing and service industry, cosmetics industry, livestock and pet food industry and others (retail sector).

Food Processing to Emerge as the Largest Sub-Segment

Food processing sector has emerged as the largest sub-segment. Global population growth is increasing, which raises consumer demand for food products. Consumers are driven to look for healthier alternatives due to a lack of time for meal preparation and an increase in duties associated to their jobs. A lot of big businesses and modern manufacturers are able to enter the ready-to-eat and ready-to-cook food sectors since consumers are time-constrained and prefer to purchase straightforward, quick items. Furthermore, companies are working to take advantage of the food industry's future possibilities in order to promote innovation, adjust to quality standards, and improve usability in order to produce such prepared, ready-to-eat foods and associated market opportunities.

Regional Outlook

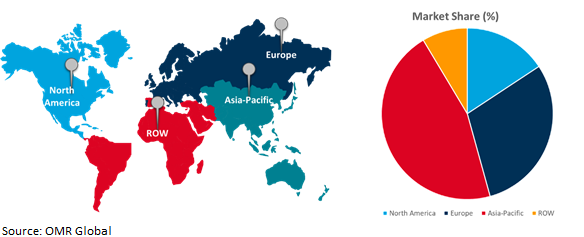

The global monosodium glutamate (MSG) market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

North American Countries to Invest More in Imports for MSG Products

- There is a rise in demand for Chinese and Asian cuisine results in increased use of MSG products in the North America market.

- The increasing consumption of ready-to-eat food in the North American market is boosting the consumption for MSGs.

Global Monosodium Glutamate (MSG) Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

China is a significant producer of MSG, which is sold to a number of nations, including Thailand, Indonesia, and India. MSG is used to improve the flavor of foods including processed meats, canned veggies, and soups. The rising demand for processed foods in emerging countries like India has led to an increase in its import requirement. Furthermore, the US and Russia are two of the leading importers of MSG from China and Indonesia, as the need for flavor enhancers increases in developed nations. Global companies, including Ajinomoto, have set up their factories in China. All these factors resulted in Asia Pacific region to emerge as the largest market.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global monosodium glutamate (MSG) market include Ajinomoto Co. Inc., Ningxia Eppen Biotech Co. Ltd., Kyowa Kirin Co. Ltd., Linghua Group Ltd., Kerry Group plc. and Fufeng Group, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global monosodium glutamate (MSG) market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Ajinomoto Co.Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Kyowa Kirin Co. Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Ningxia Eppen Biotech Co. Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Monosodium Glutamate (MSG) Market by Application

4.1.1. Preservatives

4.1.2. Additives

4.1.3. Acidity Regulators

4.1.4. Flavor Enhancers

4.2. Global Monosodium Glutamate (MSG) Market by Sales Channel

4.2.1. B2B

4.2.2. B2C (Supermarket and Online Stores)

4.3. Global Monosodium Glutamate (MSG) Market by End-user

4.3.1. Food Processing and Service Industry

4.3.2. Cosmetics Industry

4.3.3. Livestock and Pet Food Industry

4.3.4. Others (Retail sector)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Arshine Pharmaceutical Co.

6.2. Foodchem International Corp.

6.3. Fufeng Group

6.4. Global Bio-Chem Technology Group Company Ltd.

6.5. Great American Spice Company

6.6. Kerry Group plc.

6.7. Linghua Group Ltd.

6.8. Meihua Holdings Group Co. Ltd.

6.9. Prinova Group LLC.

6.10. Puramate

6.11. Sunrise Nutrachem Group Co. Ltd.

6.12. Tate & Lyle

6.13. Vedan International (Holdings) Ltd.

1. GLOBAL MONOSODIUM GLUTAMATE (MSG) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

2. GLOBAL MONOSODIUM GLUTAMATE (MSG) FOR PRESERVATIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL MONOSODIUM GLUTAMATE (MSG) FOR ADDITIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL MONOSODIUM GLUTAMATE (MSG) FOR ACIDITY REGULATORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL MONOSODIUM GLUTAMATE (MSG) FOR FLAVOR ENHANCERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL MONOSODIUM GLUTAMATE (MSG) MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2023-2031 ($ MILLION)

7. GLOBAL MONOSODIUM GLUTAMATE (MSG) FOR B2B MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL MONOSODIUM GLUTAMATE (MSG) FOR B2C MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL MONOSODIUM GLUTAMATE (MSG) MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

10. GLOBAL MONOSODIUM GLUTAMATE (MSG) FOR FOOD PROCESSING AND SERVICE INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL MONOSODIUM GLUTAMATE (MSG) COSMETICS INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL MONOSODIUM GLUTAMATE (MSG) FOR LIVESTOCK AND PET FOOD INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL MONOSODIUM GLUTAMATE (MSG) FOR OTHERSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL MONOSODIUM GLUTAMATE (MSG) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN MONOSODIUM GLUTAMATE (MSG) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN MONOSODIUM GLUTAMATE (MSG) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

17. NORTH AMERICAN MONOSODIUM GLUTAMATE (MSG) MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2023-2031 ($ MILLION)

18. NORTH AMERICAN MONOSODIUM GLUTAMATE (MSG) MARKET RESEARCH AND ANALYSIS BY END-USER,2023-2031 ($ MILLION)

19. EUROPEAN MONOSODIUM GLUTAMATE (MSG) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. EUROPEAN MONOSODIUM GLUTAMATE (MSG) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. EUROPEAN MONOSODIUM GLUTAMATE (MSG) MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2023-2031 ($ MILLION)

22. EUROPEAN MONOSODIUM GLUTAMATE (MSG) MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC MONOSODIUM GLUTAMATE (MSG) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. ASIA-PACIFICMONOSODIUM GLUTAMATE (MSG) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

25. ASIA-PACIFICMONOSODIUM GLUTAMATE (MSG) MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2023-2031 ($ MILLION)

26. ASIA-PACIFICMONOSODIUM GLUTAMATE (MSG) MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

27. REST OF THE WORLD MONOSODIUM GLUTAMATE (MSG) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

28. REST OF THE WORLD MONOSODIUM GLUTAMATE (MSG) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

29. REST OF THE WORLD MONOSODIUM GLUTAMATE (MSG) MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2023-2031 ($ MILLION)

30. REST OF THE WORLD MONOSODIUM GLUTAMATE (MSG) MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL MONOSODIUM GLUTAMATE (MSG) MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

2. GLOBAL MONOSODIUM GLUTAMATE (MSG) FOR PRESERVATIVES MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL MONOSODIUM GLUTAMATE (MSG) FOR ADDITIVES MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL MONOSODIUM GLUTAMATE (MSG) FOR ACIDITY REGULATORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL MONOSODIUM GLUTAMATE (MSG) FLAVOR ENHANCERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL MONOSODIUM GLUTAMATE (MSG) MARKET SHARE BY SALES CHANNEL, 2023 VS 2031 (%)

7. GLOBAL MONOSODIUM GLUTAMATE (MSG) FOR B2B MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL MONOSODIUM GLUTAMATE (MSG) FOR B2C MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL MONOSODIUM GLUTAMATE (MSG) MARKET SHARE BY END-USER, 2023 VS 2031 (%)

10. GLOBAL MONOSODIUM GLUTAMATE (MSG) FOR FOOD PROCESSING AND SERVICE INDUSTRY MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL MONOSODIUM GLUTAMATE (MSG) FOR COSMETICS INDUSTRY MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL MONOSODIUM GLUTAMATE (MSG) FOR LIVESTOCK AND PET FOOD INDUSTRY MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL MONOSODIUM GLUTAMATE (MSG) FOR OTHERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL THERMOCHEMICAL IN MONOSODIUM GLUTAMATE (MSG) MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL MONOSODIUM GLUTAMATE (MSG) MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. US MONOSODIUM GLUTAMATE (MSG) MARKET SIZE, 2023-2031 ($ MILLION)

17. CANADA MONOSODIUM GLUTAMATE (MSG) MARKET SIZE, 2023-2031 ($ MILLION)

18. UK MONOSODIUM GLUTAMATE (MSG) MARKET SIZE, 2023-2031 ($ MILLION)

19. FRANCE MONOSODIUM GLUTAMATE (MSG) MARKET SIZE, 2023-2031 ($ MILLION)

20. GERMANY MONOSODIUM GLUTAMATE (MSG) MARKET SIZE, 2023-2031 ($ MILLION)

21. ITALY MONOSODIUM GLUTAMATE (MSG) MARKET SIZE, 2023-2031 ($ MILLION)

22. SPAIN MONOSODIUM GLUTAMATE (MSG) MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF EUROPE MONOSODIUM GLUTAMATE (MSG) MARKET SIZE, 2023-2031 ($ MILLION)

24. INDIA MONOSODIUM GLUTAMATE (MSG) MARKET SIZE, 2023-2031 ($ MILLION)

25. CHINA MONOSODIUM GLUTAMATE (MSG) MARKET SIZE, 2023-2031 ($ MILLION)

26. JAPAN MONOSODIUM GLUTAMATE (MSG) MARKET SIZE, 2023-2031 ($ MILLION)

27. SOUTH KOREA MONOSODIUM GLUTAMATE (MSG) MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF ASIA-PACIFIC MONOSODIUM GLUTAMATE (MSG) MARKET SIZE, 2023-2031 ($ MILLION)

29. LATIN AMERICA MONOSODIUM GLUTAMATE (MSG) MARKET SIZE, 2023-2031 ($ MILLION)

30. MIDDLE EAST AND AFRICA MONOSODIUM GLUTAMATE (MSG) MARKET SIZE, 2023-2031 ($ MILLION)