Data Warehousing Market

Global Data Warehousing Market Size, Share & Trends Analysis Report by Mode of Deployment (On-Premises and Cloud-Based), by Industry Vertical (Banking, Financial Services and Insurance (BFSI), IT & Telecom, Retail, Healthcare, and Others) and Forecast 2019-2025

The global data warehousing market is estimated to grow at a significant growth rate of 10.7% during the forecast period. The market is driven by a significant rise in big data and the increasing adoption of cloud-based services owing to its flexibility and cost-effectiveness. The companies are adopting data warehousing services to enhance the flexibility and scalability of their business efficiency and effectiveness.

Moreover, major companies are managing their business data through data warehousing as the deployment of an infrastructure facility involves a high cost that propels enterprises to shift to data warehousing services. Data warehousing is considered as a secure platform with cost-saving potential and capability to enhance performance and security. Due to these benefits, data warehousing is being significantly preferred in several application sectors such as BFSI, IT & telecom, retail, healthcare, and others.

Segmental Outlook

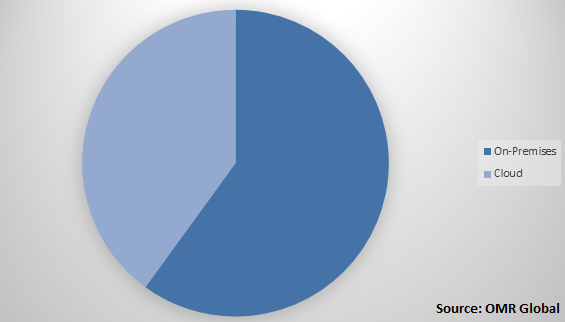

The global data warehousing market is segmented on the basis of mode of deployment, industry vertical, and region. Based on the mode of deployment, the market is sub-segmented into on-premises and cloud-based data warehousing. On the basis of industry vertical, the market is classified into BFSI, IT & telecom, retail, healthcare, and others.

Global Data Warehousing Market Share by Mode of Deployment, 2018 (%)

- In July 2019, Equinix has opened its 11th data center in Tokyo. Through this expansion, the company is looking to fix Japan's growing digital transformation and cloud adoption drive.

- In March 2019, Microsoft and Telecom Egypt entered into a collaboration to provide a Microsoft cloud network in Egypt. This would enable the company to spread its footprints in the untapped market.

- In February 2018, Equinix Inc. entered into a definitive agreement to acquire the Infomart Dallas. This acquisition will further strengthen the Equinix global platform and expand its reach in the Dallas market.

- In September 2017, Equinix acquired Itconic, a Spain-based data center service provider. It operates its five data centers in Spain and Portugal.

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global data warehousing market. Based on the availability of data, information related to products and services, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Amazon Web Services, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Google LLC

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. IBM Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. SAP SE

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Dell Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Data Warehousing Market by Mode of Deployment

5.1.1. On-Premises

5.1.2. Cloud-Based

5.2. Global Data Warehousing Market by Industry Vertical

5.2.1. Banking, Financial Services and Insurance (BFSI)

5.2.2. IT & Telecom

5.2.3. Retail

5.2.4. Healthcare

5.2.5. Others (Manufacturing)

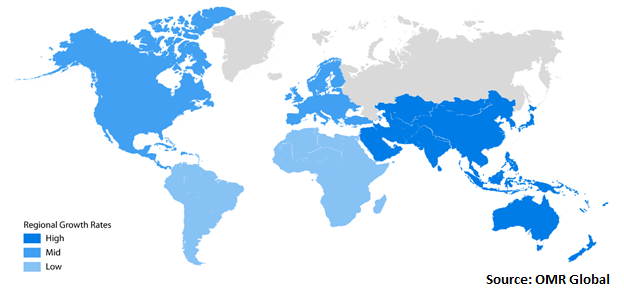

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. Japan

6.3.3. India

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Actian Corp.

7.2. Amazon Web Services Inc.

7.3. Cloudera Inc.

7.4. Dell Inc.

7.5. Equinix Inc.

7.6. Google LLC

7.7. Hewlett-Packard Co.

7.8. IBM Corp.

7.9. Infobright Inc.

7.10. Kognitio Ltd.

7.11. Microsoft Corp.

7.12. Oracle Corp.

7.13. Pivotal Software, Inc.

7.14. SAP SE

7.15. Snowflake Inc.

7.16. Teradata Corp.

1. GLOBAL DATA WAREHOUSING MARKET RESEARCH AND ANALYSIS BY MODE OF DEPLOYMENT, 2018-2025 ($ MILLION)

2. GLOBAL ON-PREMISES DATA WAREHOUSING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL CLOUD-BASED DATA WAREHOUSING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL DATA WAREHOUSING MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2018-2025 ($ MILLION)

5. GLOBAL DATA WAREHOUSING IN BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL DATA WAREHOUSING IN IT & TELECOM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL DATA WAREHOUSING IN RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL DATA WAREHOUSING IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL DATA WAREHOUSING IN OTHER INDUSTRY VERTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL DATA WAREHOUSING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

11. NORTH AMERICAN DATA WAREHOUSING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN DATA WAREHOUSING MARKET RESEARCH AND ANALYSIS BY MODE OF DEPLOYMENT, 2018-2025 ($ MILLION)

13. NORTH AMERICAN DATA WAREHOUSING MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2018-2025 ($ MILLION)

14. EUROPEAN DATA WAREHOUSING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. EUROPEAN DATA WAREHOUSING MARKET RESEARCH AND ANALYSIS BY MODE OF DEPLOYMENT, 2018-2025 ($ MILLION)

16. EUROPEAN DATA WAREHOUSING MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC DATA WAREHOUSING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC DATA WAREHOUSING MARKET RESEARCH AND ANALYSIS BY MODE OF DEPLOYMENT, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC DATA WAREHOUSING MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2018-2025 ($ MILLION)

20. REST OF THE WORLD DATA WAREHOUSING MARKET RESEARCH AND ANALYSIS BY MODE OF DEPLOYMENT, 2018-2025 ($ MILLION)

21. REST OF THE WORLD DATA WAREHOUSING MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2018-2025 ($ MILLION)

1. GLOBAL DATA WAREHOUSING MARKET SHARE BY MODE OF DEPLOYMENT, 2018 VS 2025 (%)

2. GLOBAL DATA WAREHOUSING MARKET SHARE BY INDUSTRY VERTICAL, 2018 VS 2025 (%)

3. GLOBAL DATA WAREHOUSING MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US DATA WAREHOUSING MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA DATA WAREHOUSING MARKET SIZE, 2018-2025 ($ MILLION)

6. UK DATA WAREHOUSING MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE DATA WAREHOUSING MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY DATA WAREHOUSING MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY DATA WAREHOUSING MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN DATA WAREHOUSING MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE DATA WAREHOUSING MARKET SIZE, 2018-2025 ($ MILLION)

12. CHINA DATA WAREHOUSING MARKET SIZE, 2018-2025 ($ MILLION)

13. JAPAN DATA WAREHOUSING MARKET SIZE, 2018-2025 ($ MILLION)

14. INDIA DATA WAREHOUSING MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC DATA WAREHOUSING MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD DATA WAREHOUSING MARKET SIZE, 2018-2025 ($ MILLION)