Decarbonization Market

Decarbonization Market Size, Share & Trends Analysis Report By Service (Carbon Accounting & Reporting Services, Sustainable Transportation Services and Waste Reduction & Circular Economy Services), by Technology (Renewable Energy Technologies, Energy Efficiency Solutions, Carbon Removal Technologies and Carbon Capture and Storage (CCS)), and by End-User (Oil & Gas, Energy & Utility, Agriculture, Government, Automotive & Transportation, Aerospace & Defense and Manufacturing), Forecast Period (2025-2035)

Industry Overview

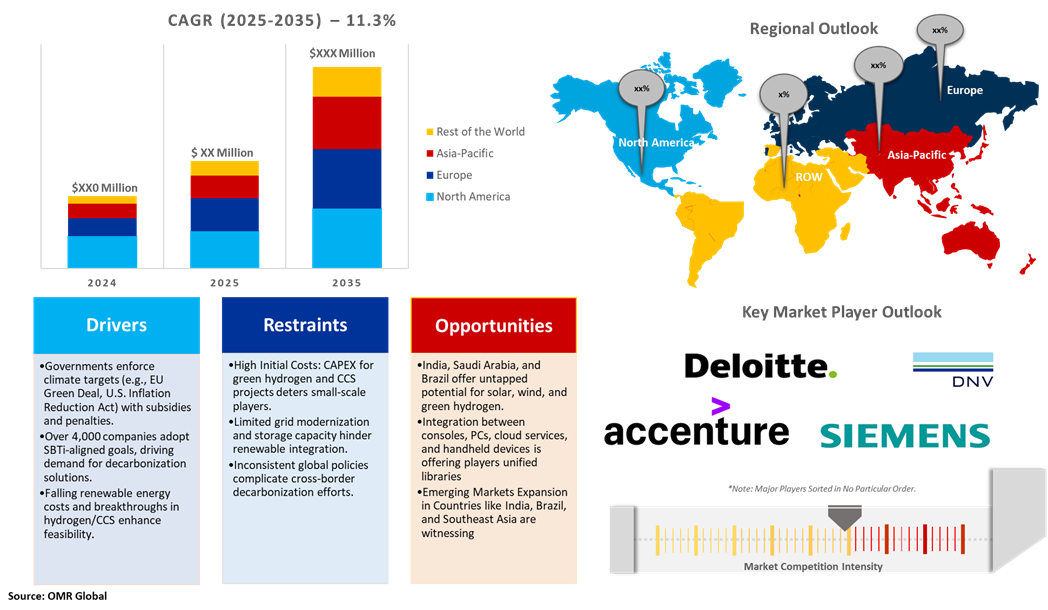

Decarbonization industry, valued at $2,090 billion in 2024, is projected to reach $6,808 billion by 2035, growing at a CAGR of 11.3% over the forecast period from 2025 to 2035. Decarbonization in the industrial sector refers to attempts to minimize the industry's carbon footprint and transition to a more sustainable and low-carbon energy future. The growing adoption of CO2 capture absorption process technology is the key factor supporting the growth of the market globally. Various market players scale up in decarbonization technology, carbon capture, utilization, and storage (CCUS), new energies, oil and gas emissions reduction, digital applications, advanced materials for decarbonization, and nature-based solutions. The market players are also focusing on introducing decarbonization technology solutions that further bolster the market growth. For instance, in May 2023, Abu Dhabi National Oil Company (ADNOC) launched a global competition to find innovations that would reshape the global energy landscape, the competition was launched at the UAE Climate Tech Forum in Abu Dhabi, where over 1,000 global policymakers, innovators, and industrial leaders met to drive technological solutions for decarbonization.

Market Dynamics

Government Support for Decarbonization Through Policies

Governments are supporting decarbonization through subsidies, carbon pricing, and regulations. For instance, in August 2022, the US president signed the Inflation Reduction Act into law, and this legislation contains approximately $369 billion of incentives for energy and climate programs, including Tax credits, research loans, and grants to expand domestic manufacturing capacity for wind turbines, solar panels, batteries, electric vehicles, and other critical components of clean energy production and storage. Further, the European Climate Law legally commits the EU to reach complete climate neutrality by 2050 and requires a halfway reduction of at least 55 % of net greenhouse gas emissions by 2030 (compared with 1990 levels) to provide a clear, legally binding path to the block’s long-term climate objectives.

Market Segmentation

- Based on the service, the market is segmented into carbon accounting & reporting services, sustainable transportation services, and waste reduction & circular economy services.

- Based on the technology, the market is segmented into renewable energy technologies, energy efficiency solutions, carbon removal technologies, and carbon capture and storage (CCS).

- Based on the end-user, the market is segmented into oil & gas, energy & utility, agriculture, government, automotive & transportation, aerospace & defense, and manufacturing.

The Carbon Capture and Storage (CCS) Sub-Segment is Anticipated to Hold a Considerable Share of the Global Decarbonization Market

Among the technology, the carbon capture and storage sub-segment is expected to hold a considerable share of the global programmatic advertisement market. The segmental growth is attributed to the growing influence of carbon capture and storage for reducing carbon emissions, which could be key to helping to tackle global warming. Through standardization with catch modular product, digitalization, and integration of the full value chain, Carbon Capture as a Service will not only accelerate the market but also accelerate cost reductions. For instance, the US federal government dedicated a considerable part of its investment to carbon capture and storage through a combination of direct grants and tax incentives. Additionally, the Infrastructure Investment and Jobs Act (IIJA) reserved $8.2 billion of advance funding for CCS projects for 2022-2026, to advance technology innovation and development of megaprojects. Besides funding directly, the 2022 reconciliation act also enhanced the economic viability of CCS by raising the tax credit rate for CO? capture and storage by 70%, promoting corporate adoption. The steps are aimed at advancing decarbonization across sectors while supporting compliance with local climate goals.

Carbon Accounting and Reporting Services Segment to Witness Fastest Growth

Carbon reporting and accounting services are a core segment of the decarbonization sector, offering businesses methodical ways to track, quantify, and report their carbon footprint. These services have risen to the fore as governments worldwide enact stricter regulations on emissions disclosure. The growth in the segment is fueled by increasing corporate commitments to net-zero targets that require effective carbon accounting systems for creating baselines and monitoring improvement. Investor expectations for climate risk disclosure, too, as well as consumer preferences for transparency into the environmental footprint, are further promoting adoption across industries. The main players in this segment are specialized consultancies such as Carbon Trust and EcoAct, as well as wider professional services firms like Deloitte and EY, who have established bespoke carbon accounting practices.

Regional Outlook

Global decarbonization is further divided by region, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

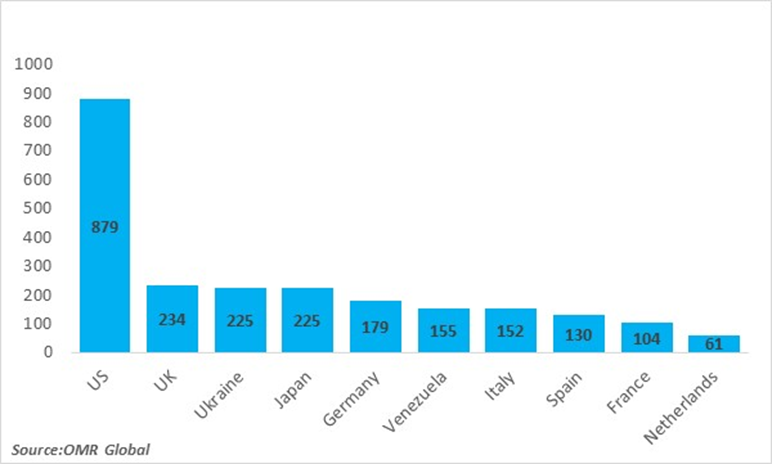

Largest Declines in Carbon Emissions in Million Metric Tons, 2007-2022

North America Region is expected to grow at a Significant CAGR in the Global Decarbonization Market

Among all regions, the region of North America is expected to grow at a significant CAGR during the period of forecast. Regional growth is owing to the growing number of projects and investments made in the green environment. For instance, in May 2023, the US Department of Energy (DOE) announced the Clean Fuels & Products Shot, an innovative initiative aimed at drastically lowering the greenhouse gas emissions (GHGs) of carbon-based fuels and products essential to our lifestyle. This is the seventh DOE Energy Earthshot that targets minimizing carbon emissions from the chemical and fuel industry, utilizing alternative and sustainable sources of carbon to reach a minimum of 85.0% less GHG emissions compared to fossil sources by 2035. Furthermore, the adoption of sustainable transportation services using data and technology to optimize transportation services, reduce traffic congestion, and improve the efficiency of sustainability in transportation drives the growth of the market in the region. The key market players include Amazon Inc., Canadian Solar Inc., Microsoft, NextEra Energy, Inc., Tesla, Inc., and others.

Market Players Outlook

The major companies operating in the global decarbonization market include Accenture PLC, Dakota Software Corporation, Deloitte Touche Tohmatsu Limited, DNV A/S, International Business Machines Corporation (IBM Corp.), and Siemens Industry Software, Inc., among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In September 2024, Schneider Electric launched Zeigo Activate Lite, which redefines the approach to emissions reduction. The software offers an array of features designed to enable businesses to establish a carbon emissions baseline, set a measurable decarbonization target, calculate ongoing Scope 1 and 2 emissions using readily available energy data, and connect with solution providers.

- In August 2024, Accenture acquired BOSLAN to add global capabilities in engineering and deliver net-zero transition projects, such as renewable energy infrastructure (offshore/onshore wind, solar, and hydrogen plants), smart grids, EV charging networks and data centers. The acquisition allows Accenture to use AI and digital technologies to optimize lifecycle management, cost management, and carbon-neutral project delivery.

- In March 2023, Deloitte launched Green Light Solution, an end-to-end decarbonization software as it is a SaaS-based cloud solution built on CortexAI — a cutting-edge, scalable, artificial intelligence (AI) platform for data management and analytics, a modular system of tools that helps empower organizations to act at every stage of decarbonization journey.

- In February 2023, Schneider Electric acquired EcoAct SAS. The acquisition will make EcoAct's strong portfolio, comprising net-zero strategy consulting, leading climate data analytics, and nature-based carbon offsetting projects, fully integrated with Schneider Electric's Sustainability Business. This alliance reinforces Schneider's position in sustainability advisory services, complementing its energy management, renewable purchasing, climate risk management, end-to-end decarbonization, and ESG reporting services.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global decarbonization market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Decarbonization Market Sales Analysis – Service | Technology | End-User ($ Million)

• Decarbonization Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Decarbonization Trends

2.2.2. Market Recommendations

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Decarbonization Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Decarbonization Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Decarbonization Market Revenue and Share by Manufacturers

• Decarbonization Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Accenture PLC

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Deloitte

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. DNV A/S

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Siemens AG.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Decarbonization Market Sales Analysis by Service ($ Million)

5.1. Carbon Accounting & Reporting Services

5.2. Sustainable Transportation Services

5.3. Waste Reduction & Circular Economy Services

6. Global Decarbonization Market Sales Analysis by Technology ($ Million)

6.1. Renewable Energy Technologies

6.2. Energy Efficiency Solutions

6.3. Carbon Removal Technologies

6.4. Carbon Capture and Storage (CCS)

7. Global Decarbonization Market Sales Analysis by End-User ($ Million)

7.1. Oil & Gas

7.2. Energy & Utility

7.3. Agriculture

7.4. Government

7.5. Automotive & Transportation

7.6. Aerospace & Defense

7.7. Manufacturing

8. Regional Analysis

8.1. North American Decarbonization Market Sales Analysis – Service | Technology | End-User | Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Decarbonization Market Sales Analysis – Service | Technology | End-User | Country ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Decarbonization Market Sales Analysis – Service | Technology | End-User | Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Decarbonization Market Sales Analysis – Service | Technology | End-User | Country ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Accenture PLC

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. Air Liquide group

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. Aramco (Saudi Arabian Oil Company)

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Atos SE

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. Carbon Clean

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. CarbonFree

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. Dakota Software Corporation

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. Danfoss group

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Deloitte Touche Tohmatsu Limited

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. DNV A/S

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. EcoAct (Schneider Electric Group)

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. EnergyCAP, LLC

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. GE Vernova

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. International Business Machines Corporation (IBM Corp.)

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Intelex Technologies ULC

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. ISOMETRIX

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. MAN Energy Solutions

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Microsoft Corporation

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. Persefoni AI Inc.

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. Renew India (RENEW ENERGY GLOBAL PLC)

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

9.21. SAP SE

9.21.1. Quick Facts

9.21.2. Company Overview

9.21.3. Product Portfolio

9.21.4. Business Strategies

9.22. Salesforce, Inc.

9.22.1. Quick Facts

9.22.2. Company Overview

9.22.3. Product Portfolio

9.22.4. Business Strategies

9.23. Shell Energy Solution

9.23.1. Quick Facts

9.23.2. Company Overview

9.23.3. Product Portfolio

9.23.4. Business Strategies

9.24. Siemens AG

9.24.1. Quick Facts

9.24.2. Company Overview

9.24.3. Product Portfolio

9.24.4. Business Strategies

9.25. SINAI

9.25.1. Quick Facts

9.25.2. Company Overview

9.25.3. Product Portfolio

9.25.4. Business Strategies

1. Global Decarbonization Market Research And Analysis By Service, 2024-2035 ($ Million)

2. Global Decarbonization Accounting & Reporting Services Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Sustainable Transportation Services Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Waste Reduction & Circular Economy Services Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Decarbonization Market Research And Analysis By Technology, 2024-2035 ($ Million)

6. Global Renewable Energy Technologies Market Research And Analysis, 2024-2035 ($ Million)

7. Global Energy Efficiency Solutions Market Research And Analysis, 2024-2035 ($ Million)

8. Global Carbon Removal Technologies Market Research And Analysis, 2024-2035 ($ Million)

9. Global Carbon Capture And Storage (CCS) Market Research And Analysis, 2024-2035 ($ Million)

10. Global Decarbonization Market Research And Analysis By End-User, 2024-2035 ($ Million)

11. Global Decarbonization For Oil & Gas Market Research And Analysis, 2024-2035 ($ Million)

12. Global Decarbonization For Energy & Utility Market Research And Analysis, 2024-2035 ($ Million)

13. Global Decarbonization For Agriculture Market Research And Analysis, 2024-2035 ($ Million)

14. Global Decarbonization For Government Market Research And Analysis, 2024-2035 ($ Million)

15. Global Decarbonization For Automotive & Transportation Market Research And Analysis, 2024-2035 ($ Million)

16. Global Decarbonization For Aerospace & Defense Market Research And Analysis, 2024-2035 ($ Million)

17. Global Decarbonization For Manufacturing Market Research And Analysis, 2024-2035 ($ Million)

18. Global Decarbonization Market Research And Analysis By Region, 2024-2035 ($ Million)

19. North American Decarbonization Market Research And Analysis By Country, 2024-2035 ($ Million)

20. North American Decarbonization Market Research And Analysis By Service, 2024-2035 ($ Million)

21. North American Decarbonization Market Research And Analysis By Technology, 2024-2035 ($ Million)

22. North American Decarbonization Market Research And Analysis By End-User, 2024-2035 ($ Million)

23. European Decarbonization Market Research And Analysis By Country, 2024-2035 ($ Million)

24. European Decarbonization Market Research And Analysis By Service, 2024-2035 ($ Million)

25. European Decarbonization Market Research And Analysis By Technology, 2024-2035 ($ Million)

26. European Decarbonization Market Research And Analysis By End Users, 2024-2035 ($ Million)

27. Asia- Pacific Decarbonization Market Research And Analysis By Country, 2024-2035 ($ Million)

28. Asia-Pacific Decarbonization Market Research And Analysis By Service, 2024-2035 ($ Million)

29. Asia-Pacific Decarbonization Market Research And Analysis By Technology, 2024-2035 ($ Million)

30. Asia-Pacific Decarbonization Market Research And Analysis By End Users, 2024-2035 ($ Million)

31. Rest Of The World Decarbonization Market Research And Analysis By Region, 2024-2035 ($ Million)

32. Rest Of The World Decarbonization Market Research And Analysis By Service, 2024-2035 ($ Million)

33. Rest Of The World Decarbonization Market Research And Analysis By Technology, 2024-2035 ($ Million)

34. Rest Of The World Decarbonization Market Research And Analysis By End Users, 2024-2035 ($ Million)

1. Global Decarbonization Market Share By Service, 2024 Vs 2035 (%)

2. Global Decarbonization Accounting & Reporting Services Market Share By Region, 2024 Vs 2035 (%)

3. Global Decarbonization Sustainable Transportation Services Market Share By Region, 2024 Vs 2035 (%)

4. Global Waste Reduction & Circular Economy Services Market Share By Region, 2024 Vs 2035 (%)

5. Global Decarbonization Market Share By Technology, 2024 Vs 2035 (%)

6. Global Renewable Energy Technologies Market Share By Region, 2024 Vs 2035 (%)

7. Global Energy Efficiency Solutions Market Share By Region, 2024 Vs 2035 (%)

8. Global Carbon Removal Technologies Market Share By Region, 2024 Vs 2035 (%)

9. Global Carbon Capture And Storage (CCS) Market Share By Region, 2024 Vs 2035 (%)

10. Global Decarbonization Market Share Analysis By End-User, 2022 Vs 2030 ($ Million)

11. Global Decarbonization For Oil & Gas Market Share By Region, 2024 Vs 2035 (%)

12. Global Decarbonization For Energy & Utility Market Share By Region, 2024 Vs 2035 (%)

13. Global Decarbonization For Agriculture Market Share By Region, 2024 Vs 2035 (%)

14. Global Decarbonization For Government Market Share By Region, 2024 Vs 2035 (%)

15. Global Decarbonization For Automotive & Transportation Market Share By Region, 2024 Vs 2035 (%)

16. Global Decarbonization For Aerospace & Defense Market Share By Region, 2024 Vs 2035 (%)

17. Global Decarbonization For Manufacturing Market Share By Region, 2024 Vs 2035 (%)

18. Global Market Share By Region, 2024 Vs 2035 (%)

19. US Market Size, 2024-2035 ($ Million)

20. Canada Market Size, 2024-2035 ($ Million)

21. UK Decarbonization Market Size, 2024-2035 ($ Million)

22. France Decarbonization Market Size, 2024-2035 ($ Million)

23. Germany Decarbonization Market Size, 2024-2035 ($ Million)

24. Italy Decarbonization Market Size, 2024-2035 ($ Million)

25. Spain Decarbonization Market Size, 2024-2035 ($ Million)

26. Rest Of Europe Decarbonization Market Size, 2024-2035 ($ Million)

27. India Decarbonization Market Size, 2024-2035 ($ Million)

28. China Decarbonization Market Size, 2024-2035 ($ Million)

29. Japan Decarbonization Market Size, 2024-2035 ($ Million)

30. South Korea Decarbonization Market Size, 2024-2035 ($ Million)

31. ASEAN Economies Decarbonization Market Size, 2024-2035 ($ Million)

32. Australia And New Zealand Decarbonization Market Size, 2024-2035 ($ Million)

33. Rest Of Asia-Pacific Decarbonization Market Size, 2024-2035 ($ Million)

34. Latin America Decarbonization Market Size, 2024-2035 ($ Million)

35. Middle East And Africa Decarbonization Market Size, 2024-2035 ($ Million)

FAQS

The size of the Decarbonization market in 2024 is estimated to be around $2,090 billion.

North America holds the largest share in the Decarbonization market.

Leading players in the Decarbonization market include Accenture PLC, Dakota Software Corporation, Deloitte Touche Tohmatsu Limited, DNV A/S, International Business Machines Corporation (IBM Corp.), and Siemens Industry Software, Inc., among others.

Decarbonization market is expected to grow at a CAGR of 11.3% from 2025 to 2035.

The Decarbonization Market is growing due to rising climate regulations, clean energy investments, and advancements in low-carbon technologies.