E-Scrap Recycling Market

E-Scrap Recycling Market Size, Share & Trends Analysis Report by Product Type (IT and Telecommunications Equipment, Large White Goods, Small Household Appliances, and Others) and by Processed Materials (Plastic, Metal, Glass, and Others) Forecast Period (2024-2031)

E-scrap recycling market is anticipated to grow at a significant CAGR of 10.9% during the forecast period (2024-2031). E-waste (electronic waste, e-scrap, or end-of-life electronics) refers to used electronics nearing obsolescence. The e-scrap recycling market deals with their recycling.

Market Dynamics

Escalating Electronic Waste: A Driving Force Behind E-Scrap Recycling Market Growth

One of the primary drivers of the E-Scrap Recycling Market's expansion is the surging generation of electronic waste. According to the UN’s fourth Global E-waste Monitor (GEM) In 2022, a record-breaking 62 million tonnes of electronic waste (e-waste) were produced, marking an 82.0% increase from 2010, with projections indicating a further surge to 82 million tonnes by 2030.In 2022, only 22.3% of the year's e-waste mass was reported to have been adequately collected and recycled, leaving approximately US$62 billion worth of recoverable natural resources unaccounted for. This phenomenon is fueled by two key trends: rapid technological advancements and a decline in product lifespans. On one hand, technological innovation leads to a constant stream of new electronic devices with improved functionalities. Consumers are enticed to upgrade to these newer models, discarding their previously used electronics. On the other hand, the lifespan of electronic devices has been steadily decreasing. This can be attributed to factors like planned obsolescence by manufacturers, the increasing complexity of devices leading to faster breakdowns, and the desire for the latest features. These factors result in a significant and ever-growing mountain of electronic waste that necessitates efficient and responsible recycling solutions.

Stricter Environmental Regulations: A Catalyst for Responsible E-waste Management

Stricter environmental regulations are driving a global shift in e-waste disposal. Governments, aware of the dangers of improper practices, are implementing regulations. For instance, in April 2023, Washington state lawmakers have passed a bill (SB 5144) establishing extended producer responsibility (EPR) for batteries, covering a wide range of types. This approach, supported by the Product Stewardship Institute (PSI), aims to ensure fair recycling cost allocation among manufacturers and eliminate free riders. The move reflects the trend of stricter environmental regulations and a growing commitment to sustainable waste management practices. These regulations target hazardous materials by mandating collection and recycling while restricting landfilling and incineration. This push for responsible management is a catalyst for change, prompting manufacturers, recyclers, and consumers to adopt more sustainable practices. As regulations tighten, we can expect a significant move towards a more environmentally friendly approach to e-waste disposal.

Market Segmentation

Our in-depth analysis of the global E-Scrap Recyclingmarket includes the following segments by product type and processed materials:

- Based onproduct type, the market is sub-segmented intoIT and Telecommunications Equipment, Large White Goods, Small Household Appliances, and Others.

- Based on processed materials, the market is sub-segmented into plastic, metal, glass, and others.

Large White Goods Lead E-Scrap Charge: From Fridge to Future

The Large White Goods segment is experiencing the most significant growth within the E-Scrap Recycling Market due to various factors. Firstly, this segment currently holds the largest share of the market, indicating a considerable existing base of appliances.According to the European Environmental Bureau,in 2021, the European Union witnessed a significant surge in the sales of electrical and electronic equipment, exceeding 13 million tonnes, marking an impressive 85% rise compared to 2013 figures. Notably, the Netherlands led the EU member states in per capita consumption, followed closely by Germany, Denmark, France, and Belgium, highlighting substantial demand trends across the region. Secondly, while these appliances traditionally boast a longer lifespan than smaller electronics, advancements in technology and the rise of connected appliances are likely leading to more frequent replacements. This, coupled with the inherently larger size and material composition of large white goods, translates to a greater volume of e-waste generated when they reach their end-of-life. Consequently, the Large White Goods segment is experiencing a surge in recycling activity, solidifying its position as the fastest-growing sector within the E-Scrap Recycling Market.

Metals Hold a Considerable Market Share

The Metals segment within the e-scrap recycling market is poised for significant growth due to several factors. Firstly, the ever-increasing demand for electronics translates to anincreased need for the metals used in their production, such as copper, aluminum, and rare earth elements. Recycling e-waste offers a sustainable solution to meet this demand, providing a reliable source of these valuable materials. Secondly, advancements in technology often lead to more complex electronic devices with a higher concentration of metals. This further strengthens the case for efficient e-scrap recycling to recover these resources.According to the Global E-waste Monitor 2024, In 2022, all e-waste worldwide contained31 billion kg of metals, of which an estimated 19 billion kg were viably recoveredand brought back into circulation. Finally, the economic advantage of e-scrap metal recovery comes into play. Recycling metals is generally cheaper and requires less energy compared to virgin material extraction, making it a more attractive option for manufacturers and the environment.According to the British Metals Recycling Association, recycling metal emits 80.0% less CO2 than production from raw materials and recycling steel uses 70.0% less energy than mining and refining ore.Therefore, due to these factors, the metals segment is expected to experience the highest growth within the E-Scrap Recycling Market.

Regional Outlook

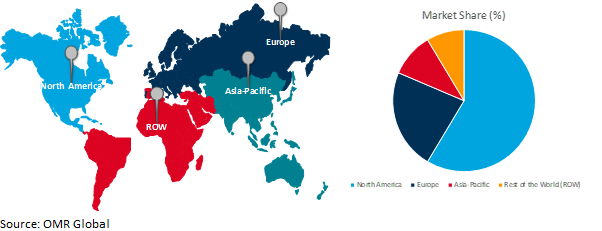

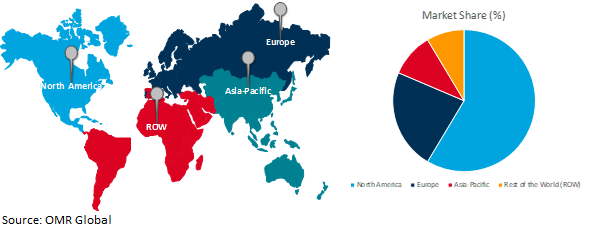

The global e-scrap recycling market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

North America: A Leader in the E-Scrap Recycling Market

- High Consumption and Short Lifespans of Electronics: North American consumers exhibit a high propensity for purchasing the latest electronic devices.According to the Two Sides North America, the average smartphone lifecycle in the US does not usually exceed 18 to 24 months. The US and Canada annually generate 7.7 million metric tons (Mt) of electronic waste or 20.9 kilograms (kg) per capita. Of that 7.7 Mt, the US generates 7 Mt and Canada generates 0.7 Mt.This trend, coupled with planned obsolescence practices by manufacturers and a desire for the newest features, leads to a shorter lifespan for electronics and a constant influx of e-waste.

- Stringent Environmental Regulations and Growing Public Awareness: Governments across North America are implementing increasingly stricter regulations on e-waste disposal. For instance, in the United States of America, a total of 25 states and the District of Columbia have implemented legislation establishing state-wide e-waste recycling programs.Additionally, 76 landfill bans are in place across various Canadian regions, including Newfoundland, Nova Scotia, Prince Edward Island, Vancouver, British Columbia, and parts of Ontario. These regulations often mandate specific collection and recycling targets, while restricting practices like landfilling or incineration. Additionally, there is a growing public awareness of the environmental hazards associated with improper e-waste disposal.

Global E-Scrap Recycling Market Growth by Region 2024-2031

Asia Pacific: Evolving Regulations Fuel E-Scrap Recycling Growth

The evolving regulatory landscape in Asia-Pacific is a key driver of the E-Scrap Recycling Market's growth. While regulations are still under development in some countries, a growing awareness of improper e-waste disposal's environmental and health risks is prompting stricter legislation. For instance,the first E-waste (Management and Handling) Rules 213 were notified in 2011 by the Ministry of Environment, Forests and Climate Change, which is responsible for waste-related legislation, with the latest amendment having come into force in April 2023.Moreover, Taiwan has established a robust legal framework to regulate e-waste management, ensuring proper disposal and recycling of EEE. The Waste Disposal Act and the Recycling Fund Management Act serve as the cornerstone of this regulatory framework. This includes setting collection, recycling targets,and promoting the formalization of the e-scrap recycling sector. As regulations become more comprehensive, the market is expected to flourish, promoting responsible e-waste management in the region.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global E-Scrap Recycling market include DOWA ECO-SYSTEM Co., Ltd., Eco Recycling Ltd (Ecoreco), JX Metals Corporation (ENEOS Holdings, Inc), Stena Metall AB, and Umicore SA among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in August 2022, Tokyo-based JX Metals Corp. (formally JX Nippon Mining & Metals Corporation)strengthened its e-waste disposal capabilities with the acquisition of Mississauga's eCycle Solutions Inc. from Montreal's Horizon Capital Holdings. eCycle, Canada's largest e-waste recycler, brings eight operational sites and robust collection networks to JX, bolstering its commitment to sustainability and positioning the company as a key player in global e-waste solutions.

Recent Developments

- In January 2024, BASF and Stena Recycling have united to advance electric vehicle battery recycling in Europe. Their collaboration aims to enhance offerings to European OEM customers. Stena Recycling will collect and pre-treat batteries in Halmstad, Sweden, producing black mass. BASF will refine it in Schwarzheide, Germany. This partnership signifies a crucial step in sustainable battery recycling for the European automotive sector.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the globalE-Scrap Recyclingmarket. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. DOWA ECO-SYSTEM Co., Ltd. (DOWA Holdings Co., Ltd)

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Eco Recycling Ltd (Ecoreco)

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. JX Metals Corporation (ENEOS Holdings, Inc)

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Stena Metall AB

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Umicore SA

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global E-Scrap Recycling Market by Product Type

4.1.1. IT and Telecommunications Equipment

4.1.2. Large White Goods

4.1.3. Small Household Appliances

4.1.4. Others (Medical Devices, Test and Measurement Equipment, Power Tools, Lighting Equipment, Toys and Consumer Electronics, Industrial Equipment)

4.2. Global E-Scrap Recycling Market by Processed Materials

4.2.1. Plastic

4.2.2. Metal

4.2.3. Glass

4.2.4. Others (Printed Circuit Boards (PCBs), Rubber and Textiles, Hazardous Materials)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. A&H IT Renew, Inc.

6.2. Aurubis AG

6.3. Desco Electronic Recyclers

6.4. Electronic Recyclers International, Inc.

6.5. EMP Recycling

6.6. ENVIRO-HUB HOLDINGS LTD.

6.7. Kat Metal Estonia OÜ

6.8. Namo eWaste Management Ltd.

6.9. Quantum Lifecycle Partners

6.10. WM Intellectual Property Holdings, L.L.C

1. GLOBAL E-SCRAP RECYCLING MARKET BYPRODUCT TYPE, 2023-2031 ($ MILLION)

2. GLOBALE-SCRAP RECYCLING FOR IT AND TELECOMMUNICATIONS EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL E-SCRAP MARKET FOR LARGE WHITE GOODS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL E-SCRAP RECYCLING FOR SMALL HOUSEHOLD APPLIANCES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL E-SCRAP RECYCLING FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL E-SCRAP RECYCLING MARKET BY PROCESSED MATERIALS, 2023-2031 ($ MILLION)

7. GLOBAL PLASTICE-SCRAP RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL METAL E-SCRAP RECYCLING MARKETRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL GLASSE-SCRAP RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL OTHERS E-SCRAP RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBALE-SCRAP RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN E-SCRAP RECYCLING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN E-SCRAP RECYCLING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE 2023-2031 ($ MILLION)

14. NORTH AMERICAN E-SCRAP RECYCLING MARKET RESEARCH AND ANALYSIS BY PROCESSED MATERIALS, 2023-2031 ($ MILLION)

15. EUROPEAN E-SCRAP RECYCLING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. EUROPEAN E-SCRAP RECYCLING MARKET RESEARCH AND ANALYSIS BYPRODUCT TYPE2023-2031 ($ MILLION)

17. EUROPEAN E-SCRAP RECYCLING MARKET RESEARCH AND ANALYSIS BY PROCESSED MATERIALS, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC E-SCRAP RECYCLING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. ASIA- PACIFIC E-SCRAP RECYCLING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

20. ASIA- PACIFIC E-SCRAP RECYCLING MARKET RESEARCH AND ANALYSIS BY PROCESSED MATERIALS, 2023-2031 ($ MILLION)

21. REST OF THE WORLD E-SCRAP RECYCLING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. REST OF THE WORLD E-SCRAP RECYCLING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

23. REST OF THE WORLD E-SCRAP RECYCLING MARKET RESEARCH AND ANALYSIS BY PROCESSED MATERIALS, 2023-2031 ($ MILLION)

1. GLOBAL E-SCRAP RECYCLING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023 VS 2031 (%)

2. GLOBAL E-SCRAP RECYCLINGFOR IT AND TELECOMMUNICATIONS EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL E-SCRAP RECYCLING FOR LARGE WHITE GOODS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL E-SCRAP RECYCLING FOR SMALL HOUSEHOLD APPLIANCES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL E-SCRAP RECYCLING FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

6. GLOBAL E-SCRAP RECYCLING MARKET RESEARCH AND ANALYSIS BY PROCESSED MATERIALS, 2023 VS 2031 (%)

7. GLOBAL PLASTICE-SCRAP RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL METALE-SCRAP RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBAL GLASS E-SCRAP RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. GLOBAL OTHERS E-SCRAP RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. GLOBAL E-SCRAP RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

12. US E-SCRAP RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA E-SCRAP RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

14. UK E-SCRAP RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE E-SCRAP RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY E-SCRAP RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY E-SCRAP RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN E-SCRAP RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE E-SCRAP RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA E-SCRAP RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA E-SCRAP RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN E-SCRAP RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA E-SCRAP RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC E-SCRAP RECYCLING MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA E-SCRAP RECYCLING MARKET S031 ($ 2031 ($ MILLION)

26. MIDDLE EAST & AFRICA E-SCRAP RECYCLING MARKET S031 ($ 2031 ($ MILLION)