Digital Innovation in Insurance Market

Digital Innovation in Insurance Market Size, Share & Trends Analysis Report by Insurance Type (Health Insurance, Motor Insurance, Home insurance, Travel Insurance, Commercial Insurance, and Others) and by Technology (Cloud Computing, Internet of Things, Advanced Analytics, Telematics, and Others) Forecast Period (2023-2030)

Digital innovation in insurance market is anticipated to grow at a considerable CAGR of 12.2% during the forecast period. The insurance industry has long been held back by manual processes, difficult-to-digitize workflows, and restrictive custom software for submitting, tracking, and paying out claims. Large insurance companies entrenched in legacy technology have historically found it hard to take advantage of advancements in technology without major changes to their business processes and underlying systems. The market players are digitally transforming the way insurers handle key aspects of their business and often partner with more established insurance providers to pair their new technology functionality with larger customer bases. Insurance companies are leveraging new technology to update their backend claim systems, benefits platforms, customer portals, and more which is expected to contribute to the global digital innovation in insurance market during the forecast period.

Insurance companies have shifted to adoption of transformative digital technologies to help support current income and revenue opportunities. Digital platforms enable personalization and strengthen connections with customers by providing new offerings and services. Digital platform allows access to deeper insights from data analytics, and applies it to new business models to reduce risk and fraud, and improve segmentation and reduce fraud. Need to overhaul traditional business models, cost reduction, increased efficiency, and rise in profit margin drive the global digital innovation in the insurance market. However, insurance companies are yet to fully capitalize upon the transformative power of digital technology, and many are still in the process of developing digital strategies that align with their business objectives. Use of digital channels to create new products and services presents a major opportunity for the market development market.

Segmental Outlook

The global digital innovation in insurance market is segmented into insurance type and technology. Based on the insurance type, the market is augmented into health insurance, motor insurance, home insurance, travel insurance, commercial insurance, and others. Further, based on technology, the market is again sub-segmented into cloud computing, internet of things (IoT), advanced analytics, telematics, and others. Among insurance type, the health insurance sub-segment is expected to hold considerable share in the market over the forecast period owing to rising healthcare and Medicare expenditure among population across the globe.

The Cloud Computing Sub-Segment Is Anticipated To Hold Prominent Share in the Global Digital Innovation in Insurance Market

Among technology, the cloud computing segment is expected to hold a prominent share in the market over the forecast period. The increasing realization among enterprises for importance of saving money and resources by moving their data to the cloud instead of building and maintaining new data storage is driving the demand for cloud-based solutions. Further, the adoption of on-demand digital insurance platforms owing to multiple benefits are anticipated to drive the growth of the market during the forecast period.

Regional Outlooks

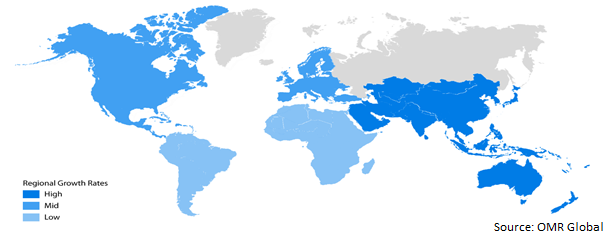

The global Digital Innovation in Insurance market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for particular region or country level as per the requirement. Among these, the North American region is projected to experience considerable growth in the digital innovation in insurance market owing to the presence of large number of market players and well established infrastructure in the region.

Global Digital Innovation in Insurance Market Growth, by Region 2023-2030

The Asia-Pacific Region is expected to Hold Prominent Share in the Global Digital Innovation in Insurance Market

Among all countries, the Asia-Pacific region is expected to hold a prominent share in the global digital innovation in insurance market during the forecast period. The integration of payment and social media into platforms that enable targeted insurance marketing and offer highly responsive customer engagement capabilities is something that insurance companies see across Asia. These platforms offer insurer’s payment and marketing services online which is accelerating the growth of the market during the forecast period. In China, digital channels are becoming more prominent which is further expected to rise digital innovation in insurance. Moreover, in many Asia-Pacific jurisdictions, consumers are open to having insurers provide ecosystem services. These digital insurance ecosystems are interconnected players forming sets of products and services that allow users to fulfill a variety of needs in one integrated experience. This is expected to augment the demand for a digital insurance platform in the region.

Market Players Outlook

The major companies serving the global digital innovation in insurance market include Accenture Plc, Allianz SE, Axa S.A., Hitachi Solutions Ltd., Prudential Financial, Inc., United Health Group Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in 2019, Axa launched a digital platform known as Axa Affiliates that enables partners to integrate the company's insurance solutions within their websites or apps. That focus on innovation has been an asset in ensuring business continuity during COVID-19 and to serve customers in an unprecedented context.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global digital innovation in insurance market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Digital Innovation in Insurance Market by Insurance Type

4.1.1. Healthcare Insurance

4.1.2. Motor Insurance

4.1.3. Home Insurance

4.1.4. Travel Insurance

4.1.5. Commercial Insurance

4.1.6. Others

4.2. Global Digital Innovation in Insurance Market by Technology

4.2.1. Cloud Computing

4.2.2. Internet of Things (IoT)

4.2.3. Advanced Analytics

4.2.4. Telematics

4.2.5. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

1.1.1. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Accenture Plc

6.2. Allianz SE

6.3. Assicurazioni Generali S.P.A.

6.4. Axa S.A.

6.5. Berkshire Hathaway Inc.

6.6. China Life Insurance Co. Ltd.

6.7. Hitachi Solutions Ltd.

6.8. Japan Post Holdings Co., Ltd.

6.9. Munich Re Group

6.10. Prudential Financial, Inc.

6.11. United Health Group Inc.

6.12. Zurich Insurance Group

1. GLOBAL DIGITAL INNOVATION IN INSURANCE MARKET RESEARCH AND ANALYSIS BY INSUR-ANCE TYPE, 2022-2030 ($ MILLION)

2. GLOBAL DIGITAL INNOVATION IN HEALTHCARE INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL DIGITAL INNOVATION IN MOTOR INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL DIGITAL INNOVATION IN HOME INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL DIGITAL INNOVATION IN TRAVEL INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL DIGITAL INNOVATION IN COMMERCIAL INSURANCE MARKET RESEARCH AND ANALY-SIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL DIGITAL INNOVATION IN OTHER INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL DIGITAL INNOVATION IN INSURANCE MARKET RESEARCH AND ANALYSIS BY TECH-NOLOGY, 2022-2030 ($ MILLION)

9. GLOBAL DIGITAL INNOVATION IN INSURANCE BY CLOUD COMPUTING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL DIGITAL INNOVATION IN INSURANCE BY IOT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL DIGITAL INNOVATION IN INSURANCE BY ADVANCED ANALYTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL DIGITAL INNOVATION IN INSURANCE BY TELEMATICS MARKET RESEARCH AND ANAL-YSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL DIGITAL INNOVATION IN INSURANCE BY OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. GLOBAL DIGITAL INNOVATION IN INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. NORTH AMERICAN DIGITAL INNOVATION IN INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

16. NORTH AMERICAN DIGITAL INNOVATION IN INSURANCE MARKET RESEARCH AND ANALYSIS BY INSURANCE TYPE, 2022-2030 ($ MILLION)

17. NORTH AMERICAN DIGITAL INNOVATION IN INSURANCE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

18. EUROPEAN DIGITAL INNOVATION IN INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

19. EUROPEAN DIGITAL INNOVATION IN INSURANCE MARKET RESEARCH AND ANALYSIS BY IN-SURANCE TYPE, 2022-2030 ($ MILLION)

20. EUROPEAN DIGITAL INNOVATION IN INSURANCE MARKET RESEARCH AND ANALYSIS BY TECH-NOLOGY, 2022-2030 ($ MILLION)

21. ASIA-PACIFIC DIGITAL INNOVATION IN INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

22. ASIA-PACIFIC DIGITAL INNOVATION IN INSURANCE MARKET RESEARCH AND ANALYSIS BY IN-SURANCE TYPE, 2022-2030 ($ MILLION)

23. ASIA-PACIFIC DIGITAL INNOVATION IN INSURANCE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

24. REST OF THE WORLD DIGITAL INNOVATION IN INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

25. REST OF THE WORLD DIGITAL INNOVATION IN INSURANCE MARKET RESEARCH AND ANALYSIS BY INSURANCE TYPE, 2022-2030 ($ MILLION)

26. REST OF THE WORLD DIGITAL INNOVATION IN INSURANCE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

1. GLOBAL DIGITAL INNOVATION IN INSURANCE MARKET SHARE BY INSURANCE TYPE, 2022 VS 2030 (%)

2. GLOBAL DIGITAL INNOVATION IN HEALTHCARE INSURANCE MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL DIGITAL INNOVATION IN MOTOR INSURANCE MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL DIGITAL INNOVATION IN HOME INSURANCE MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL DIGITAL INNOVATION IN TRAVEL INSURANCE MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL DIGITAL INNOVATION IN COMMERCIAL INSURANCE MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL DIGITAL INNOVATION IN OTHER INSURANCE MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL DIGITAL INNOVATION IN INSURANCE MARKET SHARE BY TECHNOLOGY, 2022 VS 2030 (%)

9. GLOBAL DIGITAL INNOVATION IN INSURANCE BY CLOUD COMPUTING MARKET SHARE BY RE-GION, 2022 VS 2030 (%)

10. GLOBAL DIGITAL INNOVATION IN INSURANCE BY IOT MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL DIGITAL INNOVATION IN INSURANCE BY ADVANCED ANALYTICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL DIGITAL INNOVATION IN INSURANCE BY TELEMATICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL DIGITAL INNOVATION IN INSURANCE BY OTHER MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. GLOBAL DIGITAL INNOVATION IN INSURANCE MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. US DIGITAL INNOVATION IN INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

16. CANADA DIGITAL INNOVATION IN INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

17. UK DIGITAL INNOVATION IN INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

18. FRANCE DIGITAL INNOVATION IN INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

19. GERMANY DIGITAL INNOVATION IN INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

20. ITALY DIGITAL INNOVATION IN INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

21. SPAIN DIGITAL INNOVATION IN INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

22. REST OF EUROPE DIGITAL INNOVATION IN INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

23. INDIA DIGITAL INNOVATION IN INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

24. CHINA DIGITAL INNOVATION IN INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

25. JAPAN DIGITAL INNOVATION IN INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

26. SOUTH KOREA DIGITAL INNOVATION IN INSURANCE MARKET SIZE, 2022-2030 ($ MILLION)

27. REST OF ASIA-PACIFIC DIGITAL INNOVATION IN INSURANCE MARKET SIZE, 2022-2030 ($ MIL-LION)

28. REST OF THE WORLD DIGITAL INNOVATION IN INSURANCE MARKET SIZE, 2022-2030 ($ MIL-LION)