Digital Remittance Market

Digital Remittance Market & Trends Analysis Report byType(Inward Digital Remittance and Outward Digital Remittance),by Distribution Channel (Banks, Money Transfer Operstors, Online Platform, and Other Channels),and by End User (Business, and Personal) Forecast Period (2022-2028)

Digital remittance market is anticipated to grow at a CAGR of 15.9% during the forecast period. The market growth can be attributed to the increasing fund transfers from migrant workers to their families. Moreover, the increasing number of cross-border transactions and the growing adoption of mobile-based payment channels are expected to propel market growth over the forecast period. According to Visa Economic Empowerment Institute, global remittances totalled $706 billion in 2019, of this, low- and middle-income countries (LMICs) received a record $554 billion, which was larger than foreign direct investments (FDIs) in these countries. In addition, customers across the globe are also shifting toward digital remittance services as they reduced the money transfer time and remittance costs, and offer high privacy and protection for consumers’ money.

Moreover, numerous players which include Digital Wallet Corp, InstaReM Pvt. Ltd., and WorldRemit Ltd., in the market are focusing on adopting various strategies such as partnership, funding, collaboration, and advanced services which further drive the market growth. For instance, in August 2021, WorldRemit Ltd. launched its money transfer services in Malaysia, allowingWorldRemit users to send money from Malaysia, in addition to 50 other countries, including the US and the UK, to more than 130 destinations. Based on their location, users can choose from numerous payout methods for the recipient, including payments to mobile wallets, bank deposits, mobile airtime top-up, and cash pick-up.

Segmental Outlook

The global digital remittance market is segmented based on type, distribution channel, and end user. Based on type, the market is sub-segmented into inward digital remittance and outward digital remittance. Based on distribution channel, the market is sub-divided into banks, money transfer operstors, online platform, and other channels. On the basis of end user, the market is divided into business, and personal.Among the distribution channels, the money transfer operators segment is expected to grow at a significant rate. The growth is manily driven due to rise in cross-border transactions and decrease in remittance transfer time and cost.

While the online platform segment is anticipated to register significant growth owing to the increasing adoption of digital wallets across the globe.

Among the type, the inward digital remittance segment is anticipated to register a significant CAGR during the forecast period. Increasing adoption of mobile payment technology for money transfer among migrants is anticipated to propel the segment growth, as this technology enables banks to offer services to both non-resident and resident customers of the banks. Moreover, the increasing use of wire transfer services for inward remittance owing to its safest, fastest, and most popular mode of transfer properties, and offers by various key vendors, which in turn drives the segment growth.

For instance, in September 2021, Paytm Payments Bank forged a tied-up with Ria Money Transfer, to provide its customer with a service of receiving money from their relatives living in abroad. This partnership makes Paytm the country’s first platform to accept international remittances directly into a digital wallet. Moreover, every money transfer will be made in real-time, and will have security features such as account validation and name matching.

Regional Outlooks

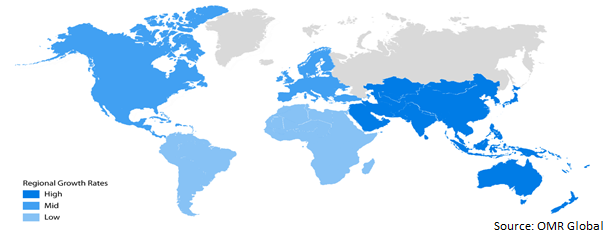

The global digital remittancemarket is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). North America is anticipated to have progressive growth during the forecast period. The growth is mainly attributed owing to the presence of well-established banking and financial institutions such as Truist Financial, Bank of America, and US Bancorp that adopt various technological solutions. Some technological solutions includes the introduction of real-time banking technology, along with benefits which include faster funds transfer, lower costs than traditional money transfer serviceswhich is drivingthe market growth in the region.

Global Digital Remittance Market Growth, by Region 2022-2028

The Asia-Pacific Reigon is Expected to Grow at a Significant Rate in the Digital Remittance Market

The Asia Pacific regional market is anticipated to emerge as the fastest-growing region during the forecast period. Growth in the adoption of banking and financial services in emerging economies such as China and India are largely focusing on the adoption of mobile banking, cashless payments, and mobile-based payment solutions, thereby contributing to the regional market growth.

For instance, according to the Union Minister of State of Finance, in 2021, India’s digital payments reached $585.9 million, and in August 2021, Razorpay announced that digital payment transactions have grown up to 76% in the last 12 months.

Market Players Outlook

The major companies serving the global digital remittance market include MoneyGram International, Inc., PayPal, Remitly Inc., Western Union Holding Inc., Digital Wallet Corp., Flywireand others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance,inJanuary 2022, MoneyGram International, Inc., announced a strategic partnership with Digital Wallet Corp. Through this partnership, cnsumers in Japan get access of the Smiles mobile app – powered by MoneyGram’s global payment rails and near real-time capabilities – to send money to more than 200 countries and territories across theglobe. .

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global digital remittance market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. ByRegion

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. MoneyGram International, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. PayPal

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Remitly Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Western Union Holding Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Digital RemittanceMarket by Type

4.1.1. Inward Digital Remittance

4.1.2. Outward Digital Remittance

4.2. Global Digital RemittanceMarket by Distribution Channel

4.2.1. Banks

4.2.2. Money Transfer Operators

4.2.3. Online Platform

4.2.4. Other Channels

4.3. Global Digital Remittance Market by End User

4.3.1. Business

4.3.2. Personal

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Arcus

6.2. Azimo Ltd.

6.3. Coins. ph Pte. Ltd.

6.4. Digital Wallet Corp.

6.5. Flywire

6.6. InstaReM PTE Ltd.

6.7. OrbitRemit Global Money Transfer Ltd.

6.8. Pontual Money Transfer

6.9. Ria Financial Services Ltd.

6.10. Ripple

6.11. The Currency Cloud Ltd.

6.12. TNG Ltd.

6.13. Toastme Pte Ltd.

6.14. TransferGo Ltd.

6.15. TransferWise Ltd.

6.16. WorldRemit Ltd.

1. GLOBAL DIGITAL REMITTANCE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL INWARD DIGITAL REMITTANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL OUTWARD DIGITAL REMITTANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL DIGITAL REMITTANCE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

5. GLOBAL DIGITAL REMITTANCE BY BANKS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL DIGITAL REMITTANCE BY MONEY TRANSFER OPERATORS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL DIGITAL REMITTANCE BY ONLINE PLATFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL DIGITAL REMITTANCE BY OTHER CHANNELS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL DIGITAL REMITTANCE MARKET RESEARCH AND ANALYSIS BY END USER, 2021-2028 ($ MILLION)

10. GLOBAL DIGITAL REMITTANCE FOR BUSINESS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBALDIGITAL REMITTANCE FOR PERSONAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL DIGITAL REMITTANCE MARKET RESEARCH AND ANALYSIS BYREGION , 2021-2028 ($ MILLION)

13. NORTH AMERICANDIGITAL REMITTANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. NORTH AMERICAN DIGITAL REMITTANCE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

15. NORTH AMERICAN DIGITAL REMITTANCE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

16. NORTH AMERICAN DIGITAL REMITTANCE MARKET RESEARCH AND ANALYSIS BY END USER, 2021-2028 ($ MILLION)

17. EUROPEAN DIGITAL REMITTANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. EUROPEAN DIGITAL REMITTANCE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

19. EUROPEANDIGITAL REMITTANCE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

20. EUROPEAN DIGITAL REMITTANCE MARKET RESEARCH AND ANALYSIS BY END USER, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC DIGITAL REMITTANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC DIGITAL REMITTANCE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC DIGITAL REMITTANCE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC DIGITAL REMITTANCEMARKET RESEARCH AND ANALYSIS BY END USER, 2021-2028 ($ MILLION)

25. REST OF THE WORLD DIGITAL REMITTANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

26. REST OF THE WORLD DIGITAL REMITTANCE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

27. REST OF THE WORLD DIGITAL REMITTANCE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

28. REST OF THE WORLD DIGITAL REMITTANCE MARKET RESEARCH AND ANALYSIS BY END USER, 2021-2028 ($ MILLION)

1. GLOBAL DIGITAL REMITTANCE MARKET SHARE BY TYPE, 2021 VS 2028 (%)

2. GLOBAL INWARD DIGITAL REMITTANCE MARKET SHARE BYREGION , 2021 VS 2028 (%)

3. GLOBAL OUTWARD DIGITAL REMITTANCE MARKET SHARE BYREGION , 2021 VS 2028 (%)

4. GLOBAL DIGITAL REMITTANCE MARKET SHARE BY DISTRIBUTION CHANNEL, 2021 VS 2028 (%)

5. GLOBAL DIGITAL REMITTANCE BY BANKS MARKET SHARE BY REGION , 2021 VS 2028 (%)

6. GLOBAL DIGITAL REMITTANCE BY MONEY TRANSFER OPERATORS MARKET SHARE BY REGION , 2021 VS 2028 (%)

7. GLOBAL DIGITAL REMITTANCE BY ONLINE PLATFORM MARKET SHARE BYREGION , 2021 VS 2028 (%)

8. GLOBAL DIGITAL REMITTANCE BY OTHER CHANNELS MARKET SHARE BYREGION , 2021 VS 2028 (%)

9. GLOBAL DIGITAL REMITTANCE MARKET SHARE BY END USER, 2021 VS 2028 (%)

10. GLOBAL DIGITAL REMITTANCE FOR BUSINESS MARKET SHARE BYREGION , 2021 VS 2028 (%)

11. GLOBAL DIGITAL REMITTANCE FOR PERSONAL MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL DIGITAL REMITTANCE MARKET SHARE BYREGION , 2021 VS 2028 (%)

13. US DIGITAL REMITTANCE MARKET SIZE, 2021-2028 ($ MILLION)

14. CANADA DIGITAL REMITTANCE MARKET SIZE, 2021-2028 ($ MILLION)

15. UK DIGITAL REMITTANCE MARKET SIZE, 2021-2028 ($ MILLION)

16. FRANCE DIGITAL REMITTANCE MARKET SIZE, 2021-2028 ($ MILLION)

17. GERMANY DIGITAL REMITTANCE MARKET SIZE, 2021-2028 ($ MILLION)

18. ITALY DIGITAL REMITTANCE MARKET SIZE, 2021-2028 ($ MILLION)

19. SPAIN DIGITAL REMITTANCE MARKET SIZE, 2021-2028 ($ MILLION)

20. REST OF EUROPE DIGITAL REMITTANCE MARKET SIZE, 2021-2028 ($ MILLION)

21. INDIA DIGITAL REMITTANCE MARKET SIZE, 2021-2028 ($ MILLION)

22. CHINA DIGITAL REMITTANCE MARKET SIZE, 2021-2028 ($ MILLION)

23. JAPAN DIGITAL REMITTANCE MARKET SIZE, 2021-2028 ($ MILLION)

24. SOUTH KOREA DIGITAL REMITTANCE MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF ASIA-PACIFICDIGITAL REMITTANCE MARKET SIZE, 2021-2028 ($ MILLION)

26. REST OF THE WORLD DIGITAL REMITTANCE MARKET SIZE, 2021-2028 ($ MILLION)