E-SIM Card Market

E-SIM Card Market Size, Share & Trends By Application (Connected Cars, Smart Home Appliances, Machine-to-Machine (M2M), Smartphones, Vehicle Tracking, Wearables, Others (Drones, Smart Meters, Smart Grids)), and by Vertical (Automotive, Consumer Electronics, Energy & Utilities, Manufacturing, Retail, Transportation & Logistics, Other Verticals (Smartphones)) Forecast Period (2025-2035)

Industry Overview

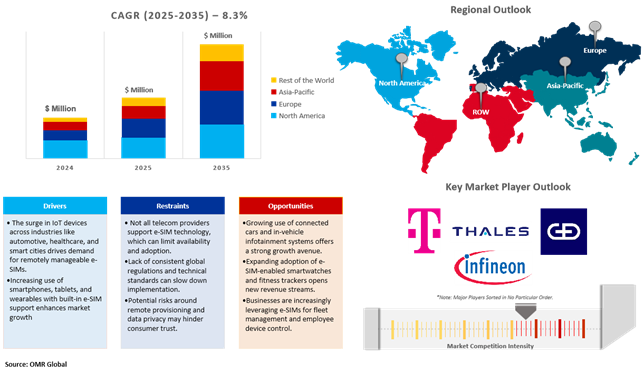

E-Sim card industry was worth $10.1 billion in 2024 and is anticipated to reach $23.9 billion by 2035 with a CAGR of 8.3% between 2025 and 2035. E-SIM stands for embedded SIM, which is an industry-standard digital SIM, allowing you to turn on the mobile data plan from your provider without a physical SIM. Various consumer devices like cellphones, wearables, and laptops utilize E-SIM cards. They also occur in connected cars, smart meters, healthcare IoT devices, home automation, security systems, handheld POS (Point of Sales) systems, and healthcare IoT devices. The prime drivers for the E-SIM market include collaboration between smartphone vendors to embed e-SIM technology on their smartphones directly is expected to drive demand and boost growth. Different consumer gadgets such as cellphones, wearables, and laptops use E-SIM cards. They also exist in connected cars, smart meters, healthcare IoT devices, home automation, security systems, handheld POS (Point of Sales) systems, and healthcare IoT devices. The key drivers of the E-SIM market are cooperation among smartphone vendors to implement e-SIM technology on their smartphones directly is likely to propel demand and fuel growth. For instance, in March 2025, Giesecke+Devrient unveiled a collaboration with Amazon Web Services to propel cloud-based eSIM solutions. The collaboration, through AWS global infrastructure, brings eSIM deployments security and efficiency, fueling adoption in sectors like IoT, automotive, and mobile.

Market Dynamics

The Rapid Rise of eSIM: Driving Mobile Connectivity and Travel Tech Growth

E-SIM technology is rapidly gaining traction in mid-tier smartphones, with Apple and several other premium OEMs fully adopting the standard. As international travel rebounds, countries like Spain are set to welcome 95 million tourists in 2024—an increase of 10% year-on-year and well above pre-pandemic levels. Growing awareness of travel E-SIM options is being driven by aggressive digital marketing efforts from leading providers.

By 2025, the number of active E-SIM subscriptions for smartphones is projected to reach 2.4 billion. Meanwhile, mobile connectivity, including both consumer and IoT applications, is expected to account for around 4.8% of global GDP by 2023. Retail spending on travel E-SIMs is forecasted to surge by 500%, reaching $10 billion by 2028.

Rising Adoption of IoT Devices

The rising adoption of IoT devices is a significant driver of the global e-SIM card market. As industries such as automotive, healthcare, logistics, and smart cities increasingly rely on IoT applications, the need for reliable, scalable, and flexible connectivity grows. eSIM technology comes to the rescue by enabling remote provisioning and management, enabling devices to subscribe to mobile networks without needing physical SIM swaps. It's particularly worth it for businesses such as autos, where cars need to be always online for the likes of navigation and diagnostics; health, where wearables and monitors need secure, real-time data transfer; logistics, where packages and fleets can be tracked; and smart cities, where IoT devices monitor everything from traffic flow to refuse collection. As the exponential growth of IoT devices globally becomes a reality, eSIM technology is becoming the go-to solution to facilitate ubiquitous, secure, and efficient connectivity for these industries.

The integration of cloud-based eSIM management with 5G technologies

The combination of cloud-based eSIM management with 5G technologies provides greater scalability and performance for enterprises and mobile operators. Cloud-based eSIM management enables remote provisioning and lifecycle management of eSIM profiles, which minimizes the use of physical SIM cards and streamlines operations. In addition, eSIMs can be updated over the air, keeping devices up to date without manual intervention. Combined with 5G, these systems take advantage of ultra-high-speed data transmission and low latency, making real-time operations such as IoT applications, AR/VR, and connected cars more powerful. 5G's network slicing capability allows mobile operators to customize virtual networks to suit various needs, further optimizing resource allocation and overall performance of eSIM devices. For instance, in May 2023, Gcore launched its Zero-Trust 5G eSIM Cloud platform delivering secure high-speed internet access to over 150 countries. The platform allows businesses to access corporate resources and the Gcore Cloud easily and securely using software-defined eSIM technology. The platform supports next-generation AI applications like smart factories, IoT, and machine-learning diagnostics.

Market Segmentation

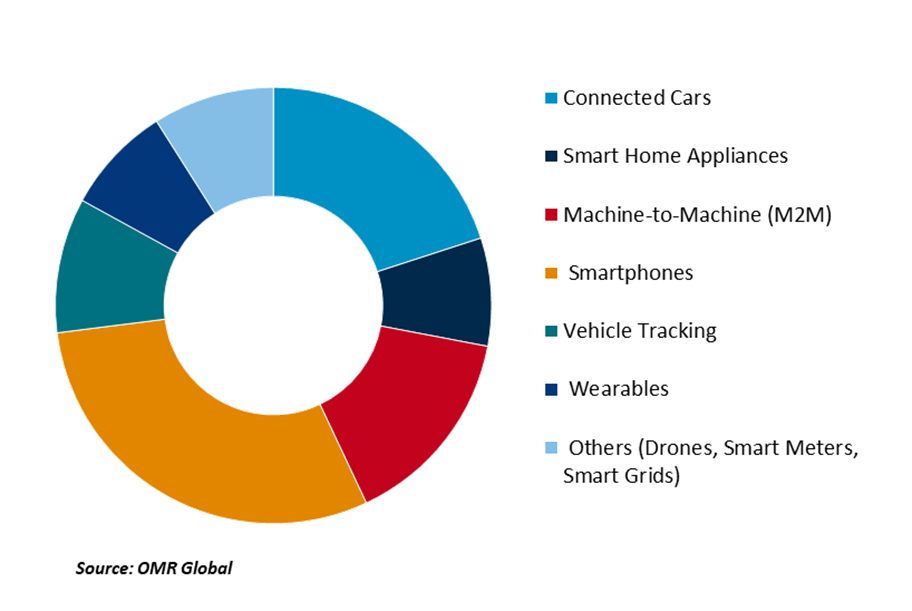

- Based on the application, the market is segmented into connected cars, smart home appliances, machine-to-machine (M2M), smartphones, vehicle tracking, wearables, and others (drones, smart meters, smart grids).

- Based on the vertical, the market is segmented into automotive, consumer electronics, energy & utilities, manufacturing, retail, transportation & logistics, and other verticals (smartphones)

Machine-to-Machine (M2M) Segment to Lead the Market with the Largest Share

The Machine-to-Machine (M2M) segment will dominate the world eSIM card market with the highest share owing to the booming growth of the Internet of Things (IoT) and the use of connected devices in numerous industries. M2M communication allows devices to send and receive data and execute automated tasks without the intervention of human beings, and hence it is suitable for applications such as smart meters, vehicle tracking, industrial automation, and medical devices.eSIM technology facilitates remote SIM profile provision and management and is suited for application in M2M devices since it simplifies deployment and does away with physical SIMs, which are costly and wasteful for mass device rollouts. In 2024, Trusted Connectivity Alliance (TCA) reported it experienced considerable growth in Machine-to-Machine (M2M) eSIM adoption, and its growing uptake for industries. As the eSIM ecosystem grew worldwide, M2M eSIMs were well adopted, as demand for remote provisioning and lifecycle management picked up. GSMA's release of eSIM IoT Specification (SGP.32) will speed up the adoption of eSIM technology in IoT solutions.

Global E-SIM Card Market Share by Application, 2024 (%)

Smartphones: A Key Segment in Market Growth

Smartphones are a prime driver of growth in the global eSIM card market, driven by widespread adoption and growing demand for flexible connectivity. The technology enables remote provisioning and convenient carrier switching without the use of physical SIM cards. This aspect is most useful to frequent travelers who can switch to local carriers without high roaming fees. Furthermore, eSIMs provide stronger security and support 5G connectivity, which is gradually becoming a necessity for today's smartphones. As key players such as Apple and Google incorporate eSIM technology in their products, consumers are now increasingly taking up eSIM-based smartphones. For example, in May 2020, Google Cloud partnered with Thales to extend its eSIM management solution, providing secure, scalable activation for eSIM-enabled devices. Thales' solution, running on Google Cloud, is the GSMA-certified eSIM activation platform offering telecom operators a secure means of managing mobile subscriptions.

Regional Outlook

The global e-sim card market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

The Rollout of 5G Networks Across North America

The expansion of 5G networks throughout North America has played a major role in driving the rapid adoption of eSIM technology., as both complement each other in enabling next-generation connectivity. With the high-speed, low-latency benefits of 5G, users, and industries demand more flexible and seamless ways to access mobile networks. eSIMs, which are directly embedded for use in devices and can be remotely configured, enable users to change carriers without having to physically swap a SIM card. With an increasing number of 5G-capable devices including smartphones, wearables, and connected vehicles entering the market with integrated eSIM support, the combination of 5G and eSIM is fueling fast uptake and transforming the management of connectivity throughout North America. In March 2025, according to 5G Americas, global 5G adoption climbed to 2.25 billion connections evolving four times faster than 4G did in its first few years. North America was at the forefront of the growth, registering 289 million 5G connections and with 77% of its populace covered, there was a 67% year-over-year surge. The area was the first to achieve parity between 5G and 4G LTE networks, due to its pioneering infrastructure and policy support. In the meantime, the worldwide IoT ecosystem also grew very fast, adding 438 million new connections. With 354 live 5G networks across the globe, the technology-dominated, with projections estimating 8.3 billion connections by 2029.

Asia Pacific Region Dominates the Market with Major Share

The Asia Pacific E-SIM market is projected to highest growth during the forecast period due to many key factors. Rapid advancements in mobile technology, increasing smartphone penetration, and the growing adoption of IoT (Internet of Things) devices are driving demand for embedded SIM solutions across the region. Countries like China, India, Japan, and South Korea are at the forefront of technological innovation and have strong consumer bases, which creates a favorable environment for E-SIM adoption. According to the Mercator Institute for China Studies (MERICS), in June 2021, China is playing a pivotal role in shaping the global Internet of Things (IoT) landscape through a combination of strong state-led policies, massive infrastructure investment, and the growing influence of its digital industries. With 800,000 5G base stations around 70% of the global total, China is increasing the foundation necessary for advanced IoT applications. Cities like Shenzhen have already achieved full 5G standalone coverage, enabling transformative uses such as intelligent connected vehicles (ICVs). While this positions China as a technological leader, it also raises concerns about global interconnectivity, cybersecurity, and the fragmentation of cyberspace, prompting countries like the US and parts of Europe to reassess their digital strategies.

Market Players Outlook

The major companies operating in the global e-sim card market include Deutsche Telekom AG, AT&T, Verizon, and Thales, among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Development

- In September 2024, Trasna Holdings announced its acquisition of Workz. This strategic move significantly enhances Trasna’s capabilities in mobile IoT by integrating Workz’s expertise in eSIM, SIM hardware, over-the-air services, and data management. With Workz's cloud-based eSIM platform already supporting over 150 network operators globally, the acquisition positions Trasna as a key player in the shift toward next-gen SIM technologies like eSIM and iSIM.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global e-sim card market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global E-SIM Card Market Sales Analysis –Application| Vertical ($ Million)

• E-SIM Card Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key E-SIM Card Fordustry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the E-SIM Card Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global E-SIM Card Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global E-SIM Card Market: Impact Analysis

3.3. Market Opportunities

3.3.1. Opportunities For Global E-SIM Card Market: Impact Analysis

4. Competitive Landscape

4.1. Competitive Dashboard – E-SIM Card Market Revenue and Share by Manufacturers

• E-SIM Card Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.3. AT&T, Inc.

4.3.1.1. Overview

4.3.1.2. Product Portfolio

4.3.1.3. Financial Analysis (Subject to Data Availability)

4.3.1.4. SWOT Analysis

4.3.1.5. Business Strategy

4.4. Verizon Communications Inc.

4.4.1.1. Overview

4.4.1.2. Product Portfolio

4.4.1.3. Financial Analysis (Subject to Data Availability)

4.4.1.4. SWOT Analysis

4.4.1.5. Business Strategy

4.5. Deutsche Telekom AG

4.5.1.1. Overview

4.5.1.2. Product Portfolio

4.5.1.3. Financial Analysis (Subject to Data Availability)

4.5.1.4. SWOT Analysis

4.5.1.5. Business Strategy

4.6. Top Winning Strategies by Market Players

4.6.1. Merger and Acquisition

4.6.2. Product Launch

4.6.3. Partnership And Collaboration

5. Global E-SIM Card Market Sales Analysis by Application ($ Million)

5.1. Connected Cars

5.2. Smart Home Appliances

5.3. Machine-to-Machine (M2M)

5.4. Smartphones

5.5. Vehicle Tracking

5.6. Wearables

5.7. Others (Drones, Smart Meters, Smart Grids)

6. Global E-SIM Card Market Sales Analysis by Vertical ($ Million)

6.1. Automotive

6.2. Consumer Electronics

6.3. Energy & Utilities

6.4. Manufacturing

6.5. Retail

6.6. Transportation & Logistics

6.7. Other Verticals (Smartphones)

7. Regional Analysis

7.1. North American E-SIM Card Market Sales Analysis – Application| Vertical |Country ($ Million)

• Macroeconomic Factors for North America

7.1.1. United States

7.1.2. Canada

7.2. European E-SIM Card Market Sales Analysis – Application| Vertical |Country ($ Million)

• Macroeconomic Factors for Europe

7.2.1. UK

7.2.2. Germany

7.2.3. Italy

7.2.4. Spain

7.2.5. France

7.2.6. Russia

7.2.7. Rest of Europe

7.3. Asia-Pacific E-SIM Card Market Sales Analysis – Application| Vertical |Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

7.3.1. China

7.3.2. Japan

7.3.3. South Korea

7.3.4. India

7.3.5. Australia & New Zealand

7.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

7.3.7. Rest of Asia-Pacific

7.4. Rest of the World E-SIM Card Market Sales Analysis – Application| Vertical |Country ($ Million)

• Macroeconomic Factors for the Rest of the World

7.4.1. Latin America

7.4.2. Middle East and Africa

8. Company Profiles

8.1. Airalo Pte. Ltd.

8.1.1. Quick Facts

8.1.2. Company Overview

8.1.3. Product Portfolio

8.1.4. Business Strategies

8.2. Apple Inc

8.2.1. Quick Facts

8.2.2. Company Overview

8.2.3. Product Portfolio

8.2.4. Business Strategies

8.3. AT&T, Inc.

8.3.1. Quick Facts

8.3.2. Company Overview

8.3.3. Product Portfolio

8.3.4. Business Strategies

8.4. Deutsche Telekom AG

8.4.1. Quick Facts

8.4.2. Company Overview

8.4.3. Product Portfolio

8.4.4. Business Strategies

8.5. GigSky

8.5.1. Quick Facts

8.5.2. Company Overview

8.5.3. Product Portfolio

8.5.4. Business Strategies

8.6. IDEMIA

8.6.1. Quick Facts

8.6.2. Company Overview

8.6.3. Product Portfolio

8.6.4. Business Strategies

8.7. Kigen Ltd

8.7.1. Quick Facts

8.7.2. Company Overview

8.7.3. Product Portfolio

8.7.4. Business Strategies

8.8. KORE Wireless

8.8.1. Quick Facts

8.8.2. Company Overview

8.8.3. Product Portfolio

8.8.4. Business Strategies

8.9. LotusFlare, Inc

8.9.1. Quick Facts

8.9.2. Company Overview

8.9.3. Product Portfolio

8.9.4. Business Strategies

8.10. Nomad app

8.10.1. Quick Facts

8.10.2. Company Overview

8.10.3. Product Portfolio

8.10.4. Business Strategies

8.11. NTT Docomo

8.11.1. Quick Facts

8.11.2. Company Overview

8.11.3. Product Portfolio

8.11.4. Business Strategies

8.12. NXP Semiconductors N V

8.12.1. Quick Facts

8.12.2. Company Overview

8.12.3. Product Portfolio

8.12.4. Business Strategies

8.13. Samsung Electronics Co. Ltd

8.13.1. Quick Facts

8.13.2. Company Overview

8.13.3. Product Portfolio

8.13.4. Business Strategies

8.14. Singtel

8.14.1. Quick Facts

8.14.2. Company Overview

8.14.3. Product Portfolio

8.14.4. Business Strategies

8.15. STMicroelectronics N.V.

8.15.1. Quick Facts

8.15.2. Company Overview

8.15.3. Product Portfolio

8.15.4. Business Strategies

8.16. Telefónica Global Solutions, S.L.U

8.16.1. Quick Facts

8.16.2. Company Overview

8.16.3. Product Portfolio

8.16.4. Business Strategies

8.17. Thales Group

8.17.1. Quick Facts

8.17.2. Company Overview

8.17.3. Product Portfolio

8.17.4. Business Strategies

8.18. Trasna Solutions Technologies Ltd

8.18.1. Quick Facts

8.18.2. Company Overview

8.18.3. Product Portfolio

8.18.4. Business Strategies

8.19. Valid S.A.

8.19.1. Quick Facts

8.19.2. Company Overview

8.19.3. Product Portfolio

8.19.4. Business Strategies

8.20. Vodafone Group Plc

8.20.1. Quick Facts

8.20.2. Company Overview

8.20.3. Product Portfolio

8.20.4. Business Strategies

8.21. Zetexa Global Private Ltd

8.21.1. Quick Facts

8.21.2. Company Overview

8.21.3. Product Portfolio

8.21.4. Business Strategies

1. Global E-SIM Card Market Research And Analysis By Application, 2024-2035 ($ Million)

2. Global E-Sim Card For Connected Cars Market Research And Analysis By Region 2024-2035 ($ Million)

3. Global E-Sim Card For Smart Home Appliances Market Research And Analysis By Region 2024-2035 ($ Million)

4. Global E-Sim Card For M2M Market Research And Analysis By Region 2024-2035 ($ Million)

5. Global E-Sim Card For Smartphones Market Research And Analysis By Region 2024-2035 ($ Million)

6. Global E-Sim Card For Vehicle Tracking Market Research And Analysis By Region 2024-2035 ($ Million)

7. Global E-Sim Card For Wearables Market Research And Analysis By Region 2024-2035 ($ Million)

8. Global E-Sim Card For Other Market Research And Analysis By Region 2024-2035 ($ Million)

9. Global E-SIM Card Market Research And Analysis By Vertical, 2024-2035 ($ Million)

10. Global E-SIM Card For Automotive Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global E-SIM Card For Consumer Electronics Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global E-SIM Card For Energy & Utilities Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global E-SIM Card For Manufacturing Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global E-SIM Card For Retail Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global E-SIM Card For Transportation & Logistics Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global E-SIM Card For Other Verticals Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global E-SIM Card Market Research And Analysis By Region, 2024-2035 ($ Million)

18. North American E-SIM Card Market Research And Analysis By Country, 2024-2035 ($ Million)

19. North American E-SIM Card Market Research And Analysis By Application, 2024-2035 ($ Million)

20. North American E-SIM Card Market Research And Analysis By Vertical, 2024-2035 ($ Million)

21. European E-SIM Card Market Research And Analysis By Country, 2024-2035 ($ Million)

22. European E-SIM Card Market Research And Analysis By Application, 2024-2035 ($ Million)

23. European E-SIM Card Market Research And Analysis By Vertical, 2024-2035 ($ Million)

24. Asia-Pacific E-SIM Card Market Research And Analysis By Country, 2024-2035 ($ Million)

25. Asia-Pacific E-SIM Card Market Research And Analysis By Application, 2024-2035 ($ Million)

26. Asia-Pacific E-SIM Card Market Research And Analysis By Vertical, 2024-2035 ($ Million)

27. Rest Of The World E-SIM Card Market Research And Analysis By Country, 2024-2035 ($ Million)

28. Rest Of The World E-SIM Card Market Research And Analysis By Application, 2024-2035 ($ Million)

29. Rest Of The World E-SIM Card Market Research And Analysis By Vertical, 2024-2035 ($ Million)

1. GLOBAL E-SIM CARD MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2024-2035 ($ MILLION)

2. Global E-Sim Card Market Share By Application, 2024 Vs 2035 ($ Million)

3. Global E-Sim Card For Connected Cars Market Share By Region, 2024 Vs 2035 (%)

4. Global E-Sim Card For Smart Home Appliances Market Share By Region, 2024 Vs 2035 (%)

5. Global E-Sim Card For M2M Market Share By Region, 2024 Vs 2035 (%)

6. Global E-Sim Card For Smartphones Market Share By Region, 2024 Vs 2035 (%)

7. Global E-Sim Card For Vehicle Tracking Market Share By Region, 2024 Vs 2035 (%)

8. Global E-Sim Card For Other Applications Market Share By Region, 2024 Vs 2035 (%)

9. Global E-Sim Card Market Share By Vertical, 2024 Vs 2035 ($ Million)

10. Global E-Sim Card For Automotive Market Share By Region, 2024 Vs 2035 (%)

11. Global E-Sim Card For Consumer Electronics Market Share By Region, 2024 Vs 2035 (%)

12. Global E-Sim Card For Energy & Utilities Market Share By Region, 2024 Vs 2035 (%)

13. Global E-Sim Card For Manufacturing Market Share By Region, 2024 Vs 2035 (%)

14. Global E-Sim Card For Retail Market Share By Region, 2024 Vs 2035 (%)

15. Global E-Sim Card For Transportation & Logistics Market Share By Region, 2024 Vs 2035 (%)

16. Global E-Sim Card For Other Vertical Market Share By Region, 2024 Vs 2035 (%)

17. Global E-Sim Card Market Share By Region, 2024-2035 (%)

18. US E-Sim Card Market Size, 2024-2035 ($ Million)

19. Canada E-Sim Card Market Size, 2024-2035 ($ Million)

20. UK E-Sim Card Market Size, 2024-2035 ($ Million)

21. France E-Sim Card Market Size, 2024-2035 ($ Million)

22. Germany E-Sim Card Market Size, 2024-2035 ($ Million)

23. Italy E-Sim Card Market Size, 2024-2035 ($ Million)

24. Spain E-Sim Card Market Size, 2024-2035 ($ Million)

25. Rest Of Europe E-Sim Card Market Size, 2024-2035 ($ Million)

26. India E-Sim Card Market Size, 2024-2035 ($ Million)

27. China E-Sim Card Market Size, 2024-2035 ($ Million)

28. Japan E-Sim Card Market Size, 2024-2035 ($ Million)

29. South Korea E-Sim Card Market Size, 2024-2035 ($ Million)

30. Rest Of Asia-Pacific E-Sim Card Market Size, 2024-2035 ($ Million)

31. Latin America E-SIM Card Market Size, 2024-2035 ($ Million)

32. Middle East And Africa E-SIM Card Market Size, 2024-2035 ($ Million)

FAQS

The size of the E-SIM Card market in 2024 is estimated to be around $10.1 billion.

Asia Pacific holds the largest share in the E-SIM Card market.

Leading players in the E-SIM Card market include Deutsche Telekom AG, AT&T, Verizon, and Thales, among others.

E-SIM Card market is expected to grow at a CAGR of 8.3% from 2025 to 2035.

The E-SIM Card Market is growing due to rising IoT adoption, smartphone penetration, 5G rollout, and demand for seamless global connectivity.