Ethylene Oxide and Ethylene Glycol Market

Ethylene Oxide and Ethylene Glycol Market Size, Share & Trends Analysis Report by Ethylene Oxide Product (Ethylene Carbonate, Ethanolamines, Glycol Ethers, and Others),Ethylene Glycol Product (Monoethylene Glycol, Triethylene Glycol, Diethylene Glycol, Polyethylene Terephthalate, and Others), and Ethylene oxide and Ethylene Glycol Application (Polyester Fibers, PET Resins, Antifreeze, Brake Fluids, Surfactants, Automotive Coolants, Plastics, and Others) Forecast Period (2024-2031)

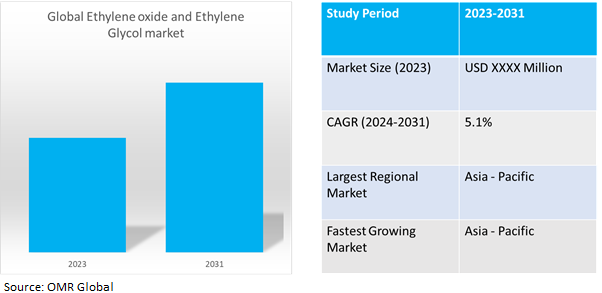

Ethylene oxide and ethylene glycol market is anticipated to grow at a considerable CAGR of 5.1% during the forecast period (2024-2031). Ethylene oxide (EtO) is a chemical intermediate used to produce ethylene glycol, which is then used to make other industrial chemicals. Ethylene oxide is also used as a fumigant in agriculture and as a sterilant for medical equipment.

Market Dynamics

Ethylene Oxide: Safeguarding Healthcare through Sterilization Innovation

The fight against hospital-acquired infections (HAIs) is a powerful driver for the ethylene oxide and ethylene glycol market, particularly in healthcare sterilization. For instance, according to WHO, the toll of healthcare-associated infections (HAIs) and antimicrobial resistance on individuals is immeasurable. Each year, over 24.0% of patients afflicted with healthcare-associated sepsis and 52.3% of those treated in intensive care units succumb to these conditions. Ethylene oxide's effectiveness in eliminating bacteria, viruses, and spores on heat and moisture-sensitive medical equipment and pharmaceuticals makes it a vital tool.Rising global healthcare spending translates to increased investment in sterilized medical supplies, pushing demand for these chemicals. Stricter regulations emphasizing proper sterilization practices further underscore the need for ethylene oxide, while advancements in the technology aim to minimize environmental impact and worker exposure concerns, ensuring its long-term viability within the healthcare sector.

Revving Up Growth: The Expanding Automotive Industry and the Ethylene Oxide and Ethylene Glycol Market

The expanding global automotive industry acts as a powerful driver for the ethylene oxide and ethylene glycol market. Ethylene glycol's primary function here lies in its role as a key component of automotive coolants and antifreeze solutions, preventing engine overheating and freezing, crucial for optimal performance and protection. As car ownership surges, especially in developing economies, the demand for these coolants and antifreeze solutions soars, consequently driving the demand for ethylene glycol. For instance in 2022, the US had a total of 278,870,463 registered personal and commercial vehicles. This marked a 3.5% increase from the 2018 figure of 269,417,884 registered vehicles, reflecting a consistent upward trend in car ownership. Furthermore, the automotive industry's focus on lightweight vehicles to improve fuel efficiency creates a demand for new and improved plastic components, many of which rely on PET resins derived from ethylene glycol.

Market Segmentation

Our in-depth analysis of the global ethylene oxide and ethylene glycol includes the following segments by ethylene oxide products, ethylene glycol products and by application:

- Based on ethylene oxide products, the market is sub-segmented into ethylene carbonate, ethanolamines, glycol ethers, and others.

- Based on ethylene glycol products, the market is bifurcated into monoethylene glycol, triethylene glycol, diethylene glycol, polyethylene terephthalate, and others.

- Based on ethylene oxide and ethylene glycol application, the market is augmented intopolyester fibres, PET resins, antifreeze, brake fluids, surfactants, automotive coolants, plastics, and others.

Emerging Dominance: Triethylene Glycol's Dominance in the Ethylene Glycol Market

Triethylene Glycol (TEG) is emerging as the fastest-growing segment in the ethylene glycol market, complementing monoethylene glycol's established applications. With its distinctive properties and expanding utility, TEG is gaining traction. Its high boiling point and water miscibility make it ideal for natural gas dehydration, meeting the rising global demand for efficient natural gas transport. According to International Energy AssociationGlobal gas demand is expected to rise by 2.5% (or 100 bcm) in 2024, supported by industry, residential, and commercial sectors. Limited growth in LNG supply may cap growth in import markets. The Asia Pacific region anticipates a 4.0% increase, driven by industrial activity and power sector demand. North America expects 1.5% growth, while Europe forecasts a 3.0% rise, although gas-fired generation is set to decline. Gas demand in Africa, the Middle East, and Eurasia is projected to increase by 3.0%.

PET resins Holds a Considerable Market Share

PET resins are the fastest-growing segment within the ethylene oxide and ethylene glycol marketapplication segment, potentially surpassing even the traditionally dominant polyester fibers. A union of factors fuels this surge. Consumers' preference for convenient and lightweight packaging solutions is driving demand for PET bottles and food containers. For instance, the majority of single-serving and 2-liter bottles containing sodas and water in the U.S. are crafted from PET plastic. Currently, 70% of soft drinks, including carbonated beverages, still drinks, fruit juices, and bottled water, are packaged in PET plastic bottles. The remaining portion is primarily distributed in glass bottles, metal cans, and cartons. Furthermore, advancements in PET resin technology are leading to lighter-weight materials and even bio-based options, appealing to environmentally conscious consumers.

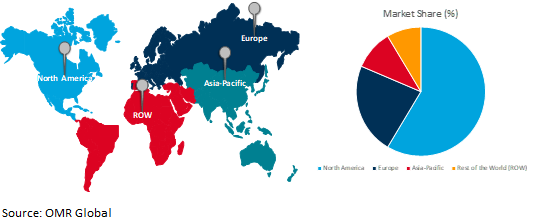

Regional Outlook

The global Ethylene oxide and Ethylene Glycolis further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Ethylene oxide and Ethylene Glycol Growth by Region 2024-2031

Dominance and Growth Drivers of the Asia-Pacific Ethylene Oxide and Ethylene Glycol Market

The Asia Pacific region reigns supreme in the global ethylene oxide and ethylene glycol market, claiming both the largest market share and the fastest growth trajectory. This dominance is fueled by a powerful combination of factors. The region's robust economic growth fosters a burgeoning middle class with disposable income, driving demand for textiles, PET packaging, and automotive products – all heavily reliant on these chemicals. Additionally, government initiatives promote domestic production of ethylene oxide and ethylene glycol, further boosting the market. Looking ahead, the region is expected to maintain its leadership position with the fastest growth. This surge is propelled by a significant increase in production capacities across these industries, potentially stricter healthcare regulations that could elevate the demand for ethylene oxide in sterilization processes, and a growing focus on sustainable production methods that resonate with environmentally conscious consumers in the region.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global Ethylene oxide and Ethylene Glycol include BASF SE, China Petrochemical Corporation, INEOS GROUP HOLDINGS S.A, Reliance Industries Limited, Saudi Basic Industries Corporation, and Shell PLCamong others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance,in October 2023,BASF has significantly bolstered its production capabilities at the Verbund site in Antwerp, Belgium, with a substantial investment exceeding €500 million. This expansion adds an impressive 400,000 metric tons per year to BASF's production capacity for ethylene oxide and its derivatives. The complex includes a state-of-the-art ethylene oxide plant alongside increased capacities for essential derivatives.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global ethylene oxide and ethylene glycol based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. BASF SE

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. China Petrochemical Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. INEOS GROUP HOLDINGS S.A

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Reliance Industries Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Saudi Basic Industries Corp.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Shell PLC

3.7.1. Overview

3.7.2. Financial Analysis

3.7.3. SWOT Analysis

3.7.4. Recent Developments

3.8. Key Strategy Analysis

4. Market Segmentation

4.1. Global Ethylene Oxide by Product

4.1.1. Ethylene Carbonate

4.1.2. Ethanolamines

4.1.3. Glycol Ethers

4.1.4. Others

4.2. Global Ethylene Glycol by Product

4.2.1. Monoethylene Glycol

4.2.2. Triethylene Glycol

4.2.3. Diethylene Glycol

4.2.4. Polyethylene Terephthalate

4.2.5. Others

4.3. Global Ethylene oxide and Ethylene Glycol by Application

4.3.1. Polyester Fibers

4.3.2. PET Resins

4.3.3. Antifreeze

4.3.4. Brake Fluids

4.3.5. Surfactants

4.3.6. Automotive Coolants

4.3.7. Plastics

4.3.8. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle east & Africa

6. Company Profiles

6.1. Dow Chemical Company

6.2. Exxon Mobil Corp.

6.3. India Glycols Ltd.

6.4. LOTTE Chemical

6.5. LyondellBasell Industries Holdings B.V.

6.6. Mitsubishi Chemical Corp.

6.7. NIPPON SHOKUBAI CO., LTD.

6.8. Pertamina Rosneft Pengolahan&Petrolkimia

6.9. Sasol Ltd.

6.10. Toyo Engineering Korea Ltd.

1. GLOBAL ETHYLENE OXIDE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL ETHYLENE CARBONATE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL ETHANOLAMINES MARKETRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL GLYCOL ETHERSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL OTHERS ETHYLENE OXIDE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL ETHYLENE GLYCOL MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

7. GLOBAL MONO ETHYLENE GLYCOLMARKETRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL TRIETHYLENE GLYCOLMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL DIETHYLENE GLYCOL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL POLYETHYLENE TEREPHTHALATE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL OTHERS ETHYLENE GLYCOL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL ETHYLENE OXIDE AND ETHYLENE GLYCOLMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

13. GLOBALETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET FOR POLYESTER FIBERS RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL ETHYLENE OXIDE AND ETHYLENE GLYCOLMARKET FOR PET RESINS RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET FOR ANTIFREEZE RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET FOR BRAKE FLUIDS RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET FOR SURFACTANTS RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL COOLANTS ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET FOR AUTOMOTIVE RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET FOR PLASTICS RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. GLOBAL ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET FOR OTHERS RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. GLOBALETHYLENE OXIDE AND ETHYLENE GLYCOL RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. NORTH AMERICAN ETHYLENE OXIDE AND ETHYLENE GLYCOL RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. NORTH AMERICAN ETHYLENE OXIDE RESEARCH AND ANALYSIS BYPRODUCT 2023-2031 ($ MILLION)

24. NORTH AMERICAN ETHYLENE GLYCOL RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

25. NORTH AMERICAN ETHYLENE OXIDE AND ETHYLENE GLYCOL RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

26. EUROPEAN ETHYLENE OXIDE AND ETHYLENE GLYCOL RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

27. EUROPEAN ETHYLENE OXIDE RESEARCH AND ANALYSIS BYPRODUCT2023-2031 ($ MILLION)

28. EUROPEAN ETHYLENE GLYCOL RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

29. EUROPEAN ETHYLENE OXIDE AND ETHYLENE GLYCOL RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC ETHYLENE OXIDE AND ETHYLENE GLYCOL RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

31. ASIA-PACIFICETHYLENE OXIDE RESEARCH AND ANALYSIS BYPRODUCT, 2023-2031 ($ MILLION)

32. ASIA- PACIFIC ETHYLENE GLYCOL RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

33. ASIA-PACIFICETHYLENE OXIDE AND ETHYLENE GLYCOL RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

34. REST OF THE WORLD ETHYLENE OXIDE AND ETHYLENE GLYCOL RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

35. REST OF THE WORLD ETHYLENE OXIDE RESEARCH AND ANALYSIS BYPRODUCT, 2023-2031 ($ MILLION)

36. REST OF THE WORLD ETHYLENE GLYCOL RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

37. REST OF THE WORLD ETHYLENE OXIDE AND ETHYLENE GLYCOL RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL ETHYLENE OXIDE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL ETHYLENE CARBONATE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL ETHANOLAMINES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL GLYCOL ETHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL OTHERS ETHYLENE OXIDE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

6. GLOBAL ETHYLENE GLYCOL RESEARCH AND ANALYSIS BY PRODUCT, 2023 VS 2031 (%)

7. GLOBAL MONOETHYLENE GLYCOL RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL TRIETHYLENE GLYCOL RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBAL DIETHYLENE GLYCOL RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. GLOBAL POLYETHYLENE TEREPHTHALATE RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. GLOBAL OTHERS ETHYLENE GLYCOL RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

12. GLOBAL ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023 VS 2031 (%)

13. GLOBALETHYLENE OXIDE AND ETHYLENE MARKET FOR GLYCOL POLYESTER FIBERS RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

14. GLOBAL ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKETFOR PET RESINS RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

15. GLOBAL ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET FOR ANTIFREEZE RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

16. GLOBAL ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET FOR BRAKE FLUIDS RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

17. GLOBAL ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET FOR SURFACTANTS RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

18. GLOBAL AUTOMOTIVE COOLANTS ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

19. GLOBAL ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET FOR PLASTICS RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

20. GLOBAL ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET FOR OTHERS RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

21. GLOBAL ETHYLENE OXIDE AND ETHYLENE GLYCOL RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

22. GLOBAL ETHYLENE OXIDE AND ETHYLENE GLYCOL RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

23. US ETHYLENE OXIDE AND ETHYLENE GLYCOLMARKET SIZE, 2023-2031 ($ MILLION)

24. CANADA ETHYLENE OXIDE AND ETHYLENE GLYCOLMARKET SIZE, 2023-2031 ($ MILLION)

25. UK ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET SIZE, 2023-2031 ($ MILLION)

26. FRANCE ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET SIZE, 2023-2031 ($ MILLION)

27. GERMANY ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET SIZE, 2023-2031 ($ MILLION)

28. ITALY ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET SIZE, 2023-2031 ($ MILLION)

29. SPAIN ETHYLENE OXIDE AND ETHYLENE GLYCOLMARKET SIZE, 2023-2031 ($ MILLION)

30. REST OF EUROPE ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET SIZE, 2023-2031 ($ MILLION)

31. INDIA ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET SIZE, 2023-2031 ($ MILLION)

32. CHINA ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET SIZE, 2023-2031 ($ MILLION)

33. JAPAN ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET SIZE, 2023-2031 ($ MILLION)

34. SOUTH KOREA ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET SIZE, 2023-2031 ($ MILLION)

35. REST OF ASIA-PACIFIC ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET SIZE, 2023-2031 ($ MILLION)

36. REST OF THE WORLD ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKETSIZE, 2023-2031 ($ MILLION)