Factory Automation Market

Global Factory Automation Market Size, Share & Trends Analysis Report by Component (Industrial Robots, Machine Vision, Human Machine Interface (HMI), Sensors, Control Valves, and Others), By Control Systems (PLC, DCS, SCADA, MES, and Others), By Industry (Automotive, Aerospace & Defense, Oil & Gas, Chemical, Food & Beverages, Healthcare, and Others) and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global market for factory automation is projected to have considerable CAGR of around 9.2% during the forecast period. The market growth mainly backed by the increasing inclination towards automated manufacturing process with advent of AI and IoT. Additionally, there has been a range of government-led initiatives towards promotion of automation with private partnership. For instance, in May 2018, NITI Aayog and ABB India signed a statement of intent (SoI) to incorporate the latest developments in robotics and AI in various sectors such as manufacturing. These government initiatives are aimed at exploring R&D programs and stimulating the adoption og automation platforms. This is intended to foster public confidence in automation technologies and protects privacy, civil liberties, and values to completely realize the potential of automation and AI technologies for the company’s people. Moreover growing technological development in manufacturing sector such as growing integration of industry 4.0 in manufacturing further provide substantial opportunity to the market growth.

Segmental Outlook

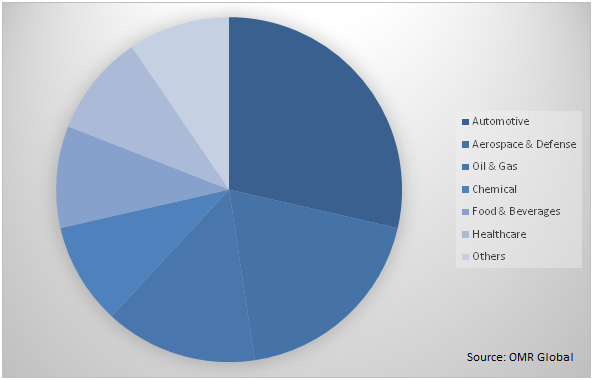

The global factory automation market is segmented based on component, control systems, and industry. Based on the component, the market is further classified intoindustrial robots, machine vision, human machine interface (HMI), sensors, control valves, and others. The industrial robots segment is projected to have considerable share owing to the growing demand of automated manufacturing process in various industries such as automotive and aerospace. Moreover, the increasing deployment of industrial robots in China, Japan, the US further contribute in the growth of the segmental market. Based on component the market for factory automation further segregated into programmable logic controllers (PLC), distributed control systems (DCS), supervisory control and data acquisition system(SCADA), manufacturing execution system (MES), and others(Product Lifecycle Management). The DCS segment is projected to hold significant share in the global factory automation market. On the basis of industry the market is further segregated into automotive, aerospace & defense, oil & gas, chemical, food & beverages, healthcare, and others.

Global Factory Automation Market Share by Industry, 2019 (%)

Global factory automation market to be driven by Automotive Industry

Among industry, the automotive segment held a considerable growth in the market owing to increasing initiatives by automotive companies to adopt automated solutions in order to improve the efficiency of manufacturing such as automotive parts. There is an increasing role of industrial robots in the automotive industry, which in turn, is offering significant opportunity for the growth of the market. For instance, as per IFR, in terms of market share, the most important consumer of robots is the automotive sector. The APAS assistant mobile is a collaborative and movable robot for flexible applications in the smart factory. As an intelligent robot-based assistant, it is primarily aimed at end-users who benefit from rapid and cost-efficient realization applications for new product variants, high robustness, easy handling and intuitive operation. For instance, since June 2017, the two APAS assistants are working in the production of diesel injection systems for utility vehicles. This emerging demand for industrial robots in the automotive industry is anticipated to propel the adoption of automated technologies.

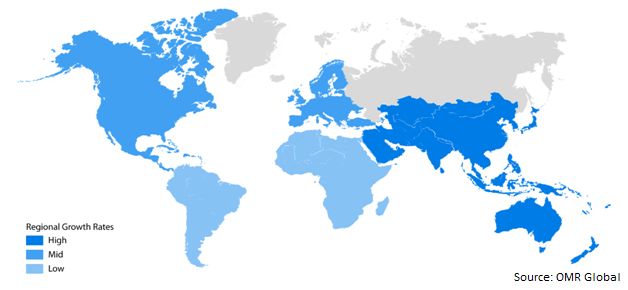

Regional Outlook

Geographically, the global factory automation market is further classified into North America, Europe, Asia-Pacific and the Rest of the World. North America have considerable market share in the global factory automation market. The market growth is attributed to the contribution from the major economies including the US and Canada. The market in the US is growing due to rising manufacturing sector coupled with the government efforts for promoting the implementation of AI. For instance, in February 2019, the US president signed an executive order for the American AI initiative. Further, there is a rising need to meet the increasing demand for high efficiency in the manufacturing sector that further strengthen the market share in the region. Robot density in the US manufacturing industry in 2017 reached 200 robots per 10,000 manufacturing employees as compared to 97 in China, as per the International Federation of Robotics. The trend of automate production in domestic as well as global markets is the major factor driving the installation of robots in the US.

Global factory automation Market Growth, by Region 2020-2026

Asia-Pacific to hold a considerable growth in the global factory automation market

Geographically, Asia-Pacific is projected to hold a significant market growth in the global factory automation market during the forecast period. Major economies which are anticipated to contribute to Asia-Pacific factory automation market are China, India Japan and others. The major factors contributing to the growth of the market in the region include the rising demand of industrial robots and partnerships for the development of factory automation. China has rapidly positioned itself as a global leader in terms of automation. According to the International Federation of Robotics, the sales for industrial robots is expected to increase between 15% and 20% on average per year during 2018-2020. The major factors contributing to this growth in China include the growth in electrical and electronics industry. Sales in this industry increased by 75% to almost 30,000 units in 2016. All the global robot suppliers also increased sales by more than 59% to the electrical and electronics industry. Moreover, major contract manufacturers of electronic devices have started to automate production that further contribute in the market growth.

Market Players Outlook

The key players in the factory automation market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include ABB Ltd., Honeywell International, Inc., Emerson Electric Co., Schneider Electric SE, Siemens AG, and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global factory automation market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. ABB Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Honeywell International, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Emerson Electric Co.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Schneider Electric SE

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Siemens AG

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Factory Automation Market by Component

5.1.1. Industrial Robots

5.1.2. Machine Vision

5.1.3. Human Machine Interface(HMI)

5.1.4. Sensors

5.1.5. Control Valves

5.1.6. Others( Field Instruments)

5.2. Global Factory Automation Market by Control Systems

5.2.1. Programmable Logic Controllers(PLC)

5.2.2. Distributed Control Systems (DCS)

5.2.3. Supervisory Control and Data Acquisition System (SCADA)

5.2.4. Manufacturing Execution System (MES)

5.2.5. Others( Product Lifecycle Management)

5.3. Global Factory Automation Market by Industry

5.3.1. Automotive

5.3.2. Aerospace & Defense

5.3.3. Oil & Gas

5.3.4. Chemical

5.3.5. Food & Beverages

5.3.6. Healthcare

5.3.7. Others( Mining and Electronics)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ABB Ltd.

7.2. Azbil Corp.

7.3. Dwyer Instruments, Inc.

7.4. Danfoss A/S

7.5. Emerson Electric Co.

7.6. Endress+Hauser Group Services AG

7.7. Fuji Electric Co., Ltd.

7.8. Fanuc Corp.

7.9. General Electric Co.

7.10. Honeywell International Inc.

7.11. Hitachi, Ltd.

7.12. KROHNE Messtechnik GmbH

7.13. Mitsubishi Electric Corp.

7.14. NovaTech, LLC

7.15. Omron Corp.

7.16. Rockwell Automation, Inc.

7.17. Siemens AG

7.18. Schneider Electric SE

7.19. WIKA Instruments India Pvt. Ltd.

7.20. Yokogawa Electric Corp.

1. GLOBAL FACTORY AUTOMATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

2. GLOBAL INDUSTRIAL ROBOTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL MACHINE VISION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL HMI MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL CONTROL VALVES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL OTHER COMPONENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL FACTORY AUTOMATION MARKET RESEARCH AND ANALYSIS BY CONTROL SYSTEMS, 2019-2026 ($ MILLION)

9. GLOBAL PLC MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL DCS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL SCADA MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL MES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL OTHER CONTROL SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL FACTORY AUTOMATION MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2019-2026 ($ MILLION)

15. GLOBAL FACTORY AUTOMATION IN AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

16. GLOBAL FACTORY AUTOMATION IN AEROSPACE & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

17. GLOBAL FACTORY AUTOMATION IN OIL & GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

18. GLOBAL FACTORY AUTOMATION IN CHEMICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

19. GLOBAL FACTORY AUTOMATION IN FOOD & BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

20. GLOBAL FACTORY AUTOMATION IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

21. GLOBAL FACTORY AUTOMATION IN OTHER INDUSTRIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

22. GLOBAL FACTORY AUTOMATION MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

23. NORTH AMERICAN FACTORY AUTOMATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

24. NORTH AMERICAN FACTORY AUTOMATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

25. NORTH AMERICAN FACTORY AUTOMATION MARKET RESEARCH AND ANALYSIS BY CONTROL SYSTEMS, 2019-2026 ($ MILLION)

26. NORTH AMERICAN FACTORY AUTOMATION MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2019-2026 ($ MILLION)

27. EUROPEAN FACTORY AUTOMATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

28. EUROPEAN FACTORY AUTOMATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

29. EUROPEAN FACTORY AUTOMATION MARKET RESEARCH AND ANALYSIS BY CONTROL SYSTEMS, 2019-2026 ($ MILLION)

30. EUROPEAN FACTORY AUTOMATION MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2019-2026 ($ MILLION)

31. ASIA-PACIFIC FACTORY AUTOMATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

32. ASIA-PACIFIC FACTORY AUTOMATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

33. ASIA-PACIFIC FACTORY AUTOMATION MARKET RESEARCH AND ANALYSIS BY CONTROL SYSTEMS, 2019-2026 ($ MILLION)

34. ASIA-PACIFIC FACTORY AUTOMATION MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2019-2026 ($ MILLION)

35. REST OF THE WORLD FACTORY AUTOMATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

36. REST OF THE WORLD FACTORY AUTOMATION MARKET RESEARCH AND ANALYSIS BY CONTROL SYSTEMS, 2019-2026 ($ MILLION)

37. REST OF THE WORLD FACTORY AUTOMATION MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2019-2026 ($ MILLION)

1. GLOBAL FACTORY AUTOMATION MARKET SHARE BY COMPONENT, 2019 VS 2026 (%)

2. GLOBAL FACTORY AUTOMATION MARKET SHARE BY CONTROL SYSTEMS, 2019 VS 2026 (%)

3. GLOBAL FACTORY AUTOMATION MARKET SHARE BY INDUSTRY, 2019 VS 2026 (%)

4. GLOBAL FACTORY AUTOMATION MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US FACTORY AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA FACTORY AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)

7. UK FACTORY AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE FACTORY AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY FACTORY AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY FACTORY AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN FACTORY AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE FACTORY AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA FACTORY AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA FACTORY AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN FACTORY AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC FACTORY AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD FACTORY AUTOMATION MARKET SIZE, 2019-2026 ($ MILLION)