Fill Finish Manufacturing Market

Fill Finish Manufacturing Market Size, Share & Trends Analysis Report by Product (Vials, Prefilled Syringes, Cartridges and Other), and by End-Users (Pharmaceutical & Biotechnology Companies and Contract Manufacturing Organizations) Forecast Period (2024-2031)

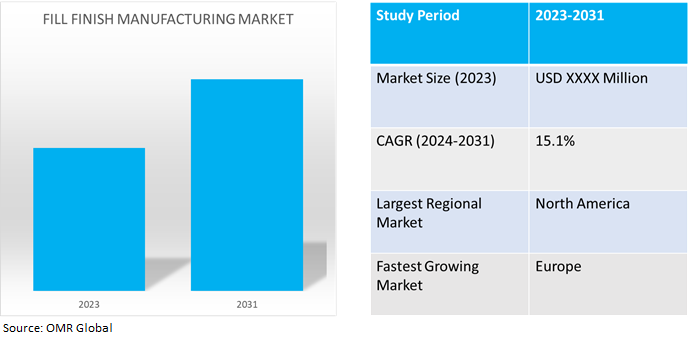

Fill finish manufacturing market is anticipated to grow at a CAGR of 15.1% during the forecast period (2024-2031). The growth of the fill finish manufacturing market is attributed to increasing demand for biologics and vaccines including monoclonal antibodies, recombinant proteins, and cell therapies, which offer novel treatment options for a wide range of diseases driving the growth of the market. According to the National Institute of Health (NIH), in June 2023, WHO Vaccine Market Report 2022, globally, only 10 manufacturers provide 70.0% of vaccine doses. An estimated 55.0% of vaccine manufacturing capacity is in East Asia and 40.0% in Europe and North America.

Market Dynamics

Automation and robotics in fill-finish manufacturing

Automation and robotics in fill-finish manufacturing use advanced technology and machines to perform specific tasks without the need for humans to intervene. The goal of automation is to increase efficiency, productivity, and accuracy in the production process, reducing manual labor and minimizing the risk of human error. From data logging to closing and sealing a container, expensive and time-consuming manual techniques can be eliminated in an automated scenario almost anywhere in the fill-finish process. Similarly, automation can lessen human interventions—interventions that are adverse to timely production. Additionally, in conjunction with robotic filling lines, artificial intelligence (AI)-influenced line controls and automation will be able to offer faster scalability and increased flexibility for manufacturers.

Advanced Aseptic Processing

Advancements in aseptic fill-finish technologies have ushered in a new era of efficiency, sterility, and product quality in the bioprocessing industry. The integration of single-use systems and advanced barrier technologies has transformed the way pharmaceuticals are manufactured. For producing safe products, advanced aseptic processes demand a higher degree of engineering and operation. Instead, reducing bioburden during the process and using heat for terminal sterilization is more easier and less expensive. Most biologics, vaccines, and cancer medications are among the many medications that cannot survive a heat sterilization process. To provide the right dose to the patient and lower the risk of contamination during the production, storage, shipping, and delivery processes, each biologic dose needs to be precisely filled.

Market Segmentation

Our in-depth analysis of the global fill finish manufacturing market includes the following segments product and end-users.

- Based on product, the market is sub-segmented into vials, prefilled syringes, cartridges, and other (consumables).

- Based on end-users, the market is sub-segmented into pharmaceutical & biotechnology companies and contract manufacturing organizations.

Prefilled Syringes is Projected to Emerge as the Largest Segment

Based on the product, the global fill finish manufacturing market is sub-segmented into vials, prefilled syringes, cartridges, and other (consumables). Among these prefilled syringes, the sub-segment is expected to hold the largest share of the market. The primary factors supporting the segment's growth include the increasing development of biologics and biosimilar drugs and the rise in demand for injectable medication in prefilled forms of expensive drug products. For instance, in March 2024, SCHOTT Pharma expanded in the US with a $371.0 million investment in a new refillable syringe manufacturing facility in Wilson, North Carolina. The US manufacturing facility fills demand for the domestic supply of glass and polymer prefillable syringes that deliver mRNA, GLP-1, and other therapies. According to the United Nations Office on Drugs and Crime (UNODC), in 2021, By 2030, demographic factors project the number of people using drugs to rise by 11.0% around the globe, and as much as 40.0% in Africa alone.

Pharmaceutical & Biotechnology Companies Sub-segment to Hold a Considerable Market Share

Based on the end-users, the global fill finish manufacturing market is sub-segmented into pharmaceutical & biotechnology companies and contract manufacturing organizations. Among these, the pharmaceutical & biotechnology companies sub-segment is expected to hold a considerable share of the market. Fill-finish pharmaceutical and biotechnology companies are driven by several factors, including the increasing complexity of prescription formulations, the growing demand for biologics and biosimilars, and the need for flexible and cost-effective production options. Global manufacturing capabilities in the pharma services industry by offering high-speed, sterile fill finish lines with onsite formulation, compounding, and packaging capabilities increase the fill finish manufacturing market. For instance, in March 2024, SMC Ltd. announced the expansion of sterile fill finish capabilities and introduced a state-of-the-art facility in North Carolina. The facility enables SMC to offer a wider portfolio of services to its pharma clients including lab-to-market development, analytical services, device manufacture, fill-finish, final assembly, and secondary packaging.

Regional Outlook

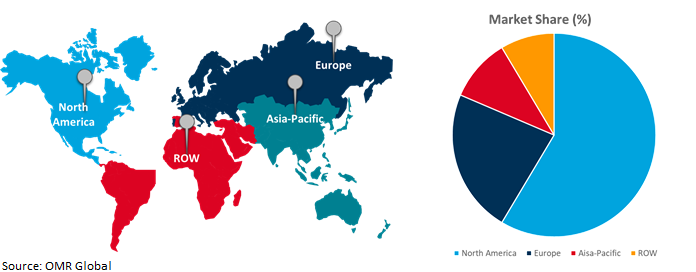

Global fill finish manufacturing market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Fill Finish Manufacturing Adoption in Europe

- In Europe, growing demand for vaccines and biologics and increasing pharmaceutical and biotechnology applications drive the growth of fill finish manufacturing market. According to the Gov.UK, in December 2022, There were 2,068 sites in 2021 involved in the manufacturing of life sciences products across the UK.

- In February 2022, Piramal Pharma Ltd. Solutions announced an investment of approximately £55.0 million in the company’s UK-based drug development and manufacturing capabilities including fill/finish, payloads, and peptides.

Global Fill Finish Manufacturing Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to numerous prominent companies and fill finish manufacturing providers. The growth is attributed to the growing applications in biotechnology & pharmaceutical industries and increasing adoption of pre-filled syringes for parenteral dosages driving the growth of the fill finish manufacturing market in the region. Furthermore, the government in the region collaborating with companies to expand its fill finish manufacturing. For instance, in November 2021, Endo International plc entered into a cooperative agreement to expand its sterile fill-finish manufacturing production capacity and capabilities at its Rochester, Michigan plant to support the US government's national defense efforts regarding the production of critical medicines advancing preparation. Under the terms of the agreement, the US government funds approximately $90.0 million of the program's total expected cost of approximately $120.0 million.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global fill finish manufacturing market include AbbVie Inc., Baxter International Inc., Becton, Dickinson and Company (BD), Novartis AG, and Pfizer Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in February 2022, Moderna and Thermo Fisher Scientific announced a long-term strategic collaboration to enable dedicated large-scale manufacturing in the US of Spikevax®, Moderna’s vaccine, and other investigational mRNA medicines in its pipeline. Thermo Fisher provides dedicated capacity for a range of aseptic fill-finish services including lyophilized and liquid filling.

Recent Development

- In February 2024, Catalent, Inc. enabling the development and supply of better treatments for patients globally, has completed upgrades in its capsule filling of Dry Powders for Inhalation and capsule blistering suites in Boston, MA USA, to handle potent drugs. The capsule filling lines use drum dosing technology with in-line AMV (advanced mass verification) sensor technology and flexibility for custom powder feeding based on complex powder characteristics.

- In October 2023, Lonza announced a Filling line for the commercial supply of antibody-drug conjugates for a dedicated customer. The new cGMP filling line at Lonza’s Stein (CH) site will enable the handling and filling of bioconjugates for commercial supply.

- In September 2022, BD (Becton, Dickinson, and Company), a global medical technology company, introduced a next-generation glass pre-fillable syringe (PFS) that sets a new standard in performance for vaccine PFS with new and tightened specifications for processability, cosmetics, contamination and integrity. The new BD EffivaxTM Glass Prefillable Syringe has been designed in collaboration with pharmaceutical companies to meet the complex and evolving needs of vaccine manufacturing.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global fill finish manufacturing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. AbbVie Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Becton, Dickinson and Company (BD)

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Novartis AG

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Fill Finish Manufacturing Market by Product

4.1.1. Vial

4.1.2. Prefilled Syringes

4.1.3. Cartridge

4.1.4. Other (Consumables)

4.2. Global Fill Finish Manufacturing Market by End-Users

4.2.1. Pharmaceutical & Biotechnology Companies

4.2.2. Contract Manufacturing Organization

4.2.3. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Almac Group

6.2. Boehringer Ingelheim International GmbH

6.3. Catalent, Inc.

6.4. Cytovance Biologics

6.5. Fresenius Kabi Contract Manufacturing

6.6. Gerresheimer AG

6.7. Grifols, S.A.

6.8. Jubilant HollisterStier LLC

6.9. Lonza Group Ltd.

6.10. Nipro Corp.

6.11. Piramal Pharma Solutions

6.12. Recipharm AB

6.13. Sandoz Group AG

6.14. Sartorius AG

6.15. Thermo Fisher Scientific Inc.

6.16. Vetter Pharma-Fertigung GmbH & Co. KG

6.17. West Pharmaceutical Services, Inc.

6.18. WuXi Biologics Co., Ltd.

1. GLOBAL FILL FINISH MANUFACTURING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL FILL FINISH VIAL MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL FILL FINISH PREFILLED SYRINGES MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL FILL FINISH CARTRIDGE MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL FILL FINISH OTHER PRODUCT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL FILL FINISH MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

7. GLOBAL FILL FINISH MANUFACTURING FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL FILL FINISH MANUFACTURING FOR CONTRACT MANUFACTURING ORGANIZATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL FILL FINISH MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. NORTH AMERICAN FILL FINISH MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

11. NORTH AMERICAN FILL FINISH MANUFACTURING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

12. NORTH AMERICAN FILL FINISH MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

13. EUROPEAN FILL FINISH MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. EUROPEAN FILL FINISH MANUFACTURING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

15. EUROPEAN FILL FINISH MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

16. ASIA-PACIFIC FILL FINISH MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. ASIA-PACIFIC FILL FINISH MANUFACTURING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC FILL FINISH MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

19. REST OF THE WORLD FILL FINISH MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. REST OF THE WORLD FILL FINISH MANUFACTURING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

21. REST OF THE WORLD FILL FINISH MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

1. GLOBAL FILL FINISH MANUFACTURING MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL FILL FINISH VIAL MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL FILL FINISH PREFILLED SYRINGES MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL FILL FINISH CARTRIDGE MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL FILL FINISH OTHER PRODUCT MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL FILL FINISH MANUFACTURING MARKET SHARE BY END-USERS, 2023 VS 2031 (%)

7. GLOBAL FILL FINISH MANUFACTURING FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL FILL FINISH MANUFACTURING FOR CONTRACT MANUFACTURING ORGANIZATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. US FILL FINISH MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

10. CANADA FILL FINISH MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

11. UK FILL FINISH MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

12. FRANCE FILL FINISH MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

13. GERMANY FILL FINISH MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

14. ITALY FILL FINISH MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

15. SPAIN FILL FINISH MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

16. REST OF EUROPE FILL FINISH MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

17. INDIA FILL FINISH MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

18. CHINA FILL FINISH MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

19. JAPAN FILL FINISH MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

20. SOUTH KOREA FILL FINISH MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF ASIA-PACIFIC FILL FINISH MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

22. LATIN AMERICA FILL FINISH MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

23. MIDDLE EAST AND AFRICA FILL FINISH MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)