Forestry Equipment Market

Forestry Equipment Market Size, Share & Trends Analysis Report by Equipment (Felling Equipment, Extracting Equipment, On-Site Processing Equipment, and Other Forestry Equipment) and by End-User (Private Organization and Public Organization) Forecast Period (2024-2031)

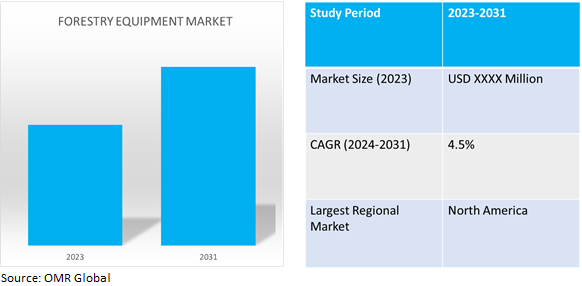

Forestry equipment market is anticipated to grow at a CAGR of 4.5% during the forecast period (2024-2031). The forestry equipment market is primarily driven by the increasing demand for timber and wood-based products across various industries such as construction, paper, and furniture. This growing demand is fueling investments in forest management and logging activities, leading to the adoption of advanced forestry equipment for efficient operations. Additionally, technological advancements in machinery, such as the introduction of automated and remote-controlled equipment, are improving productivity and safety in logging processes. Environmental concerns and the need for sustainable forest management practices are also encouraging the adoption of modern forestry equipment that reduces waste and minimizes ecological impact. Furthermore, government incentives and policies promoting sustainable forestry are expected to drive market growth in the coming years.

Market Dynamics

Increased use of wood pellets for industrial and household applications globally

The growing demand for renewable energy has led to an upsurge in wood pellet consumption. These pellets serve as a clean and sustainable biomass fuel, making them an attractive choice for power generation and heating. As a result, forestry equipment manufacturers experience heightened demand for machinery used in wood pellet production, such as pellet mills, chippers, and drying systems. Industries and households are increasingly transitioning to wood pellets as an eco-friendly alternative to coal, oil, and other non-renewable energy sources. This shift necessitates specialized forestry equipment to harvest, process, and transport wood feedstock for pellet production. The global adoption of wood pellets as a sustainable energy source has spurred investment in forestry equipment, supporting efficient wood pellet production and contributing to the overall growth of the forestry equipment market.

Scaling investment across the forestry sector

Globally, the surge in investments across the forestry sector is significantly driving the global forestry equipment market. Governments, private entities, and conservation organizations are increasingly focusing on sustainable forest management. Investments are channeled into activities such as afforestation, reforestation, and ecosystem restoration. As forest management practices evolve, there is a growing demand for specialized forestry equipment to efficiently carry out tasks like tree planting, thinning, and habitat restoration.

Market Segmentation

Our in-depth analysis of the global forestry equipment market includes the following segments by equipment and end-user:

- Based on equipment, the market is sub-segmented into felling equipment, extracting equipment, on-site processing equipment, and other forestry equipment.

- Based on end-users, the market is bifurcated into private organizations and public organizations.

Private Organization is Projected to Emerge as the Largest Segment

Based on the end-user, the global forestry equipment market is sub-segmented into private organizations and public organizations. Among these, the private organization sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the ability to invest in research, development, and innovation which allows them to stay ahead in the market. Private organization's financial strength, adaptability, customer-centric approach, and risk-taking mindset position them as major players in the global forestry equipment market.

Felling Equipment Sub-segment to Hold a Considerable Market Share

The felling equipment segment, comprising harvesters, chainsaws, and feller bunchers, records considerable market share. The growth can be attributed to the rising trend of commercial forestry and the consequent need for felling, harvesting, delimbing, processing, and bucking trees. Chainsaws, harvesters, and feller bunchers are essential for precise tree cutting, reducing waste, and optimizing timber production. As the global demand for wood products continues to rise, efficient felling equipment becomes indispensable. According to the Center for International Forestry Research (CIFOR), approximately 24.7 million acres of fast-wood plantations or commercially planted forests exist worldwide. The market will expand even further as automated equipment with control system integration and increasing use of aluminum alloys gain traction.

Regional Outlook

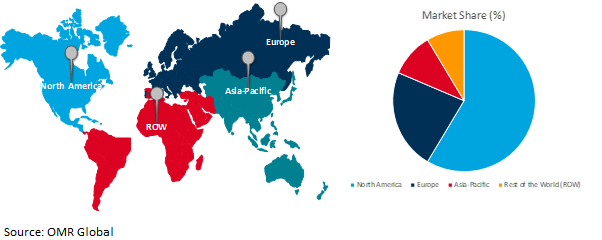

The global forestry equipment market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

European countries to invest in the forestry equipment market

- High return-on-investment and success rates in economies such as Germany are investing more in this market which is leading to rising demand for forestry equipment in Europe.

- The rise in mechanized practices, low competition, and adoption of precision forestry in France are driving the growth of the market.

Global Forestry Equipment Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share propelled by the growing government support for silviculture in the U.S. to maintain vegetation and forest cover. In the furniture, heating, and paper industries, there is an increasing need for wood due to the fast-expanding population as well as the expanding residential and commercial sectors. For instance, in December 2022, new home sales in the US surged 5.8% to an approximate annual rate of 640000 units. The rise in government & private investments in enhancing the transportation and infrastructure systems is also driving the regional market growth.

Integration of the GPS control system within the forestry equipment is boosting productivity by offering real-time tracking and sustainable operations, thereby majorly increasing its demand in North America. Additionally, as a primary hub for manufacturing forestry equipment tires, this region is poised to become a prominent global consumer of Original Equipment Manufacturer (OEM) forestry equipment tires. This growth is driven by expanding construction, manufacturing, and energy sectors.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global forestry equipment market include Komatsu Ltd., Caterpillar, John Deere, Epiroc AB, Volvo Group, Hitachi Construction Machinery Co., Ltd., Husqvarna AB, and Liebherr-International Deutschland GmbH, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in June 2022, Komatsu Ltd. signed an agreement to acquire Bracke Forest AB, headquartered in Bräcke, Sweden, through a wholly-owned subsidiary, Komatsu Forest AB. Bracke Forest AB deals in developing, manufacturing, and selling application-specific attachments for silviculture.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global forestry equipment market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Caterpillar, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Deere & Company

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Komatsu Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Volvo Group

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Forestry Equipment Market by Equipment

4.1.1. Felling Equipment

4.1.2. Extracting Equipment

4.1.3. On-Site Processing Equipment

4.1.4. Other Forestry Equipment

4.2. Global Forestry Equipment Market by End-User

4.2.1. Private Organization

4.2.2. Public Organization

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Barko Hydraulics, LLC

6.2. Doosan Corp.

6.3. Eco Log Sweden AB

6.4. Epiroc AB

6.5. Hitachi Construction Machinery Co., Ltd.

6.6. Husqvarna AB

6.7. Kesla Oyj

6.8. Liebherr-International Deutschland GmbH

6.9. Logset Oy

6.10. Ponsse Plc

6.11. Rottne Industri AB.

6.12. Sandvik Group

6.13. STIHL

6.14. Tigercat Industries Inc.

6.15. TimberPro Inc

1. GLOBAL FORESTRY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023-2031 ($ MILLION)

2. GLOBAL FORESTRY FELLING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL FORESTRY EXTRACTING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL FORESTRY ON-SITE PROCESSING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL OTHER FORESTRY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL FORESTRY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

7. GLOBAL FORESTRY EQUIPMENT FOR PRIVATE ORGANIZATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL FORESTRY EQUIPMENT FOR PUBLIC ORGANIZATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL FORESTRY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. NORTH AMERICAN FORESTRY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

11. NORTH AMERICAN FORESTRY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023-2031 ($ MILLION)

12. NORTH AMERICAN FORESTRY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

13. EUROPEAN FORESTRY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. EUROPEAN FORESTRY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023-2031 ($ MILLION)

15. EUROPEAN FORESTRY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

16. ASIA-PACIFIC FORESTRY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. ASIA-PACIFIC FORESTRY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC FORESTRY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

19. REST OF THE WORLD FORESTRY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. REST OF THE WORLD FORESTRY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023-2031 ($ MILLION)

21. REST OF THE WORLD FORESTRY EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL FORESTRY EQUIPMENT MARKET SHARE BY EQUIPMENT, 2023 VS 2031 (%)

2. GLOBAL FORESTRY FELLING EQUIPMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL FORESTRY EXTRACTING EQUIPMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL FORESTRY ON-SITE PROCESSING EQUIPMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL OTHER FORESTRY EQUIPMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL FORESTRY EQUIPMENT MARKET SHARE BY END-USER, 2023 VS 2031 (%)

7. GLOBAL FORESTRY EQUIPMENT FOR PRIVATE ORGANIZATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL FORESTRY EQUIPMENT FOR PUBLIC ORGANIZATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL FORESTRY EQUIPMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. US FORESTRY EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

11. CANADA FORESTRY EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

12. UK FORESTRY EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

13. FRANCE FORESTRY EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

14. GERMANY FORESTRY EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

15. ITALY FORESTRY EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

16. SPAIN FORESTRY EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

17. REST OF EUROPE FORESTRY EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

18. INDIA FORESTRY EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

19. CHINA FORESTRY EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

20. JAPAN FORESTRY EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

21. SOUTH KOREA FORESTRY EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF ASIA-PACIFIC FORESTRY EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

23. LATIN AMERICA FORESTRY EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

24. MIDDLE EAST AND AFRICA FORESTRY EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)