Heat Sink Market

Heat Sink Market Size, Share & Trends Analysis Report by Type (Active Heat Sink, Passive Heat Sink, and Hybrid Heat Sink), and by Material (Aluminum, Copper, and Others (Graphite, Diamond, Alloys) Forecast Period (2025-2035)

Industry Overview

Heat sink market was valued at $6.7 billion in 2024 and is projected to reach $13.2 billion in 2035, growing at a CAGR of 6.5% during the forecast period (2025-2035). Heat sink is a device that helps cool down electronic parts by absorbing and dissipating heat. The heat sink market size is driven by increasing demand for heat sink industries, such as electronics, automotive, and aerospace. They use high-performance components that generate a lot of heat. As devices become faster and more powerful, especially in electric vehicles, advanced computers, and aircraft systems. Passive heat sinks are mostly used in consumer electronics and other applications where airflow is available. Aluminum is the most commonly used material for heat sinks due to its good thermal conductivity (205W/m²K), lightweight nature, and cost-effectiveness.

Market Dynamics

Growing Electronics and Energy Efficiency Trends

The heat sink market is growing fast due to increasing demand for high-performance devices, and electric vehicles are driving growth. High-performance devices such as smartphones, laptops, and gaming consoles need an efficient cooling system to prevent overheating. Heat sinks are used in computers to cool central processing units or graphics processors. Heat sinks are utilized with high-power semiconductor devices such as power transistors and optoelectronics such as lasers and light-emitting diodes (LEDs) when the component's heat dissipation capability is insufficient to keep the temperature under control. The latest trend in designing electronics systems is to increase the functionality into smaller form factors. Demand for electronics and power devices is growing across a variety of end industries. For instance, the upcoming 5G implementation is expected to support a large influx of data and connectivity requirements for industries such as autonomous vehicles, smart cities, robotics, augmented reality, virtual reality, and manufacturing automation. Because of the increased use of artificial intelligence and the Internet of Things, which integrate smart functionality and connectivity across most industries, the number of cloud data centre deployments is rapidly expanding. As a result, the power dissipation of most Integrated circuit devices continues to rise, fuelling the demand for more effective heat sinks and optimized designs.

Growing Innovation in the Material & Manufacturing Segment

The heat sink market is growing due to new innovations in materials and manufacturing. New materials such as graphene, special alloys, and even diamond are used to make heat sinks more effective and lighter. Common materials like aluminum and copper remain popular due to their good heat transfer properties and affordability. Modern manufacturing methods like 3D printing and cold plate technology are helping to create better designs that cool faster and cost less. These improvements are helping meet the rising need for heat control in electronics, cars, and airplanes.

Market Segmentation

- Based on the type, the market is segmented into active heat sink, passive heat sink, and hybrid heat sink.

- Based on the material, the market is segmented into aluminum, copper, and others (graphite, diamond, alloys).

Rising EV Adoption Fuels Demand for Heat Sinks in Automotive Sector

The automotive part of the heat sink is expanding fast, mainly because more people are buying electric vehicles, hybrid cars, and high-tech gadgets that sit inside the dashboard. As the electric vehicle sector accelerates, the demand for high-performance thermal management systems, particularly in heat sinks, is increasing rapidly. Components such as batteries, electric motors, and power electronics generate substantial heat during operation. Without efficient dissipation, this thermal load can lead to reduced system efficiency, accelerated battery degradation, and overall reliability issues within the vehicle architecture. To meet those cooling demands, manufacturers install different solutions in each part of the vehicle-air coolers, liquid loops, and even phase-change materials (PCMs) while choosing the right one for the job, so every component runs at its best.

Regional Outlook

The global heat sink market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Innovation and Manufacturing in Asia-Pacific

The Asia-Pacific region’s high manufacturing prospective and rapidly expanding electronics and automotive industries drive this dominance. China, India, Japan, and South Korea are becoming global hubs for smartphone, consumer device, LED lighting, and computer element production. These nations have massive production facilities that are scaling up to meet domestic as well as international demands. Additionally, the region is experiencing a robust boom in EV adoption. As EVs require efficient thermal management of batteries and electronic control units, this trend is heavily influencing the demand for advanced heat sinks. The convergence of industrial growth, technological advancements, and rising consumer electronics demand places Asia-Pacific firmly at the forefront of the global heat sink market.

North America Region holds Major Market Share

North America stands out as a key player in the global heat sink market, driven by rapid growth in technology, cloud computing, and electric vehicles. The region's demand is fueled by data centers, automotive advancements like EVs and ADAS, and the rising need for efficient cooling in aerospace, automation, and smart devices. With strong R&D investments, especially in the U.S., and government support for energy-efficient technologies, North America's demand for advanced thermal management solutions continues to rise. The aerospace and defense industries play a major role in driving the market, as they rely on specialized heat sinks to support critical systems that must perform flawlessly. With constant innovation and strong investment in next-generation technologies, North America is steadily reinforcing its position as a global leader in advanced thermal management solutions.

Market Players Outlook

The major companies operating in the global heat sink market include Advanced Thermal Solutions Inc., Body Corp., CeramTech GmbH, KURL Technology Corp., TE Connectivity, among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In October 2023, Thermalright launched the HR-10 2280 PRO and HR-10 2280 PRO BLACK, featuring heat pipes and a fan for enhanced cooling of M.2 SSDs. The HR-10 Pro utilizes two copper heat pipes connected to 44 aluminum fins in order to dissipate heat away from the m.2 SSD.

- In September 2023, Advanced Thermal Solutions Inc. introduced the picoHEX series, a line of compact liquid-to-air heat exchangers designed for applications with limited space, such as AI, CPUs, GPUs, and FPGAs. These heat exchangers offer high heat transfer performance and are based on ATS's Ultra-Cool CPU cooler design. The picoHEX series features a tube-to-fin design with high-density fins for efficient heat transfer from liquid to air, allowing for lower liquid temperatures compared to other heat exchangers.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global heat sink market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Heat Sink Market Sales Analysis - Type | Material ($ Million)

• Heat Sink Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Heat Sink Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Heat Sink Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

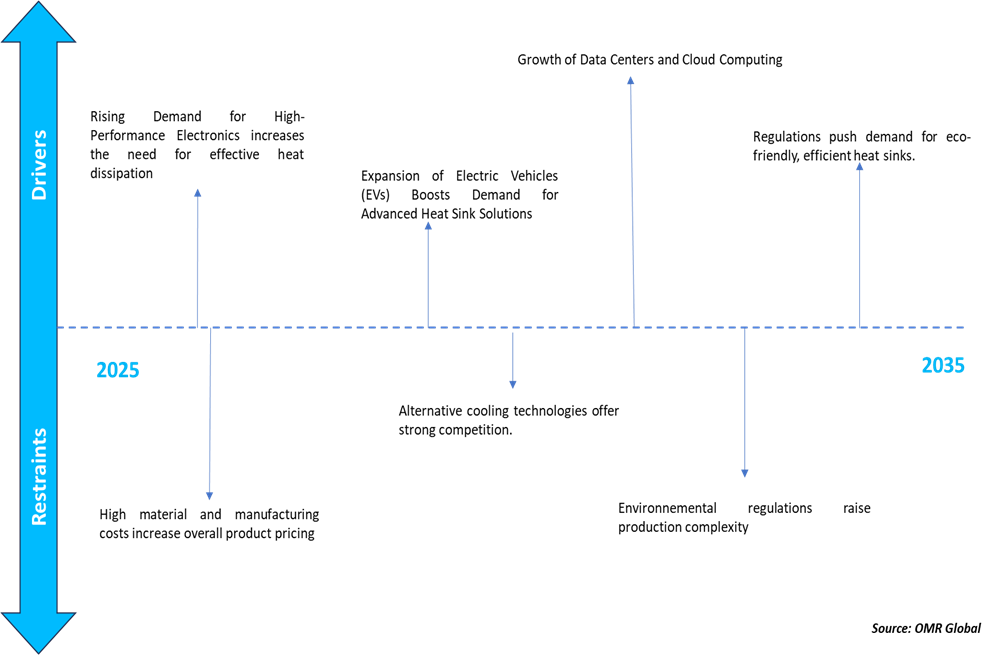

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For the Global Heat Sink Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For the Global Heat Sink Market: Impact Analysis

3.3. Market Opportunities

3.3.1. Opportunities For the Global Heat Sink Market: Impact Analysis

4. Competitive Landscape

4.1. Competitive Dashboard – Heat Sink Market Revenue and Share by Manufacturers

• Heat Sink Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Advanced Thermal Solutions, Inc.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Boyd Corp.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. CeramTech GmbH

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. KURL TECHNOLOGY CORP.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. TE Connectivity

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Heat Sink Market Sales Analysis by Type ($ Million)

5.1. Active Heat Sink

5.2. Passive Heat Sink

5.3. Hybrid Heat Sink

6. Global Heat Sink Market Sales Analysis by Material ($ Million)

6.1. Aluminum

6.2. Copper

6.3. Others (Graphite, Diamond, Alloys)

7. Regional Analysis

7.1. North American Heat Sink Market Sales Analysis – Type | Material | Country ($ Million)

• Macroeconomic Factors for North America

7.1.1. United States

7.1.2. Canada

7.2. European Heat Sink Market Sales Analysis -Type| Material | Country ($ Million)

• Macroeconomic Factors for Europe

7.2.1. UK

7.2.2. Germany

7.2.3. Italy

7.2.4. Spain

7.2.5. France

7.2.6. Russia

7.2.7. Rest of Europe

7.3. Asia-Pacific Heat Sink Market Sales Analysis – Type | Material | Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

7.3.1. China

7.3.2. Japan

7.3.3. South Korea

7.3.4. India

7.3.5. Australia & New Zealand

7.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

7.3.7. Rest of Asia-Pacific

7.4. Rest of the World Heat Sink Market Sales Analysis – Type | Material | Country ($ Million)

• Macroeconomic Factors for the Rest of the World

7.4.1. Latin America

7.4.2. Middle East and Africa

8. Company Profiles

8.1. Advanced Thermal Solutions, Inc.

8.1.1. Quick Facts

8.1.2. Company Overview

8.1.3. Product Portfolio

8.1.4. Business Strategies

8.2. Applied Power Systems, Inc.

8.2.1. Quick Facts

8.2.2. Company Overview

8.2.3. Product Portfolio

8.2.4. Business Strategies

8.3. Alpha Company Ltd.

8.3.1. Quick Facts

8.3.2. Company Overview

8.3.3. Product Portfolio

8.3.4. Business Strategies

8.4. Align Sourcing, LLC.

8.4.1. Quick Facts

8.4.2. Company Overview

8.4.3. Product Portfolio

8.4.4. Business Strategies

8.5. Alutronic Kuhlkorper GmbH & Co. KG

8.5.1. Quick Facts

8.5.2. Company Overview

8.5.3. Product Portfolio

8.5.4. Business Strategies

8.6. Boyd Corp.

8.6.1. Quick Facts

8.6.2. Company Overview

8.6.3. Product Portfolio

8.6.4. Business Strategies

8.7. Bel Fuse Inc.

8.7.1. Quick Facts

8.7.2. Company Overview

8.7.3. Product Portfolio

8.7.4. Business Strategies

8.8. Bhoomi Modular Systems Pvt. Ltd

8.8.1. Quick Facts

8.8.2. Company Overview

8.8.3. Product Portfolio

8.8.4. Business Strategies

8.9. CollJag

8.9.1. Quick Facts

8.9.2. Company Overview

8.9.3. Product Portfolio

8.9.4. Business Strategies

8.10. C&H Technology, Inc.

8.10.1. Quick Facts

8.10.2. Company Overview

8.10.3. Product Portfolio

8.10.4. Business Strategies

8.11. CeramTech GmbH

8.11.1. Quick Facts

8.11.2. Company Overview

8.11.3. Product Portfolio

8.11.4. Business Strategies

8.12. Capri Thermal Systems LLP

8.12.1. Quick Facts

8.12.2. Company Overview

8.12.3. Product Portfolio

8.12.4. Business Strategies

8.13. Compelma

8.13.1. Quick Facts

8.13.2. Company Overview

8.13.3. Product Portfolio

8.13.4. Business Strategies

8.14. Delta Electronics, Inc.

8.14.1. Quick Facts

8.14.2. Company Overview

8.14.3. Product Portfolio

8.14.4. Business Strategies

8.15. Furukawa Electric Co., Ltd

8.15.1. Quick Facts

8.15.2. Company Overview

8.15.3. Product Portfolio

8.15.4. Business Strategies

8.16. Greegoo Electric Co., Ltd.

8.16.1. Quick Facts

8.16.2. Company Overview

8.16.3. Product Portfolio

8.16.4. Business Strategies

8.17. Jyoti Heatsink Pvt. Ltd.

8.17.1. Quick Facts

8.17.2. Company Overview

8.17.3. Product Portfolio

8.17.4. Business Strategies

8.18. KURLTechnology Corp.

8.18.1. Quick Facts

8.18.2. Company Overview

8.18.3. Product Portfolio

8.18.4. Business Strategies

8.19. Ohmite Mfg Co.

8.19.1. Quick Facts

8.19.2. Company Overview

8.19.3. Product Portfolio

8.19.4. Business Strategies

8.20. PSIL INDIA PVT LTD.

8.20.1. Quick Facts

8.20.2. Company Overview

8.20.3. Product Portfolio

8.20.4. Business Strategies

8.21. Same Sky (Back Porch International, Inc.)

8.21.1. Quick Facts

8.21.2. Company Overview

8.21.3. Product Portfolio

8.21.4. Business Strategies

8.22. Sunonwealth Electric Machine Industry Co., Ltd.

8.22.1. Quick Facts

8.22.2. Company Overview

8.22.3. Product Portfolio

8.22.4. Business Strategies

8.23. Sensata Technologies, Inc.

8.23.1. Quick Facts

8.23.2. Company Overview

8.23.3. Product Portfolio

8.23.4. Business Strategies

8.24. Seeed Technology Co., Ltd.

8.24.1. Quick Facts

8.24.2. Company Overview

8.24.3. Product Portfolio

8.24.4. Business Strategies

8.25. Trenz Electronic GmbH

8.25.1. Quick Facts

8.25.2. Company Overview

8.25.3. Product Portfolio

8.25.4. Business Strategies

8.26. Toradex AG

8.26.1. Quick Facts

8.26.2. Company Overview

8.26.3. Product Portfolio

8.26.4. Business Strategies

8.27. TE Connectivity

8.27.1. Quick Facts

8.27.2. Company Overview

8.27.3. Product Portfolio

8.27.4. Business Strategies

8.28. Wakefield Thermal, Inc.

8.28.1. Quick Facts

8.28.2. Company Overview

8.28.3. Product Portfolio

8.28.4. Business Strategies

1. Global Heat Sink Market Research and Analysis by Type, 2024–2035 ($ Million)

2. Global Active Heat Sink Market Research and Analysis by Region, 2024–2035 ($ Million)

3. Global Passive Heat Sink Market Research and Analysis by Region, 2024–2035 ($ Million)

4. Global Hybrid Heat Sink Market Research and Analysis by Region, 2024–2035 ($ Million)

5. Global Heat Sink Market Research and Analysis by Material, 2024–2035 ($ Million)

6. Global Aluminum Heat Sink Market Research and Analysis by Region, 2024–2035 ($ Million)

7. Global Copper Heat Sink Research and Analysis by Region, 2024–2035 ($ Million)

8. Global Other Heat Sink Research and Analysis by Region, 2024–2035 ($ Million)

9. Global Heat Sink Market Research and Analysis by Region, 2024–2035 ($ Million)

10. North American Heat Sink Market Research and Analysis by Country, 2024–2035 ($ Million)

11. North American Heat Sink Market Research and Analysis by Type, 2024–2035 ($ Million)

12. North American Heat Sink Market Research and Analysis by Material, 2024–2035 ($ Million)

13. North American Heat Sink Market Research and Analysis by Application, 2024–2035 ($ Million)

14. European Heat Sink Market Research and Analysis by Country, 2024–2035 ($ Million)

15. European Heat Sink Market Research and Analysis by Type, 2024–2035 ($ Million)

16. European Heat Sink Market Research and Analysis by Material, 2024–2035 ($ Million)

17. European Heat Sink Market Research and Analysis by Application, 2024–2035 ($ Million)

18. Asia-Pacific Heat Sink Market Research and Analysis by Country, 2024–2035 ($ Million)

19. Asia-Pacific Heat Sink Market Research and Analysis by Type, 2024–2035 ($ Million)

20. Asia-Pacific Heat Sink Market Research and Analysis by Material, 2024–2035 ($ Million)

21. Asia-Pacific Heat Sink Market Research and Analysis by Application, 2024–2035 ($ Million)

22. Rest of the World Heat Sink Market Research and Analysis by Region, 2024–2035 ($ Million)

23. Rest of the World Heat Sink Market Research and Analysis by Type, 2024–2035 ($ Million)

24. Rest of the World Heat Sink Market Research and Analysis by Material, 2024–2035 ($ Million)

25. Rest of the World Heat Sink Market Research and Analysis by Application, 2024–2035 ($ Million)

1. Global Heat Sink Market Share by Type, 2024 Vs 2035 (%)

2. Global Active Heat Sink Market Share by Region, 2024 Vs 2035 (%)

3. Global Passive Heat Sink Market Share by Region, 2024 Vs 2035 (%)

4. Global Hybrid Heat Sink Market Share by Region, 2024 Vs 2035 (%)

5. Global Heat Sink Market Share by Material, 2024 Vs 2035 (%)

6. Global Aluminum Heat Sink Market Share by Region, 2024 Vs 2035 (%)

7. Global Copper Heat Sink Market Share by Region, 2024 Vs 2035 (%)

8. Global Other Heat Sink Market Share by Region, 2024 Vs 2035 (%)

9. Global Heat Sink Market Share by Region, 2024 Vs 2035 (%)

10. US Heat Sink Market Size, 2024–2035 ($ Million)

11. Canada Heat Sink Market Size, 2024–2035 ($ Million)

12. UK Heat Sink Market Size, 2024–2035 ($ Million)

13. France Heat Sink Market Size, 2024–2035 ($ Million)

14. Germany Heat Sink Market Size, 2024–2035 ($ Million)

15. Italy Heat Sink Market Size, 2024–2035 ($ Million)

16. Spain Heat Sink Market Size, 2024–2035 ($ Million)

17. Russia Heat Sink Market Size, 2024–2035 ($ Million)

18. Rest of Europe Heat Sink Market Size, 2024–2035 ($ Million)

19. India Heat Sink Market Size, 2024–2035 ($ Million)

20. China Heat Sink Market Size, 2024–2035 ($ Million)

21. Japan Heat Sink Market Size, 2024–2035 ($ Million)

22. South Korea Heat Sink Market Size, 2024–2035 ($ Million)

23. Australia and New Zealand Heat Sink Market Size, 2024–2035 ($ Million)

24. ASEAN Economies Heat Sink Market Size, 2024–2035 ($ Million)

25. Rest of Asia-Pacific Heat Sink Market Size, 2024–2035 ($ Million)

26. Latin America Heat Sink Market Size, 2024–2035 ($ Million)

27. Middle East and Africa Heat Sink Market Size, 2024–2035 ($ Million)

FAQS

The size of the Heat Sink market in 2024 is estimated to be around $6.7 billion.

North America holds the largest share in the Heat Sink market.

Leading players in the Heat Sink market include Advanced Thermal Solutions Inc., Body Corp., CeramTech GmbH, KURL Technology Corp., TE Connectivity, among others.

Heat Sink market is expected to grow at a CAGR of 6.5% from 2025 to 2035.

The Heat Sink Market is driven by rising demand for thermal management in high-performance electronics and energy-efficient systems.