Gas Analyzer Market

Global Gas Analyzer Market Size, Share & Trends Analysis Report, By Product Type (Fixed and Portable), By Technology (Paramagnetic, Electrochemical, Zirconia, Infrared, and Others), By End-User Industry (Pharmaceutical, Oil and Gas, Energy and Utility, Chemical, Food and Beverage, Water and Wastewater, and Others) and Forecast, 2020-2026

The global gas analyzer market is estimated to grow at a CAGR of nearly 5.0% during the forecast period. The major factors contributing to the market growth include the rising oil and gas industry and rising investment in waster and wastewater projects. As per the International Energy Agency (IEA), in 2019, the global upstream oil and gas investment is $505 billion, a rise of 6% in nominal terms compared to the previous year. The global demand for oil rose by 900 kb/d (Thousand Barrels Per Day) year-over-year in the third quarter of 2019. Approximately three-quarters of the growth reported in China. The demand for oil in India increased to 135 kb/d.

The global oil demand has significantly led owing to the increasing demand for fuel in automobile and aviation industry. The increasing oil production has increased the adoption of gas analyzers. Gas analyzers are used to identify valuable fracking zones. Mineral layer porosity and rock layer boundaries are some physicochemical characteristics that can considerably affect the oil well efficiency and inform the effective payoff for using hydraulic fracturing. Gas analyzers can be utilized significantly for monitoring of drilling media to assess hydrocarbon distribution, layer properties, fracking zone quality, and petroleum pay zones.

In this manner, the use of gas analyzers can improve the profits in oil exploration, as well as supports to adhere with the stringent environmental regulations through minimizing the carbon footprint of the oil and gas industry by drastically reducing waste. The applications where such analyzers are used comprise Nitrogen Oxide (NOx) reduction & ammonia slip, continuous emissions monitoring, natural gas quality, ethylene production & purity measurements, and combustion control. Therefore, the rising investment in oil and gas exploration activity coupled with the stringent environmental regulations is offering an opportunity for market growth. Further, technological innovations are expected to further accelerate the adoption of gas analyzers.

Market Segmentation

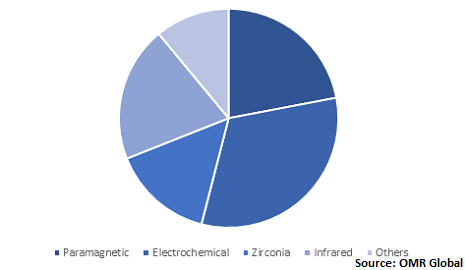

The global gas analyzer market is segmented based on product type, technology, and end-user industry. Based on product type, the market is classified into fixed and portable. Based on technology, the market is classified into paramagnetic, electrochemical, zirconia, infrared, and others. Based on end-user industry, the market is classified into pharmaceutical, oil and gas, energy and utility, chemical, food and beverage, water and wastewater, and others.

Infrared gas analyzer has been gaining significance across the end-user verticals

Infrared gas analyzers are used to measure the quantity of several gases. These gas analyzers are capable of measuring the concentrations of Nitric oxide (NO), Sulfur dioxide (SO2), Carbon dioxide (CO2), Carbon monoxide (CO), Methane (CH4) and Oxygen (O2) components in the sample gas. CO2, CH4, NO, SO2, and CO are measured by the non-dispersive infrared method (NDIR). Dispersion infrared analyzers are utilized in laboratories as spectrophotometers, while NDIR is used for constant measurement in industrial applications. It can monitor emission levels over a longer duration and are regarded as standard detectors to measure gas in any environment. Therefore, it is being successfully used for constant chemical analysis in the industrial processes.

Global Gas Analyzer Market Share by Technology, 2019 (%)

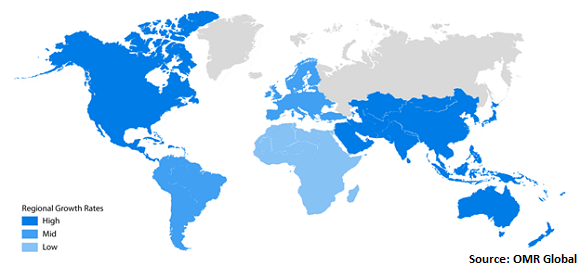

Regional Outlook

The global gas analyzer market is segmented based on four major regions, including North America, Europe, Asia-Pacific, and Rest of the World (RoW). Asia-Pacific is estimated to witness considerable growth during the forecast period owing to the rising industrialization and increasing oil and gas industry in the region. As per the International Brand Equity Foundation (IBEF), in 2018, India had 4.5 thousand million barrels of proven oil reserves and produced 39.5 million tonnes. In India, the petroleum and natural gas sector attracted FDI amounted to $7.1 billion during the period, April 2000 and December 2019. This, in turn, will support the oil and gas exploration activity in the country and thereby will increase the adoption of gas analyzers to support measure process efficiency and support the effective removal of sulphur and other contaminants.

Global Gas Analyzer Market Growth, by Region 2020-2026

Market Players Outlook

The major players operating in the market include ABB Ltd., Siemens AG, Honeywell International Inc., Emerson Electric Co., and Fuji Electric Co., Ltd. The market players are constantly focusing on gaining major market share by adopting mergers & acquisitions, geographical expansion, product launch, and partnerships and collaborations. For instance, in January 2019, Nederman Holding AB declared that it has completed a deal to acquire Gasmet Technologies Oy, a provider of Fourier-transform infrared (FTIR) gas analysis solutions for both mercury and continuous emission monitoring systems and portable gas analyzers.

The company’s portables are ideal for a comprehensive range of industries including engine exhaust and flue gas measurement, ambient air monitoring, heat treating atmosphere, as well as for residential, commercial, and industrial settings. With this acquisition, Gasmet will become part of Nederman’s Monitoring & Control Technology division where the monitoring technology of Gasmet will be highly complementary to that of both Auburn FilterSense acquired in 2018 and Neo Monitors acquired by Nerderman in 2017. This acquisition will reinforce Nederman’s position in Monitoring & Control Technology division and thereby will enable Nederman to further leverage its Clean Air products, solutions and services going forward.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global gas analyzer market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. ABB Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Siemens AG

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Honeywell International Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Emerson Electric Co.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Fuji Electric Co., Ltd.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Gas Analyzer Market by Product Type

5.1.1. Fixed

5.1.2. Portable

5.2. Global Gas Analyzer Market by Technology

5.2.1. Paramagnetic

5.2.2. Electrochemical

5.2.3. Zirconia

5.2.4. Infrared

5.2.5. Others

5.3. Global Gas Analyzer Market by End-User Industry

5.3.1. Pharmaceutical

5.3.2. Oil and Gas

5.3.3. Energy and Utility

5.3.4. Chemical

5.3.5. Food and Beverage

5.3.6. Water and Wastewater

5.3.7. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ABB Ltd.

7.2. AMETEK, Inc.

7.3. California Analytical Instruments, Inc.

7.4. Cambridge Sensotec Ltd.

7.5. Drägerwerk AG & Co. KGaA

7.6. Emerson Electric Co.

7.7. Enerac

7.8. ENOTEC GmbH

7.9. Figaro Engineering Inc.

7.10. Fuji Electric Co., Ltd.

7.11. HNL Systems Pvt. Ltd.

7.12. Honeywell International Inc.

7.13. Mettler-Toledo India Pvt. Ltd.

7.14. Nederman Holding AB

7.15. Servomex Group Ltd.

7.16. Siemens AG

7.17. Systech Instruments Ltd and Illinois Instruments, Inc.

7.18. Teledyne Analytical Instruments

7.19. Tenova S.p.A.

7.20. Testo SE & Co. KGaA

7.21. Thermo Fisher Scientific Inc.

7.22. Yokogawa Electric Corp.

1. GLOBAL GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

2. GLOBAL FIXED GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL PORTABLE GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

5. GLOBAL PARAMAGNETIC GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL ELECTROCHEMICAL GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL ZIRCONIA GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL INFRARED GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL OTHER GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2019-2026 ($ MILLION)

11. GLOBAL GAS ANALYZER IN PHARMACEUTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL GAS ANALYZER IN OIL AND GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL GAS ANALYZER IN ENERGY AND UTILITY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL GAS ANALYZER IN CHEMICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

15. GLOBAL GAS ANALYZER IN FOOD AND BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

16. GLOBAL GAS ANALYZER IN WATER AND WASTEWATER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

17. GLOBAL GAS ANALYZER IN OTHER END-USER INDUSTRIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

18. GLOBAL GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

19. NORTH AMERICAN GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

20. NORTH AMERICAN GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

21. NORTH AMERICAN GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

22. NORTH AMERICAN GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2019-2026 ($ MILLION)

23. EUROPEAN GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

24. EUROPEAN GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

25. EUROPEAN GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

26. EUROPEAN GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2019-2026 ($ MILLION)

27. ASIA-PACIFIC GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

28. ASIA-PACIFIC GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

29. ASIA-PACIFIC GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

30. ASIA-PACIFIC GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2019-2026 ($ MILLION)

31. REST OF THE WORLD GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

32. REST OF THE WORLD GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

33. REST OF THE WORLD GAS ANALYZER MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2019-2026 ($ MILLION)

1. GLOBAL GAS ANALYZER MARKET SHARE BY PRODUCT TYPE, 2019 VS 2026 (%)

2. GLOBAL GAS ANALYZER MARKET SHARE BY TECHNOLOGY, 2019 VS 2026 (%)

3. GLOBAL GAS ANALYZER MARKET SHARE BY END-USER INDUSTRY, 2019 VS 2026 (%)

4. GLOBAL GAS ANALYZER MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US GAS ANALYZER MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA GAS ANALYZER MARKET SIZE, 2019-2026 ($ MILLION)

7. UK GAS ANALYZER MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE GAS ANALYZER MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY GAS ANALYZER MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY GAS ANALYZER MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN GAS ANALYZER MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE GAS ANALYZER MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA GAS ANALYZER MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA GAS ANALYZER MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN GAS ANALYZER MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC GAS ANALYZER MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD GAS ANALYZER MARKET SIZE, 2019-2026 ($ MILLION)