Gastrointestinal Catheters Market

Gastrointestinal Catheters Market Size, Share & Trends Analysis Report by Product Type (Nasogastric Tubes, Percutaneous Endoscopic Gastrostomy (PEG) Tube, Gastrostomy Tubes (G-Tubes), Jejunostomy Tubes (J-Tubes), Gastrojejunostomy Tubes (GJ-Tubes), Rectal Catheters, Ileus Tube, and Others), and by Application (Enteral Feeding, Decompression and Drainage, Diagnostics and Therapeutic ), and by End-User (Hospitals & Clinics, Ambulatory Surgical Centers (ASCs), Long-Term Care Facilities, and Home Care Settings) Forecast Period (2025-2035)

Industry Overview

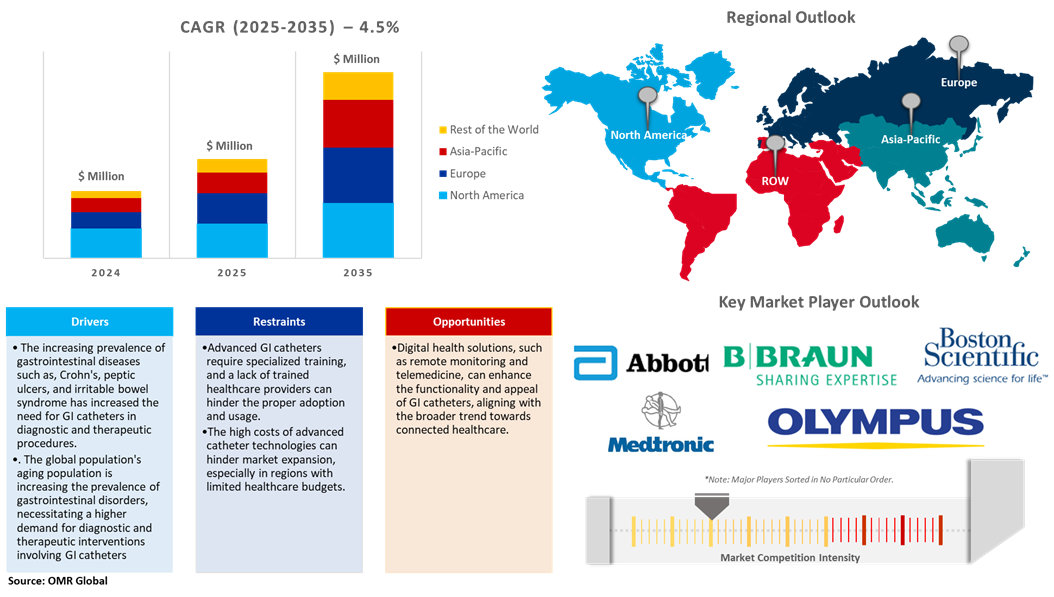

Gastrointestinal catheters market is anticipated to reach $5.5 billion in 2035 from $3.4 billion in 2024, growing at a CAGR of 4.5% during the forecast period (2025-2035). The increase in gastrointestinal diseases, the need for minimally invasive procedures, advancement in catheter technology, and the increase in the population of elderly people are all drivers of the increase in GI disorders. Healthcare expenditure and infrastructure in emerging economies are increasing, coupled with awareness of enteral feeding tubes. Government policies and regulatory support ensure the safety and efficacy of GI catheters.

Market Dynamics

Technological Advancements

Advances in catheter technology and materials have produced flexible, durable, biocompatible medical devices with antimicrobial surfaces and onboard sensors, propelling growth in the market for diagnostic and therapeutic uses. For instance, in May 2024, Laborie launched the Solar Compact System and Solar Anorectal Manometry Catheter, the first disposable HRAM catheters, for improved gastrointestinal diagnostics. The instruments record static and dynamic pressures in the lower gastrointestinal tract, increasing diagnostic potential for defecatory disorders and pelvic-floor dysfunction. The cost-effective and portable solar compact system simplifies pharyngeal, esophageal, and anorectal motility studies, following the International Anorectal Physiology Working Group protocol. The software provides customizable procedures and reports.

Rising GI Disorders

Crohn's disease and ulcerative colitis are inflammatory bowel diseases that result in chronic inflammation and damage to the gastrointestinal tract and produce symptoms such as chronic diarrhea, abdominal pain, and weight loss. Crohn's disease involves the gastrointestinal tract, the ileum, and the colon. It appears in patches, affecting some areas and leaving others untouched. Furthermore, inflammation can extend through the bowel wall. The prevalence of gastrointestinal disorders such as Crohn's disease, GERD, and colorectal cancer is on the rise. According to the Crohn's & Colitis Foundation, in 2024, inflammatory bowel diseases (IBD), including Crohn's disease and ulcerative colitis, affected approximately 1.6 million Americans, with the majority diagnosed before age 35. The chronic conditions are not curable; however, they are treatable, influencing patients' quality of life and creating significant economic burdens. According to the Olmsted County study, 780,000 individuals in the US have Crohn's disease, and 907,000 have ulcerative colitis, most of whom are diagnosed between 15 and 35 years of age; the median age of diagnosis is 34.9 years for ulcerative colitis and 29.5 years for Crohn's disease.

Market Segmentation

- Based on the product type, the market is segmented into nasogastric tubes, percutaneous endoscopic gastrostomy (PEG) tube, gastrostomy tubes (G-Tubes), jejunostomy tubes (J-Tubes), gastrojejunostomy tubes (GJ-Tubes), rectal catheters, ileus tube, and others (biliary drainage catheter, ERCP catheter, percutaneous endoscopic jejunostomy (PEJ) tube, and other).

- Based on the application, the market is segmented into enteral feeding, decompression and drainage, diagnostics, and therapeutic.

- Based on the end-user, the market is segmented into hospitals & clinics, ambulatory surgical centers (ASCs), long-term care facilities, and home care settings.

Percutaneous Endoscopic Gastrostomy (PEG) Tube Segment to Lead the Market with the Largest Share

A PEG tube is a surgical procedure that inserts a feeding tube directly into the stomach for long-term nutrition when oral intake is not feasible or sufficient. A PEG tube, or G-tube, is a feeding tube for patients with dysphagia, inadequate nutrition, or body nutrient processing conditions. PEG tube insertion is a minimally invasive procedure used for conditions such as brain injury, head and neck cancer, stroke, chronic loss of appetite, neurological disorders, burn, cystic fibrosis, abdominal cancer, prolonged coma, and HIV/AIDS. PEG tubes offer a safer, more effective option compared to nasogastric tubes and laparotomy-assisted feeding by decreasing the risk of aspiration, distress, and improving the quality of life of patients and caregivers.

Diagnostics: A Key Segment in Market Growth

Gastrointestinal catheters are essential medical devices for diagnosing, monitoring, and treating gastrointestinal tract disorders, evaluating gastrointestinal motility, detecting abnormalities, and guiding therapeutic intervention.GI catheters are employed in a range of diagnostic uses, such as esophageal manometry, antroduodenal manometry, colonic manometry, pH and impedance monitoring, nutritional and enteral access, and endoscopic and radiologic guidance. It is used to monitor esophageal pressure, assess stomach and small bowel motor function, detect acid reflux, and facilitate nutrition in patients with swallowing dysfunction. It further assists in contrast studies and endoscopic retrograde cholangiopancreatography for imaging and diagnostic reasons. GI catheters yield reliable diagnostic information, minimally invasive testing, treatment planning, and long-term gastrointestinal function monitoring, allowing proper diagnosis, treatment planning, and continuous ambulatory monitoring.

Regional Outlook

The global gastrointestinal catheters market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

Rising Incidence of Gastrointestinal Tract (GIT) cancers in Asia-Pacific

The increase in GIT cancer incidence across the globe has promoted increased demand for state-of-the-art diagnostic and treatment technologies, accelerating the market growth. As reported by the Indian Government, in November 2024, researchers at IITGN designed a new hydrogel platform to enhance the treatment process of GIT cancers. The hydrogel developed is made in India, and it forms a stable cushion during endoscopic interventions, boosting precise and secure treatments. This innovation can revolutionize disease-responsive intelligent drug delivery systems and enhance patient quality of life and survival. The gel material may sustain its cushion-like structure, retaining high amounts of water and responding to the increase in GIT cancers globally.

North America Region Dominates the Market with Major Share

North America holds a significant share, owing to the growing prevalence of gastrointestinal disorders necessitates advanced diagnostic and therapeutic tools, driving market growth in specialized catheters. For instance, in January 2025, QIAGEN secured US clearance for its first QIAstat-Dx mini gastrointestinal panel, the QIAstat-Dx Gastrointestinal Panel 2 Mini B&V (bacterial and viral), which is designed to provide fast answers for outpatient diagnosis of gastrointestinal conditions. The panel covers five causes of gastrointestinal illness recommended by the Infectious Diseases Society of America (IDSA), such as Campylobacter, Salmonella, Shiga-like toxin E. coli (STEC), Shigella, and Norovirus. The panel is the first in a series of QIAstat-Dx Gastrointestinal Panel tests for clinical use, supporting QIAGEN's strategy to improve patient treatment options in this important market. It intends to file the QIAstat-Dx rise high-capacity instrument version for FDA approval in early 2025.

Market Players Outlook

The major companies operating in the global gastrointestinal catheters market include Abbott Laboratories, B. Braun SE, Boston Scientific Corp., Medtronic Inc., and Olympus Corp., among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In January 2024, QIAGEN introduced two syndromic testing panels for its QIAstat-Dx instruments in India, namely the Gastrointestinal Panel 2 and Meningitis/Encephalitis Panel. These panels, which obtained regulatory approval from the Central Drugs Standard Control Organization (CDSCO), allow healthcare professionals to diagnose patients better, quicker, and more easily. The system of QIAstat-Dx employs cost-saving cartridges, multiplex real-time PCR, and simple-to-view cycle threshold levels. The Meningitis/Encephalitis Panel tests for 15 viral, bacterial, and fungal pathogens in patients with a suspected central nervous system infection.

- In August 2024, ATL Technology acquired MDCM Solutions, a Minnesota-based business that specializes in advanced catheter technologies for minimally invasive medical devices. The purchase is a knowledge center for advanced catheter extrusion, braiding, coiling, FEP heat shrink, product development, and process qualification for ATL Technology's global operations.

- In August 2024, Neptune Medical announced its subsidiary, Jupiter Endovascular, after a $97 million Series D round. The investment is funding a pivotal trial of pulmonary embolism and additional clinical uses of Neptune Medical's Endoportal technology that can robotically guide catheters.

- In December 2024, AIG Hospitals introduced PillBotT, a robotic endoscopy capsule technology designed by Endiatx, though clinical trials and FDA clearance were awaited in India.

- In August 2022, Obsidio was acquired by Boston Scientific, a private firm that invented GEM technology for embolization of blood vessels in peripheral vasculature, a minimally invasive intervention employed to arrest hemorrhage and stabilize malformations.

- In March 2022, Guerbet aimed to double its microcatheters and launch a new guidewire line, providing a comprehensive portfolio of interventional imaging and embolization products. SeQure and DraKon technologies deliver improved navigation, flow-directed embolization, and an increased amount of beads.

- In April 2022, Laborie Medical Technologies acquired GI Supply, a top distributor of specialty endoscopy and paracentesis products for gastroenterologists, colorectal surgeons, and interventional radiologists.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global gastrointestinal catheters market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Gastrointestinal Catheters Market Sales Analysis – Product Type| Application| End-User ($ Million)

• Gastrointestinal Catheters Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Gastrointestinal Catheters Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Gastrointestinal Catheters Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For the Global Gastrointestinal Catheters Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For the Global Gastrointestinal Catheters Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Gastrointestinal Catheters Market Revenue and Share by Manufacturers

• Gastrointestinal Catheters Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Abbott Laboratories

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. B. Braun SE

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Boston Scientific Corp.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Medtronic Inc.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Olympus Corp.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Gastrointestinal Catheters Market Sales Analysis by Product Type ($ Million)

5.1. Nasogastric Tubes

5.2. Percutaneous Endoscopic Gastrostomy (PEG) Tube

5.3. Gastrostomy Tubes (G-Tubes)

5.4. Jejunostomy Tubes (J-Tubes)

5.5. Gastrojejunostomy Tubes (GJ-Tubes)

5.6. Rectal Catheters

5.7. Ileus Tube

5.8. Others (Biliary Drainage Catheter, ERCP Catheter, Percutaneous Endoscopic Jejunostomy (PEJ) Tube, and Other)

6. Global Gastrointestinal Catheters Market Sales Analysis by Application ($ Million)

6.1. Enteral Feeding

6.2. Decompression and Drainage

6.3. Diagnostics

6.4. Therapeutic

7. Global Gastrointestinal Catheters Market Sales Analysis by End-User ($ Million)

7.1. Hospitals & Clinics

7.2. Ambulatory Surgical Centers (ASCs)

7.3. Long-Term Care Facilities

7.4. Home Care Settings

8. Regional Analysis

8.1. North American Gastrointestinal Catheters Market Sales Analysis – Product Type| Application End-User| Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Gastrointestinal Catheters Market Sales Analysis – Product Type| Application| End-User| Country ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Gastrointestinal Catheters Market Sales Analysis – Product Type| Application| End-User| Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Gastrointestinal Catheters Market Sales Analysis – Product Type| Application| End-User| Country ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Abbott Laboratories

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. Ambu A/S

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. B. Braun SE

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Boston Scientific Corp.

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. ConMed Corp.

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Cook Group Inc.

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. Edwards Lifesciences Corp.

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. Kaneka Corp.

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. KARL STORZ

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. Medical Measurement Systems BV

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Medtronic Inc.

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. MICRO-TECH ENDOSCOPY USA INC.

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. Olympus Corp.

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. PENTAX Europe GmbH

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Poly Medicure Ltd.

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. Stryker Corp.

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. Zeon Corp.

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Zeus Company LLC

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

1. Global Gastrointestinal Catheters Market Research And Analysis By Product Type, 2024-2035 ($ Million)

2. Global Nasogastric Tubes Catheters Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Percutaneous Endoscopic Gastrostomy (PEG) Tube Catheters Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Gastrostomy Tubes (G-Tubes) Catheters Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Jejunostomy Tubes (J-Tubes) Catheters Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Gastrojejunostomy Tubes (GJ-Tubes) Catheters Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Rectal Catheters Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Ileus Tube Catheters Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Other Gastrointestinal Catheters Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Gastrointestinal Catheters Market Research And Analysis By Application, 2024-2035 ($ Million)

11. Global Gastrointestinal Catheters For Enteral Feeding Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Gastrointestinal Catheters For Decompression and Drainage Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Gastrointestinal Catheters For Diagnostics Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Gastrointestinal Catheters For Therapeutic Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Gastrointestinal Catheters Market Research And Analysis By End-User, 2024-2035 ($ Million)

16. Global Gastrointestinal Catheters For Hospitals & Clinics Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global Gastrointestinal Catheters For Ambulatory Surgical Centers (ASCs) Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global Gastrointestinal Catheters For Long-Term Care Facilities Market Research And Analysis By Region, 2024-2035 ($ Million)

19. Global Gastrointestinal Catheters For Home Care Settings Market Research And Analysis By Region, 2024-2035 ($ Million)

20. Global Gastrointestinal Catheters Market Research And Analysis By Region, 2024-2035 ($ Million)

21. North American Gastrointestinal Catheters Market Research And Analysis By Country, 2024-2035 ($ Million)

22. North American Gastrointestinal Catheters Market Research And Analysis By Product Type, 2024-2035 ($ Million)

23. North American Gastrointestinal Catheters Market Research And Analysis By Application, 2024-2035 ($ Million)

24. North American Gastrointestinal Catheters Market Research And Analysis By End-User, 2024-2035 ($ Million)

25. European Gastrointestinal Catheters Market Research And Analysis By Country, 2024-2035 ($ Million)

26. European Gastrointestinal Catheters Market Research And Analysis By Product Type, 2024-2035 ($ Million)

27. European Gastrointestinal Catheters Market Research And Analysis By Application, 2024-2035 ($ Million)

28. European Gastrointestinal Catheters Market Research And Analysis By End-User, 2024-2035 ($ Million)

29. Asia-Pacific Gastrointestinal Catheters Market Research And Analysis By Country, 2024-2035 ($ Million)

30. Asia-Pacific Gastrointestinal Catheters Market Research And Analysis By Product Type, 2024-2035 ($ Million)

31. Asia-Pacific Gastrointestinal Catheters Market Research And Analysis By Application, 2024-2035 ($ Million)

32. Asia-Pacific Gastrointestinal Catheters Market Research And Analysis By End-User, 2024-2035 ($ Million)

33. Rest Of The World Gastrointestinal Catheters Market Research And Analysis By Region, 2024-2035 ($ Million)

34. Rest Of The World Gastrointestinal Catheters Market Research And Analysis By Product Type, 2024-2035 ($ Million)

35. Rest Of The World Gastrointestinal Catheters Market Research And Analysis By Application, 2024-2035 ($ Million)

36. Rest Of The World Gastrointestinal Catheters Market Research And Analysis By End-User, 2024-2035 ($ Million)

1. Global Gastrointestinal Catheters Market Research And Analysis By Product Type, 2024 Vs 2035 (%)

2. Global Nasogastric Tubes Catheters Market Share By Region, 2024 Vs 2035 (%)

3. Global Percutaneous Endoscopic Gastrostomy (PEG) Tube Catheters Market Share By Region, 2024 Vs 2035 (%)

4. Global Nasogastric Tubes Catheters Market Share By Region, 2024 Vs 2035 (%)

5. Global Gastrostomy Tubes (G-Tubes) Catheters Market Share By Region, 2024 Vs 2035 (%)

6. Global Jejunostomy Tubes (J-Tubes) Catheters Market Share By Region, 2024 Vs 2035 (%)

7. Global Gastrojejunostomy Tubes (GJ-Tubes) Catheters Market Share By Region, 2024 Vs 2035 (%)

8. Global Rectal Catheters Market Share By Region, 2024 Vs 2035 (%)

9. Global Ileus Tube Catheters Market Share By Region, 2024 Vs 2035 (%)

10. Global Other Type Gastrointestinal Catheters Market Share By Region, 2024 Vs 2035 (%)

11. Global Gastrointestinal Catheters Market Research And Analysis By Application, 2024 Vs 2035 (%)

12. Global Gastrointestinal Catheters For Enteral Feeding Market Share By Region, 2024 Vs 2035 (%)

13. Global Gastrointestinal Catheters For Decompression and Drainage Market Share By Region, 2024 Vs 2035 (%)

14. Global Gastrointestinal Catheters For Diagnostics Market Share By Region, 2024 Vs 2035 (%)

15. Global Gastrointestinal Catheters For Therapeutic Market Share By Region, 2024 Vs 2035 (%)

16. Global Gastrointestinal Catheters Market Research And Analysis By End-User, 2024 Vs 2035 (%)

17. Global Gastrointestinal Catheters For Hospitals & Clinics Market Share By Region, 2024 Vs 2035 (%)

18. Global Gastrointestinal Catheters For Ambulatory Surgical Centers (ASCs) Market Share By Region, 2024 Vs 2035 (%)

19. Global Gastrointestinal Catheters For Long-Term Care Facilities Market Share By Region, 2024 Vs 2035 (%)

20. Global Gastrointestinal Catheters For Home Care Settings Market Share By Region, 2024 Vs 2035 (%)

21. Global Gastrointestinal Catheters Market Share By Region, 2024 Vs 2035 (%)

22. US Gastrointestinal Catheters Market Size, 2024-2035 ($ Million)

23. Canada Gastrointestinal Catheters Market Size, 2024-2035 ($ Million)

24. UK Gastrointestinal Catheters Market Size, 2024-2035 ($ Million)

25. France Gastrointestinal Catheters Market Size, 2024-2035 ($ Million)

26. Germany Gastrointestinal Catheters Market Size, 2024-2035 ($ Million)

27. Italy Gastrointestinal Catheters Market Size, 2024-2035 ($ Million)

28. Spain Gastrointestinal Catheters Market Size, 2024-2035 ($ Million)

29. Russia Gastrointestinal Catheters Market Size, 2024-2035 ($ Million)

30. Rest Of Europe Gastrointestinal Catheters Market Size, 2024-2035 ($ Million)

31. India Gastrointestinal Catheters Market Size, 2024-2035 ($ Million)

32. China Gastrointestinal Catheters Market Size, 2024-2035 ($ Million)

33. Japan Gastrointestinal Catheters Market Size, 2024-2035 ($ Million)

34. South Korea Gastrointestinal Catheters Market Size, 2024-2035 ($ Million)

35. ASEAN Gastrointestinal Catheters Market Size, 2024-2035 ($ Million)

36. Australia and New Zealand Gastrointestinal Catheters Market Size, 2024-2035 ($ Million)

37. Rest Of Asia-Pacific Gastrointestinal Catheters Market Size, 2024-2035 ($ Million)

38. Latin America Gastrointestinal Catheters Market Size, 2024-2035 ($ Million)

39. Middle East And Africa Gastrointestinal Catheters Market Size, 2024-2035 ($ Million)

FAQS

The size of the Gastrointestinal Catheters Market in 2024 is estimated to be around $3.4 billion.

North America holds the largest share in the Gastrointestinal Catheters Market.

Leading players in the Gastrointestinal Catheters Market include Abbott Laboratories, B. Braun SE, Boston Scientific Corp., Medtronic Inc., and Olympus Corp., among others.

Gastrointestinal Catheters Market is expected to grow at a CAGR of 4.5% from 2025 to 2035.

The Gastrointestinal Catheters Market is growing due to rising digestive disorders, demand for minimally invasive procedures, and advancements in catheter technology.