Respiratory Catheters Market

Respiratory Catheters Market Size, Share & Trends Analysis Report by Type (Suction Catheters, Airway Exchange Catheters, Pulmonary Artery Catheters (PACs), and Others), and by End-User (Hospitals, Ambulatory Care Centers, and Homecare Settings) Forecast Period (2025-2035)

Industry Overview

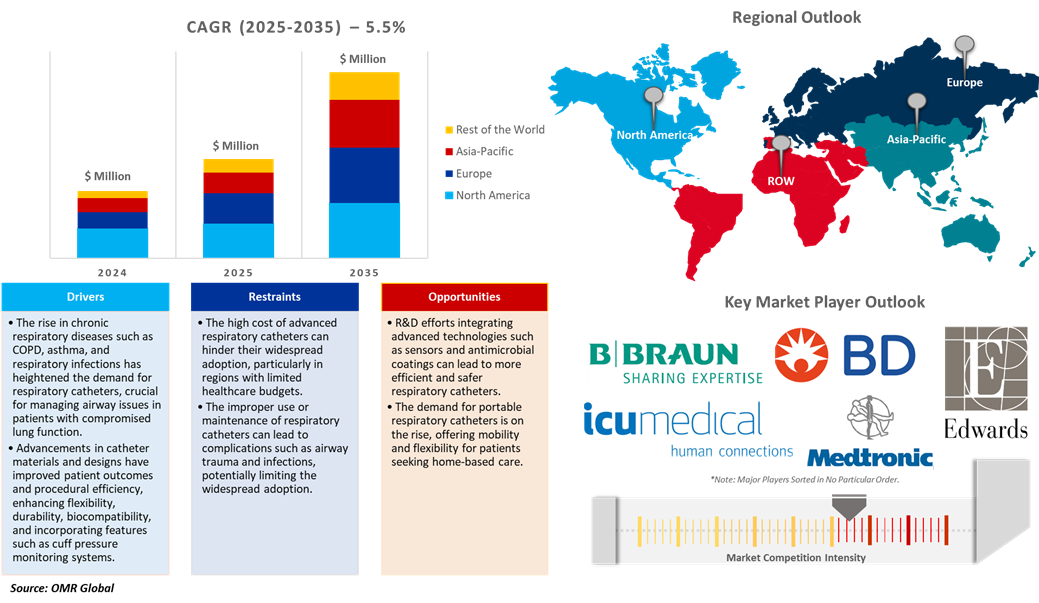

Respiratory catheters market was valued at $8,240 million in 2024 and is projected to reach $14,839 million in 2035, witnessing a CAGR of 5.5% during the forecast period (2025-2035). The growing incidence of respiratory illnesses, aging population, technological innovation, rising ICU admissions, and home healthcare needs are the factors leading to the increased respiratory complications. Moreover, increased air pollution, growing healthcare infrastructure, and government policies are factors leading to this problem.

Market Dynamics

Increasing Prevalence of Respiratory Diseases

Chronic Obstructive Pulmonary Disease (COPD), additionally referred to as emphysema or chronic bronchitis, is a common lung disease that features limited airflow and shortness of breath. COPD, which is caused by smoking and air pollution, causes damage to the lungs, coughing, shortness of breath, wheezing, and tiredness, increasing the risk of other diseases. The expansion in chronic respiratory illnesses, such as COPD, asthma, and RDS, is enhancing demand for respiratory catheters, fueled by air pollution, smoking behaviors, and work hazards. As per the World Health Organization, in November 2024, COPD is the fourth most prominent cause of death globally, that is accountable for 3.5 million deaths, which accounts for approximately 5% of total global deaths. In low- and middle-income countries, almost 90% of COPD mortality in individuals under the age of 70 takes place, and it is the eighth most important cause of poor health globally, in terms of disability-adjusted life years. While tobacco smoking is responsible for more than 70% of COPD in high-income countries, in LMICs, it is responsible for 30–40% of cases, and household air pollution is an important risk factor.

Technological Advancements

Technological innovation, including stent retrievers and aspiration systems, has enhanced the safety and efficacy of thrombectomy procedures, accelerating market demand for healthcare providers and patients. For instance, in January 2025, Argon Medical Devices recruited the first US study patient to investigate a new catheter-based device in the treatment of blood clots in the lungs. The Cleaner Pro thrombectomy system is a catheter-based aspiration technique that removes blood clots efficiently and rapidly, having the potential to enhance patient outcomes. The Cleaner Pro thrombectomy system, presented on the market under the commercial name Cleaner Vac thrombectomy system, aims to remove new, soft thrombi and emboli from peripheral venous vessels.

Market Segmentation

- Based on the type, the market is segmented into suction catheters, airway exchange catheters, pulmonary artery catheters (PACs), and others (central venous catheters (CVCs), peripherally inserted central catheters (PICCs), tunneled central venous catheters, and implantable catheters).

- Based on the end-user, the market is segmented into hospitals, ambulatory care centers, and home care settings.

Suction Catheters Segment to Lead the Market with the Largest Share

A suction catheter is a health device employed in the removal of fluids from a patient's airway, ensuring clear breathing by passing it into the trachea or other airway structures. Suction catheters are essential in healthcare settings for airway clearance, endotracheal and tracheostomy suctioning, postoperative care, emergencies, and managing chronic respiratory conditions. It removes mucus, blood, and secretions from the respiratory tract, prevents obstruction and infections, and helps patients with respiratory conditions.

Ambulatory Care Centers: A Key Segment in Market Growth

The market growth is driven by a surge in preference for less invasive medical interventions, particularly catheter-based treatments, that offer reduced recovery times and complication rates. For instance, in March 2025, Egypt's Ministry of Health and Population initiated a catheter-based pulmonary valve implantation system at the National Heart Institute, providing an open-heart operation alternative that is safer for individuals suffering from serious pulmonary valve stenosis or regurgitation, lowering risks from surgery, reducing hospitalization stays, and eliminating waiting lists.

Regional Outlook

The global respiratory catheters market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

Technological Advancements in Asia-Pacific

Technological advancements have revolutionized the production of more efficient and user-friendly respiratory catheters, boosting their adoption in clinical settings and driving market growth. For instance, in February 2024, Royal Philips installed 1500+ Cath Labs in the Indian subcontinent, a milestone in its vision to develop innovative solutions for improved health outcomes, enhanced patient experience, staff experience, and reduced care costs. The firm has installed its Azurion Cath Labs at key locations in the country, such as Delhi, Bangalore, Mumbai, Kolkata, Hyderabad, Chennai, and Pune. Philips further introduced two trailblazing solutions to help Indian patients deal with the Cardiovascular Disease (CVD) burden in India, innovative solutions to respond to the expanding prevalence of coronary artery disease in India, such as the OmniWire and the Image Guided Therapy Mobile C-arm System, that maximize clinical effectiveness through streamlined workflow and state-of-the-art software solutions.

North America Region Dominates the Market with Major Share

North America holds a significant share, owing to the increasing preference for home-based healthcare services, driven by convenience, cost-effectiveness, and reduced hospital-acquired infections, which is driving the market growth for respiratory devices. For instance, in February 2025, BD invested $10 million in US manufacturing to enhance the production of life-critical syringes, needles, and IV catheters. New lines for the manufacture of needles and syringes have been placed at Connecticut and Nebraska plants, raising the capacity of the company by more than 40% and conventional syringes by 50%. In 2025, the company intended to invest $30 million in Utah for the expansion of IV lines.

Market Players Outlook

The major companies operating in the global respiratory catheters market include B. Braun SE, Becton, Dickinson, and Co., Edwards Lifesciences Corp., ICU Medical, Inc., and Medtronic Inc., among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Development

- In February 2024, J&J MedTech launched the Cereglide 92 catheter system, a 0.092-inch catheter system used to treat acute ischemic stroke, enabling doctors to create large distal access and decrease flow in the M1 during interventional device placement.

- In June 2023, SunMed intended to buy Avanos Medical's respiratory health division for $110 million, part of a product simplification strategy to concentrate on areas where it can excel, reinforcing its presence as an anesthesia and respiratory consumables provider.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global respiratory catheters market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Respiratory Catheters Market Sales Analysis – Type | End-User ($ Million)

• Respiratory Catheters Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Respiratory Catheters Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Respiratory Catheters Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For the Global Respiratory Catheters Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For the Global Respiratory Catheters Market: Impact Analysiss

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Respiratory Catheters Market Revenue and Share by Manufacturers

• Respiratory Catheters Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. B. Braun SE

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Becton, Dickinson, and Co.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Edwards Lifesciences Corp.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. ICU Medical, Inc.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Medtronic Inc.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Respiratory Catheters Market Sales Analysis by Type ($ Million)

5.1. Suction Catheters

5.2. Airway Exchange Catheters

5.3. Pulmonary Artery Catheters (PACs)

5.4. Others (Central Venous Catheters (CVCs), Peripherally Inserted Central Catheters (PICCs), Tunneled Central Venous Catheters, and Implantable Catheters)

6. Global Respiratory Catheters Market Sales Analysis by End-User ($ Million)

6.1. Hospitals

6.2. Ambulatory Care Centers

6.3. Homecare Settings

7. Regional Analysis

7.1. North American Respiratory Catheters Market Sales Analysis – Type | End-User| Country ($ Million)

• Macroeconomic Factors for North America

7.1.1. United States

7.1.2. Canada

7.2. European Respiratory Catheters Market Sales Analysis – Type | End-User| Country ($ Million)

• Macroeconomic Factors for Europe

7.2.1. UK

7.2.2. Germany

7.2.3. Italy

7.2.4. Spain

7.2.5. France

7.2.6. Russia

7.2.7. Rest of Europe

7.3. Asia-Pacific Respiratory Catheters Market Sales Analysis – Type | End-User| Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

7.3.1. China

7.3.2. Japan

7.3.3. South Korea

7.3.4. India

7.3.5. Australia & New Zealand

7.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

7.3.7. Rest of Asia-Pacific

7.4. Rest of the World Respiratory Catheters Market Sales Analysis – Type | End-User| Country ($ Million)

• Macroeconomic Factors for the Rest of the World

7.4.1. Latin America

7.4.2. Middle East and Africa

8. Company Profiles

8.1. 3M Co.

8.1.1. Quick Facts

8.1.2. Company Overview

8.1.3. Product Portfolio

8.1.4. Business Strategies

8.2. B. Braun SE

8.2.1. Quick Facts

8.2.2. Company Overview

8.2.3. Product Portfolio

8.2.4. Business Strategies

8.3. Becton, Dickinson, and Co.

8.3.1. Quick Facts

8.3.2. Company Overview

8.3.3. Product Portfolio

8.3.4. Business Strategies

8.4. Cardinal Health

8.4.1. Quick Facts

8.4.2. Company Overview

8.4.3. Product Portfolio

8.4.4. Business Strategies

8.5. Coloplast A/S

8.5.1. Quick Facts

8.5.2. Company Overview

8.5.3. Product Portfolio

8.5.4. Business Strategies

8.6. Cook Group Inc.

8.6.1. Quick Facts

8.6.2. Company Overview

8.6.3. Product Portfolio

8.6.4. Business Strategies

8.7. Edwards Lifesciences Corp.

8.7.1. Quick Facts

8.7.2. Company Overview

8.7.3. Product Portfolio

8.7.4. Business Strategies

8.8. General Electric Co.

8.8.1. Quick Facts

8.8.2. Company Overview

8.8.3. Product Portfolio

8.8.4. Business Strategies

8.9. ICU Medical, Inc.

8.9.1. Quick Facts

8.9.2. Company Overview

8.9.3. Product Portfolio

8.9.4. Business Strategies

8.10. Integrated Medical Systems, Inc. (IMS)

8.10.1. Quick Facts

8.10.2. Company Overview

8.10.3. Product Portfolio

8.10.4. Business Strategies

8.11. MEDQOR

8.11.1. Quick Facts

8.11.2. Company Overview

8.11.3. Product Portfolio

8.11.4. Business Strategies

8.12. Medtronic Inc.

8.12.1. Quick Facts

8.12.2. Company Overview

8.12.3. Product Portfolio

8.12.4. Business Strategies

8.13. Penumbra, Inc.

8.13.1. Quick Facts

8.13.2. Company Overview

8.13.3. Product Portfolio

8.13.4. Business Strategies

8.14. Poly Medicure Ltd.

8.14.1. Quick Facts

8.14.2. Company Overview

8.14.3. Product Portfolio

8.14.4. Business Strategies

8.15. Stryker

8.15.1. Quick Facts

8.15.2. Company Overview

8.15.3. Product Portfolio

8.15.4. Business Strategies

8.16. Vygon SAS

8.16.1. Quick Facts

8.16.2. Company Overview

8.16.3. Product Portfolio

8.16.4. Business Strategies

1. Global Respiratory Catheters Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global Suction Respiratory Catheters Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Airway Exchange Respiratory Catheters Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Pulmonary Artery (PACs) Respiratory Catheters Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Other Type Respiratory Catheters Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Respiratory Catheters Market Research And Analysis By End-User, 2024-2035 ($ Million)

7. Global Respiratory Catheters For Hospitals Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Respiratory Catheters For Ambulatory Care Centers Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Respiratory Catheters For Homecare Settings Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Respiratory Catheters Market Research And Analysis By Region, 2024-2035 ($ Million)

11. North American Respiratory Catheters Market Research And Analysis By Country, 2024-2035 ($ Million)

12. North American Respiratory Catheters Market Research And Analysis By Type, 2024-2035 ($ Million)

13. North American Respiratory Catheters Market Research And Analysis By End-User, 2024-2035 ($ Million)

14. European Respiratory Catheters Market Research And Analysis By Country, 2024-2035 ($ Million)

15. European Respiratory Catheters Market Research And Analysis By Type, 2024-2035 ($ Million)

16. European Respiratory Catheters Market Research And Analysis By End-User, 2024-2035 ($ Million)

17. Asia-Pacific Respiratory Catheters Market Research And Analysis By Country, 2024-2035 ($ Million)

18. Asia-Pacific Respiratory Catheters Market Research And Analysis By Type, 2024-2035 ($ Million)

19. Asia-Pacific Respiratory Catheters Market Research And Analysis By End-User, 2024-2035 ($ Million)

20. Rest Of The World Respiratory Catheters Market Research And Analysis By Region, 2024-2035 ($ Million)

21. Rest Of The World Respiratory Catheters Market Research And Analysis By Type, 2024-2035 ($ Million)

22. Rest Of The World Respiratory Catheters Market Research And Analysis By End-User, 2024-2035 ($ Million)

1. Global Respiratory Catheters Market Research And Analysis By Type, 2024 Vs 2035 (%)

2. Global Suction Respiratory Catheters Market Share By Region, 2024 Vs 2035 (%)

3. Global Airway Exchange Respiratory Catheters Market Share By Region, 2024 Vs 2035 (%)

4. Global Pulmonary Artery Respiratory Catheters Market Share By Region, 2024 Vs 2035 (%)

5. Global Other Type Respiratory Catheters Market Share By Region, 2024 Vs 2035 (%)

6. Global Respiratory Catheters Market Research And Analysis By End-User, 2024 Vs 2035 (%)

7. Global Respiratory Catheters For Hospitals Market Share By Region, 2024 Vs 2035 (%)

8. Global Respiratory Catheters For Ambulatory Care Centers Market Share By Region, 2024 Vs 2035 (%)

9. Global Respiratory Catheters For Homecare Settings Market Share By Region, 2024 Vs 2035 (%)

10. Global Respiratory Catheters Market Share By Region, 2024 Vs 2035 (%)

11. US Respiratory Catheters Market Size, 2024-2035 ($ Million)

12. Canada Respiratory Catheters Market Size, 2024-2035 ($ Million)

13. UK Respiratory Catheters Market Size, 2024-2035 ($ Million)

14. France Respiratory Catheters Market Size, 2024-2035 ($ Million)

15. Germany Respiratory Catheters Market Size, 2024-2035 ($ Million)

16. Italy Respiratory Catheters Market Size, 2024-2035 ($ Million)

17. Spain Respiratory Catheters Market Size, 2024-2035 ($ Million)

18. Russia Respiratory Catheters Market Size, 2024-2035 ($ Million)

19. Rest Of Europe Respiratory Catheters Market Size, 2024-2035 ($ Million)

20. India Respiratory Catheters Market Size, 2024-2035 ($ Million)

21. China Respiratory Catheters Market Size, 2024-2035 ($ Million)

22. Japan Respiratory Catheters Market Size, 2024-2035 ($ Million)

23. South Korea Respiratory Catheters Market Size, 2024-2035 ($ Million)

24. ASEAN Respiratory Catheters Market Size, 2024-2035 ($ Million)

25. Australia and New Zealand Respiratory Catheters Market Size, 2024-2035 ($ Million)

26. Rest Of Asia-Pacific Respiratory Catheters Market Size, 2024-2035 ($ Million)

27. Latin America Respiratory Catheters Market Size, 2024-2035 ($ Million)

28. Middle East And Africa Respiratory Catheters Market Size, 2024-2035 ($ Million)

FAQS

The size of the Respiratory Catheters market in 2024 is estimated to be around $8,240 million.

North America holds the largest share in the Respiratory Catheters market.

Leading players in the Respiratory Catheters market include B. Braun SE, Becton, Dickinson, and Co., Edwards Lifesciences Corp., ICU Medical, Inc., and Medtronic Inc., among others.

Respiratory Catheters market is expected to grow at a CAGR of 5.5% from 2025 to 2035.

The respiratory catheters market is growing due to rising respiratory disorders, increased surgical interventions, and advancements in catheter technology.