Green Hydrogen Market

Green Hydrogen Market Size, Share & Trends Analysis Report by Technology (Alkaline Water Electrolysis (AWE), Proton Exchange Membrane (PEM), Solid Oxide Electrolysis (SOE)), by Distribution Channel (Pipeline, and Cargo), and by End-User (Transportation, Power Generation, and Industrial Processes) Forecast Period (2025-2035)

Industry Overview

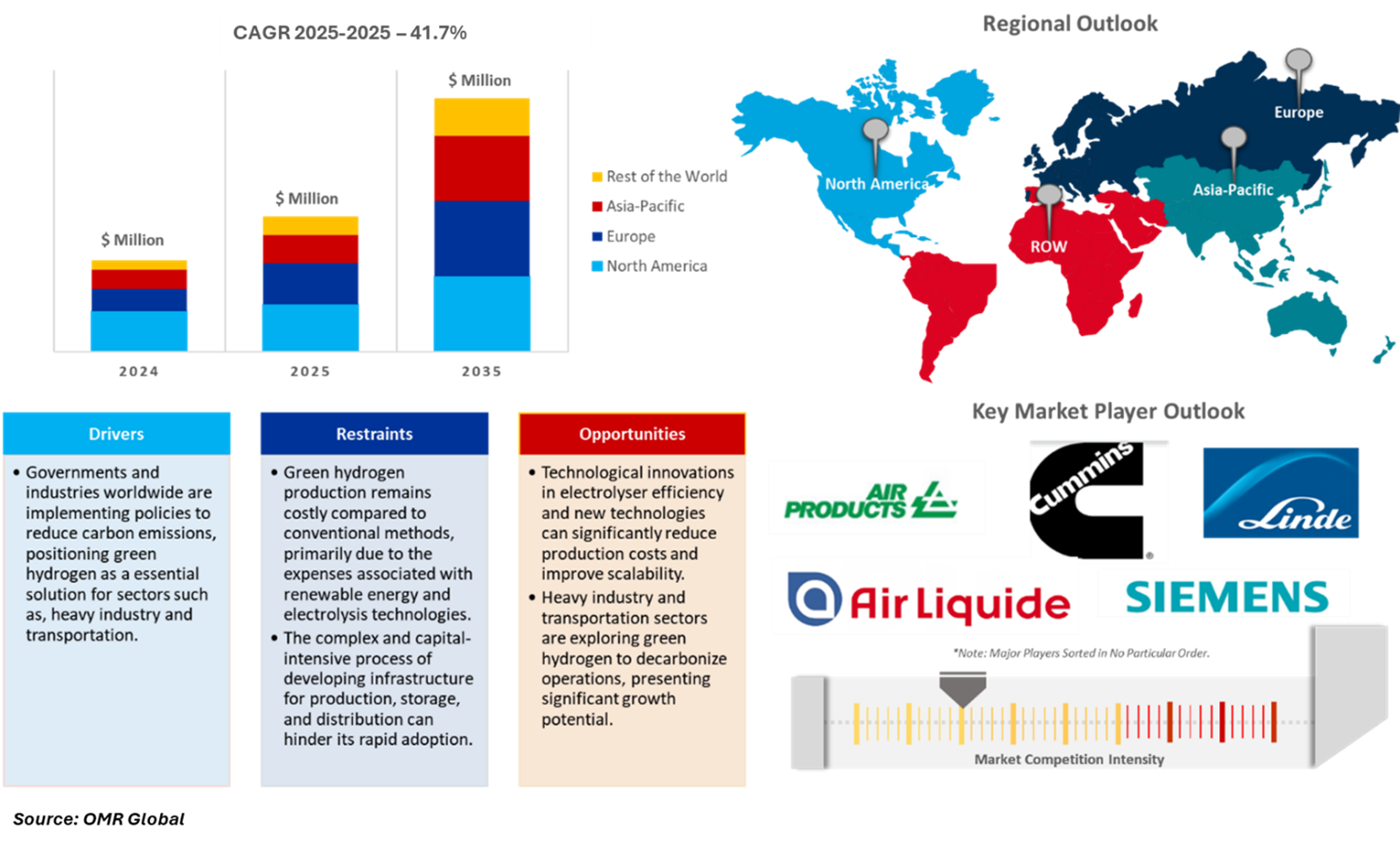

Green hydrogen market was valued at $1.5 billion in 2024 and is projected to reach $70.0 billion by 2035, growing at a 41.7% CAGR during the forecast period (2025-2035). Green hydrogen is essential to meet net-zero carbon emissions and aid industries such as steel, cement, and chemicals. It complements renewable energy sources such as solar and wind, and is being coupled with power plants. Green hydrogen is being applied in industries such as ammonia production, refineries, and methanol synthesis. Government investments and incentives, electrolyzer technology development, and public-private partnerships are driving hydrogen production and commercialization. Key uses are industrial feedstock, transportation, power and energy storage, and fuel blending and heating. Key market participants are Nel ASA, Air Liquide, Plug Power, Siemens Energy, ITM Power, Linde, Cummins Inc., Hydrogenics, Toshiba Energy Systems, and Reliance Industries.

Market Dynamics

Decarbonization Efforts

The high contribution of green hydrogen in decarbonizing industries such as steel production, chemicals, and shipping fuels the growth of the market via decarbonization strategies. For instance, in January 2025, RenewableUK and Hydrogen UK unveiled proposals to reduce the cost of green hydrogen production by 58%. The recommendations are aimed at accelerating the deployment of renewable electricity to produce hydrogen in electrolysers utilizing water split into oxygen and hydrogen. The cost of hydrogen can fall from $1.25 per GBP to below $125/MWh when widely implemented. Green hydrogen must be affordable to play a part in constructing the future energy system and to decarbonise the steel, chemicals, and shipping industries.

The report offers eleven recommendations to improve the cost-effectiveness of the electrolytic hydrogen industry by decreasing electricity prices for electrolysis, and they comprise:

- The government is implored to restructure the hydrogen production business model (HPBM) with realistic strike prices to optimize investment from new market entrants.

- Encouraging electrolysis during the cheapest electricity times can enhance the energy system's benefits and prevent grid-related electricity waste.

- The goal is to eliminate obstacles that prevent hydrogen producers from collaborating with renewable energy generators that already have planning consent.

- The strategy aims to establish a hydrogen transmission network linking Scotland to England and Wales to enhance the availability of green hydrogen.

- The project aims to decrease the fees that project developers are required to pay for access to the electricity grid.

Technological innovations and cost reduction

Electrolyzer technologies are improving efficiency and lowering production costs, which is making green hydrogen competitive with traditional means and fueling market expansion. For instance, in March 2025, TotalEnergies purchased approximately 30,000 metric tons of green hydrogen annually from RWE for its Leuna refinery in Saxony-Anhalt starting in 2030, marking the largest contracted amount of climate-neutral hydrogen from an electrolyzer in Germany. The deal, which targets the utilization of green hydrogen to prevent 300,000 metric tons of CO2 emissions each year, that is the amount of emissions made by about 140,000 cars, represents a move to drive the German market to minimize greenhouse gas emissions in the future. RWE intends to manufacture this hydrogen from a 300-megawatt electrolysis facility in Lingen, going into operation in 2027, based on renewable energy sources, with supplementary hydrogen storage capacity in Gronau-Epe for guaranteed supply.

Market Segmentation

- Based on the technology, the market is segmented into alkaline water electrolysis (AWE), proton exchange membrane (PEM), and solid oxide electrolysis (SOE).

- Based on the distribution channel, the market is segmented into pipeline and cargo.

- Based on the end-user, the market is segmented into transportation, power generation, and industrial processes.

Alkaline Water Electrolysis (AWE) Segment to Lead the Market with the Largest Share

Alkaline Water Electrolysis (AWE) is a low-temperature hydrogen production technology through a potassium or sodium hydroxide solution to dissociate water into hydrogen and oxygen. AWE is a clean energy technology utilized in green hydrogen production, industrial hydrogen supply, energy storage, fuel cell vehicles, metallurgical industry, synthetic fuel, and power generation. It is used in refineries, ammonia, the chemical industry, grid-scale energy storage, fuel cell vehicles, green steel, synthetic fuels, and gas turbines. AWE is important in the international green hydrogen economy because it is economical, scalable, and convertible with renewables. It facilitates the decarbonization of steel, cement, and chemicals industries, and is being invested in to boost the hydrogen economy across the globe.

Transportation: A Key Segment in Market Growth

Transportation finds application across a range of industries, ranging from personal transportation to freight and logistics, public transportation, commercial and industrial transport, energy transport, and intelligent transport systems, such as electric and autonomous cars. Transportation finds application in the global green hydrogen industry, facilitating the use of hydrogen fuel-cell vehicles, aviation, and ocean transport. The companies involved include TATA Motors, Toyota, Hyundai, and Nikola, which invest in hydrogen cars. Specialized cryogenic storage facilities and hydrogen pipelines enable effective transport. Green hydrogen is being infused into transport infrastructure for a comprehensive source of clean energy, driving market expansion.

For instance, according to the Government of India, in March 2025, Proposals were solicited for various hydrogen-fuel-based vehicles, corridors, and fueling stations. Out of a rigorous evaluation, the Ministry of New and Renewable Energy sanctioned five pilot projects, including 37 vehicles (buses and trucks) and 9 hydrogen fueling stations. After a meticulous examination, the Ministry of New and Renewable Energy approved five pilot projects, consisting of 37 vehicles (trucks and buses) and 9 hydrogen fuel stations. The trial included 15 hydrogen fuel cell cars and 22 hydrogen internal combustion engine cars across 10 routes in the country, such as Noida to Agra and Pune to Mumbai. Firms such as TATA Motors, Reliance Industries, and NTPC are engaged, with government funding of about $24.13 million. These projects are likely to be commissioned in 18-24 months to establish commercially viable hydrogen technology in transport. The project aims to prove safety, technical viability, and economic viability under actual operating conditions.

Regional Outlook

The global green hydrogen market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

Government Initiatives in Asia-Pacific

Governments are establishing policies to encourage green hydrogen, which fuels market expansion. As per the International Trade Administration (ITA), in June 2024, India, which is responsible for 7% of CO2 emissions globally, will be the third-largest emitter on the globe. Green hydrogen, which is derived from non-carbon sources such as solar and wind, is an opportunity to reduce these emissions and increase energy independence. The National Hydrogen Mission is focusing on green hydrogen to meet 46% of India's hydrogen requirements by 2030, with the initial investment being around $2.4 billion, including incentives for the manufacture of electrolyzers and green hydrogen, pilot projects, R&D, and other aspects. By 2030, the green hydrogen market in India could reach $8 billion, expanding to $340 billion by 2050, while the electrolyzer market might grow to $5 billion by 2030 and $31 billion by 2050, supported by policy measures such as subsidies, tax incentives, and the establishment of green hydrogen corridors.

North America Region Dominates the Market with Major Share

North America holds a significant share, owing to the US policies that are supporting green hydrogen projects with massive funding, reflecting strong government support, and propelling market growth. As per Green Hydrogen, in March 2024, the US administration invested in 52 hydrogen projects across 24 states, targeting electrolysis and fuel cells to boost scalability and minimize costs. These projects, funded through the Bipartisan Infrastructure Law, aim to generate 14 GW of fuel cells—enough to power approximately 50,000 vehicles annually—and produce 10 GW of electrolysers each year, capable of creating 1.3 million metric tons of green hydrogen to power about 170,000 trucks. The funding includes $316 million for low-cost electrolyzer manufacturing, $150 million for advanced fuel cell production, $82 million for supply chain development, $81 million for electrolyzer components, $72 million for advanced technology, and $50 million for a recycling consortium.

Market Players Outlook

The major companies operating in the global green hydrogen market include Air Products and Chemicals, Inc., Cummins Inc., L’AIR LIQUIDE S.A., Linde PLC, and Siemens Energy AG, among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Development

- In February 2025, Siemens and Guofu Hydrogen entered into a Memorandum of Understanding to speed up green hydrogen production globally. The collaboration aims at the development and production of electrolyzers and green hydrogen production, with Siemens as the technology partner and preferred supplier. RCT GH Hydrogen is the leader in engineering, procurement, and construction of advanced hydrogen production plants.

- In May 2024, GAIL (India) Limited commissioned its first Green Hydrogen Plant at GAIL Vijaipur in Madhya Pradesh as a major step in alternative energy and in line with the National Green Hydrogen Mission, led by the Secretary of the Ministry of Petroleum & Natural Gas. The Vijaipur, India, Green Hydrogen plant generates 4.3 TPD of hydrogen from 10MW PEM electrolyzer units of power based on renewable power. The hydrogen is utilized as fuel and distributed to the retail customers. GAIL is also establishing 20 MW solar power facilities to fulfill the green power demand.

- In September 2024, India's National Green Hydrogen Mission aims for a $129 billion investment by 2030 to produce 5 million tons of green hydrogen annually. The initiative adds 135 GW of renewable energy capacity, mainly wind and solar. The investment helped India to decarbonize major industries such as fertilizers, refineries, and methanol production, reducing its reliance on fossil fuels.

- In September 2024, Uttar Pradesh attracted close to $13.7 billion worth of private investment plans for the green hydrogen industry, enhancing the state's clean energy plan. Welspun Group is investing $4.6 billion in a Bulandshahr factory, while Hygenco Green Energies has floated a 0.2-million-ton unit in Prayagraj. The state plans to lower the cost of production through research and innovation.

- In October 2024, Adani Enterprises Ltd. consolidated two green energy units, ANIL and Adani New Industries, to drive green energy initiatives in solar, wind, and hydrogen technologies. ANIL is a low-carbon project-focused, produces wind turbines and solar module batteries, and caters to various sectors of the globe.

- In December 2024, the EU initiated its second renewable hydrogen auction, seeking to raise $1.2 billion to fund the creation of a green hydrogen economy in Europe. The auction, which follows the first in 2023, involves strict deadline submissions, the utilization of forms made available via the European Funding and Tenders Portal, and the submission of necessary documentation. Successful bidders were awarded a fixed premium of €/kg of green hydrogen produced over ten years, filling the difference between production costs and the off-take price.

- In September 2023, Chevron New Energies purchased a majority interest in the Advanced Clean Energy Storage Hydro project in Delta, Utah. The project, which employs electrolysis to produce hydrogen from renewable energy, employs solution-mined salt caverns for seasonal storage. The initial project, to convert 100 metric tons per day, is being built and is scheduled to begin commercial-scale operations in mid-2025.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global green hydrogen market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Green Hydrogen Market Sales Analysis – Technology| Distribution Channel | End-User ($ Million)

• Green Hydrogen Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Green Hydrogen Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Green Hydrogen Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For the Global Green Hydrogen Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For the Global Green Hydrogen Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Green Hydrogen Market Revenue and Share by Manufacturers

• Green Hydrogen Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Air Products and Chemicals, Inc.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Cummins Inc.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. L’AIR LIQUIDE S.A.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Linde plc

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Siemens Energy AG

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Green Hydrogen Market Sales Analysis by Technology ($ Million)

5.1. Alkaline Water Electrolysis (AWE)

5.2. Proton Exchange Membrane (PEM)

5.3. Solid Oxide Electrolysis (SOE)

6. Global Green Hydrogen Market Sales Analysis by Distribution Channel ($ Million)

6.1. Pipeline

6.2. Cargo

7. Global Green Hydrogen Market Sales Analysis by End-User($ Million)

7.1. Transportation

7.2. Power Generation

7.3. Industrial Processes

8. Regional Analysis

8.1. North American Green Hydrogen Market Sales Analysis – Technology| Distribution Channel | End-User| Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Green Hydrogen Market Sales Analysis – Technology| Distribution Channel | End-User| Country ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Green Hydrogen Market Sales Analysis – Technology| Distribution Channel | End-User| Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Green Hydrogen Market Sales Analysis – Technology| Distribution Channel | End-User| Country ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. ACWA Power International

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. Air Products and Chemicals, Inc.

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. Ballard Power Systems Inc.

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. BP International Limited

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. Cummins Inc.

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Enel Green Power S.p.A

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. ENGIE SA

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. Fortescue Ltd.

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Hyundai Motor Co.

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. Iberdrola, S.A.

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. ITM Power PLC

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. L’AIR LIQUIDE S.A.

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. Linde plc

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Nel ASA

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Ohmium International, Inc.

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. Ørsted A/S

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. Plug Power Inc.

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. ReNew

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. Siemens Energy AG

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. Sumitomo Corp.

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

9.21. Toshiba Energy Systems & Solutions Corp.

9.21.1. Quick Facts

9.21.2. Company Overview

9.21.3. Product Portfolio

9.21.4. Business Strategies

9.22. Uniper SE

9.22.1. Quick Facts

9.22.2. Company Overview

9.22.3. Product Portfolio

9.22.4. Business Strategies

1. Global Green Hydrogen Market Research And Analysis By Technology, 2024-2035 ($ Million)

2. Global Alkaline Water Electrolysis (AWE) Based Green Hydrogen Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Proton Exchange Membrane (PEM) Based Green Hydrogen Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Solid Oxide Electrolysis (SOE) Based Green Hydrogen Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Green Hydrogen Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

6. Global Green Hydrogen By Pipeline Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Green Hydrogen By Cargo Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Green Hydrogen Market Research And Analysis By End-User, 2024-2035 ($ Million)

9. Global Green Hydrogen For Transportation Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Green Hydrogen For Power Generation Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Green Hydrogen For Industrial Processes Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Green Hydrogen Market Research And Analysis By Region, 2024-2035 ($ Million)

13. North American Green Hydrogen Market Research And Analysis By Country, 2024-2035 ($ Million)

14. North American Green Hydrogen Market Research And Analysis By Technology, 2024-2035 ($ Million)

15. North American Green Hydrogen Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

16. North American Green Hydrogen Market Research And Analysis By End-User, 2024-2035 ($ Million)

17. European Green Hydrogen Market Research And Analysis By Country, 2024-2035 ($ Million)

18. European Green Hydrogen Market Research And Analysis By Technology, 2024-2035 ($ Million)

19. European Green Hydrogen Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

20. European Green Hydrogen Market Research And Analysis By End-User, 2024-2035 ($ Million)

21. Asia-Pacific Green Hydrogen Market Research And Analysis By Country, 2024-2035 ($ Million)

22. Asia-Pacific Green Hydrogen Market Research And Analysis By Technology, 2024-2035 ($ Million)

23. Asia-Pacific Green Hydrogen Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

24. Asia-Pacific Green Hydrogen Market Research And Analysis By End-User, 2024-2035 ($ Million)

25. Rest Of The World Green Hydrogen Market Research And Analysis By Region, 2024-2035 ($ Million)

26. Rest Of The World Green Hydrogen Market Research And Analysis By Technology, 2024-2035 ($ Million)

27. Rest Of The World Green Hydrogen Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

28. Rest Of The World Green Hydrogen Market Research And Analysis By End-User, 2024-2035 ($ Million)

1. Global Green Hydrogen Market Research And Analysis By Technology, 2024 Vs 2035 (%)

2. Global Alkaline Water Electrolysis (AWE) Based Green Hydrogen Market Share By Region, 2024 Vs 2035 (%)

3. Global Proton Exchange Membrane (PEM) Based Green Hydrogen Market Share By Region, 2024 Vs 2035 (%)

4. Global Solid Oxide Electrolysis (SOE) Based Green Hydrogen Market Share By Region, 2024 Vs 2035 (%)

5. Global Green Hydrogen Market Research And Analysis By Distribution Channel, 2024 Vs 2035 (%)

6. Global Green Hydrogen By Pipeline Market Share By Region, 2024 Vs 2035 (%)

7. Global Green Hydrogen By Cargo Market Share By Region, 2024 Vs 2035 (%)

8. Global Green Hydrogen Market Research And Analysis By End-User, 2024 Vs 2035 (%)

9. Global Green Hydrogen For Transportation Market Share By Region, 2024 Vs 2035 (%)

10. Global Green Hydrogen For Power Generation Market Share By Region, 2024 Vs 2035 (%)

11. Global Green Hydrogen For Industrial Processes Market Share By Region, 2024 Vs 2035 (%)

12. Global Green Hydrogen Market Share By Region, 2024 Vs 2035 (%)

13. US Green Hydrogen Market Size, 2024-2035 ($ Million)

14. Canada Green Hydrogen Market Size, 2024-2035 ($ Million)

15. UK Green Hydrogen Market Size, 2024-2035 ($ Million)

16. France Green Hydrogen Market Size, 2024-2035 ($ Million)

17. Germany Green Hydrogen Market Size, 2024-2035 ($ Million)

18. Italy Green Hydrogen Market Size, 2024-2035 ($ Million)

19. Spain Green Hydrogen Market Size, 2024-2035 ($ Million)

20. Russia Green Hydrogen Market Size, 2024-2035 ($ Million)

21. Rest Of Europe Green Hydrogen Market Size, 2024-2035 ($ Million)

22. India Green Hydrogen Market Size, 2024-2035 ($ Million)

23. China Green Hydrogen Market Size, 2024-2035 ($ Million)

24. Japan Green Hydrogen Market Size, 2024-2035 ($ Million)

25. South Korea Green Hydrogen Market Size, 2024-2035 ($ Million)

26. ASEAN Green Hydrogen Market Size, 2024-2035 ($ Million)

27. Australia and New Zealand Green Hydrogen Market Size, 2024-2035 ($ Million)

28. Rest Of Asia-Pacific Green Hydrogen Market Size, 2024-2035 ($ Million)

29. Latin America Green Hydrogen Market Size, 2024-2035 ($ Million)

30. Middle East And Africa Green Hydrogen Market Size, 2024-2035 ($ Million)

FAQS

The size of the Green Hydrogen market in 2024 is estimated to be around $1.5 billion.

North America holds the largest share in the Green Hydrogen market.

Leading players in the Green Hydrogen market include Air Products and Chemicals, Inc., Cummins Inc., L’AIR LIQUIDE S.A., Linde PLC, and Siemens Energy AG, among others.

Green Hydrogen market is expected to grow at a CAGR of 41.7% from 2025 to 2035.

Rising demand for clean energy, supportive government policies, and advancements in electrolysis technology are key factors driving green hydrogen market growth.