Heparin Market

Heparin Market Size, Share & Trends Analysis Report, by Product (Unfractionated Heparin, Low Molecular Weight Heparin and Ultra-Low Molecular Weight Heparin), by Route of Administration (Intravenous and Subcutaneous), by Application (Atrial Fibrillation & heart Attack, Coronary Heart Disease, Pulmonary Embolism, Deep Vein Thrombosis and Others) and Forecast Period, 2019-2025.

The global heparin market is estimated to grow at a CAGR of around 3% during the forecast period. The major factors contributing to the growth of the market include a significant rise in the number of venous thromboembolism and cardiovascular disorders such as coronary heart disease and heart attack. Heparin is an anticoagulant or a blood thinner used to prevent blood clots in the patients suffering from a heart attack, and strokes. It is an injectable drug used generally before the treatment of surgical procedures in order to reduce the risk of damage to veins and arteries. It is used for the treatment of heart diseases, injuries and other emergency medication in which blood supply to the heart is suddenly stopped.

The pharmaceuticals companies are continuously working on the treatment and development of drugs associated with blood clotting and cardiovascular disease. For instance, in November 2019, Fresenius Kabi AG announced its launch of new heparin sodium injection Simplest which is ready to administer prefilled syringe used for the treatment of venous thromboembolism and pulmonary embolism. It is an anticoagulant and can also be used for the treatment of clotting in arterial and cardiac surgery. Further, in April 2019, B. Braun Medical Inc. announced its launch of Heparin Sodium Injection, USP. It is FDA approved and first of its kind syringe with attached needle for subcutaneous and intravenous use. It is designed with an aim to provide their patients with a better treatment experience with reduced risk of errors and expanding its product portfolio in the US in the medical field.

Segmentation

The global heparin market is segmented based on the product, route of administration and application. Based on the product, the market is classified into unfractionated heparin, low molecular weight heparin and ultra-low molecular weight heparin. Based on the route of administration, the market is classified into intravenous and subcutaneous. Based on the application, the market is classified into atrial fibrillation & heart attack, coronary heart disease, pulmonary embolism, deep vein thrombosis and others.

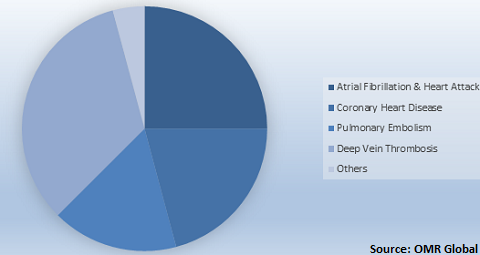

Heparin Market Finds Its Significant Application in Deep Vein Thrombosis

Deep vein thrombosis is anticipated to hold a significant share in the market in 2018. Deep vein thrombosis can be caused due to sports injuries, surgeries injuries veins which result in a medical condition in which normal blood clotting to a wound and breakdown of blood clotting has an imbalance in it. Heparin is used to prevent blood clotting or growing the existing blood clot. According to the report, every year more than 500,000 people suffer from sports injuries or accidents. This high prevalence of injuries is expected to grow the deep vein thrombosis segment of the heparin market.

Global Heparin Market Share by Application, 2018 (%)

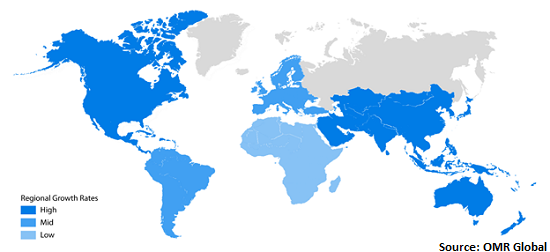

Regional Outlook

Geographically, the global heparin market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. North America is estimated to dominate the market owing to the significant prevalence of the cardiovascular disease. Increasing healthcare expenditure and the increasing number of multi-specialty hospitals and oncology clinics is further strengthening the market growth in the region. Moreover, the major companies are expanding their presence in these regions, which in turn, will likely contribute to the significant growth of the heparin market.

Global Heparin Market Growth, by Region 2019-2025

Asia-Pacific region to witness the highest growth in the market

The market in the Asia-Pacific region is anticipated to witness the highest growth during the forecast period owing to the presence of major companies such as Nanjing Jianyou Biochemical Pharmaceutical Co. Ltd. and Hebei Changshan Biochemical Pharmaceutical Co. Ltd. in the region. These companies are significantly focusing on marketing their products across the globe and gain a competitive advantage. Additionally, increasing awareness about thrombosis and stroke disorder is expected to drive the market in the region. Increasing health care expenditure in developing and developed countries in the region are also encouraging the heparin market to grow.

Competitive Landscape

The major companies in the heparin market include B Barun Melsungen AG, Baxter International Inc., Eisai Co. Ltd., F. Hoffman-La Roche Ltd., Fresenius Kabi AG, Mylan N.V., Novartis AG, Pfizer Inc., and Sanofi S.A. These players are continuously making efforts in order to capture the market share. For instance, in March 2019, Baxter International Inc. received US FDA approved cardiovascular medicine Eptifibatide. Eptifibatide is a platelet aggregation inhibitor that is used to prevent blood cells from sticking together and clotting. It is a ready-to-use emergency medication used for the treatment of heart attack and other diseases in which blood supply is suddenly stopped to the heart and in order to treat with such emergency cases Eptifibatide is used.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global heparin market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Baxter International, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. B Barun Melsungen AG

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Pfizer, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Sanofi S.A.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Novartis AG

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Heparin Market by Product

5.1.1. Unfractionated Heparin

5.1.2. Low molecular weight Heparin (LMWH)

5.1.3. Ultra-Low Molecular Weight Heparin (ULMWH)

5.2. Global Heparin Market by Route of Administration

5.2.1. Intravenous

5.2.2. Subcutaneous

5.3. Global Heparin Market by Application

5.3.1. Atrial Fibrillation & Heart Attack

5.3.2. Coronary Artery Disease

5.3.3. Pulmonary Embolism(PE)

5.3.4. Deep Vein Thrombosis (DVT)

5.3.5. Others (Stroke)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. B Barun Melsungen AG

7.2. Baxter International Inc.

7.3. Eisai Co. Ltd.

7.4. F. Hoffman-La Roche Ltd.

7.5. Fresenius Kabi AG

7.6. GlaxoSmithKline plc

7.7. Hebei Changshan Biochemical Pharmaceutical Co. Ltd.

7.8. Hikma Pharmaceuticals PLC

7.9. Leo Pharma A/S

7.10. Mylan N.V.

7.11. Nanjing Jianyou Biochemical Pharmaceutical Co. Ltd.

7.12. Novartis AG

7.13. Opocrin S.P.A

7.14. Pfizer Inc.

7.15. Sanofi S.A.

7.16. Syntex S.A.

1. GLOBAL HEPARIN MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL UNFRACTIONATED HEPARIN MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL LOW MOLECULAR WEIGHT HEPARIN (LMWH) MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL ULTRA-LOW MOLECULAR WEIGHT HEPARIN (LMWH) MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL HEPARIN MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2018-2025 ($ MILLION)

6. GLOBAL INTRAVENOUS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL SUBCUTANEOUS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL HEPARIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

9. GLOBAL HEPARIN IN ATRIAL FIBRILLATION & HEART ATTACK MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL HEPARIN IN CORONARY HEART DISEASE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL HEPARIN IN DEEP VEIN THROMBOSIS (DVT) MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL HEPARIN IN PULMONARY EMBOLISM (PE) MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL HEPARIN IN OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL HEPARIN MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

15. NORTH AMERICAN HEPARIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. NORTH AMERICAN HEPARIN MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

17. NORTH AMERICAN HEPARIN MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2018-2025 ($ MILLION)

18. NORTH AMERICAN HEPARIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

19. EUROPEAN HEPARIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

20. EUROPEAN HEPARIN MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

21. EUROPEAN HEPARIN MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2018-2025 ($ MILLION)

22. EUROPEAN HEPARIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

23. ASIA-PACIFIC HEPARIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

24. ASIA-PACIFIC HEPARIN MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

25. ASIA-PACIFIC HEPARIN MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2018-2025 ($ MILLION)

26. ASIA-PACIFIC HEPARIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

27. REST OF THE WORLD HEPARIN MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

28. REST OF THE WORLD HEPARIN MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2018-2025 ($ MILLION)

29. REST OF THE WORLD HEPARIN MARKET RESEARCH AND ANALYSIS BY APLICATION, 2018-2025 ($ MILLION)

1. GLOBAL HEPARIN MARKET SHARE BY PRODUCT, 2018 VS 2025 (%)

2. GLOBAL HEPARIN MARKET SHARE BY ROUTE OF ADMINISTRATION, 2018 VS 2025 (%)

3. GLOBAL HEPARIN MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

4. GLOBAL HEPARIN MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US HEPARIN MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA HEPARIN MARKET SIZE, 2018-2025 ($ MILLION)

7. UK HEPARIN MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE HEPARIN MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY HEPARIN MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY HEPARIN MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN HEPARIN MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE HEPARIN MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA HEPARIN MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA HEPARIN MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN HEPARIN MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC HEPARIN MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD HEPARIN MARKET SIZE, 2018-2025 ($ MILLION)