Hot Melt Adhesives Market

Global Hot Melt Adhesives Market Size, Share & Trends Analysis Report by Type (Ethylene Vinyl Acetate (EVA), Styrenic Block Copolymers (SBC), Amorphous Polyalphaolefins (APAO), Polyamide, Polyvinyl Acetate, and Others) and by Application (Packaging Solutions, Furniture & Woodwork, Nonwoven Hygiene Products, Automotive, and Others) and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global hot melt adhesives market is growing at a significant CAGR of around 7.0% during the forecast period (2020-2026). Hot melt has been widely used in packaging industry since 1960's. The hot melt is considered cost effective when used in conjunction with hot melt systems running continuously. Ethylene-vinyl acetate (EVA) and polyolefin are the two most popular types of hot melt adhesives. Ethylene-vinyl acetate (EVA) – this form of hot melt adhesive works well with paper and cellulosic materials and has a wide range of formulation. The reason for the increased adoption of hot melt adhesives as compared to water-based adhesives in industries can be accounted to the fast cool and setting feature. They are made primarily of one or more polymers and a combination of additives such as resins and pigments that provide different characteristics to various adhesives.

Moreover, there are other various pivotal factors that are driving the global hot melt adhesives market, which includes the rising packaging industry across the globe. For instance, packaging is the 5th largest sector of India's economy and steady growth has been reported over past several years which show high potential for further expansion. Moreover, opportunities for growth driven packaging industry owing to rising consumption of packaged as well as general growth across a range of consumer goods areas are widespread across the countries. However, a lower thermal resistance of hot melt adhesives will affect the market growth during the forecast period.

Segmental Outlook

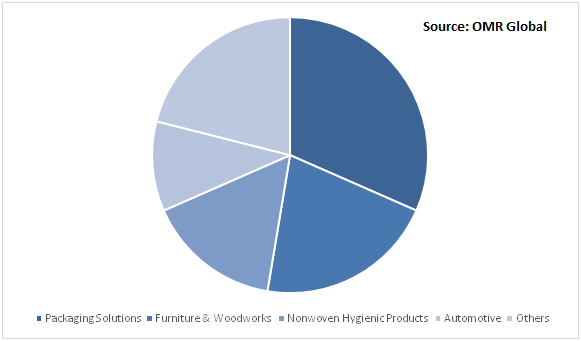

The hot melt adhesives market is classified on the basis of type and application. Based on type, the market is segmented into ethylene vinyl acetate (EVA), styrenic block copolymers (SBC), amorphous polyalphaolefins (APAO), polyamide, polyvinyl acetate, and others. Based on application, the market is segregated into packaging solutions, furniture & woodwork, nonwoven hygiene products, automotive, and others.

Global Hot Melt Adhesives Market Share by Application, 2019 (%)

Global hot melt adhesives market is driven by its rising application in packaging

Packaging contributes significantly in the growth of the hot melt adhesives market globally and will further project a considerable CAGR during the forecast period. The packaging applications include holding and protecting bulk materials, cases, loads or individual items for shipping and receiving, organizing products in static or automated storage systems. Packaging used by almost every industry, including aerospace, appliance, automotive, beverage, chemicals, construction, consumer goods, E-commerce, food, hardware, hospital, manufacturing, materials processing, paper, pharmaceutical, plastics, retail, warehousing, and distribution.

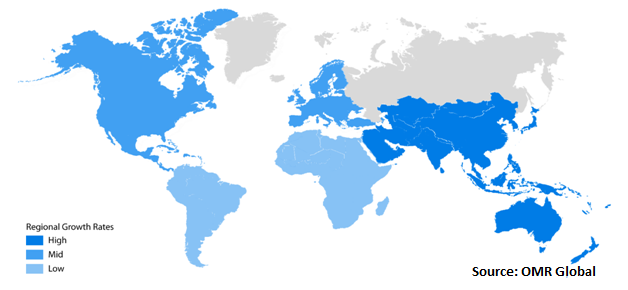

Regional Outlook

The global hot melt adhesives market is classified on the basis of geography, which includes North America, Europe, Asia-Pacific, and Rest of the World. North America holds a significant share in the global hot melt adhesives market. The US held a dominant position in the North American hot melt adhesives market in 2019, owing to the rapid increase in demand for hot melt adhesive in packaging industry. Moreover, the presence of some of the key market players, such as 3M Co. and Dow, Inc. is another major factor that drives the market growth in North America.

Global Hot Melt Adhesives Market Growth, by Region 2020-2026

Asia-Pacific is expected to propel with a considerable growth rate in the global market

Asia-Pacific is estimated to project a considerable CAGR in the global hot melt adhesives market. Countries in Asia-Pacific that are contributing to the market growth include China, India, and Japan. The increasing demand of packaged product in various industry such as food & beverages and e-commerce is also boosting the market growth. For instance, Indian pharmaceuticals market has been growing due to which the demand for packaging will increase. The demand for packaging has been steadily increasing in Asia-Pacific, especially in countries, such as, India, China, and among other South Asian countries, due to a steady growth in the food-processing sector. Increased demand for hot melt adhesives in product assembly and other applications such as textiles, plastics, and woodworking are also contributing in the hot melt adhesives market growth.

Market Players Outlook

The key players in the hot melt adhesives market are contributing significantly by providing advanced technology-based products and through expanding their geographical presence across the globe. The key players operating in the global hot melt adhesives market include Henkel AG & Co., KGaA, 3M Co., Arkema Group, Evonik Industries AG, H.B. Fuller Co., Dow Inc., Jowat SE, and Sika AG. These market players adopt various strategies such as product launch, partnerships, collaborations, merger, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global hot melt adhesives market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Henkel AG & Co., KGaA

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. The 3M Co.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Arkema Group

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Evonik Industries AG

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. H.B. Fuller Co.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Hot Melt Adhesive Market by Type

5.1.1. Ethylene Vinyl Acetate (EVA)

5.1.2. Styrenic Block Copolymers (SBC)

5.1.3. Amorphous Polyalphaolefins (APAO)

5.1.4. Polyamide

5.1.5. Polyvinyl Acetate

5.1.6. Others (Metallocene Polyolefin (mPO) and Polyurethane)

5.2. Global Hot Melt Adhesive Market by Application

5.2.1. Packaging Solutions

5.2.2. Furniture & Woodwork

5.2.3. Nonwoven Hygiene Products

5.2.4. Automotive

5.2.5. Others (Electronics)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 3M Co.

7.2. Adtek Consolidated Sdn. Bhd.

7.3. Arkema Group

7.4. Beardow Adams

7.5. Bond Tech Industries

7.6. Bühnen GmbH & Co. KG

7.7. Cherng Tay Technology Co., Ltd.

7.8. Costchem S.r.l.

7.9. Daubert Chemical Co.

7.10. Dow Inc.

7.11. Evans Adhesive Corp.

7.12. Evonik Industries AG

7.13. H.B. Fuller Co.

7.14. Henkel AG & Co., KGaA

7.15. IFS Industries (DURAPRO)

7.16. Jowat SE

7.17. Multibond Corp.

7.18. Sika AG

1. GLOBAL HOT MELT ADHESIVE MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL EVA MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL SBC MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL APAO MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL POLYAMIDE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL PVA MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL OTHER TYPES OF HOT MELT ADHESIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL HOT MELT ADHESIVE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

9. GLOBAL HOT MELT ADHESIVE IN PACKAGING SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL HOT MELT ADHESIVE IN FURNITURE & WOODWORK MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL HOT MELT ADHESIVE IN NON WOVEN HYGIENIC PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL HOT MELT ADHESIVE IN AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL HOT MELT ADHESIVE IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL HOT MELT ADHESIVE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

15. NORTH AMERICAN HOT MELT ADHESIVE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN HOT MELT ADHESIVE MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

17. NORTH AMERICAN HOT MELT ADHESIVE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

18. EUROPEAN HOT MELT ADHESIVE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

19. EUROPEAN HOT MELT ADHESIVE MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

20. EUROPEAN HOT MELT ADHESIVE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC HOT MELT ADHESIVE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC HOT MELT ADHESIVE MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC HOT MELT ADHESIVE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

24. REST OF THE WORLD HOT MELT ADHESIVE MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

25. REST OF THE WORLD HOT MELT ADHESIVE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL HOT MELT ADHESIVE MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL HOT MELT ADHESIVE MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL HOT MELT ADHESIVE MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US HOT MELT ADHESIVE MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA HOT MELT ADHESIVE MARKET SIZE, 2019-2026 ($ MILLION)

6. UK HOT MELT ADHESIVE MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE HOT MELT ADHESIVE MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY HOT MELT ADHESIVE MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY HOT MELT ADHESIVE MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN HOT MELT ADHESIVE MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE HOT MELT ADHESIVE MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA HOT MELT ADHESIVE MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA HOT MELT ADHESIVE MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN HOT MELT ADHESIVE MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC HOT MELT ADHESIVE MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD HOT MELT ADHESIVE MARKET SIZE, 2019-2026 ($ MILLION)