Hub Motor Market

Hub Motor Market Size, Share & Trends Analysis Report by MotorType (Geared and Gearless Motor), by Position (Front Hub Motor, Rear Hub Motor and Both Front and Rear Hub motor),by Sales Channel (OEM and Aftermarket),and by Vehicle Type (Electric vehicles (EVs), Electric bikes (e-bikes),Other Applications) Forecast Period (2023-2030)

Hub motor market is anticipated to grow at a moderate CAGR of 4.9% during the forecast period (2023-2030). The market is driven by the increasing demand for electric vehicles. As the electric vehicles sector is growing significantly, there is a growing focus on enhancing their efficiency, power, and overall performance. Hub motors which are primarily used for direct power delivery to the wheels bring several advantages. These include instantaneous torque, facilitating rapid acceleration, and responsive handling, thereby enhancing the overall driving experience.

Segmental Outlook

The global hub motor market is segmented by motor type, position, sales channel, and vehicle type. By motor type, the market is sub-segmented into geared and gearless motors. By position, the market is sub-segmented into front hub motor, rear hub motor, and both front and rear hub motor. By sales channel, the market is sub-segmented into original equipment manufacturer (OEM) and aftermarket. By vehicle type, the market is sub-segmented into electric vehicles (EVs), electric bikes (e-bikes), and other applications such as scooters and wheelchairs.

The E-Bike Segment Contribute Highest in the Global Hub Motor Industry

Among the vehicle types, the e-bikes contribute highest to the global hub motor market. The growing demand for hub motors in E-bikes is driven by factors such as the growing adoption of e-bikes globally, government support for the production and sales of e-bikes through policies and incentives, rapid technological advancements, and product launches in the e-bike industry among others. For instance, in October 2023, Sole Bicycles, a traditional bicycle manufacturer, ventured into the electric bicycle market with the introduction of the E-24 e-bike. This electric bike is equipped with a 750W hub motor and features BMX styling. The compact designsuits the limited space of these smaller electric vehicles, offering an efficient wheel hub integration. Hub motors provide a direct drive system, simplifying the structure and reducing maintenance needs. The quiet and smooth operation aligns with urban commuting preferences, making hub motors a crucial element in meeting the increasing demand for user-friendly and sustainable electric mobility solutions.

Regional Outlook

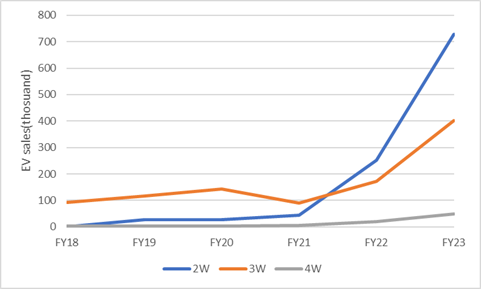

The global hub motor market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). Among regions, the Asia-Pacific region is the largest market for the global hub motor market. The sizable populations of countries within the region, notably India and China, contribute significantly to the robust demand for two-wheeler electric vehicles (EVs) featuring hub motors. As per the data from the Society of Manufacturers of Electric Vehicles (SMEV), the total sales of 2-wheelers in India have grown from 44.8 thousand to 252 thousand from FY2021 to FY2022 and has reached 728 thousand till November 2023. These vehicles are in high demand due to their cost-effectiveness and efficiency, making them a widely favored means of transportation. Furthermore, the region experiences significant urbanization, coupled with congested city streets, creating a demand for compact and environmentally friendly personal mobility solutions. Hub motors align seamlessly with these requirements, presenting a compelling solution. Apart from this, the implementation of government policies, subsidies, and incentives to promote electric mobility has also contributed to driving both production and consumer adoption of hub motor technology. This approach has effectively stimulated market growth. Apart from this, the Asia Pacific economies benefit from extensive manufacturing infrastructure, enabling cost-effective production. This, in turn, enhances accessibility to hub motor-equipped vehicles across a broad spectrum of consumers.

India EV sales

Source: SMEV

Global Hub Motor Market Growth by Region 2023-2030

The North American Region Hub Motor Market is Expected to Grow Significantly in the Forecasting Period

North America is expected to grow significantly in the hub motor market. Leading EV manufacturers such as General Motors and Tesla in the region are driving market expansion by investing heavily in hub motor R&D and production. For instance, in October 2022, Bosch announced more than $260 million in investment in electric motor production at the Charleston site. The focus on creating advanced and efficient hub motor solutions made to North American needs by market players is expected to boost demand. The region's well-established electric charging infrastructure, supported by a network of charging stations, enhances accessibility to electric mobility. As this infrastructure expands, there is a substantial anticipated growth in demand for hub motors. North America's robust automotive sector and manufacturing capabilities contribute significantly to the hub motor industry's progress. The region's expertise and resources position it as a key player, ensuring a steady supply to meet increasing demand and driving expected growth in the market.

Market Players Outlook

The major companies serving the global hub motor market are Ananda Drive Techniques?Shanghai?Co., Ltd., Amirpower Transmission Limited, Brose Fahrzeugteile SE & Co., and Dana Inc. among others. The market players are focusing on collaboration with end-user industries for business expansion and product development to stay competitive. Strategies like these are also contributing to the growth of the overall hub motor market. For instance, in February 2023, FLASH, a technology supplier and electronic component manufacturer, further bolstered its Electric Vehicle (EV) capabilities and product lineup through a new technological collaboration with GEM Motors, a European electric vehicle company. Through this partnership, both companies collaborated in producing hub motors for various segments of electric vehicles, spanning from 1 kW to 15 kW. The motors will feature a flexible and modular design, allowing FLASH to offer customization options with faster turnaround times. This approach enables FLASH to meet customers' specific requirements and effectively accommodate their demanding project deadlines.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the hub motor market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Bafang Electric (Suzhou) Co., Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.3. Denso Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Fuji Electric Co., Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Infineon Technologies AG

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

4. Market Segmentation

4.1. Global Hub Motor Market By Motor Type

4.1.1. Geared

4.1.2. Gearless

4.2. Global Hub Motor Market By Position

4.2.1. Front Hub motor

4.2.2. Rear Hub motor

4.2.3. Both Front and rear Hub Motor

4.3. Global Hub Motor Market By Sales Channel

4.3.1. OEM

4.3.2. Aftermarket

4.4. Global Hub Motor Market By Vehicle Type

4.4.1. Electric vehicles (EVs)

4.4.2. Electric bikes (e-bikes)

4.4.3. Other applications (scooters, wheelchairs)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Amirpower Transmission Ltd.

6.2. Ananda Drive Techniques (Shanghai)Co., Ltd.

6.3. Brose Fahrzeugteile SE & Co.

6.4. Changzhou Keling Power Technology Co., Ltd.

6.5. Cutler MAC (Shanghai) Brushless Motor Co., Ltd.

6.6. Dana Inc.

6.7. Elaphe LAB

6.8. Heinzmann GmbH & Co. KG

6.9. JK Fenner

6.10. Johnson Electric Holdings Ltd.

6.11. Leaf Bike Technology Co., Ltd.

6.12. Mitsuba Corp.

6.13. NTN Corp.

6.14. QS MOTOR LTD.

6.15. Robert Bosch GmbH

6.16. Suzhou XiongFeng Motor Co., Ltd.

1. GLOBAL HUB MOTOR MARKET RESEARCH AND ANALYSIS BY MOTOR TYPE, 2022-2030 ($ MILLION)

2. GLOBAL GEARED HUB MOTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL GEARLESS HUB MOTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL HUB MOTOR MARKET RESEARCH AND ANALYSIS BY POSITION, 2022-2030 ($ MILLION)

5. GLOBAL FRONT HUB MOTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL REAR HUB MOTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL BOTH FRONT AND REAR HUB MOTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL HUB MOTOR MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2022-2030 ($ MILLION)

9. GLOBAL OEM HUB MOTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL AFTERMARKET HUB MOTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL OTHER HUB MOTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL HUB MOTOR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

13. GLOBAL ELECTRIC VEHICLES (EVS) BASED HUB MOTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. GLOBAL ELECTRIC BIKES (E-BIKES) BASED HUB MOTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. GLOBAL OTHER APPLICATIONS BASED HUB MOTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

16. GLOBAL HUB MOTORMARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

17. NORTH AMERICAN HUB MOTORMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

18. NORTH AMERICAN HUB MOTORMARKET RESEARCH AND ANALYSIS BY MOTOR TYPE, 2022-2030 ($ MILLION)

19. NORTH AMERICAN HUB MOTORMARKET RESEARCH AND ANALYSIS BY POSITION, 2022-2030 ($ MILLION)

20. NORTH AMERICAN HUB MOTORMARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2022-2030 ($ MILLION)

21. NORTH AMERICAN HUB MOTOR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

22. EUROPEAN HUB MOTORMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

23. EUROPEAN HUB MOTORMARKET RESEARCH AND ANALYSIS BY MOTOR TYPE, 2022-2030 ($ MILLION)

24. EUROPEAN HUB MOTORMARKET RESEARCH AND ANALYSIS BY POSITION, 2022-2030 ($ MILLION)

25. EUROPEAN HUB MOTORMARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2022-2030 ($ MILLION)

26. EUROPEAN HUB MOTOR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

27. ASIA-PACIFIC HUB MOTORMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

28. ASIA-PACIFICHUB MOTORMARKET RESEARCH AND ANALYSIS BY MOTOR TYPE, 2022-2030 ($ MILLION)

29. ASIA-PACIFICHUB MOTORMARKET RESEARCH AND ANALYSIS BYPOSITION, 2022-2030 ($ MILLION)

30. ASIA-PACIFICHUB MOTORMARKET RESEARCH AND ANALYSIS BYSALES CHANNEL, 2022-2030 ($ MILLION)

31. ASIA-PACIFICHUB MOTOR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

32. REST OF THE WORLD HUB MOTORMARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

33. REST OF THE WORLD HUB MOTORMARKET RESEARCH AND ANALYSIS BY MOTOR TYPE, 2022-2030 ($ MILLION)

34. REST OF THE WORLD HUB MOTORMARKET RESEARCH AND ANALYSIS BY POSITION, 2022-2030 ($ MILLION)

35. REST OF THE WORLD HUB MOTORMARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2022-2030 ($ MILLION)

36. REST OF THE WORLD HUB MOTOR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

1. GLOBAL HUB MOTORMARKETSHARE BY MOTOR TYPE, 2022 VS 2030 (%)

2. GLOBAL GEARED MOTOR MARKETSHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL GEARLESS MOTOR MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL HUB MOTOR MARKET SHARE BY POSITION, 2022 VS 2030 (%)

5. GLOBAL FRONT HUB MOTOR MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL REAR HUB MOTOR MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL FRONT AND REARHUB MOTOR MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL HUB MOTOR MARKET SHARE BY SALES CHANNEL, 2022 VS 2030 (%)

9. GLOBAL OEM BASED HUB MOTOR MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL AFTERMARKET HUB MOTOR MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL HUB MOTOR MARKET SHARE BY VEHICLE TYPE, 2022 VS 2030 (%)

12. GLOBAL EV HUB MOTOR MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL E-BIKE HUB MOTOR MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. GLOBAL OTHER APPLICATIONS BASED HUB MOTOR MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. GLOBAL HUB MOTORMARKETSHARE BY REGION, 2022 VS 2030 (%)

16. US HUB MOTORMARKET SIZE, 2022-2030 ($ MILLION)

17. CANADA HUB MOTORMARKET SIZE, 2022-2030 ($ MILLION)

18. UK HUB MOTORMARKET SIZE, 2022-2030 ($ MILLION)

19. FRANCE HUB MOTORMARKET SIZE, 2022-2030 ($ MILLION)

20. GERMANY HUB MOTORMARKET SIZE, 2022-2030 ($ MILLION)

21. ITALY HUB MOTORMARKET SIZE, 2022-2030 ($ MILLION)

22. SPAIN HUB MOTORMARKET SIZE, 2022-2030 ($ MILLION)

23. REST OF EUROPE HUB MOTORMARKET SIZE, 2022-2030 ($ MILLION)

24. INDIA HUB MOTORMARKET SIZE, 2022-2030 ($ MILLION)

25. CHINA HUB MOTORMARKET SIZE, 2022-2030 ($ MILLION)

26. JAPAN HUB MOTORMARKET SIZE, 2022-2030 ($ MILLION)

27. SOUTH KOREA HUB MOTORMARKET SIZE, 2022-2030 ($ MILLION)

28. REST OF ASIA-PACIFIC HUB MOTORMARKET SIZE, 2022-2030 ($ MILLION)

29. REST OF THEWORLD HUB MOTORMARKET SIZE, 2022-2030 ($ MILLION)