Hydraulic Equipment Market

Hydraulic Equipment Market Size, Share & Trends Analysis Report by Type (Mobile, and Industrial), By Component (Motors, Pumps, Cylinders, Valves, Filters, Accumulators, Transmissions, and Others) By Sensors (Tilt, Position, Pressure, Temperature, Level, and Flow) and By End-User (Construction, Agriculture, Material Handling, Mining, Aerospace and Defense, Automotive, Marine, Metal & Machinery Manufacturing, Oil & Gas, and Others) Forecast Period (2025-2035)

Industry Overview

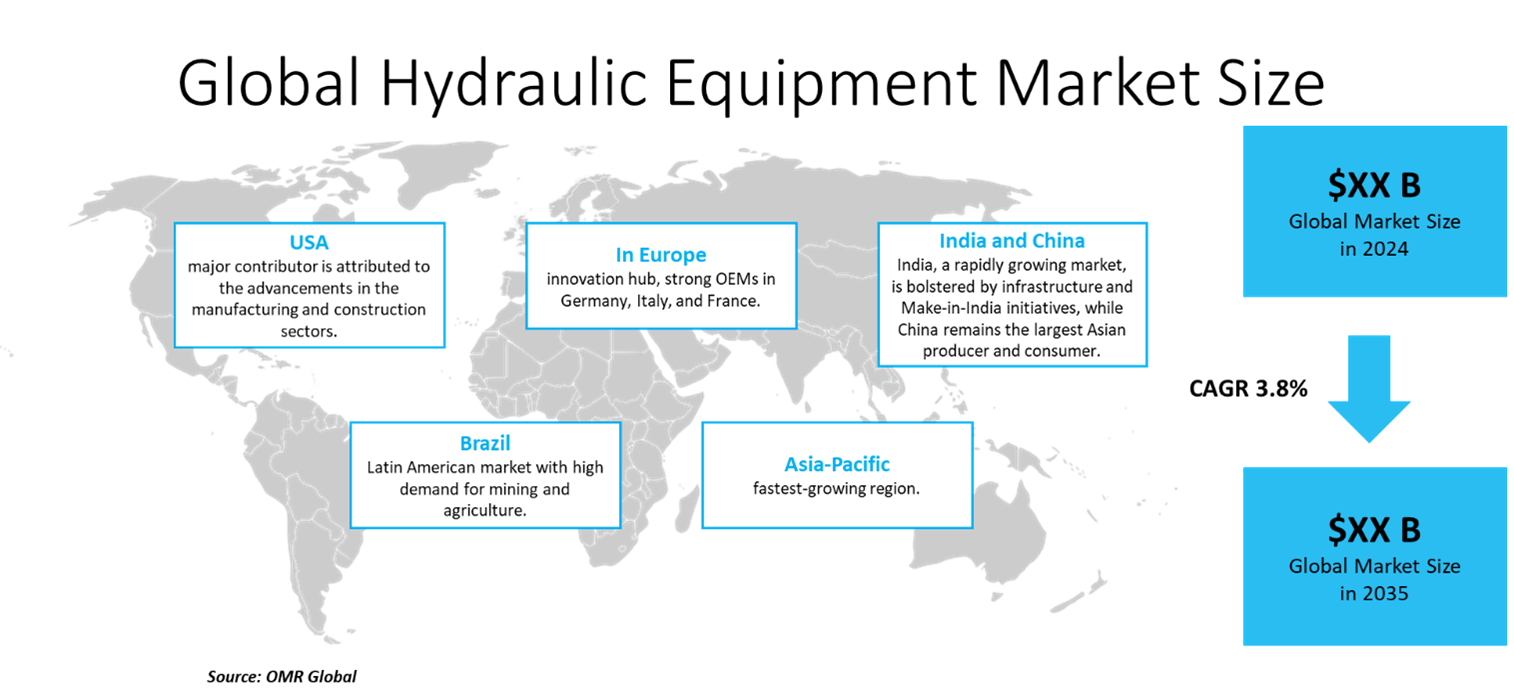

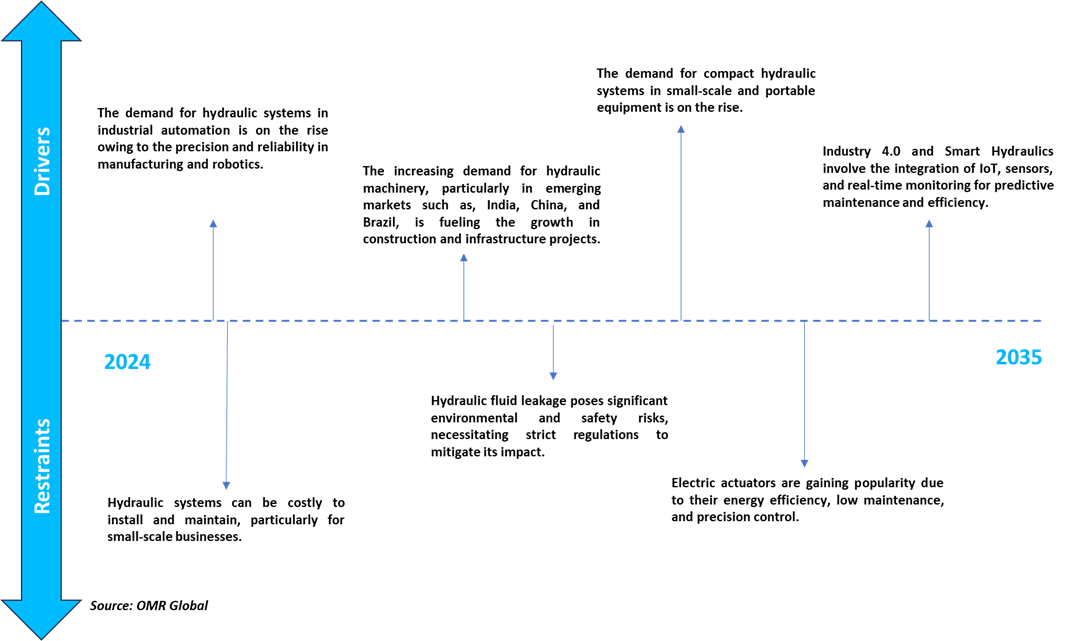

Hydraulic equipment market is projected to grow from $43.8 billion in 2024 to $65.0 billion by 2035, registering a CAGR of 3.8% during the forecast period (2025–2035). The global demand for hydraulic systems is increasing owing to infrastructure development, industrial automation, agriculture mechanization, and defense and aerospace applications, driven by increased military spending and advancements in aircraft hydraulics.

Market Dynamics

Technological Advancements

Technological advancements, including telematics integration, improved hydraulic system designs, and noise/vibration reduction technologies, are driving market growth in hydraulic machinery. For instance, in December 2024, L&T Construction & Mining Machinery and Komatsu launched the Komatsu PC35MR-3 Mini Hydraulic Excavator, offering economical and sustainable solutions for the Indian construction industry. The compact, fuel-efficient machine is ideal for precise work in confined spaces, reducing operational costs and manual labor. Its low maintenance cost and low noise levels reflect L&T and Komatsu's commitment to sustainability.

Growing Construction Industry Demand via Government Infrastructure Development

The growth of the construction sector, fueled by government investment in infrastructure projects, is driving the need for construction hydraulics in a range of applications, including excavators, loaders, cranes, bulldozers, backhoes, and other heavy earthmoving, material handling, demolition, and road construction equipment. This positive trend in demand closely follows increasing construction expenditure. According to the International Factoring Association, in November 2024, construction spending has consistently increased, reaching an annual rate of $2.1 trillion, a 4.1% rise compared to 2023. In the first eight months, expenditures amounted to $1.43 trillion, a 7.6% increase from the $1.33 trillion in the same period last year. Private construction continues to dominate with an annual total of approximately $1.64 trillion, while residential spending slightly declined due to higher mortgage rates, around $900 billion. Non-residential spending rose by 3.6%, driven by demand for healthcare, educational facilities, and infrastructure. Public construction, particularly in highways, educational facilities, and public safety projects, increased by nearly 7.8%, reflecting a focus on infrastructure development.

Market Segmentation

- Based on the type, the market is segmented into mobile and industrial.

- Based on the Component, the market is segmented into motors, pumps, cylinders, valves, filters, accumulators, transmissions, and others (hydraulic power units, hydraulic presses, hydraulic torque wrenches, hydraulic jacks, and hydraulic winches).

- Based on the sensors, the market is segmented into tilt, position, pressure, temperature, level, and flow.

- Based on the end-user, the market is segmented into construction, agriculture, material handling, mining, aerospace and defense, automotive, marine, metal & machinery manufacturing, oil & gas, and others (hydraulic press, plastics, railways, and healthcare & medical equipment).

Pressure Sensor: A Key Segment in Market Growth

A pressure sensor calculates the pressure force of a fluid on a surface and converts and senses pressure into an electric signal. Pressure sensors are used for monitoring, control, and safety in many industries such as industrial automation, automotive, medical devices, consumer products, and aerospace and aviation. Pressure sensors monitor the pressure in pipelines and tanks, manufacturing processes, and tire pressure, and regulate engine oil, fuel, and air intake. Pressure sensors play a vital role in hydraulic systems to monitor system pressure, prevent overpressure, initiate safety mechanisms, maximize performance, predict maintenance, provide the best hydraulic fluid pressure, and avoid equipment failure. The increasing use of hydraulic systems in construction, agriculture, and mining machinery is boosting the need for advanced pressure sensors for system efficiency and safety. For instance, in May 2024, Parker Hannifin launched the SCP09 pressure sensor, a reliable and versatile solution for hydraulic applications. This sensor is designed for accurate pressure measurement in various conditions, making it suitable for mobile machinery and industrial hydraulic applications. The pressure range of 10 to 600 bar allows for seamless integration into existing systems and production processes, with a pin configuration specifically designed for OEM use.

Regional Outlook

The global hydraulic equipment market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

Digitalization & Automation in Oilfield Services in North America

The growing need for automation in oilfield services is prompting companies to adopt AI-driven platforms to minimize human error, enhance design precision, and enhance operational efficiency. For instance, in February 2025, Halliburton and Coterra introduced autonomous hydraulic fracturing technology in North America, allowing Coterra to fully automate hydraulic design and execution. The service, part of Halliburton's Zeus platform, increased stage efficiency by 17%, subsequently deploying it to other completion programs.

Asia-Pacific Region Dominates the Market with Major Share

Asia-Pacific holds a significant share, owing to the expansion of the hydraulic equipment market is largely driven by the increased automation of manufacturing processes and the growing demand for hydraulic-powered systems in different industries. These are construction, automotive, aerospace, agriculture, mining, and material handling since all rely heavily on robust and efficient hydraulic components. As a result of this growing demand, manufacturers are increasing their capacity and investing in sophisticated hydraulic solutions. For instance, in September 2024, Goodluck India Ltd opened a hydraulic tube manufacturing facility in Bulandshahr, Sikandrabad, with an investment of INR 200 crore. The plant has a production capacity of 50,000 MT and serves various sectors, including construction machinery and light commercial vehicles. This project, financed entirely through internal funds, aims to improve profit margins by offering a premium product that reduces reliance on seamless tube imports.

- In August 2024, Wipro Hydraulics opened a Rs 250 crore manufacturing facility in Jaipur, focusing on hydraulic cylinders and components, with a daily production capacity of 1,000.

Market Players Outlook

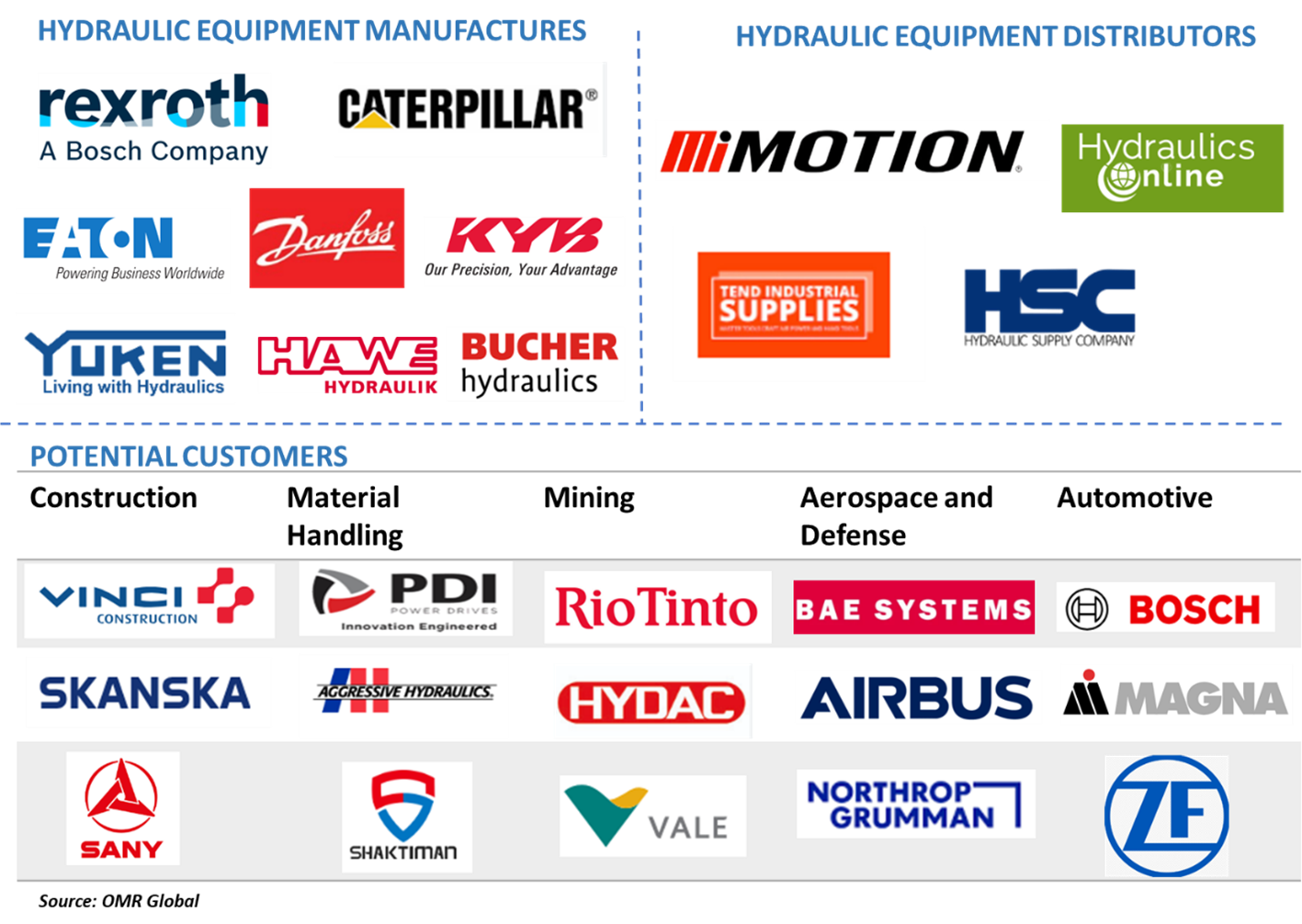

The major companies operating in the global hydraulic equipment market include Continental AG, Huawei Technologies Co., Ltd., Renesas Electronics Corp., Robert Bosch GmbH, and ZF Friedrichshafen AG, among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In June 2024, Volvo CE introduced the EC210, a 20-tonne class hydraulic excavator designed for the Indian CE market. The EC210 offers superior performance, fuel efficiency, and lower maintenance. It features a next-generation positive control hydraulics system, a Made in India T3 electronic engine, and 10 working modes for various applications. The excavator is suitable for road building, rock breaking, construction, waste management, quarries, and sand mining. It additionally offers a user-friendly mobile app for service booking.

- In November 2024, Fortress acquired Texas Hydraulics, a hydraulic solutions co, offering end-to-end services for hydraulic components, including bespoke engineering and after-market support, used by OEMs and aftermarket customers in heavy-duty and extreme-duty applications.

- In December 2024, L&T-Komatsu unveiled the Komatsu PC35MR-3 Mini Hydraulic Excavator at BAUMA CONEXPO INDIA 2024, offering economical and sustainable solutions for the Indian construction industry. The compact, fuel-efficient machine is ideal for precise work in confined spaces, reducing operational costs and manual labor. Its low maintenance cost makes it suitable for various applications, including foundation digging, demolition, utility installations, and agricultural usage.

- In December 2024, Schwing Stetter's XE215i Excavator is a powerful, durable, and efficient machine suitable for construction, mining, and heavy equipment sectors. It features a Cummins 6BT5.9C engine, an advanced hydraulic system, and a comfortable cabin with standard HVAC and front mesh guard.

- In July 2023, Bosch Rexroth acquired HydraForce, aiming to expand its global hydraulics business by combining its presence in Europe, North America, and Asia. The merger maintains regional supply chains, enhances product availability, and strengthens customer support while focusing on compact hydraulic components.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global hydraulic equipment market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Hydraulic Equipment Market Sales Analysis – Type | Component | Sensors | End-User($ Million)

• Hydraulic Equipment Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Hydraulic Equipment Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Hydraulic Equipment Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Hydraulic Equipment Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Hydraulic Equipment Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Hydraulic Equipment Market Revenue and Share by Manufacturers

• Hydraulic Equipment Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Bosch Rexroth AG

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Danfoss A/S

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Eaton Corp. plc

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Caterpillar Inc.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Kawasaki Heavy Industries Ltd.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Hydraulic Equipment Market Sales Analysis by Type ($ Million)

5.1. Mobile

5.2. Industrial

6. Global Hydraulic Equipment Market Sales Analysis by Component ($ Million)

6.1. Motors

6.2. Pumps

6.3. Cylinders

6.4. Valves

6.5. Filters

6.6. Accumulators

6.7. Transmissions

6.8. Others (Hydraulic Power Units, Hydraulic Presses, Hydraulic Torque Wrenches, Hydraulic Jacks, and Hydraulic Winches)

7. Global Hydraulic Equipment Market Sales Analysis by Sensors ($ Million)

7.1. Tilt Sensors

7.2. Position Sensors

7.3. Pressure Sensors

7.4. Temperature Sensors

7.5. Level Sensors

7.6. Flow Sensors

7.7. Other

8. Global Hydraulic Equipment Market Sales Analysis by End-User ($ Million)

8.1. Construction

8.2. Agriculture

8.3. Material Handling

8.4. Mining

8.5. Aerospace and Defense

8.6. Automotive

8.7. Marine

8.8. Metal & Machinery Manufacturing

8.9. Oil & Gas

8.10. Others (Hydraulic Press, Plastics, Railways, and Healthcare & Medical Equipment)

9. Regional Analysis

9.1. North American Hydraulic Equipment Market Sales Analysis – Type | Component | Sensors | End-User| Country ($ Million)

• Macroeconomic Factors for North America

9.1.1. United States

9.1.2. Canada

9.2. European Hydraulic Equipment Market Sales Analysis – Type | Component | Sensors | End-User| Country ($ Million)

• Macroeconomic Factors for Europe

9.2.1. UK

9.2.2. Germany

9.2.3. Italy

9.2.4. Spain

9.2.5. France

9.2.6. Russia

9.2.7. Rest of Europe

9.3. Asia-Pacific Hydraulic Equipment Market Sales Analysis – Type | Component | Sensors | End-User| Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

9.3.7. Rest of Asia-Pacific

9.4. Rest of the World Hydraulic Equipment Market Sales Analysis – Type | Component | Sensors | End-User| Country ($ Million)

• Macroeconomic Factors for the Rest of the World

9.4.1. Latin America

9.4.2. Middle East and Africa

10. Company Profiles

10.1. Bosch Rexroth AG

10.1.1. Quick Facts

10.1.2. Company Overview

10.1.3. Product Portfolio

10.1.4. Business Strategies

10.2. Bucher Hydraulics

10.2.1. Quick Facts

10.2.2. Company Overview

10.2.3. Product Portfolio

10.2.4. Business Strategies

10.3. Caterpillar Inc.

10.3.1. Quick Facts

10.3.2. Company Overview

10.3.3. Product Portfolio

10.3.4. Business Strategies

10.4. Daikin Industries, Ltd.

10.4.1. Quick Facts

10.4.2. Company Overview

10.4.3. Product Portfolio

10.4.4. Business Strategies

10.5. Danfoss A/S

10.5.1. Quick Facts

10.5.2. Company Overview

10.5.3. Product Portfolio

10.5.4. Business Strategies

10.6. Eaton Corp. plc

10.6.1. Quick Facts

10.6.2. Company Overview

10.6.3. Product Portfolio

10.6.4. Business Strategies

10.7. Festo AB

10.7.1. Quick Facts

10.7.2. Company Overview

10.7.3. Product Portfolio

10.7.4. Business Strategies

10.8. Flowserve Corp.

10.8.1. Quick Facts

10.8.2. Company Overview

10.8.3. Product Portfolio

10.8.4. Business Strategies

10.9. HAWE Hydraulik SE

10.9.1. Quick Facts

10.9.2. Company Overview

10.9.3. Product Portfolio

10.9.4. Business Strategies

10.10. Hitachi Construction Machinery Co., Ltd.

10.10.1. Quick Facts

10.10.2. Company Overview

10.10.3. Product Portfolio

10.10.4. Business Strategies

10.11. HYDAC International GmbH

10.11.1. Quick Facts

10.11.2. Company Overview

10.11.3. Product Portfolio

10.11.4. Business Strategies

10.12. J C Bamford Excavators Ltd.

10.12.1. Quick Facts

10.12.2. Company Overview

10.12.3. Product Portfolio

10.12.4. Business Strategies

10.13. Kawasaki Heavy Industries, Ltd.

10.13.1. Quick Facts

10.13.2. Company Overview

10.13.3. Product Portfolio

10.13.4. Business Strategies

10.14. Komatsu Ltd.

10.14.1. Quick Facts

10.14.2. Company Overview

10.14.3. Product Portfolio

10.14.4. Business Strategies

10.15. LHY Powertrain GmbH & Co. KG

10.15.1. Quick Facts

10.15.2. Company Overview

10.15.3. Product Portfolio

10.15.4. Business Strategies

10.16. Liebherr Group

10.16.1. Quick Facts

10.16.2. Company Overview

10.16.3. Product Portfolio

10.16.4. Business Strategies

10.17. Moog Inc.

10.17.1. Quick Facts

10.17.2. Company Overview

10.17.3. Product Portfolio

10.17.4. Business Strategies

10.18. Nachi-Fujikoshi Corp.

10.18.1. Quick Facts

10.18.2. Company Overview

10.18.3. Product Portfolio

10.18.4. Business Strategies

10.19. Norgren Ltd.

10.19.1. Quick Facts

10.19.2. Company Overview

10.19.3. Product Portfolio

10.19.4. Business Strategies

10.20. Parker Hannifin Corp.

10.20.1. Quick Facts

10.20.2. Company Overview

10.20.3. Product Portfolio

10.20.4. Business Strategies

10.21. SMC Corp.

10.21.1. Quick Facts

10.21.2. Company Overview

10.21.3. Product Portfolio

10.21.4. Business Strategies

10.22. Sumitomo Heavy Industries, Ltd.

10.22.1. Quick Facts

10.22.2. Company Overview

10.22.3. Product Portfolio

10.22.4. Business Strategies

10.23. XCMG Group

10.23.1. Quick Facts

10.23.2. Company Overview

10.23.3. Product Portfolio

10.23.4. Business Strategies

10.24. Yuken Kogyo Co., Ltd.

10.24.1. Quick Facts

10.24.2. Company Overview

10.24.3. Product Portfolio

10.24.4. Business Strategies

1. Global Hydraulic Equipment Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global Mobile Hydraulic Equipment Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Industrial Hydraulic Equipment Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Hydraulic Equipment Market Research And Analysis By Component, 2024-2035 ($ Million)

5. Global Hydraulic Equipment Motors Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Hydraulic Equipment Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Hydraulic Equipment Cylinders Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Hydraulic Equipment Valves Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Hydraulic Equipment Filters Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Hydraulic Equipment Accumulators Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Hydraulic Equipment Transmissions Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Hydraulic Equipment Other Component Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Hydraulic Equipment Market Research And Analysis By Sensors, 2024-2035 ($ Million)

14. Global Tilt Sensor For Hydraulic Equipment Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Position Sensor For Hydraulic Equipment Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Pressure Sensor For Hydraulic Equipment Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global Temperature Sensor For Hydraulic Equipment Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global Level Sensor For Hydraulic Equipment Market Research And Analysis By Region, 2024-2035 ($ Million)

19. Global Flow Sensor For Hydraulic Equipment Market Research And Analysis By Region, 2024-2035 ($ Million)

20. Global Other Sensor For Hydraulic Equipment Market Research And Analysis By Region, 2024-2035 ($ Million)

21. Global Hydraulic Equipment Market Research And Analysis By End-User, 2024-2035 ($ Million)

22. Global Hydraulic Equipment For Construction Market Research And Analysis By Region, 2024-2035 ($ Million)

23. Global Hydraulic Equipment For Agriculture Market Research And Analysis By Region, 2024-2035 ($ Million)

24. Global Hydraulic Equipment For Material Handling Market Research And Analysis By Region, 2024-2035 ($ Million)

25. Global Hydraulic Equipment For Mining Market Research And Analysis By Region, 2024-2035 ($ Million)

26. Global Hydraulic Equipment For Aerospace and Defense Market Research And Analysis By Region, 2024-2035 ($ Million)

27. Global Hydraulic Equipment For Automotive Market Research And Analysis By Region, 2024-2035 ($ Million)

28. Global Hydraulic Equipment For Marine Market Research And Analysis By Region, 2024-2035 ($ Million)

29. Global Hydraulic Equipment For Metal & Machinery Manufacturing Market Research And Analysis By Region, 2024-2035 ($ Million)

30. Global Hydraulic Equipment For Oil & Gas Market Research And Analysis By Region, 2024-2035 ($ Million)

31. Global Hydraulic Equipment For Other End-User Market Research And Analysis By Region, 2024-2035 ($ Million)

32. Global Hydraulic Equipment Market Research And Analysis By Region, 2024-2035 ($ Million)

33. North American Hydraulic Equipment Market Research And Analysis By Country, 2024-2035 ($ Million)

34. North American Hydraulic Equipment Market Research And Analysis By Type, 2024-2035 ($ Million)

35. North American Hydraulic Equipment Market Research And Analysis By Component, 2024-2035 ($ Million)

36. North American Hydraulic Equipment Market Research And Analysis By Sensors, 2024-2035 ($ Million)

37. North American Hydraulic Equipment Market Research And Analysis By End-User, 2024-2035 ($ Million)

38. European Hydraulic Equipment Market Research And Analysis By Country, 2024-2035 ($ Million)

39. European Hydraulic Equipment Market Research And Analysis By Type, 2024-2035 ($ Million)

40. European Hydraulic Equipment Market Research And Analysis By Component, 2024-2035 ($ Million)

41. European Hydraulic Equipment Market Research And Analysis By Sensors, 2024-2035 ($ Million)

42. European Hydraulic Equipment Market Research And Analysis By End-User, 2024-2035 ($ Million)

43. Asia-Pacific Hydraulic Equipment Market Research And Analysis By Country, 2024-2035 ($ Million)

44. Asia-Pacific Hydraulic Equipment Market Research And Analysis By Type, 2024-2035 ($ Million)

45. Asia-Pacific Hydraulic Equipment Market Research And Analysis By Component, 2024-2035 ($ Million)

46. Asia-Pacific Hydraulic Equipment Market Research And Analysis By Sensors, 2024-2035 ($ Million)

47. Asia-Pacific Hydraulic Equipment Market Research And Analysis By End-User, 2024-2035 ($ Million)

48. Rest Of The World Hydraulic Equipment Market Research And Analysis By Region, 2024-2035 ($ Million)

49. Rest Of The World Hydraulic Equipment Market Research And Analysis By Type, 2024-2035 ($ Million)

50. Rest Of The World Hydraulic Equipment Market Research And Analysis By Component, 2024-2035 ($ Million)

51. Rest Of The World Hydraulic Equipment Market Research And Analysis By Sensors, 2024-2035 ($ Million)

52. Rest Of The World Hydraulic Equipment Market Research And Analysis By End-User, 2024-2035 ($ Million)

1. Global Hydraulic Equipment Market Research And Analysis By Type, 2024 Vs 2035 (%)

2. Global Mobile Hydraulic Equipment Market Share By Region, 2024 Vs 2035 (%)

3. Global Industrial Hydraulic Equipment Market Share By Region, 2024 Vs 2035 (%)

4. Global Hydraulic Equipment Market Research And Analysis By Component, 2024 Vs 2035 (%)

5. Global Hydraulic Equipment Motors Market Share By Region, 2024 Vs 2035 (%)

6. Global Hydraulic Equipment Pumps Market Share By Region, 2024 Vs 2035 (%)

7. Global Hydraulic Equipment Cylinders Market Share By Region, 2024 Vs 2035 (%)

8. Global Hydraulic Equipment Valves Market Share By Region, 2024 Vs 2035 (%)

9. Global Hydraulic Equipment Filters Market Share By Region, 2024 Vs 2035 (%)

10. Global Hydraulic Equipment Accumulators Market Share By Region, 2024 Vs 2035 (%)

11. Global Hydraulic Equipment Transmissions Market Share By Region, 2024 Vs 2035 (%)

12. Global Hydraulic Equipment Other Component Market Share By Region, 2024 Vs 2035 (%)

13. Global Hydraulic Equipment Market Research And Analysis By Sensors, 2024 Vs 2035 (%)

14. Global Tilt Sensor For Hydraulic Equipment Market Share By Region, 2024 Vs 2035 (%)

15. Global Position Sensor For Hydraulic Equipment Market Share By Region, 2024 Vs 2035 (%)

16. Global Pressure Sensor For Hydraulic Equipment Market Share By Region, 2024 Vs 2035 (%)

17. Global Temperature Sensor For Hydraulic Equipment Market Share By Region, 2024 Vs 2035 (%)

18. Global Level Sensor For Hydraulic Equipment Market Share By Region, 2024 Vs 2035 (%)

19. Global Flow Sensor For Hydraulic Equipment Market Share By Region, 2024 Vs 2035 (%)

20. Global Other Sensor For Hydraulic Equipment Market Share By Region, 2024 Vs 2035 (%)

21. Global Hydraulic Equipment Market Research And Analysis By End-User, 2024 Vs 2035 (%)

22. Global Hydraulic Equipment For Construction Market Share By Region, 2024 Vs 2035 (%)

23. Global Hydraulic Equipment For Agriculture Market Share By Region, 2024 Vs 2035 (%)

24. Global Hydraulic Equipment For Material Handling Market Share By Region, 2024 Vs 2035 (%)

25. Global Hydraulic Equipment For Mining Market Share By Region, 2024 Vs 2035 (%)

26. Global Hydraulic Equipment For Aerospace and Defense Market Share By Region, 2024 Vs 2035 (%)

27. Global Hydraulic Equipment For Automotive Market Share By Region, 2024 Vs 2035 (%)

28. Global Hydraulic Equipment For Marine Market Share By Region, 2024 Vs 2035 (%)

29. Global Hydraulic Equipment For Metal & Machinery Manufacturing Market Share By Region, 2024 Vs 2035 (%)

30. Global Hydraulic Equipment For Oil & Gas Market Share By Region, 2024 Vs 2035 (%)

31. Global Hydraulic Equipment For Other End-User Market Share By Region, 2024 Vs 2035 (%)

32. Global Hydraulic Equipment Market Share By Region, 2024 Vs 2035 (%)

33. US Hydraulic Equipment Market Size, 2024-2035 ($ Million)

34. Canada Hydraulic Equipment Market Size, 2024-2035 ($ Million)

35. UK Hydraulic Equipment Market Size, 2024-2035 ($ Million)

36. France Hydraulic Equipment Market Size, 2024-2035 ($ Million)

37. Germany Hydraulic Equipment Market Size, 2024-2035 ($ Million)

38. Italy Hydraulic Equipment Market Size, 2024-2035 ($ Million)

39. Spain Hydraulic Equipment Market Size, 2024-2035 ($ Million)

40. Russia Hydraulic Equipment Market Size, 2024-2035 ($ Million)

41. Rest Of Europe Hydraulic Equipment Market Size, 2024-2035 ($ Million)

42. India Hydraulic Equipment Market Size, 2024-2035 ($ Million)

43. China Hydraulic Equipment Market Size, 2024-2035 ($ Million)

44. Japan Hydraulic Equipment Market Size, 2024-2035 ($ Million)

45. South Korea Hydraulic Equipment Market Size, 2024-2035 ($ Million)

46. ASEAN Hydraulic Equipment Market Size, 2024-2035 ($ Million)

47. Australia and New Zealand Hydraulic Equipment Market Size, 2024-2035 ($ Million)

48. Rest Of Asia-Pacific Hydraulic Equipment Market Size, 2024-2035 ($ Million)

49. Latin America Hydraulic Equipment Market Size, 2024-2035 ($ Million)

50. Middle East And Africa Hydraulic Equipment Market Size, 2024-2035 ($ Million)

FAQS

The size of the Hydraulic Equipment market in 2024 is estimated to be around $43.8 billion.

Asia Pacific holds the largest share in the Hydraulic Equipment market.

Leading players in the Hydraulic Equipment market include Continental AG, Huawei Technologies Co., Ltd., Renesas Electronics Corp., Robert Bosch GmbH, and ZF Friedrichshafen AG, among others.

Hydraulic Equipment market is expected to grow at a CAGR of 3.8% from 2025 to 2035.

Rising infrastructure projects, industrial automation, and demand for advanced machinery are fueling hydraulic equipment market growth.