Indian Smart Air Purifier Market

Indian Smart Air Purifier Market Size, Share & Trends Analysis Report by Type (Dust Collectors, Fume & Smoke Collectors, and Others), by Technology (High-efficiency Particulate Air (HEPA), Thermodynamic Sterilization System (TSS), and Others), and by End-Use (Residential, and Commercial), Forecast Period (2025-2035)

Industry Overview

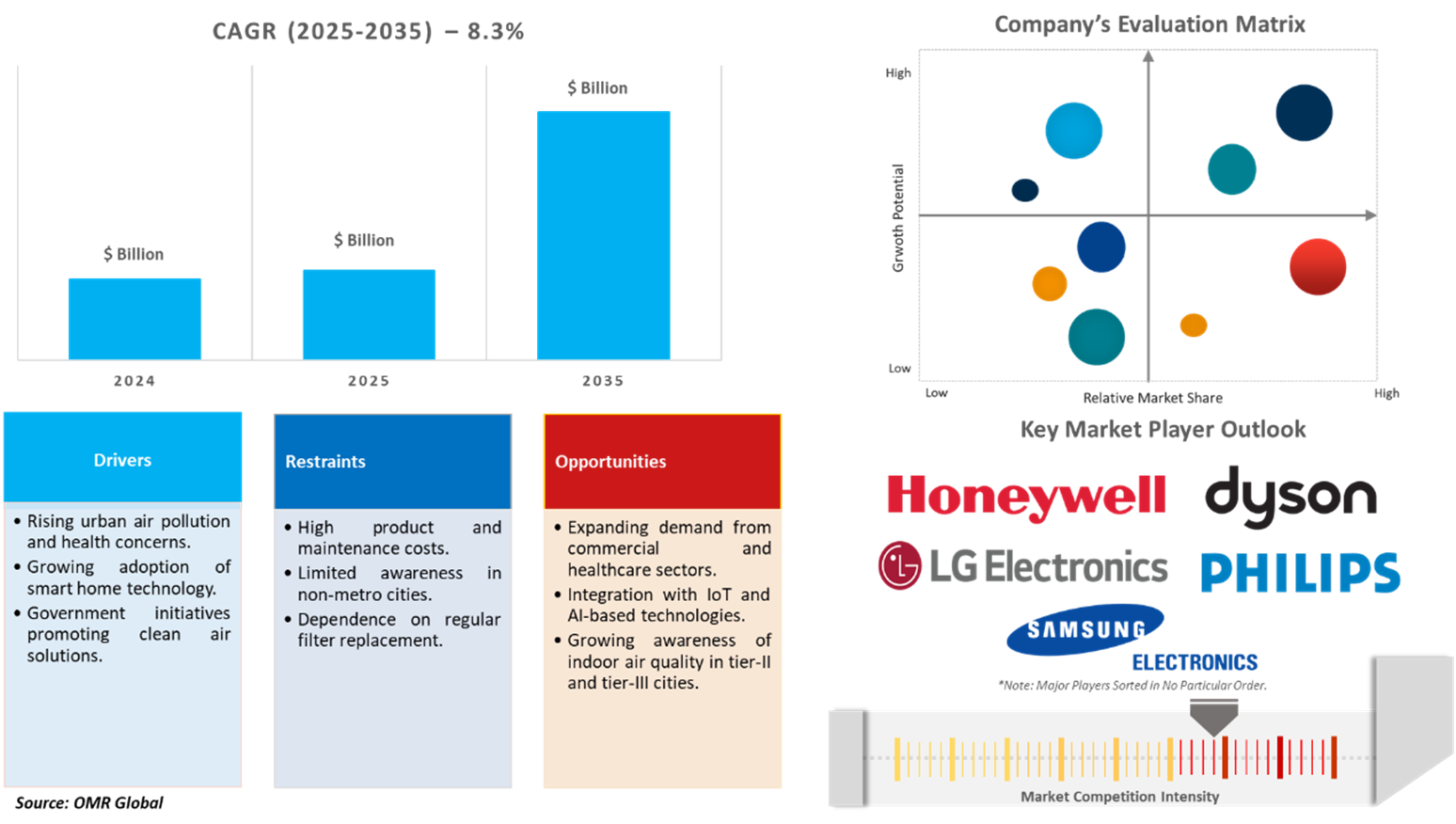

Indian smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025–2035). The smart air purifier market in India is expanding rapidly, fueled by rising concerns over air pollution, rapid industrial expansion, and supportive government measures. Increasing urbanization and the surge in industrial activity have significantly worsened air quality, especially in metropolitan areas, prompting households and businesses alike to adopt air purification solutions. Another important drive is the increase in disposable income, which has made advanced consumer technologies more affordable for a wider section of the population. At the same time, manufacturers are introducing new features and innovations, which not only improve product performance but also attract buyers who are looking for smarter, more efficient options.

Market Dynamics

Adoption of Smart Home Ecosystems is Driving the Market

One of the strongest drivers of the Indian smart air purifier market is the rapid adoption of smart home technologies. Consumers increasingly expect home devices like air purifiers to connect seamlessly within a digital ecosystem, whether through smartphone applications or voice assistants such as Alexa and Google Home. Additionally, Modern air purifier models are now capable of tracking air quality in real time, adjusting settings automatically, and notifying users when filters require replacement.

Manufacturers are responding to this trend by bringing advanced, app-based, and sensor-enabled products to market. For instance, in September 2024, Secure Connection introduced upgraded Honeywell-licensed purifiers (models P2, U1, and U2) with Alexa compatibility. Through the “Honeywell Air Touch” app, users can operate their purifiers remotely by voice command, a feature that has gained particular relevance for families and elderly users.

Additionally, in November 2024, Qubo, a smart device brand under Hero Group, released two new Smart Air Purifiers - Q600 and Q1000. These models feature enhanced QSensAI technology and can be controlled through the Qubo app, offering real-time monitoring, filter replacement reminders, and remote settings management. They also support voice control via Alexa and Google Assistant.

Government Initiatives Driving Market Opportunities

India continues to struggle with severe air pollution, and this has pushed both the government and the public to look for clean air solutions. Over the last few years, the government has stepped up its role, through public health campaigns, air quality regulations, and consumer incentives to encourage adoption of cleaner technologies. These measures are not only aimed at improving public health but are also tied to larger national programs such as Make in India and Atmanirbhar Bharat, which emphasize local innovation and self-reliance. This is expected to create several opportunities for the Indian smart air purifier market in the future.

For Instance, in April 2025, the Technology Development Board (TDB), under the Department of Science and Technology (DST), took a significant step in supporting Urban Air Labs for their project on developing an efficient air purification system. This aims to improve indoor air quality using plant-based technology.

Market Segmentation

- Based on the type, the market is segmented into dust collectors, fume & smoke collectors, and others.

- Based on the technology, the market is segmented into high-efficiency particulate air (HEPA), thermodynamic sterilization systems (TSS), and others.

- Based on the end-use, the market is segmented into residential and commercial.

Commercial Spaces Driving Market Expansion

Among the end-use segments, the commercial segment is emerging as one of the fastest-growing areas. Poor indoor air quality has turned into a major issue for offices, leading not only to health concerns but also extra costs for businesses in terms of absenteeism and lower productivity. With outdoor pollution levels worsening in most Indian cities, companies are under pressure to make workplaces safer and more comfortable for employees.

Many firms are responding by putting in place air purification measures. This includes installing purifiers, upgrading air handling units with stronger filters, and even adding greenery indoors to balance the environment. Companies such as Acer India, KPMG, PepsiCo, and Deloitte have already moved in this direction by using advanced air purifiers and MERV 14 filters along with indoor plants. Additionally, Candor TechSpace partnered with Honeywell to install electronic air cleaners across its campuses to improve air quality.

Dominance of HEPA Technology in the Market

The High Efficiency Particulate Air (HEPA) technology segment is projected to lead the Indian smart air purifier market. HEPA filters are designed with an extended surface area, which allows them to trap both larger and finer airborne particles more effectively than many other filtration methods. Their ability to capture dust, pollen, pet dander, and similar allergens has made them a preferred choice among consumers. Their high efficiency in removing contaminants makes them ideal for use not only in homes but also in hospitals and other sensitive settings.

Recognizing this demand, several leading players in the market are rolling out smart air purifiers sealed with HEPA filters, aiming to combine advanced filtration performance with smart connectivity features. For instance,, in November 2024, Dyson released the Purifier Hot+Cool Gen1 in India, offering heating, cooling, and air purification in one device. It uses Dyson's advanced filtration and airflow tech to adjust air based on room requirements. The Purifier Hot+Cool Gen1 uses HEPA filters, capable of capturing up to 99.95% of particles as small as 0.1 microns.

Market Players Outlook

The major companies operating in the Indian smart air purifier market include Dyson Group, Honeywell International Inc., Koninklijke Philips N.V., LG Electronics Inc., Samsung Electronics Co., Ltd., among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In October 2024, Versuni, previously Philips Domestic Appliances, released a new line of air purifiers in India. The range consists of models like 3200, 4200 Pro, 900 Mini, and 900 Mini Wi-Fi. These purifiers combine power, efficiency, and modern design to cater to different user needs, ensuring a quiet and clean space.

- In October 2024, Secure Connection introduced new Honeywell air purifiers in India. The Air Touch V1 and V5 models feature advanced filters, user-friendly functions like filter change indicators and reset buttons. The Air Touch V5 air purifier comes with additional features like a real-time PM2.5 display, touch control panel, child lock, Wi-Fi, and Amazon Alexa integration.

- In September 2024, Havells India launched new air purifiers Studio Meditate AP 400 and AP 250 with enhanced SpaceTech Air Purification tech. It features IoT connectivity for smart home integration and utilizes photo-catalytic oxidation for advanced air purification targeting microscopic pollutants.

- In January 2024, Praan launched HIVE, a high-performance air purifier for homes. It uses advanced H14-HEPA filtration technology, has a sleek design made of aircraft-grade aluminum, and covers 345 sq. ft. with a top-notch Clean Air Delivery Rate (CADR).

- In October 2023, Dyson launched the Purifier Big+Quiet air purifier in India. It can clean air in spaces up to 1076 sq ft, features a cone aerodynamic design for up to 10-meter air projection. The air purifier has a HEPA H13-grade particle filter to absorb pollutants like NO2, Ozone, and dust particles as small as 0.1 microns.

- In April 2023, Xiaomi launched the Smart Air Purifier 4 in India, succeeding the Mi Air Purifier 3. It features an upgraded filter, larger room coverage, and a quieter design compared to its predecessor.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the Indian smart air purifier market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Indian Smart Air Purifier Market Sales Analysis – Type | Technology | End-Use ($ Million)

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Smart Air Purifier Industry Trends

2.2.2. Market Recommendations

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For the Indian Smart Air Purifier Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For the Indian Smart Air Purifier Market: Impact Analysis

3.3. Market Opportunities

3.3.1. Opportunities for the Indian Smart Air Purifier Market: Impact Analysis

4. Competitive Landscape

4.1. Competitive Dashboard – Indian Smart Air Purifier Market Revenue and Share by Manufacturers

• Smart Air Purifier Market Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Dyson Group

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Honeywell International Inc.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Koninklijke Philips N.V.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. LG Electronics Inc.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Samsung Electronics Co., Ltd.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Indian Smart Air Purifier Market Sales Analysis by Type ($ Million)

5.1. Dust Collectors

5.2. Fume & Smoke Collectors

5.3. Others

6. Indian Smart Air Purifier Market Sales Analysis by Technology ($ Million)

6.1. High-efficiency Particulate Air (HEPA)

6.2. Thermodynamic Sterilization System (TSS)

6.3. Others

7. Indian Smart Air Purifier Market Sales Analysis by End-Use ($ Million)

7.1. Residential

7.2. Commercial

8. Company Profiles

8.1. AirOasis, LLC

8.1.1. Quick Facts

8.1.2. Company Overview

8.1.3. Product Portfolio

8.1.4. Business Strategies

8.2. Blueair Inc.

8.2.1. Quick Facts

8.2.2. Company Overview

8.2.3. Product Portfolio

8.2.4. Business Strategies

8.3. Blue Star Ltd.

8.3.1. Quick Facts

8.3.2. Company Overview

8.3.3. Product Portfolio

8.3.4. Business Strategies

8.4. Carrier Global Corp.

8.4.1. Quick Facts

8.4.2. Company Overview

8.4.3. Product Portfolio

8.4.4. Business Strategies

8.5. Crusaders Technologies India Pvt. Ltd.

8.5.1. Quick Facts

8.5.2. Company Overview

8.5.3. Product Portfolio

8.5.4. Business Strategies

8.6. Cuckoo Appliances Pvt. Ltd.

8.6.1. Quick Facts

8.6.2. Company Overview

8.6.3. Product Portfolio

8.6.4. Business Strategies

8.7. Daikin Airconditioning India Pvt. Ltd. (DAIPL)

8.7.1. Quick Facts

8.7.2. Company Overview

8.7.3. Product Portfolio

8.7.4. Business Strategies

8.8. Dyson Group

8.8.1. Quick Facts

8.8.2. Company Overview

8.8.3. Product Portfolio

8.8.4. Business Strategies

8.9. Elofic Industries Ltd.

8.9.1. Quick Facts

8.9.2. Company Overview

8.9.3. Product Portfolio

8.9.4. Business Strategies

8.10. Eureka Forbes Ltd.

8.10.1. Quick Facts

8.10.2. Company Overview

8.10.3. Product Portfolio

8.10.4. Business Strategies

8.11. Frootle India Pvt. Ltd. (Coway/Levoit)

8.11.1. Quick Facts

8.11.2. Company Overview

8.11.3. Product Portfolio

8.11.4. Business Strategies

8.12. Havells India Ltd.

8.12.1. Quick Facts

8.12.2. Company Overview

8.12.3. Product Portfolio

8.12.4. Business Strategies

8.13. Hero Electronix Pvt. Ltd. (Qubo)

8.13.1. Quick Facts

8.13.2. Company Overview

8.13.3. Product Portfolio

8.13.4. Business Strategies

8.14. Honeywell International Inc.

8.14.1. Quick Facts

8.14.2. Company Overview

8.14.3. Product Portfolio

8.14.4. Business Strategies

8.15. KENT RO SYSTEMS LTD

8.15.1. Quick Facts

8.15.2. Company Overview

8.15.3. Product Portfolio

8.15.4. Business Strategies

8.16. Koninklijke Philips N.V.

8.16.1. Quick Facts

8.16.2. Company Overview

8.16.3. Product Portfolio

8.16.4. Business Strategies

8.17. LG Electronics Inc.

8.17.1. Quick Facts

8.17.2. Company Overview

8.17.3. Product Portfolio

8.17.4. Business Strategies

8.18. Panasonic Life Solutions India Pvt. Ltd.

8.18.1. Quick Facts

8.18.2. Company Overview

8.18.3. Product Portfolio

8.18.4. Business Strategies

8.19. Philips Domestic Appliances India Ltd.

8.19.1. Quick Facts

8.19.2. Company Overview

8.19.3. Product Portfolio

8.19.4. Business Strategies

8.20. Praan, Inc.

8.20.1. Quick Facts

8.20.2. Company Overview

8.20.3. Product Portfolio

8.20.4. Business Strategies

8.21. Samsung Electronics Co., Ltd.

8.21.1. Quick Facts

8.21.2. Company Overview

8.21.3. Product Portfolio

8.21.4. Business Strategies

8.22. Sharp Business Systems (India) Pvt. Ltd. (SBI)

8.22.1. Quick Facts

8.22.2. Company Overview

8.22.3. Product Portfolio

8.22.4. Business Strategies

8.23. Urban Air Labs Pvt Ltd.

8.23.1. Quick Facts

8.23.2. Company Overview

8.23.3. Product Portfolio

8.23.4. Business Strategies

8.24. Voltas Ltd.

8.24.1. Quick Facts

8.24.2. Company Overview

8.24.3. Product Portfolio

8.24.4. Business Strategies

8.25. Whirlpool of India Ltd.

8.25.1. Quick Facts

8.25.2. Company Overview

8.25.3. Product Portfolio

8.25.4. Business Strategies

8.26. Xiaomi Technology India Pvt. Ltd.

8.26.1. Quick Facts

8.26.2. Company Overview

8.26.3. Product Portfolio

8.26.4. Business Strategies

8.27. Zeitgeist Retail Pvt Ltd. (Lasko India)

8.27.1. Quick Facts

8.27.2. Company Overview

8.27.3. Product Portfolio

8.27.4. Business Strategies

1. Indian Smart Air Purifier Market Research and Analysis by Type, 2024–2035 ($ Million)

2. Indian Dust Collectors Smart Air Purifier Market Research and Analysis, 2024–2035 ($ Million)

3. Indian Fume & Smoke Collectors Smart Air Purifier Market Research and Analysis, 2024–2035 ($ Million)

4. Indian Other Type Smart Air Purifier Market Research and Analysis, 2024–2035 ($ Million)

5. Indian Smart Air Purifier Market Research and Analysis by Technology, 2024–2035 ($ Million)

6. Indian High-efficiency Particulate Air (HEPA) Smart Air Purifier Market Research and Analysis, 2024–2035 ($ Million)

7. Indian Thermodynamic Sterilization System (TSS) Smart Air Purifier Market Research and Analysis, 2024–2035 ($ Million)

8. Indian Others Technology Smart Air Purifier Market Research and Analysis, 2024–2035 ($ Million)

9. Indian Smart Air Purifier Market Research and Analysis by End-Use, 2024–2035 ($ Million)

10. Indian Residential Smart Air Purifier Market Research and Analysis, 2024–2035 ($ Million)

11. Indian Commercial Smart Air Purifier Market Research and Analysis, 2024–2035 ($ Million)

1. Indian Smart Air Purifier Market Share by Type, 2024 Vs 2035 (%)

2. Indian Dust Collectors Smart Air Purifier Market Share, 2024 Vs 2035 (%)

3. Indian Fume & Smoke Collectors Smart Air Purifier Market Share, 2024 Vs 2035 (%)

4. Indian Other Type Smart Air Purifier Market Share, 2024 Vs 2035 (%)

5. Indian Smart Air Purifier Market Share by Technology, 2024 Vs 2035 (%)

6. Indian High-Efficiency Particulate Air (HEPA) Smart Air Purifier Market Share, 2024 Vs 2035 (%)

7. Indian Thermodynamic Sterilization System (TSS) Smart Air Purifier Market Share, 2024 Vs 2035 (%)

8. Indian Others Technology Smart Air Purifier Market Share, 2024 Vs 2035 (%)

9. Indian Smart Air Purifier Market Share by End-Use, 2024 Vs 2035 (%)

10. Indian Residential Smart Air Purifier Market Share, 2024 Vs 2035 (%)

11. Indian Commercial Smart Air Purifier Market Share, 2024 Vs 2035 (%)

FAQS

The size of the Indian Smart Air Purifier market in 2024 is estimated to be around $125.8 million.

Western India holds the largest share in the Indian Smart Air Purifier market.

Leading players in the Indian Smart Air Purifier market include Dyson Group, Honeywell International Inc., Koninklijke Philips N.V., LG Electronics Inc., Samsung Electronics Co., Ltd., among others

Indian Smart Air Purifier market is expected to grow at a CAGR of 8.3% from 2025 to 2035.

The Indian Smart Air Purifier market is driven by escalating urban air pollution and health awareness, rising disposable incomes, and tech-savvy consumers embracing smart, IoT-enabled purification solutions.