Indonesia Warehouse Management System (WMS) Market

Indonesia Warehouse Management System (WMS) Market Size, Share & Trends Analysis Report by Deployment Model (Cloud and On-Premises), by End-User (Consumer Goods & Electronics, Apparel, Food & Beverages, Cosmetics & Personal Care, Automobile, Healthcare, and Others) and Forecasts, 2019–2025

Indonesia Economic Outlook

Indonesia Warehouse Management System (WMS) Market is expected to grow at over 12.4% CAGR during the forecasted period due to the growth of e-commerce market in the region. Indonesia is poised to show an economic growth above 5% over the period 2019-2020 as per the Organization for Economic Co-operation and Development (OECD). This indicates that the economy of the nation is growing at a healthy pace. According to the World Bank, Indonesia is an emerging economy located in Southeast Asia with 267.7 million population in 2018. The ongoing surge in employment, rising disposable income and expanding government support will lead to a growth in consumption of general commodities. Currently, Indonesia is in the middle of a transition period. The government of the nation is focusing on increasing the industrialization rate with an aim to improve the country’s economy. Consumers who urge for easier access to shopping have set up a new trend of proximity retailing across the country. However, with the emergence of digitalization, internet, and e-commerce; there has been a significant shift of consumers from brick and mortar trend to online shopping trend. Due to the growth in the e-commerce sector and the resultant in-house production of various commodities; the demand for warehouses is increasing.

What is driving the market?

The growth of Indonesian warehouse management systems market is likely to be propelled by the factors including growth in the retail sector, the surge in the e-commerce industry, increase in the disposable income and rapid industrialization across the country. Moreover, government support is further expected to support market growth in the country. In 2016, the government of Indonesia had eased the Negative Investment List which resulted in the flooding of foreign retailers and investors into the country. Foreign retailers penetrated the country and have set up brands that are already well-known overseas. Players operating in the market across the country have also adjusted their product offerings as per the country’s demographic needs; thereby, targeting consumers with limited incomes with lower prices of the products.

Segmental Outlook

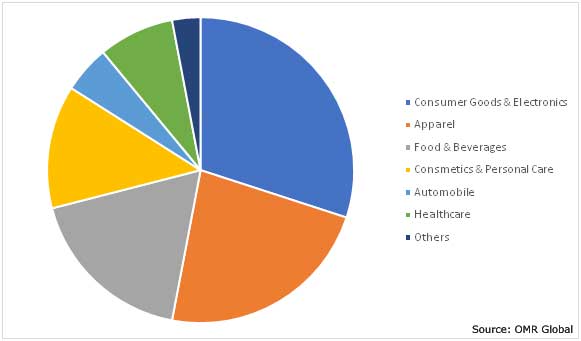

The report analyzes the Indonesia WMS market on the basis of the deployment model and end-user. On the basis of deployment model, the market is segmented into the cloud-based software and on-premises software. On the basis of end-user, the market is classified into consumer goods & electronics, apparel, food & beverages, cosmetics & personal care, automobile, healthcare, and others. Consumer goods & electronics, and apparel segments are expected to contribute majorly in the market. The growth of the segment is attributed to the emergence of e-commerce companies in the country, and high population base coupled with surging disposable income.

Indonesia WMS Market Share by End-User, 2018 (%)

Market Players Outlook

Furthermore, the market is influenced by the presence of many players operating in the country. Some of the major players providing warehouse management systems in the country include JDA Software Group, Inc., Infor, SAP SE, Oracle Corp., Manhattan Associates, Inc., and Anchanto Pte Ltd. among others. These players adopt various strategies in order to remain competitive in the market. Moreover, significant funding made by players is supporting the expansion of warehouse management systems market across the country.

Recent Developments

In July 2018, Singapore-based SaaS technology company, Anchanto Pte Ltd. raised $4 million investment funded by Telkom Indonesia’s MDI Ventures. By the utilization of funds, the company will outreach and establish a stronger presence in Southeast Asia. With the collaboration of Telkom Indonesia, the company intended to enable several Indonesian MSMEs (Micro, Small and Medium Enterprises) to combine the e-commerce bandwagon as well as onboard them on DELON of Telkom Indonesia for e-commerce warehousing/fulfillment and other digital services.

The Report Covers

- Annualized market revenues ($ million) for each market segment.

- Market value data analysis from 2018 to 2019 and forecast to 2025.

- Company share and market share data for Indonesia WMS market.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

- Investment strategies by identifying the key market segments expected to register strong growth in the near future.

- Understand the key distribution channels and identifying the most preferred mode of product distribution.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. JDA Software Group, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Manhattan Associates, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Infor

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Oracle Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. SAP SE

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Indonesia WMS Market by Deployment Model

5.1.1. Cloud

5.1.2. On-Premises

5.2. Indonesia WMS Market by End-User

5.2.1. Consumer Goods & Electronics

5.2.2. Apparel

5.2.3. Food & Beverages

5.2.4. Cosmetics & Personal Care

5.2.5. Automobile

5.2.6. Healthcare

5.2.7. Others (Paper & Printing, Defense)

6. Company Profiles

6.1. Agility Logistics Services Pte Ltd

6.2. Aramex International LLC

6.3. Anchanto Pte Ltd.

6.4. Ceva Logistics AG

6.5. Deskera Singapore Pte. Ltd.

6.6. DHL International GmbH

6.7. Epicor Software Corp.

6.8. HashMicro Pte Ltd

6.9. IBM Corp.

6.10. Infor

6.11. JDA Software Group, Inc.

6.12. Kuehne + Nagel Management AG

6.13. Linc Group

6.14. Manhattan Associates, Inc.

6.15. Oracle Corp.

6.16. PT. Intra Tekno Jaya.

6.17. SAP SE

6.18. The Yusen Logistics Group

6.19. Zebra Technologies Corp.

1. INDONESIA WMS MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODEL, 2018-2025 ($ MILLION)

2. INDONESIA CLOUD WMS MARKET RESEARCH AND ANALYSIS, 2018-2025 ($ MILLION)

3. INDONESIA ON-PREMISES WMS MARKET RESEARCH AND ANALYSIS, 2018-2025 ($ MILLION)

4. INDONESIA WMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

5. INDONESIA WMS IN CONSUMER GOODS & ELECTRONICS MARKET RESEARCH AND ANALYSIS, 2018-2025 ($ MILLION)

6. INDONESIA WMS IN APPAREL MARKET RESEARCH AND ANALYSIS, 2018-2025 ($ MILLION)

7. INDONESIA WMS IN FOOD & BEVERAGES MARKET RESEARCH AND ANALYSIS, 2018-2025 ($ MILLION)

8. INDONESIA WMS IN COSMETICS & PERSONAL CARE MARKET RESEARCH AND ANALYSIS, 2018-2025 ($ MILLION)

9. INDONESIA WMS IN AUTOMOBILE MARKET RESEARCH AND ANALYSIS, 2018-2025 ($ MILLION)

10. INDONESIA WMS IN HEALTHCARE MARKET RESEARCH AND ANALYSIS, 2018-2025 ($ MILLION)

11. INDONESIA WMS IN OTHER END-USER MARKET RESEARCH AND ANALYSIS, 2018-2025 ($ MILLION)

1. INDONESIA WMS MARKET SHARE BY DEPLOYMENT MODEL, 2018 VS 2025 (%)

2. INDONESIA WMS MARKET SHARE BY END-USER, 2018 VS 2025 (%)