Indoor Entertainment Center Market

Indoor Entertainment Center Market Size, Share & Trends Analysis Report by Facility (Up to 5,000 Sq Ft, 5,001 to 10,000 Sq Ft, 10,001 to 20,000 Sq Ft, 20,001 to 40,000 Sq Ft, 1 to 10 Acres, 11 to 30 Acres, and Over 30 Acres), by Activity Area (Arcade Studios, AR and VR Gaming Zones, Physical Play Activities, Skill Competition Games, and Others), and by Type (Children’s Entertainment Centers (CECs), Children’s Edutainment Centers (CEDCs), Adult Entertainment Centers (AECs), and Location-Based VR Entertainment Centers (LBECs)) Forecast Period (2025-2035)

Industry Overview

Indoor entertainment center market was valued at $51.29 billion in 2024 and is projected to reach $140.48 billion by 2035, growing at a CAGR of 9.6% from 2025 to 2035. The consistently increasing demand for new entertainment activities, rising investment in malls for family-oriented entertainment zones, as well as the development of amusement parts with participatory play supporting family activities, are the prominent factor that drives the market growth. The indoor entertainment center is a family-oriented entertainment zone based on the interiors of the complex, specially designed for amusing individuals such as arcades, video games, and games based on AR and VR technology. Besides this, the indoor entertainment centers also include a celebration of birthdays, or hosting a corporate event.

Market Dynamics

Adoption of Advanced Technologies

Technological advancements have significantly transformed the indoor amusement center experience by integrating innovations such as Virtual Reality (VR), Augmented Reality (AR), Artificial Intelligence (AI)-driven interactivity, and motion-tracking technology to deliver highly immersive and personalized experiences. Unlike traditional amusement parks, these technologies offer flexibility and adaptability, enabling venues to update or expand their attractions easily.

Urbanization and Growing Middle Class

Rapid urbanization in Asia-Pacific, particularly in countries such as India, China, and Southeast Asia, has led to the development of dense urban areas with limited outdoor recreational spaces. As more families move to cities with higher disposable incomes, there is an increasing demand for indoor entertainment options such as arcades, gaming zones, and interactive play areas, catering to the growing middle class. Moreover, governments in Asia-Pacific countries are also supporting urban infrastructure and entertainment zones as part of Smart City initiatives, promoting tech-driven leisure experiences.

Market Segmentation

- Based on the facility, the market is segmented into up to 5,000 Sq Ft, 5,001 to 10,000 Sq Ft, 10,001 to 20,000 Sq Ft, 20,001 to 40,000 Sq Ft, 1 to 10 acres, 11 to 30 acres, and over 30 acres.

- Based on the activity area, the market is segmented into arcade studios, AR and VR gaming zones, physical play activities, skill competition games, and others.

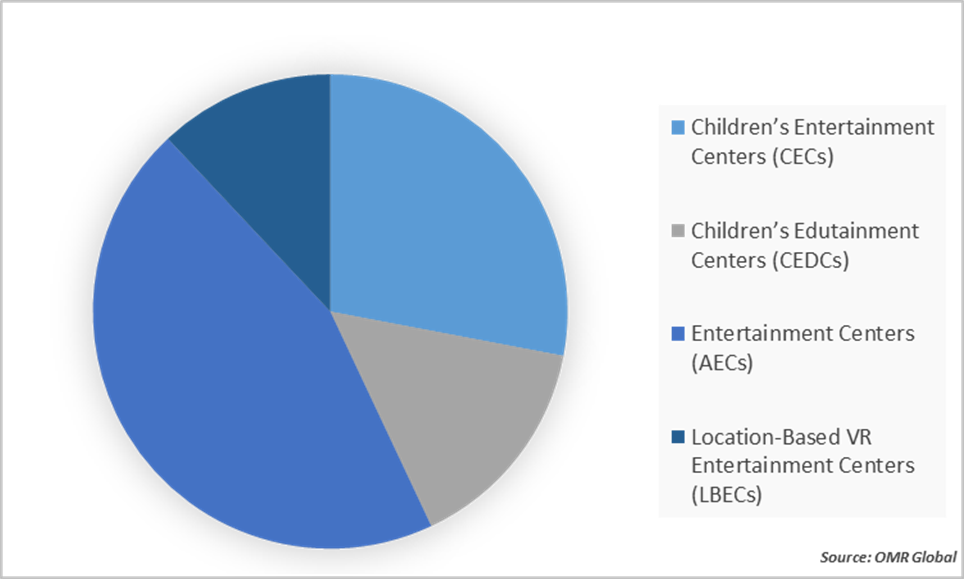

- Based on the type, the market is segmented into children’s entertainment centers (CECs), children’s edutainment centers (CEDCs), adult entertainment centers (AECs), and location-based VR entertainment centers (LBECs).

Arcade Studios Leading Segment

Arcade Studios is a dominant segment in the indoor entertainment market, largely due to its broad appeal, immersive experiences, and ability to evolve with gaming technology. Leading companies in this space have successfully blended classic arcade charm with modern gaming innovations to attract both adults and digital youth. Moreover Dave & Buster’s, Main Event, and Chuck E. Cheese. These brands have modernized the classic arcade model by integrating VR, AI-enhanced games, and social dining experiences. Dave & Buster’s, the largest in the US, expanded internationally in 2024 and partnered with tech firms like Valo Motion to launch next-gen VR attractions.

Global Indoor Entertainment Center Market Share by Activity Area, 2024 (%)

Children’s Edutainment Centers (CEDCs)

Children’s Edutainment Centers (CEDCs) are indoor facilities that combine education and entertainment, designed especially for young children. These centers typically feature interactive exhibits, role-playing zones, creative workshops, and tech-based learning environments, including mini-cities where children can play real-world professions. CEDCs are becoming increasingly important as parents and educators look for engaging, screen-free learning environments that enhance creativity, critical thinking, and social skills. With the growing emphasis on experiential learning, CEDCs offer a valuable supplement to traditional education, especially in urban areas where outdoor learning options may be limited.

Regional Outlook

The global indoor entertainment center market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement.

North American Region is Expected to Witness Substantial Growth in the Global Indoor Entertainment Centers Market

The North American region is expected to witness substantial growth in the indoor entertainment centers market. The growth is attributed to factors such as the higher adoption of AI and IoT technologies in indoor video games, along with the presence of major market players such as Kidzania Operations, Disney, and Dave & Buster's that are adopting numerous strategic initiatives such as new product development, launches, and partnership will further drive market growth. For instance, in 2024, Dave & Buster added new high-tech games by partnering with Valo Motion and other gaming tech companies. These new VR games use smart technology and motion sensors, so players can move and interact in real-time inside the virtual game world.

Market Players Outlook

The major companies serving the global indoor entertainment center market include Scene75 Entertainment Centers, International Exposition Center (I-X Center), Lotte World, Nickelodeon Universe, Galaxyland Powered by Hasbro, Sanrio Puroland, First World, and Ferrari World. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market.

Recent Development

- In November 2024, CEC Entertainment Concepts, LP introduced the Adventure Zone, an indoor playground concept designed to modernize its venues and promote physical activity among children. This addition combines the existing Trampoline Zone, a netted area for younger children, with new Ninja Run obstacle courses featuring climbing walls, balance beams, slides, and other challenges.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Indoor Entertainment Center market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Indoor Entertainment Center Market Sales Analysis – Facility | Activity Area | Type ($ Million)

• Indoor Entertainment Center Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Indoor Entertainment Center Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Indoor Entertainment Center Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Indoor Entertainment Center Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Indoor Entertainment Center Market: Impact Analysis

3.3. Market Opportunities

3.3.1. Opportunities For Global Indoor Entertainment Center Market: Impact Analysis

4. Competitive Landscape

4.1. Competitive Dashboard – Indoor Entertainment Center Market Revenue and Share by Manufacturers

• Indoor Entertainment Center Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Scene75 Entertainment Centers

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. International Exposition Center (I-X Center)

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Lotte World

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Nickelodeon Universe

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Indoor Entertainment Center Market Sales Analysis by Facility ($ Million)

5.1. Up to 5,000 Sq Ft

5.2. 5,001 to 10,000 Sq Ft

5.3. 10,001 to 20,000 Sq Ft

5.4. 20,001 to 40,000 Sq Ft

5.5. 1 to 10 Acres

5.6. 11 to 30 Acres

5.7. Over 30 Acres

6. Global Indoor Entertainment Center Market Sales Analysis by Activity Area ($ Million)

6.1. Arcade Studios

6.2. AR and VR Gaming Zones

6.3. Physical Play Activities

6.4. Skill Competition Games

6.5. Others

7. Global Indoor Entertainment Center Market Sales Analysis by Type ($ Million)

7.1. Children’s Entertainment Centers (CECs)

7.2. Children’s Edutainment Centers (CEDCs)

7.3. Adult Entertainment Centers (AECs)

7.4. Location-Based VR Entertainment Centers (LBECs)

8. Regional Analysis

8.1. North American Indoor Entertainment Center Market Sales Analysis – Facility | Activity Area | Type |Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Indoor Entertainment Center Market Sales Analysis – Facility | Activity Area | Type |Country ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Indoor Entertainment Center Market Sales Analysis – Facility | Activity Area | Type |Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Indoor Entertainment Center Market Sales Analysis – Facility | Activity Area | Type |Country ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Bandai Namco

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. Bowlero Corp.

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. CEC Entertainment Concepts, LP

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Cinergy Entertainment Group, Inc.

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. Dave & Buster's

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Disney

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. Ferrari World

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. Flip Out

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Galaxyland

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. Great Wolf Lodge

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Inflatable Solutions International Limited

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. International Exposition Center (I-X Center)

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. K1 Speed

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Kidzania Operations, S.À.R.L.

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Legoland Discovery Center

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. Lotte World

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. Lucky Strike Entertainment, LLC

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Main Event Entertainment, Inc

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. Merlin Entertainments

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. Mr. Gatti’s Pizza, LLC

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

9.21. Nickelodeon Universe

9.21.1. Quick Facts

9.21.2. Company Overview

9.21.3. Product Portfolio

9.21.4. Business Strategies

9.22. Sanrio Puroland

9.22.1. Quick Facts

9.22.2. Company Overview

9.22.3. Product Portfolio

9.22.4. Business Strategies

9.23. Scene75 Entertainment Centers

9.23.1. Quick Facts

9.23.2. Company Overview

9.23.3. Product Portfolio

9.23.4. Business Strategies

9.24. Smaaash Entertainment Pvt. Ltd.

9.24.1. Quick Facts

9.24.2. Company Overview

9.24.3. Product Portfolio

9.24.4. Business Strategies

9.25. Teeg Australia Pty Ltd.

9.25.1. Quick Facts

9.25.2. Company Overview

9.25.3. Product Portfolio

9.25.4. Business Strategies

9.26. Ten Pin Fun Center

9.26.1. Quick Facts

9.26.2. Company Overview

9.26.3. Product Portfolio

9.26.4. Business Strategies

9.27. Time Zone Entertainment

9.27.1. Quick Facts

9.27.2. Company Overview

9.27.3. Product Portfolio

9.27.4. Business Strategies

9.28. Urban Air Adventure Park

9.28.1. Quick Facts

9.28.2. Company Overview

9.28.3. Product Portfolio

9.28.4. Business Strategies

1. Global Indoor Entertainment Center Market Research And Analysis By Facility, 2024 VS 2035 ($ Million)

2. Global Up To 5,000 Sq Ft Facility For Indoor Entertainment Center Market Research And Analysis By Region, 2024 VS 2035 ($ Million)

3. Global 5,001 To 10,000 Sq Ft Facility For Indoor Entertainment Center Market Research And Analysis By Region, 2024 VS 2035 ($ Million)

4. Global 10,001 To 20,000 Sq Ft Facility For Indoor Entertainment Center Market Research And Analysis By Region, 2024 VS 2035 ($ Million)

5. Global 20,001 To 40,000 Sq Ft Facility For Indoor Entertainment Center Market Research And Analysis By Region, 2024 VS 2035 ($ Million)

6. Global 1 To 10 Acres Facility For Indoor Entertainment Center Market Research And Analysis By Region, 2024 VS 2035 ($ Million)

7. Global 11 To 30 Acres Facility For Indoor Entertainment Center Market Research And Analysis By Region, 2024 VS 2035 ($ Million)

8. Global Up To 30 Acres Facility For Indoor Entertainment Center Market Research And Analysis By Region, 2024 VS 2035 ($ Million)

9. Global Indoor Entertainment Center Market Research And Analysis By Activity Area, 2024 VS 2035 ($ Million)

10. Global Arcade Studios In Indoor Entertainment Center Market Research And Analysis By Region, 2024 VS 2035 ($ Million)

11. Global AR And VR Gaming Zones In Indoor Entertainment Center Market Research And Analysis By Region, 2024 VS 2035 ($ Million

12. Global Physical Play Activities In Indoor Entertainment Center Market Research And Analysis By Region, 2024 VS 2035 ($ Million)

13. Global Skill Competition Games In Indoor Entertainment Center Market Research And Analysis By Region, 2024 VS 2035 ($ Million)

14. Global Other Activity Area In Indoor Entertainment Center Market Research And Analysis By Region, 2024 VS 2035 ($ Million)

15. Global Indoor Entertainment Center Market Research And Analysis By Type, 2024 VS 2035 ($ Million)

16. Global Children’s Entertainment Centers (CECS) Market Research And Analysis By Region, 2024 VS 2035 ($ Million)

17. Global Children’s Edutainment Centers (CEDCS) Market Research And Analysis By Region, 2024 VS 2035 ($ Million)

18. Global Adult Entertainment Centers (AECS) Market Research And Analysis By Region, 2024 VS 2035 ($ Million)

19. Global Location Based VR Entertainment Centers (LBECS) Market Research And Analysis By Region, 2024 VS 2035 ($ Million)

20. Global Indoor Entertainment Center Market Research And Analysis By Region, 2024 VS 2035 ($ Million)

21. North American Indoor Entertainment Center Market Research And Analysis By Country, 2024 VS 2035 ($ Million)

22. North American Indoor Entertainment Center Market Research And Analysis By Facility, 2024 VS 2035 ($ Million)

23. North American Indoor Entertainment Center Market Research And Analysis By Activity Area, 2024 VS 2035 ($ Million)

24. North American Indoor Entertainment Center Market Research And Analysis By Type, 2024 VS 2035 ($ Million)

25. European Indoor Entertainment Center Market Research And Analysis By Country, 2024 VS 2035 ($ Million)

26. European Indoor Entertainment Center Market Research And Analysis By Facility, 2024 VS 2035 ($ Million)

27. European Indoor Entertainment Center Market Research And Analysis By Activity Area, 2024 VS 2035 ($ Million)

28. European Indoor Entertainment Center Market Research And Analysis By Type, 2024 VS 2035 ($ Million)

29. Asia-Pacific Indoor Entertainment Center Market Research And Analysis By Country, 2024 VS 2035 ($ Million)

30. Asia-Pacific Indoor Entertainment Center Market Research And Analysis By Facility, 2024 VS 2035 ($ Million)

31. Asia-Pacific Indoor Entertainment Center Market Research And Analysis By Activity Area, 2024 VS 2035 ($ Million)

32. Asia-Pacific Indoor Entertainment Center Market Research And Analysis By Type, 2024 VS 2035 ($ Million)

33. Rest Of The World Indoor Entertainment Center Market Research And Analysis By Country, 2024 VS 2035 ($ Million)

34. Rest Of The World Indoor Entertainment Center Market Research And Analysis By Facility, 2024 VS 2035 ($ Million)

35. Rest Of The World Indoor Entertainment Center Market Research And Analysis By Activity Area, 2024 VS 2035 ($ Million)

36. Rest Of The World Indoor Entertainment Center Market Research And Analysis By Type, 2024 VS 2035 ($ Million)?

1. Global Indoor Entertainment Center Market Share By Facility, 2024 Vs 2035 (%)

2. Global Up To 5,000 Sq Ft For Indoor Entertainment Center Market Share By Region, 2024 Vs 2035 (%)

3. Global 5,001 To 10,000 Sq Ft For Indoor Entertainment Center Market Share By Region, 2024 Vs 2035 (%)

4. Global 10,001 To 20,000 Sq Ft For Indoor Entertainment Center Market Share By Region, 2024 Vs 2035 (%)

5. Global 20,001 To 40,000 Sq Ft For Indoor Entertainment Center Market Share By Region, 2024 Vs 2035 (%)

6. Global 1 To 10 Acres For Indoor Entertainment Center Market Share By Region, 2024 Vs 2035 (%)

7. Global 11 To 30 Acres For Indoor Entertainment Center Market Share By Region, 2024 Vs 2035 (%)

8. Global Over 30 Acres For Indoor Entertainment Center Market Share By Region, 2024 Vs 2035 (%)

9. Global Indoor Entertainment Center Market Share By Activity Area, 2024 Vs 2035 (%)

10. Global Arcade Studios In Indoor Entertainment Center Market Share By Region, 2024 Vs 2035 (%)

11. Global AR And VR Gaming Zones In Indoor Entertainment Center Market Share By Region, 2024 Vs 2035 (%)

12. Global Physical Play Activities In Indoor Entertainment Center Market Share By Region, 2024 Vs 2035 (%)

13. Global Skill Competition In Indoor Entertainment Center Games Market Share By Region, 2024 Vs 2035 (%)

14. Global Other Activities Area In Indoor Entertainment Center Market Share By Region, 2024 Vs 2035 (%)

15. Global Indoor Entertainment Center Market Share By Type, 2024 Vs 2035 (%)

16. Global Children’s Entertainment Centers (CECS) Market Share By Region, 2024 Vs 2035 (%)

17. Global Children’s Edutainment Centers (CEDCS) Market Share By Region, 2024 Vs 2035 (%)

18. Global Adult Entertainment Centers (AECS) Market Share By Region, 2024 Vs 2035 (%)

19. Global Location Based VR Entertainment Centers (LBECS) Market Share By Region, 2024 Vs 2035 (%)

20. Global Indoor Entertainment Center Market Share By Region, 2024 Vs 2035 (%)

21. US Indoor Entertainment Center Market Size, 2024-2035 ($ Million)

22. Canada Indoor Entertainment Center Market Size, 2024-2035 ($ Million)

23. UK Indoor Entertainment Center Market Size, 2024-2035 ($ Million)

24. France Indoor Entertainment Center Market Size, 2024-2035 ($ Million)

25. Germany Indoor Entertainment Center Market Size, 2024-2035 ($ Million)

26. Italy Indoor Entertainment Center Market Size, 2024-2035 ($ Million)

27. Spain Indoor Entertainment Center Market Size, 2024-2035 ($ Million)

28. Rest Of Europe Indoor Entertainment Center Market Size, 2024-2035 ($ Million)

29. India Indoor Entertainment Center Market Size, 2024-2035 ($ Million)

30. China Indoor Entertainment Center Market Size, 2024-2035 ($ Million)

31. Japan Indoor Entertainment Center Market Size, 2024-2035 ($ Million)

32. South Korea Indoor Entertainment Center Market Size, 2024-2035 ($ Million)

33. Rest Of Asia-Pacific Indoor Entertainment Center Market Size, 2024-2035 ($ Million)

34. Rest Of The World Indoor Entertainment Center Market Size, 2024-2035 ($ Million)

FAQS

The size of the Indoor Entertainment Center market in 2024 is estimated to be around $51.29 billion.

North American holds the largest share in the Indoor Entertainment Center market.

Leading players in the Indoor Entertainment Center market include Scene75 Entertainment Centers, International Exposition Center (I-X Center), Lotte World, Nickelodeon Universe, Galaxyland Powered by Hasbro, Sanrio Puroland, First World, and Ferrari World

Indoor Entertainment Center market is expected to grow at a CAGR of 9.6% from 2025 to 2035.

The Indoor Entertainment Center Market is driven by the rising popularity of immersive technologies, family-friendly attractions, and year-round entertainment demand.