Industrial Alcohol Market

Industrial Alcohol Market Size, Share & Trends Analysis Report, By Type (Ethyl Alcohol, Methyl Alcohol, Isopropyl Alcohol, Isobutyl Alcohol, Benzyl Alcohol, and Others), By Source (Sugarcane & Bagasse, Corn, Grains, Molasses, Fossil Fuels, and Others), By Application (Fuel, Chemical Intermediates & Solvents, Pharmaceuticals, Personal Care Products, Food, and Others), Forecast Period (2022-2028)

Industrial alcohol market is anticipated to grow at a CAGR of 6.8% during the forecast period. The growing demand for industrial alcohol in different industries owing to its antimicrobial activity, solubility, and large octane number is a key factor driving the growth of the global industrial alcohol market. As part of its green acceleration roadmap, Maire Tecnimont Group’s NextChem partnered with Brazil-based GranBio in 2020 to co-develop and co-license the 2G ethanol technology which converts non-food lignocellulosic biomass into low-carbon second-generation biofuels.

The European patent for GranBio’s 2G ethanol production technology (GP3+) has now been officially granted in 31 countries including those rich in feedstocks such as Bulgaria, Czech Republic, Hungary, Macedonia, Poland, Romania, Serbia and Slovakia. Validated technologies such as GP3+ will play a significant role in the development of a new industrial infrastructure for sustainable mobility needed to meet EU targets by 2035. The growing consumer awareness for low carbon alternate fuels and supporting government mandates will drive the demand for industrial alcohol in the biofuel industry. The fluctuating price of raw materials may restrain the growth of the global industrial alcohol market. The growing demand for industrial alcohol from emerging markets is anticipated to offer lucrative opportunities for the growth of the global industrial alcohol market.

Impact of COVID-19 Pandemic on Global Industrial Alcohol Market

The COVID-19 pandemic has made a negative impact on the growth of the chemical industry. The decline is caused mainly due to delays in the production of industrial alcohol and supply chain disruptions, as major countries imposed lockdown, social distancing measures for workers, and financial challenges. However, the demand for industrial alcohol in the pharmaceutical industry has increased in 2021. The sudden increase in sanitiser usage is an important step among the preventive measures taken against COVID-19 that has made a significant impact on the high demand for industrial alcohol in the pharmaceutical industry. The Centers for Disease Control and Prevention (CDC) has also recommended that people use an alcohol-based hand sanitiser that contains at least 60.0% ethyl alcohol.

Segmental Outlook

The global industrial alcohol market is segmented by type, source, and application. The market segmentation based on the type includes ethyl alcohol, methyl alcohol, isopropyl alcohol, isobutyl alcohol, benzyl alcohol, and others. Based on type, ethyl alcohol held a major share in the industrial alcohol market. Significant demand for ethyl alcohol in bio-fuel generation is a key factor driving the growth of the segment. Based on the source, the market is segmented into sugarcane & bagasse, corn, grains, molasses, fossil fuels, and others. Based on source, fossil fuel held a major share in the industrial alcohol market. The growing need to reduce dependency on fossil fuel as a direct source of fuel is a key factor driving the growth of this market segment. Based on application, the market is segmented into fuel, chemical intermediates & solvents, pharmaceuticals, personal care products, food, and others.

Chemical Intermediates & Solvents Segment Held Considerable Share in the Global Industrial Alcohol Market

Based on application, the market is segmented into fuel, chemical intermediates & solvents, pharmaceuticals, personal care products, food, and others. The chemical intermediates & solvents segment held a considerable share in the market. The increased usage of alcohol as solvent/reactant in the production of chemical intermediates is driving the growth of this segment. The high usage of industrial alcohol as the main solvent in paints and inks, wood varnishes, polishes, and coatings is further contributing to the growth of this segment.

Regional Outlook

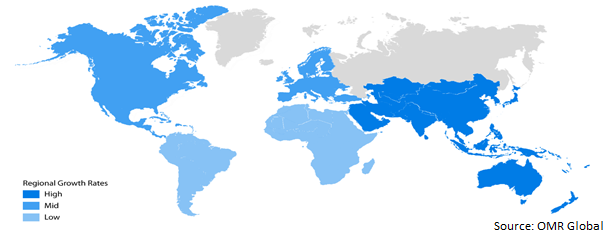

The global industrial alcohol market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. North America held a considerable share in the global industrial alcohol market. The high demand for industrial alcohol across the end-user industries along with the significant presence of key market players across the US is a key factor contributing to the high share of the regional market.

Global Industrial Alcohol Market Growth, by Region 2022-2028

Asia-Pacific Holds Prominent Share in the Global Industrial Alcohol Market

The region holds significant potential for the growth of the industrial alcohol market. The growing emphasis of the regional governments on the production of bio-fuels using ethanol is a key contributor to the growth of the market in the region. The enhanced production of industrial solvents from agricultural wastes and algae in countries, such as India and China, has created a higher demand for ethanol as a major source of octane; which in turn drives the regional market growth.

Market Players Outlook

The major companies serving the global industrial alcohol market include Cargill Inc., Raizen Energia, Sigma-Aldrich Inc., Univar Solutions, and MGP Ingredients, among others. The companies are focusing on product launches, geographical, expansions, mergers and acquisitions, and finding a new market or innovation in their core competency to expand individual market share.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global industrial alcohol market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Recovery Scenario of Global Industrial Alcohol Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Industrial Alcohol Market, By Type

4.1.1. Ethyl Alcohol

4.1.2. Methyl Alcohol

4.1.3. Isopropyl alcohol

4.1.4. Isobutyl alcohol

4.1.5. Benzyl alcohol

4.1.6. Others

4.2. Global Industrial Alcohol Market, By Source

4.2.1. Sugarcane & Bagasse

4.2.2. Corn

4.2.3. Grains

4.2.4. Molasses

4.2.5. Fossil fuels

4.2.6. Other

4.3. Global Industrial Alcohol Market, By Application

4.3.1. Fuel

4.3.2. Chemical Intermediates & Solvents

4.3.3. Pharmaceuticals

4.3.4. Personal care products

4.3.5. Food

4.3.6. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Cargill Inc.

6.2. Cristalco

6.3. Cristalco SAS

6.4. Eastman Chemical Corp.

6.5. Ethanol Chemical Co.

6.6. Exxon Mobil Corp.

6.7. Flint Hills Resources

6.8. Grain Millers Inc.

6.9. Grain Processing Corp.

6.10. Greenfield Global Inc.

6.11. MGP Ingredients Inc.

6.12. Raizen Energia

6.13. Sigma-Aldrich Inc.

6.14. The Andersons Inc.

6.15. Univar Solutions

1. GLOBAL INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL ETHYL ALCOHOL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL METHYL ALCOHOL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL ISOPROPYL ALCOHOL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL ISOBUTYL ALCOHOL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL BENZYL ALCOHOL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL OTHER ALCOHOL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY SOURCE, 2021-2028 ($ MILLION)

9. GLOBAL SUGARCANE & BAGASSE BASED INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL CORN BASED INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL GRAINS BASED INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL MOLASSES BASED INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL FOSSIL FUELS BASED INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL OTHER SOURCE BASED INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

16. GLOBAL INDUSTRIAL ALCOHOL FOR FUEL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

17. GLOBAL INDUSTRIAL ALCOHOL FOR CHEMICAL INTERMEDIATES & SOLVENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

18. GLOBAL INDUSTRIAL ALCOHOL FOR PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

19. GLOBAL INDUSTRIAL ALCOHOL FOR PERSONAL CARE PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

20. GLOBAL INDUSTRIAL ALCOHOL FOR FOOD MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

21. GLOBAL INDUSTRIAL ALCOHOL FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

22. GLOBAL INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

23. NORTH AMERICAN INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

24. NORTH AMERICAN INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

25. NORTH AMERICAN INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY SOURCE, 2021-2028 ($ MILLION)

26. NORTH AMERICAN INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

27. EUROPEAN INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

28. EUROPEAN INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

29. EUROPEAN INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY SOURCE, 2021-2028 ($ MILLION)

30. EUROPEAN INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

31. ASIA-PACIFIC INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

32. ASIA-PACIFIC INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

33. ASIA-PACIFIC INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY SOURCE, 2021-2028 ($ MILLION)

34. ASIA-PACIFIC INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

35. REST OF THE WORLD INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

36. REST OF THE WORLD INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

37. REST OF THE WORLD INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY SOURCE, 2021-2028 ($ MILLION)

38. REST OF THE WORLD INDUSTRIAL ALCOHOL MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. GLOBAL INDUSTRIAL ALCOHOL MARKET SHARE BY TYPE, 2021 VS 2028 (%)

2. GLOBAL INDUSTRIAL ALCOHOL MARKET SHARE BY SOURCE, 2021 VS 2028 (%)

3. GLOBAL INDUSTRIAL ALCOHOL MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

4. GLOBAL INDUSTRIAL ALCOHOL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

5. GLOBAL ETHYL ALCOHOL MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL METHYL ALCOHOL MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL ISOPROPYL ALCOHOL MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL ISOBUTYL ALCOHOL MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL BENZYL ALCOHOL MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL OTHER ALCOHOL MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL SUGARCANE & BAGASSE BASED INDUSTRIAL MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL CORN BASED INDUSTRIAL MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL GRAINS BASED INDUSTRIAL MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL MOLASSES BASED INDUSTRIAL MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. GLOBAL FOSSIL FUELS BASED INDUSTRIAL MARKET SHARE BY REGION, 2021 VS 2028 (%)

16. GLOBAL OTHER SOURCE BASED INDUSTRIAL MARKET SHARE BY REGION, 2021 VS 2028 (%)

17. GLOBAL INDUSTRIAL ALCOHOL FOR FUEL MARKET SHARE BY REGION, 2021 VS 2028 (%)

18. GLOBAL INDUSTRIAL ALCOHOL FOR CHEMICAL INTERMEDIATES & SOLVENTS MARKET SHARE BY REGION, 2021 VS 2028 (%)

19. GLOBAL INDUSTRIAL ALCOHOL FOR PHARMACEUTICALS MARKET SHARE BY REGION, 2021 VS 2028 (%)

20. GLOBAL INDUSTRIAL ALCOHOL FOR PERSONAL CARE PRODUCTS MARKET SHARE BY REGION, 2021 VS 2028 (%)

21. GLOBAL INDUSTRIAL ALCOHOL FOR FOOD MARKET SHARE BY REGION, 2021 VS 2028 (%)

22. GLOBAL INDUSTRIAL ALCOHOL FOR OTHER MARKET SHARE BY REGION, 2021 VS 2028 (%)

23. US INDUSTRIAL ALCOHOL MARKET SIZE, 2021-2028 ($ MILLION)

24. CANADA INDUSTRIAL ALCOHOL MARKET SIZE, 2021-2028 ($ MILLION)

25. UK INDUSTRIAL ALCOHOL MARKET SIZE, 2021-2028 ($ MILLION)

26. FRANCE INDUSTRIAL ALCOHOL MARKET SIZE, 2021-2028 ($ MILLION)

27. GERMANY INDUSTRIAL ALCOHOL MARKET SIZE, 2021-2028 ($ MILLION)

28. ITALY INDUSTRIAL ALCOHOL MARKET SIZE, 2021-2028 ($ MILLION)

29. SPAIN INDUSTRIAL ALCOHOL MARKET SIZE, 2021-2028 ($ MILLION)

30. REST OF EUROPE INDUSTRIAL ALCOHOL MARKET SIZE, 2021-2028 ($ MILLION)

31. INDIA INDUSTRIAL ALCOHOL MARKET SIZE, 2021-2028 ($ MILLION)

32. CHINA INDUSTRIAL ALCOHOL MARKET SIZE, 2021-2028 ($ MILLION)

33. JAPAN INDUSTRIAL ALCOHOL MARKET SIZE, 2021-2028 ($ MILLION)

34. SOUTH KOREA INDUSTRIAL ALCOHOL MARKET SIZE, 2021-2028 ($ MILLION)

35. REST OF ASIA-PACIFIC INDUSTRIAL ALCOHOL MARKET SIZE, 2021-2028 ($ MILLION)

36. REST OF THE WORLD INDUSTRIAL ALCOHOL MARKET SIZE, 2021-2028 ($ MILLION)