Industrial Wax Market

Industrial Wax Market Size, Share & Trends Analysis Report, By Type (Fossil Based Wax, Synthetic Wax, and Bio-Based Wax), By Application (Candles, Packaging, Coatings & Polishing, Hot Melt Adhesives, Cosmetics & Personal Care, Others), Forecast Period (2022-2028)

Industrial wax market is anticipated to grow at a CAGR of 4.2% during the forecast period. The increasing application of industrial wax in different industrial applications is one of the key factors driving the growth of the market. Industrial wax refers to an organic substance utilized in varied industrial applications as an important constituent within a wide range of products. Increasing strategic associations among several end-users may create a huge demand for raw materials, such as petroleum waxes, bio-based waxes, and synthetic waxes.

The production and processing of synthetic wax pose a major challenge for production facilities. Waxes come with the risk of dust explosion and temperature sensitivity – even slight temperature fluctuations during production or processing can have a significant effect on the quality of the end product. Declining usage of paraffin wax in the packaging application may restrain the growth of the global industrial wax market.

Impact of COVID-19 Pandemic on the Global Industrial Wax Market

COVID-19 pandemic has made a negative impact on the growth of the global industrial wax market. The decline is caused mainly due to delays in construction activity and supply chain disruptions, as major countries imposed lockdown, social distancing measures for workers, and financial challenges. The impact was further intensified by declining oil and gas prices. Further, declining demand for cosmetics, candles, and consumer products across the globe wherein the wax is used has resulted in a slump in industrial wax demand across the globe.

Segmental Outlook

The global industrial wax market is segmented by type and application. The market segmentation based on the type includes fossil-based wax, synthetic wax, and bio-based wax. Based on application, the market is segmented into candles, packaging, coatings & polishing, hot melt adhesives, cosmetics & personal care, and others. The packaging segment held a considerable share in the global industrial wax market. Packaging is one of the key factors considered by the firms engaged in the manufacturing industry. The rapid growth of the packaging industry coupled with the growing number of manufacturing units, food processing plants, and increasing industrial production has created a demand for industrial wax for flexible packaging. Lightweight, easy handling, less space-consuming, longer shelf life, and easy transit are some core properties of industrial wax which make them suitable for packaging applications.

Regional Outlook

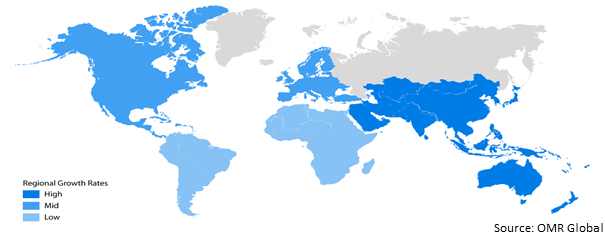

The global industrial wax market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement. North America is anticipated to exhibit considerable growth in the global industrial wax market. In North America, the US is the largest consumer of packaged goods, followed by Canada. The changing consumer behavior and manufacturers’ easier convenience are resulting in faster growth of the packaging industry in the country which in turn is driving the market growth.

Global Industrial Wax Market Growth, by Region 2022-2028

Asia-Pacific Holds Considerable Share in the Global Industrial Wax Market

Asia-Pacific holds a considerable share in the market owing to the extended packaging industry in key economies of the region such as India and China. According to Invest India, the packaging is the fifth largest sector in India. According to the Packaging Industry Association of India (PIAI), the sector is growing at a CAGR of 22.0% to 25.0%. According to the Indian Institute of Packaging (IIP), packaging consumption in India has increased 200% in the past decade, rising from 4.3 kg per person per annum (PPPA) to 8.6 kg PPPA as on FY20. Apart from the packaging industry, the growing automobile industry in Japan and the growing electronics industry in China are the contributors to the demand for industrial wax in these countries.

Market Players Outlook

The major companies serving the global industrial wax market include ExxonMobil Corp., Royal Dutch Shell plc, and Sinopec, among others. The companies are focusing on product launches, geographical expansion, mergers and acquisitions, and finding a new market or innovation in their core competency to expand individual market share. For instance, in August 2020, Sasol Ltd. entered into a distribution agreement with DKSH Management Ltd. (Switzerland) for marketing, distribution, and logistics for Sasol's chemicals and wax products in the European market.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global industrial wax market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Industrial Wax Market, By Type

4.1.1. Fossil Based Wax

4.1.2. Synthetic Wax

4.1.3. Bio-Based Wax

4.2. Global Industrial Wax Market, By Application

4.2.1. Candles

4.2.2. Packaging

4.2.3. Coatings & Polishing

4.2.4. Hot Melt Adhesives

4.2.5. Cosmetics & Personal Care

4.2.6. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Calumet Specialty Products Partners

6.2. CEPSA

6.3. ExxonMobil Corp.

6.4. Gandhar Oil refinery

6.5. Hollyfrontier Corp.

6.6. Numaligarh Refinery Ltd.

6.7. Petróleo Brasileiro

6.8. Royal Dutch Shell plc

6.9. Sasol Ltd.

6.10. Sinopec

6.11. THE PJSC Lukoil Oil Co.

1. GLOBAL INDUSTRIAL WAX MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL FOSSIL BASED WAX MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL SYNTHETIC WAX MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL BIO-BASED WAX MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL INDUSTRIAL WAX MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

6. GLOBAL INDUSTRIAL WAX FOR CANDLES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL INDUSTRIAL WAX FOR PACKAGING MARKET RESEARCH, AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL INDUSTRIAL WAX FOR COATINGS & POLISHING MARKET RESEARCH, AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL INDUSTRIAL WAX FOR HOT MELT ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL INDUSTRIAL WAX FOR COSMETICS & PERSONAL CARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL INDUSTRIAL WAX FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. NORTH AMERICAN INDUSTRIAL WAX MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

13. NORTH AMERICAN INDUSTRIAL WAX MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

14. NORTH AMERICAN INDUSTRIAL WAX MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

15. EUROPEAN INDUSTRIAL WAX MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. EUROPEAN INDUSTRIAL WAX MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

17. EUROPEAN INDUSTRIAL WAX MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC INDUSTRIAL WAX MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC INDUSTRIAL WAX MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC INDUSTRIAL WAX MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

21. REST OF THE WORLD INDUSTRIAL WAX MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22. REST OF THE WORLD INDUSTRIAL WAX MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

23. REST OF THE WORLD INDUSTRIAL WAX MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

24. GLOBAL INDUSTRIAL WAX MARKET SHARE BY TYPE, 2021 VS 2028 (%)

25. GLOBAL INDUSTRIAL WAX MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

26. GLOBAL INDUSTRIAL WAX MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

27. GLOBAL FOSSIL BASED WAX MARKET SHARE BY REGION, 2021 VS 2028 (%)

28. GLOBAL SYNTHETIC WAX MARKET SHARE BY REGION, 2021 VS 2028 (%)

29. GLOBAL BIO-BASED WAX MARKET SHARE BY REGION, 2021 VS 2028 (%)

30. GLOBAL INDUSTRIAL WAX FOR CANDLES MARKET SHARE BY REGION, 2021 VS 2028 (%)

31. GLOBAL INDUSTRIAL WAX FOR PACKAGING MARKET SHARE BY REGION, 2021 VS 2028 (%)

32. GLOBAL INDUSTRIAL WAX FOR COATINGS & POLISHING MARKET SHARE BY REGION, 2021 VS 2028 (%)

33. GLOBAL INDUSTRIAL WAX FOR HOT MELT ADHESIVES MARKET SHARE BY REGION, 2021 VS 2028 (%)

34. GLOBAL INDUSTRIAL WAX FOR COSMETICS & PERSONAL CARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

35. GLOBAL INDUSTRIAL WAX FOR OTHER APPLICATIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

36. US INDUSTRIAL WAX MARKET SIZE, 2021-2028 ($ MILLION)

37. CANADA INDUSTRIAL WAX MARKET SIZE, 2021-2028 ($ MILLION)

38. UK INDUSTRIAL WAX MARKET SIZE, 2021-2028 ($ MILLION)

39. FRANCE INDUSTRIAL WAX MARKET SIZE, 2021-2028 ($ MILLION)

40. GERMANY INDUSTRIAL WAX MARKET SIZE, 2021-2028 ($ MILLION)

41. ITALY INDUSTRIAL WAX MARKET SIZE, 2021-2028 ($ MILLION)

42. SPAIN INDUSTRIAL WAX MARKET SIZE, 2021-2028 ($ MILLION)

43. REST OF EUROPE INDUSTRIAL WAX MARKET SIZE, 2021-2028 ($ MILLION)

44. INDIA INDUSTRIAL WAX MARKET SIZE, 2021-2028 ($ MILLION)

45. CHINA INDUSTRIAL WAX MARKET SIZE, 2021-2028 ($ MILLION)

46. JAPAN INDUSTRIAL WAX MARKET SIZE, 2021-2028 ($ MILLION)

47. SOUTH KOREA INDUSTRIAL WAX MARKET SIZE, 2021-2028 ($ MILLION)

48. REST OF ASIA-PACIFIC INDUSTRIAL WAX MARKET SIZE, 2021-2028 ($ MILLION)

49. REST OF THE WORLD INDUSTRIAL WAX MARKET SIZE, 2021-2028 ($ MILLION)