Integrated Drive System Market

Global Integrated Drive System Market Size, Share & Trends Analysis Report by Product Type (Hardware and Software), by End-User (Automotive, Oil & Gas, Pharmaceutical, Chemical, Food & Beverages, Others) Forecast Period (2020-2026)

The integrated drive system market is projected to grow at a considerable CAGR of 5.2% during the forecast period (2020-2026). The integrated drive systems offer energy efficiency benefits of the comprehensive and custom engineered product and service offerings, including gearboxes, couplings, motors and drives through a single source. The increasing adoption of industry 4.0 initiative on a large scale across the globe has increased the demand for automation in industries. With the rise in the investment, the focal point of manufacturers has been increased on dropping the operational and maintenance costs, rolling need for integrated drive systems. Additionally, these systems provide high-level precise control and monitoring of the available assents in the industry.

The integration of drive technology into the totally integrated automation (TIA) portal radically simplifies engineering work diagnostics and engineering work. The rising demand for automation in the different industrial sectors such as automotive, food and beverage, pharmaceutical, oil & gas and others for overall cost reduction is a major factor to drive the growth of the global integrated drive system market. The ongoing technological advancement in equipment manufacturing is anticipated to offer considerable opportunities to the growth of the global market. However, due to the lack of a skilled workforce and limited awareness regarding integrated drive systems are limiting the growth of the market.

Segmental Outlook

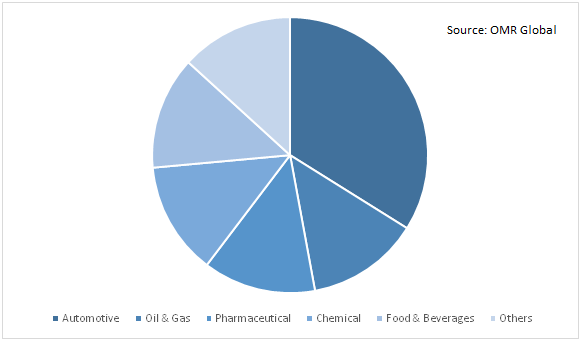

The global integrated drive system market is classified on the basis of product type, and end-user. Based on product type, the market is segmented into hardware and software. Based on end-user, the market is segmented into automotive, oil & gas, pharmaceutical, chemical, food & beverages, and others. The automotive & transportation segment is anticipated to hold considerable share based on the end-user segment.

Automotive will be considerable segment based on End-User

The automotive industry requires huge automation to support consistency in repetitive tasks. The automotive projects include assembly, paint, body, welding, stamping, and press of automotive parts. The integration of automotive systems with the plant floor connects people with technology to make more timely decisions. Moreover, the use of an integrated drive system to meet the manufacturing challenges in the automotive industry is a major contributor to the high market share of this segment.

Global Integrated Drive System Market Share by End-User in 2019 (%)

Regional Outlook

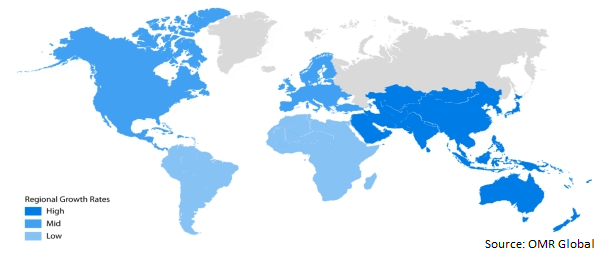

The global integrated drive system market is further segmented on the basis of geography including North America, Europe, Asia-Pacific and Rest of the World. North America is anticipated to hold considerable market share during the forecast period. Cohesive government policies to promote automation in industries are the major factor contributing to the high market share of the region. The considerable presence of various end-user verticals of integrated drive systems along with well-established IT infrastructure to further promote the high market share in the region. Moreover, the presence of a key vendor of the integrated drive system in the US is further anticipated to make considerable growth to the market share.

Global Integrated Drive System Market Growth, by Region 2020-2026

Asia-Pacific is anticipated to exhibit considerable CAGR during the forecast period 2020-2026

In Asia-Pacific, emerging countries such as India and China majorly contribute to the growth of the integrated drive system market, as they are focussing on the development of their industrial sectors. The growing need for automation in the industries, high rate of production along with the increased demand for high-quality products are creating the demand for integrated drive systems which in turn will promote the demand of these systems in the region. The adoption of ‘Made in India’ and ‘Made in China’ policies to promote the manufacturing industry is another major aspect creating the demand of integrated drive systems in the region to meet the growing demand for automation in the industries. This factor further promotes the growth of the integrated drive system market in the region.

Market Players Outlook

The major players operating in the global integrated drive system market include ABB Ltd., Siemens AG, Schneider Electric SE, Mitsubishi Electric Corp., Rockwell Automation, Inc., Emerson Electric Co., Yaskawa Electric Corp., Integrated Drive Systems LLC, Bosch Rexroth USA and so on. The integrated drive system market is a highly consolidated market. These players are actively adopting different organic and inorganic growth strategies such as new product launch, partnerships, collaboration, and mergers and acquisitions to sustain their market place. For instance, in November 2019, Rockwell Automation, Inc. and Accenture’s Industry X.0 had entered into the partnership. The partnership was aimed to develop a digital offering to facilitate industrial clients to move beyond existing manufacturing solutions for the transformation of their entire connected enterprise. In May 2018, Siemens AG launched Industrial Ethernet switches with special functions for the process industry. The firmware functions (Profinet S2 device, H-Sync, and configuration in Run/CiR/H-CiR) in interaction with the Simatic PCS 7 process control system make the new products suitable for the flexible, reliable, and high-performance networking of process automation devices.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global integrated drive system market. Based on the availability of data, information related to the products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. ABB, Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Siemens AG

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Schneider Electric SE

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Mitsubishi Electric Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Rockwell Automation, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Integrated Drive System Market by Product Type

5.1.1. Hardware

5.1.2. Software

5.2. Global Integrated Drive System Market by End-User

5.2.1. Automotive

5.2.2. Oil & Gas

5.2.3. Pharmaceutical

5.2.4. Chemical

5.2.5. Food & Beverages

5.2.6. Others

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ABB, Ltd.

7.2. Bosch Rexroth Corp.

7.3. Cummins Inc.

7.4. Eaton Corp.

7.5. Emerson Electric Co.

7.6. Honeywell International Inc.

7.7. Integrated Drive Systems LLC

7.8. Mitsubishi Electric Corp.

7.9. Rockwell Automation, Inc.

7.10. Schneider Electric SE

7.11. Siemens AG

7.12. TQ Group

7.13. Yaskawa Electric Corp.

1. GLOBAL INTEGRATED DRIVE SYSTEM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

2. GLOBAL HARDWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL INTEGRATED DRIVE SYSTEM MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

5. GLOBAL AUTOMOTIVE & TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL OIL & GAS MARKET RESEARCH AND ANALYSIS BY REGION,2019-2026 ($ MILLION)

7. GLOBAL PHARMACEUTICAL MARKET RESEARCH AND ANALYSIS BY REGION,2019-2026 ($ MILLION)

8. GLOBAL CHEMICAL MARKET RESEARCH AND ANALYSIS BY REGION,2019-2026 ($ MILLION)

9. GLOBAL FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION,2019-2026 ($ MILLION)

10. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION,2019-2026 ($ MILLION)

11. NORTH AMERICA INTEGRATED DRIVE SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN INTEGRATED DRIVE SYSTEM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

13. NORTH AMERICAN INTEGRATED DRIVE PRODUCT TYPE MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

14. EUROPEAN INTEGRATED DRIVE SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. EUROPEAN INTEGRATED DRIVE SYSTEM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

16. EUROPEAN INTEGRATED DRIVE SYSTEM MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC INTEGRATED DRIVE SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC INTEGRATED DRIVE PRODUCT TYPE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC INTEGRATED DRIVE SYSTEM MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

20. REST OF THE WORLD INTEGRATED DRIVE SYSTEM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

21. REST OF THE WORLD INTEGRATED DRIVE SYSTEM MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

1. GLOBAL INTEGRATED DRIVE SYSTEM MARKET SHARE BY PRODUCT TYPE, 2019 VS 2026 (%)

2. GLOBAL INTEGRATED DRIVE SYSTEM MARKET SHARE BY END-USER, 2019 VS 2026 (%)

3. GLOBAL INTEGRATED DRIVE SYSTEM MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. THE US INTEGRATED DRIVE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA INTEGRATED DRIVE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

6. UK INTEGRATED DRIVE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE INTEGRATED DRIVE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY INTEGRATED DRIVE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY INTEGRATED DRIVE PRODUCT TYPE MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN INTEGRATED DRIVE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE INTEGRATED DRIVE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA INTEGRATED DRIVE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA INTEGRATED DRIVE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN INTEGRATED DRIVE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC INTEGRATED DRIVE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD INTEGRATED DRIVE SYSTEM MARKET SIZE, 2019-2026 ($ MILLION)