Laminating Adhesives Market

Laminating Adhesives Market Size, Share & Trends Analysis Report, By Resin Type (Acrylic, Polyurethane, and Others), By Application (Packaging, Automotive & Transportation, and Others), Forecast Period (2022-2028)

Laminating adhesives market is anticipated to grow at a CAGR of 6.2% during the forecast period. The growing demand for flexible packaging from end-user industries is a key factor driving the growth of the global laminating adhesives market. Laminating adhesives are used for bonding metal substances and plastics with each other. They are used in packing cheese, meat, coffee, tea, pharmaceuticals, and other consumable products. The restructuring of the pharmaceutical industry in the US is projected to offer numerous opportunities for market vendors to develop more lightweight laminating adhesives.

High expenditure on biopharmaceutical R&D and growing demand for medical devices are opportunistic areas for the market players. As per the Pharmaceutical Research and Manufacturers Association, US companies spend nearly $75 billion on new medicines annually. These companies also hold intellectual property rights on most of the new medicine. The growing pharmaceutical sector is anticipated to create demand for laminating adhesives.

Impact of COVID-19 Pandemic on the Global Laminating Adhesives Market

The COVID-19 pandemic has made a negative impact on the growth of the laminating adhesives market. The decline is caused mainly due to delays in construction activity and supply chain disruptions, as major countries-imposed lockdown, social distancing measures for workers, and financial challenges. According to the International Organization of Motor Vehicle Manufacturers report, global automobile production declined by around 16.0% during COVID-19 in 2020 and even car sales dropped in 2020 by 13.8% in comparison to 2019. Due to the less demand from the automobile industry for laminating adhesives, the market declined. The growing preference for packed food products and ready-to-eat food items during COVID-19 has created a huge demand for packaging in the food & beverages sector.

Segmental Outlook

The global laminating adhesives market is segmented by resin type and application. The market segmentation based on the resin type includes acrylic, polyurethane, and others. Based on application, the market is segmented into packaging, automotive & transportation, and others.

Packaging Segment Holds Considerable Share in the Global Laminating Adhesives Market

Based on application, the market is segmented into packaging, automotive and transportation, and others. The packaging segment held a considerable share in 2021. Packaging is one of the key factors considered by the firms engaged in the manufacturing industry. The rapid growth of the packaging industry with the growing number of manufacturing units, food processing plants, and increasing industrial production has created a demand for laminating adhesives for flexible packaging. Lightweight, easy handling, less space-consuming, longer shelf life, and easy transit are the core properties of laminating adhesives which makes laminating adhesives suitable for packaging applications.

Regional Outlooks

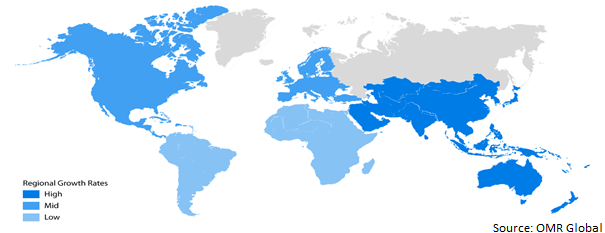

The global laminating adhesives market is further segmented based on geography including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement. North America is anticipated to exhibit considerable growth in the global laminating adhesives market. In North America, the US is the largest consumer of packaged goods, followed by Canada. The changing consumer behavior and manufacturers’ easier convenience are resulting in faster growth of the packaging market in the country which in turn drives the market growth.

Global Laminating Adhesives Market Growth, by Region 2022-2028

Asia-Pacific Holds Considerable Share in Laminating Adhesives Market

Asia-Pacific held a considerable share in the global laminating adhesives market owing to the extended packaging industry in key economies of the region such as India and China. According to Invest India, the packaging is the fifth largest sector in India. According to the Packaging Industry Association of India (PIAI), the sector is growing at a CAGR of 22.0% to 25.0%. According to the Indian Institute of Packaging (IIP), packaging consumption in India has increased 200% in the past decade, rising from 4.3 kg per person per annum (PPPA) to 8.6 kg PPPA as on FY20. Apart from the packaging industry, the growing automobile industry in Japan and the growing electronics industry in China are the contributors to the demand for laminating adhesive market.

Market Players Outlook

The major companies serving the global laminating adhesives market include Henkel AG & Co. KGaA, 3M Co., and Arkema Group (Bostik), among others. The companies are focusing on product innovation, technology advancements, expansions, mergers and acquisitions, and finding a new market or innovation in their core competency to expand individual market share. For instance, in June 2022, Toyo-Morton, a Japanese manufacturer of laminating adhesives and a member of the Toyo Ink Group, updated its laminating adhesives portfolio with food-safe products that are free of epoxy silanes and organic tin compounds. The lineup includes both the solvent-based Tomoflex and the solvent-free Ecoad series of laminating adhesives that are suitable for a wide range of multilayer flexible packaging applications, such as dry food, liquid pouch and high-performance retort. All products in the lineup conform to global food contact regulations for adhesives, such as the EU No 10/2011, US FDA 175.105, China GB 9685-2016 and Japan’s Notification No 196.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global laminating adhesives market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Laminating Adhesives Market, By Resin Type

4.1.1. Acrylic

4.1.2. Polyurethane

4.1.3. Others

4.2. Global Laminating Adhesives Market, By Application

4.2.1. Packaging

4.2.2. Automotive & Transportation

4.2.3. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. 3M Co.

6.2. Arkema Group (Bostik)

6.3. Ashland Inc.

6.4. Coim Group (Novacote)

6.5. DIC India Ltd.

6.6. DuPont

6.7. Evonik Industries AG

6.8. Flint Group

6.9. H.B. Fuller Company

6.10. Henkel AG & Co. KGaA

6.11. Hubergroup

6.12. LD Davis

6.13. Sika AG

6.14. Shandong Huacheng High-tech Adhesive Co., Ltd

6.15. Toyochem Co., Ltd.

1. GLOBAL LAMINATING ADHESIVES MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2021-2028 ($ MILLION)

2. GLOBAL ACRYLIC BASED LAMINATING ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL POLYURETHANE BASED LAMINATING ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL OTHER RESIN BASED LAMINATING ADHESIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL LAMINATING ADHESIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

6. GLOBAL LAMINATING ADHESIVES FOR PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL LAMINATING ADHESIVES FOR AUTOMOTIVE & TRANSPORTATION MARKET RESEARCH, AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL LAMINATING ADHESIVES FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. NORTH AMERICAN LAMINATING ADHESIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

10. NORTH AMERICAN LAMINATING ADHESIVES MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2021-2028 ($ MILLION)

11. NORTH AMERICAN LAMINATING ADHESIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

12. EUROPEAN LAMINATING ADHESIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

13. EUROPEAN LAMINATING ADHESIVES MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2021-2028 ($ MILLION)

14. EUROPEAN LAMINATING ADHESIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

15. ASIA-PACIFIC LAMINATING ADHESIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. ASIA-PACIFIC LAMINATING ADHESIVES MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC LAMINATING ADHESIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

18. REST OF THE WORLD LAMINATING ADHESIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. REST OF THE WORLD LAMINATING ADHESIVES MARKET RESEARCH AND ANALYSIS BY RESIN TYPES, 2021-2028 ($ MILLION)

20. REST OF THE WORLD LAMINATING ADHESIVES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

21. GLOBAL LAMINATING ADHESIVES MARKET SHARE BY RESIN TYPES, 2021 VS 2028 (%)

22. GLOBAL LAMINATING ADHESIVES MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

23. GLOBAL LAMINATING ADHESIVES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

24. GLOBAL ACRYLIC BASED LAMINATING ADHESIVES MARKET SHARE BY REGION, 2021 VS 2028 (%)

25. GLOBAL POLYURETHANE BASED LAMINATING ADHESIVES MARKET SHARE BY REGION, 2021 VS 2028 (%)

26. GLOBAL OTHER RESIN BASED LAMINATING ADHESIVES MARKET SHARE BY REGION, 2021 VS 2028 (%)

27. GLOBAL LAMINATING ADHESIVES FOR PACKAGING MARKET SHARE BY REGION, 2021 VS 2028 (%)

28. GLOBAL LAMINATING ADHESIVES FOR AUTOMOTIVE & TRANSPORTATION MARKET SHARE BY REGION, 2021 VS 2028 (%)

29. GLOBAL LAMINATING ADHESIVES FOR OTHER APPLICATION MARKET SHARE BY REGION, 2021 VS 2028 (%)

30. US LAMINATING ADHESIVES MARKET SIZE, 2021-2028 ($ MILLION)

31. CANADA LAMINATING ADHESIVES MARKET SIZE, 2021-2028 ($ MILLION)

32. UK LAMINATING ADHESIVES MARKET SIZE, 2021-2028 ($ MILLION)

33. FRANCE LAMINATING ADHESIVES MARKET SIZE, 2021-2028 ($ MILLION)

34. GERMANY LAMINATING ADHESIVES MARKET SIZE, 2021-2028 ($ MILLION)

35. ITALY LAMINATING ADHESIVES MARKET SIZE, 2021-2028 ($ MILLION)

36. SPAIN LAMINATING ADHESIVES MARKET SIZE, 2021-2028 ($ MILLION)

37. REST OF EUROPE LAMINATING ADHESIVES MARKET SIZE, 2021-2028 ($ MILLION)

38. INDIA LAMINATING ADHESIVES MARKET SIZE, 2021-2028 ($ MILLION)

39. CHINA LAMINATING ADHESIVES MARKET SIZE, 2021-2028 ($ MILLION)

40. JAPAN LAMINATING ADHESIVES MARKET SIZE, 2021-2028 ($ MILLION)

41. SOUTH KOREA LAMINATING ADHESIVES MARKET SIZE, 2021-2028 ($ MILLION)

42. REST OF ASIA-PACIFIC LAMINATING ADHESIVES MARKET SIZE, 2021-2028 ($ MILLION)

43. REST OF THE WORLD LAMINATING ADHESIVES MARKET SIZE, 2021-2028 ($ MILLION)