Large Caliber Ammunition Market

Global Large Caliber Ammunition Market Size, Share & Trends Analysis Report, By Caliber Type (Artillery Ammunition, Tank Ammunition, Mortar Ammunition, and Naval Ammunition) and Forecast, 2020-2026

The global large caliber ammunition market is estimated to grow at a CAGR of nearly 4.5% during the forecast period. The major factors leading to increasing demand for large caliber ammunition include rising military spending and significant terrorist activities and political tension between countries. As per the Stockholm International Peace Research Institute (SIPRI), in 2019, the total global military spending increased to $1,917 billion, which represents a rise of 3.6% from 2018. The five major countries that significantly invests in military spending include the US, China, India, Russia and Saudi Arabia. These countries accounted for 62% of the total global military spending.

The increasing military spending has led the demand for weapon systems to meet peer and near-peer threats. This contributes to the emerging adoption of large caliber ammunition that covers mortar rounds and tank artillery, which is available in the types of 60 mm to 155 mm. The large caliber weapons and ammunition offered by the major players include 120 mm HE DM 11 Tank Ammunition (Rheinmetall AG), 120 mm PELE Tank Ammunition (Rheinmetall AG), and 105 mm – M724A2 TPDS-T (General Dynamics Corp.), and 105 mm – M456A2 HEAT-T (General Dynamics Corp.). The 105mm M724A2 TPDS-T round is utilized as a training surrogate for all 105 mm kinetic energy cartridges, such as the M900, M774, M735, and M833.

A tracer is placed in the projectile base. A rubber obdurating band and fiber rotating band are equipped toward the sabot base. Further, DM 11, a 120 mm HE tank round is the Rheinmetall's large caliber ammunition. It is particularly appropriate to encourage infantry units that are engaged in engaging light and medium weight armoured vehicles and tasked with taking lightly fortified positions. It is an ideal match for the altered operational needs of modern main battle tanks. Upgradation of military vehicles with advanced C4ISR capabilities and weapon systems, the demand for ammunition systems is expected to grow significantly.

It has the capability to kill dismounted infantry by fragmentation and blast and to destroy non-armored and lightly armored vehicles and bunkers. Therefore, the countries use large caliber ammunition systems to protect and empower soldiers of their countries. However, the increasing demand for small caliber ammunition is acting as a major restraining factor for the market growth. The military sector is funding R&D projects that focus on decreasing the weight of equipment that soldiers carry. This, in turn, is leading to the emerging shift towards small ammunition systems.

Market Segmentation

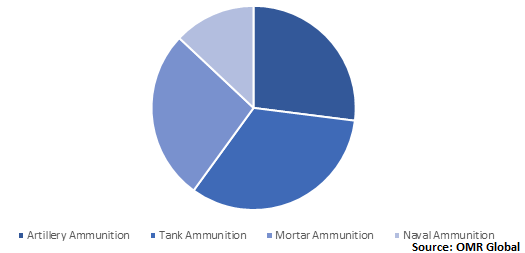

The global large caliber ammunition market is segmented based on caliber type which is classified into artillery ammunition, tank ammunition, mortar ammunition, and naval ammunition. Artillery ammunition is sub-segmented into 105 mm and 105 mm. Tank ammunition is further sub-segmented into 120 mm and 105 mm. Mortar ammunition is further sub-segmented into 60 mm, 81 mm, and 120 mm. Naval ammunition is further sub-segmented into 57 mm, 76 mm, and 127 mm.

Artillery ammunition is anticipated to hold significant share during the forecast period

The Army’s artillery ammunition program includes 105 mm and 155 mm projectiles and their associated fuzes and propelling charges. Artillery ammunition continues to play a crucial role in modern warfare. Some contracts regarding artillery ammunition has been witnessed in emerging countries. In October 2019, the Indian Army has procured more than 600 rounds of 155 mm Excalibur artillery ammunition from the US to increase the firepower of artillery. It is long-range ammunition and can hit targets over 50 Km away. A precision-guided kit is put on shells along with the Excalibur, to enhance the accuracy of the target. The Excalibur ammunition has better accuracy and more range that makes it lethal can hit targets at 40-50 km which depends on the artillery gun used.

Global Large Caliber Ammunition Market Share by Caliber Type, 2019 (%)

Regional Outlook

The global large caliber ammunition market is segmented into four major regions, including North America, Europe, Asia-Pacific, and Rest of the World (RoW). In 2019, North America is anticipated to hold a potential share in the market owing to the considerable spending on military operations and increasing focus on advanced weapon systems. As per the SIPRI, in 2019, the US military expenditure increased by 5.3% to $732 billion and held 38% of global military expenditure. The country is the largest military spender and as a result, they focus on advancing and upgrading their military systems, which contributes to the significant adoption of large caliber ammunition systems in the region.

Global Large Caliber Ammunition Market Growth, by Region 2020-2026

Market Players Outlook

The major players operating in the market include General Dynamics Corp., Rheinmetall AG, Nexter Group, Northrop Grumman Corp., and Nammo A/S. The strategies adopted by the market players include mergers and acquisitions, product launches, and partnerships and collaborations to expand market share and gain a competitive advantage. For instance, in June 2018, Northrop Grumman Corp. completes the acquisition of Orbital ATK, a provider of military solutions, including caliber ammunition systems. With this acquisition, Northrop Grumman looks forward to develop increased mission capabilities and offer more competitive products in critical global security domains. This, in turn, will enable to accelerate the company’s market share.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global large caliber ammunition market. Based on the availability of data and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. General Dynamics Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Rheinmetall AG

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Nexter Group

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Northrop Grumman Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Nammo AS

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Large Caliber Ammunition Market by Caliber Type

5.1.1. Artillery Ammunition

5.1.1.1. 105 mm

5.1.1.2. 155 mm

5.1.2. Tank Ammunition

5.1.2.1. 120 mm

5.1.2.2. 105 mm

5.1.3. Mortar Ammunition

5.1.3.1. 60 mm

5.1.3.2. 81 mm

5.1.3.3. 120 mm

5.1.4. Naval Ammunition

5.1.4.1. 57 mm

5.1.4.2. 76 mm

5.1.4.3. 127 mm

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. BAE Systems plc

7.2. Chemring Group plc

7.3. Denel SOC Ltd.

7.4. Diehl Stiftung & Co. KG

7.5. Elbit Systems Ltd.

7.6. EURENCO

7.7. General Dynamics Corp.

7.8. Inductotherm (India) Pvt. Ltd.

7.9. Leonardo S.p.A.

7.10. MAXAMCorp Holding S.L.

7.11. Nammo AS

7.12. Nexter Group

7.13. Northrop Grumman Corp.

7.14. Poongsan Corp.

7.15. Rheinmetall AG

7.16. RUAG Holding AG

7.17. Saab AB

7.18. Singapore Technologies Engineering Ltd. (ST Engineering)

7.19. Yugoimport SDPR J.P.

1. GLOBAL LARGE CALIBER AMMUNITION MARKET RESEARCH AND ANALYSIS BY CALIBER TYPE, 2019-2026 ($ MILLION)

2. GLOBAL ARTILLERY AMMUNITION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL TANK AMMUNITION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL MORTAR AMMUNITION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL NAVAL AMMUNITION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL LARGE CALIBER AMMUNITION MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

7. NORTH AMERICAN LARGE CALIBER AMMUNITION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

8. NORTH AMERICAN LARGE CALIBER AMMUNITION MARKET RESEARCH AND ANALYSIS BY CALIBER TYPE, 2019-2026 ($ MILLION)

9. EUROPEAN LARGE CALIBER AMMUNITION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

10. EUROPEAN LARGE CALIBER AMMUNITION MARKET RESEARCH AND ANALYSIS BY CALIBER TYPE, 2019-2026 ($ MILLION)

11. ASIA-PACIFIC LARGE CALIBER AMMUNITION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. ASIA-PACIFIC LARGE CALIBER AMMUNITION MARKET RESEARCH AND ANALYSIS BY CALIBER TYPE, 2019-2026 ($ MILLION)

13. REST OF THE WORLD LARGE CALIBER AMMUNITION MARKET RESEARCH AND ANALYSIS BY CALIBER TYPE, 2019-2026 ($ MILLION)

1. GLOBAL LARGE CALIBER AMMUNITION MARKET SHARE BY CALIBER TYPE, 2019 VS 2026 (%)

2. GLOBAL LARGE CALIBER AMMUNITION MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

3. US LARGE CALIBER AMMUNITION MARKET SIZE, 2019-2026 ($ MILLION)

4. CANADA LARGE CALIBER AMMUNITION MARKET SIZE, 2019-2026 ($ MILLION)

5. UK LARGE CALIBER AMMUNITION MARKET SIZE, 2019-2026 ($ MILLION)

6. FRANCE LARGE CALIBER AMMUNITION MARKET SIZE, 2019-2026 ($ MILLION)

7. GERMANY LARGE CALIBER AMMUNITION MARKET SIZE, 2019-2026 ($ MILLION)

8. ITALY LARGE CALIBER AMMUNITION MARKET SIZE, 2019-2026 ($ MILLION)

9. SPAIN LARGE CALIBER AMMUNITION MARKET SIZE, 2019-2026 ($ MILLION)

10. ROE LARGE CALIBER AMMUNITION MARKET SIZE, 2019-2026 ($ MILLION)

11. INDIA LARGE CALIBER AMMUNITION MARKET SIZE, 2019-2026 ($ MILLION)

12. CHINA LARGE CALIBER AMMUNITION MARKET SIZE, 2019-2026 ($ MILLION)

13. JAPAN LARGE CALIBER AMMUNITION MARKET SIZE, 2019-2026 ($ MILLION)

14. REST OF ASIA-PACIFIC LARGE CALIBER AMMUNITION MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF THE WORLD LARGE CALIBER AMMUNITION MARKET SIZE, 2019-2026 ($ MILLION)