Logistics Market

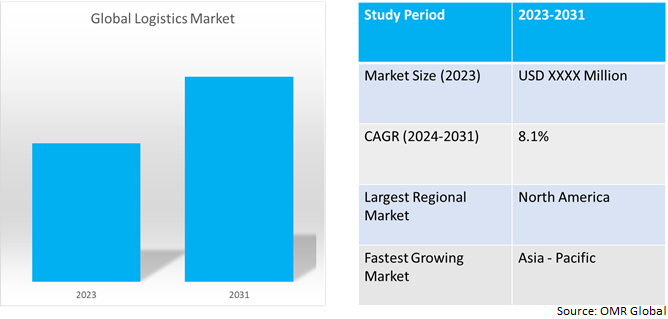

Logistics Market Size, Share & Trends Analysis Report by Mode of Transport (Railways, Airways, Roadways, and Waterways), by End Use (Healthcare, Manufacturing, Aerospace, Government and Public Utilities, Retail and Ecommerce, Trade and Transportation, and Others) and by Model (1PL, 2PL, 3PL and 4PL) Forecast Period (2024-2031) Update Available - Forecast 2025-2035

Logistics market is anticipated to grow at a CAGR of 8.1% during the forecast period (2024-2031). The global logistics market is being driven by factors including growing fleet connectivity, developing infrastructure, and improving logistics management through technology integration.

Market Dynamics

Growing e-commerce increases the need for effective fulfillment and delivery services.

The logistics industry has undergone a significant transformation due to the exponential growth of e-commerce, which is fueled by the ease and accessibility of online shopping. This surge in online buying has created a massive demand for efficient and reliable delivery and fulfillment services, and logistics companies are constantly innovating and expanding their operations to meet these evolving customer needs.For instance, according to US census department total e-commerce sales for 2023 were estimated at $1.1trillion, an increase of 7.6 percent (±1.2%) from 2022. E-commerce sales in 2023 accounted for 15.4 percent of total sales. E-commerce sales in 2022 accounted for 14.7 percent of total sales.According to estimates, U.S. retail e-commerce sales increased by 19.5% from the third quarter of 2023 to $324.8 billion in the fourth quarter. This has resulted in the development of sophisticated warehousing and distribution networks, the optimization of last-mile delivery solutions, and the integration of advanced technologies to ensure smooth and efficient order fulfillment. For instance, in October 2023, Amazon launches a new, state-of-the-art fulfilment center in Stockton-on-Tees, County Durham, for $559 million. The 464,000 square foot center was initially designed to house up to 1,000 staff, but when it started processing client orders, that number quickly increased to 2,000.

Deepening international trade ties propel demand for efficient cross-border logistics.

The expansion of international business partnerships and the intensification of global trade call for highly efficient and well-coordinated logistics infrastructure. This includes efficient transportation networks to move goods quickly across borders, effective trade facilitation measures to lower trade barriers and administrative burdens, and robust logistics solutions to manage the complexities of international trade. For instance, in September 2023 A.P. Moller - Maersk launched new product, an end-to-end intermodal ship and rail transport solution, aims to enhance the efficiency of cargo transportation particularly for consumer, lifestyle, and tech products to the growing consumer markets in Central Asia.

As countries enter into new trade agreements and partnerships, the need for robust logistics solutions to manage the complexities of international trade will only grow exponentially. This calls for ongoing infrastructure development to handle increased trade volumes, technological advancements to optimize logistics processes.In November 2023, Indian Prime Minister Narendra Modi and Bangladesh Prime Minister Sheikh Hasina, launched Akhaura-Agartala cross-border rail link. Increased commerce with India, its second-largest trading partner, is one of the promises of the train link. It has been noted that the link will promote bilateral trade in agricultural products like tea, sugar, building materials, iron and steel, and consumer goods.

Market Segmentation

Our in-depth analysis of the global logistics market includes the following segments by mode of transport, by end use, and by model:

- Based mode of transport, the market is sub-segmented into railways, airways, roadways and waterways.

- Based on end use, the market is sub-segmented intohealthcare, manufacturing, aerospace, government and public utilities, retail and ecommerce, trade and transportation and others.

- Based on application the market is sub segmented into 1PL, 2PL, 3PL and 4PL.

Healthcare emerges as the fastest growing Sub-segment

Based on the end use, the global logistics market is sub-segmented into healthcare, manufacturing, aerospace, government and public utilities, retail and ecommerce, trade and transportation and others. Among these, healthcare sector is dedicated to the specialized transportation and storage of pharmaceuticals, medical supplies, and other goods related to healthcare. The need for effective and dependable healthcare logistics solutions is growing due to the aging population, the growing global healthcare sector, and the growing demand for personalized medicine. Strict compliance with regulations and compliance requirements is required to guarantee the timely and safe delivery of essential medical supplies. In February 2024 DHL Supply Chain, announced a $200 million investment dedicated to expanding its life sciences and healthcare capabilities. This calculated move will increase their footprint to more than 13 million square feet by building brand-new, cutting-edge warehouse facilities. Furthermore, the development of temperature-controlled packaging and real-time tracking technologies is essential to preserve product integrity and guarantee patient safety.

Waterways Holds a Considerable Market Share

Waterway logistics is experiencing a resurgence driven by several factors.It is positioned as a sustainable and cost-competitive solution for global trade, playing a crucial role in the future of the global supply chain. For Instance, in November 2023Amazon India has signed a Memorandum of Understanding (MoU) with the Inland Waterways Authority of India (IWAI), under the Ministry of Ports, Shipping, and Waterways, to facilitate the movement of containerized cargo. The potential 14,500 km of navigable inland waterways are made up of rivers, canals, backwaters, and creeks.

Congestion on land routes necessitates alternative routes with greater capacity, which waterways can provide. Technological advancements in autonomous vessels and navigation systems are enhancing efficiency and safety. Government investments in infrastructure are boosting connectivity and facilitating larger cargo volumes. For instance, in September 2023, Union minister of ports, shipping and waterways & AYUSH, Sarbananda Sonowal Said “Waterways and logistics are the bedrock of our economic growth, and the Global Maritime India Summit-2023 is the catalyst for partnership and realizing the shared vision of generating investment of Rs 10 lakh crore and creating more than 15 lakh employment avenues for the youth,”.

Regional Outlook

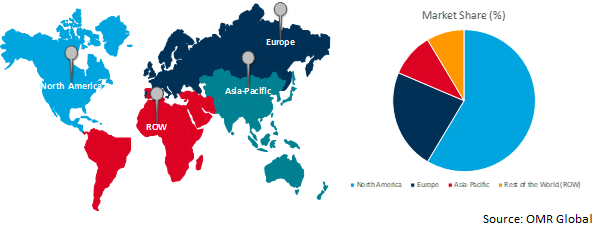

The global Logisticsmarket is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Holds the Considerable Market Share

- The developed infrastructure including airports, railroads, and highways make it easier to move commodities throughout the continent effectively. In September 2023, The Federal Railroad Administration (FRA) of the U.S. Department of Transportation (USDOT) announced that it has invested more than $1.4 billion from President Biden’s Bipartisan Infrastructure Law into 70 rail improvement projects in 35 states and Washington, D.C. This is the largest amount ever awarded for rail safety and rail supply chain upgrades through the Consolidated Rail Infrastructure and Safety Improvements (CRISI) program. Such investments are further supporting infrastructure development thereby driving the regional logistics market.

- Canada's growing e-commerce market drives the need for more robust logistics. .a According to International Trade Administration Canada has embraced e-commerce in the face of a significant challenge to traditional retail outlets.E-commerce sales as of March 2022 were roughly$2.34 billion. Retail eCommerce sales are projected to reach $40.3 billion by 2025.

Global Logistics Market Growth by Region 2024-2031

Rising Demand for Logistics in Asia-Pacific: A Look at the Driving Forces

The Asia-Pacific region's logistics industry is booming, due to the convergence of two major factors: the region's booming industrial sector and the rapidly expanding e-commerce market. The region is experiencing an exponential growth in e-commerce due to factors such as rising internet penetration, rising disposable income, and a rapidly expanding middle class. As a result, there is an increasing need for dependable and efficient logistics solutions to meet the demands of online consumers. These solutions should include robust warehousing infrastructure, well-designed last-mile delivery networks, and efficient reverse logistics capabilities to handle returns and exchanges. According to Asian Development Bank in 2022, Asia and the Pacific still accounts for the largest share of the world’s online retail market. By 2025, the worldwide e-commerce market is expected to contribute 6.1% of GDP, up from 3.8% in 2019.

Moreover, the Asia-Pacific area is one of the world's manufacturing hotspots, accounting for a large share of the world's production output. This means that reliable and reasonably priced logistics networks are required to guarantee the prompt and safe transportation of goods from production sites to international markets. For instance, the national manufacturing policy of the Government of India aims to increase the share of manufacturing in GDP to 25 percent by 2025 from 17 percent. Increased Manufacturing capabilities are supported by huge investments in logistics and supply chain network.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global logistics market include. Moller, Schenker AG, Deutsche Post AG, FeFedEx Corp., and United Parcel ServiceInc. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in January 2023, A. P. Moller - Maersk completes acquisition of project logistics Danish Martin Bencher Group. This will boost their ability to offer project logistics services to global clients.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global logistics market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. A.P. Moller - Maersk

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Schenker AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Deutsche Post AG

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. FeFedEx Corp

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. United Parcel Service, Inc

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Logistics Market by Mode of Transport

4.1.1. Railways

4.1.2. Airways

4.1.3. Roadways

4.1.4. Waterways

4.2. Global Logistics Market by End Use

4.2.1. Healthcare

4.2.2. Manufacturing

4.2.3. Aerospace

4.2.4. Government and Public Utilities

4.2.5. Retail and Ecommerce

4.2.6. Trade and Transportation

4.2.7. Others (BFSI, Technology, and Telecommunication)

4.3. Global Logistics Market by Model

4.3.1. 1PL

4.3.2. 2PL

4.3.3. 3PL

4.3.4. 4PL

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Allcargo Logistics Ltd.

6.2. Americold Logistics, Inc.

6.3. BOLLORE LOGISTICS

6.4. C.H. Robinson Worldwide Inc

6.5. CMA CGM

6.6. DSV

6.7. Expeditors International of Washington, Inc.

6.8. GEODIS

6.9. GXO Logistics, Inc

6.10. Japan Post Holdings Co., Ltd

6.11. Kintetsu World Express, Inc.

6.12. Kuehne + Nagel International AG

6.13. Landstar System Holdings, Inc.

6.14. Logwin AG

6.15. NFI Industries

6.16. Nippon Express Co., Ltd.

6.17. Orient Overseas Container Line Limited

6.18. The Aramex Group

6.19. XPO, Inc.

6.20. Yamato Holdings Co., Ltd.

1. GLOBAL LOGISTICS MARKET BY MODE OF TRANSPORT, 2023-2031 ($ MILLION)

2. GLOBAL RAILWAYS LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL AIRWAYS LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL ROADWAYS LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL WATERWAYS LOGISTICS MARKET FOR RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL LOGISTICS MARKET BY END USE, 2023-2031 ($ MILLION)

7. GLOBAL LOGISTICS FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL LOGISTICS FOR MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL LOGISTICS FOR AEROSPACE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL LOGISTICS FOR GOVERNMENT AND PUBLIC UTILITIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL LOGISTICS FOR RETAIL AND ECOMMERCE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL LOGISTICS FOR TRADE AND TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL LOGISTICS FOR OTHER END-USE MARKET SRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL LOGISTICSMARKET RESEARCH AND ANALYSIS BYMODEL, 2023-2031 ($ MILLION)

15. GLOBALL 1PL OGISTICS MARKETRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL 2PL LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL 3PL LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL 4PL LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL LOGISTICSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. NORTH AMERICAN GLOBAL LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. NORTH AMERICAN GLOBAL LOGISTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT 2023-2031 ($ MILLION)

22. NORTH AMERICAN GLOBAL LOGISTICSMARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

23. NORTH AMERICAN GLOBAL LOGISTICSMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

24. EUROPEAN GLOBAL LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. EUROPEAN GLOBAL LOGISTICS MARKET RESEARCH AND ANALYSIS BYPRODUCT, 2023-2031 ($ MILLION)

26. EUROPEAN GLOBAL LOGISTICS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2023-2031 ($ MILLION)

27. EUROPEAN GLOBAL LOGISTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

28. EUROPEAN GLOBAL LOGISTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

29. ASIA- PACIFIC GLOBAL LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

30. ASIA- PACIFIC GLOBAL LOGISTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

31. ASIA- PACIFIC GLOBAL LOGISTICS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

32. ASIA- PACIFIC GLOBAL LOGISTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

33. ASIA- PACIFIC GLOBAL LOGISTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

34. REST OF THE WORLD GLOBAL LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

35. REST OF THE WORLD GLOBAL LOGISTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

36. REST OF THE WORLD GLOBAL LOGISTICS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2023-2031 ($ MILLION)

37. REST OF THE WORLD GLOBAL LOGISTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

38. REST OF THE WORLD GLOBAL LOGISTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL LOGISTICS MARKET RESEARCH AND ANALYSIS BY MODE OF TRANSPORT, 2023 VS 2031 (%)

2. GLOBAL RAILWAYS LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL AIRWAYSLOGISTICS MARKETMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL ROADWAYS LOGISTICS MARKET MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL WATERWAYSLOGISTICS MARKET MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

6. GLOBAL LOGISTICS MARKET RESEARCH AND ANALYSIS BY END USE, 2023 VS 2031 (%)

7. GLOBAL LOGISTICS FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL LOGISTICS FOR MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBAL LOGISTICS FOR AEROSPACE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. GLOBAL LOGISTICS FOR GOVERNMENT AND PUBLIC UTILITIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. GLOBAL LOGISTICS FOR RETAIL AND ECOMMERCE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

12. GLOBAL LOGISTICS FOR TRADE AND TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

13. GLOBAL LOGISTICS FOR TRADE AND TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

14. GLOBAL LOGISTICS FOR OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

15. GLOBAL LOGISTICS MARKET RESEARCH AND ANALYSIS BY MODEL, 2023 VS 2031 (%)

16. GLOBAL 1PL LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

17. GLOBAL 2PL LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

18. GLOBAL 3PL LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

19. GLOBAL 4PL LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

20. GLOBAL LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

21. US LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

22. CANADA LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

23. UK L LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

24. FRANCE LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

25. GERMANY LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

26. ITALY LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

27. SPAIN LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF EUROPE LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

29. INDIA LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

30. CHINA LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

31. JAPAN LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

32. SOUTH KOREA LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

33. REST OF ASIA-PACIFIC LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

34. LATIN AMERICA LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)

35. THE MIDDLE EAST & AFRICA LOGISTICS MARKET SIZE, 2023-2031 ($ MILLION)