Medical Tubing Market

Medical Tubing Market Size, Share & Trends Analysis Report by Material (Plastics, Rubbers, Specialty Polymers, Silicone, and Polyolefins), and by Application (Bulk Disposable Tubing, Catheters, and Cannulas, Drug Delivery Systems, and Other Applications) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Medical tubing market is anticipated to grow at a CAGR of 8.5% during the forecast period. The rise in product launchs of medical tubes manufacturing companies across the globe is the major factor driving the growth of the market. For instance, in November 2021, Freudenberg Medical Europe GmbH launched PharmaFocus, a premium silicone tubing manufacturer for biopharmaceutical fluid processing. The product is designed for single-use pharmaceutical and bioprocessing applications. Additionally, custom tubing is also available for oxygen concentrators, ventilators, catheters, and other medical devices.

Additionally, in April 2022, Nordson Corp. launched 80 Durometer, a polyurethane medical tube manufacturer. The product is extruded from Lubrizol’s compound Pellethane PUR80A-MED, which has passed USP Class VI testing. The tube is highly resistant to abrasion and scuffing, which is accepted as a premium material for medical device use due to its flexible nature and easy stabilizability.

Segmental Outlook

The global medical tubing market is segmented based on material and application. Based on the material, the market is bifurcated into plastics, rubbers, specialty polymers, silicone, and polyolefins. Based on the application, the market is sub-segmented into bulk disposable tubing, catheters and cannulas, drug delivery systems, and other applications. Among these, the bulk disposable tubing segment is expected to hold a considerable share of the market due to the need developing healthcare infrastructure, infection prevention, and need for increased efficiency drive the bulk disposable tubing segment.

Among these, the silicone segment is expected to hold a considerable share of the market due to the changing medical requirements which are pushing manufacturers to produce silicon-based medical tubes allowing them to fulfil the demand of medical industries. In addition, to meet the demands, the key players are also expanding their manufacturing departments to increase the capacity of production. For instance, in January 2019, Tekni-Plex, Inc. installed an additional silicone tubing extrusion line in its Suzhou, China manufacturing facility to increase the capacity of production. The silicone tube provides a diameter of 0.2-25 mm (0.0079-0.984 inches), with wall thicknesses ranging from 0.10-3.0 mm (0.0039-0.118 inches), and tolerances as low as +/- 0.03 mm (0.001 inches). The product is formed to serve a range of medical pump applications, including peristaltic and patient-controlled analgesia (PCA) pumps.

Regional Outlooks

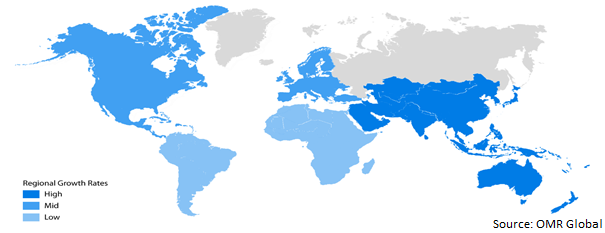

The global medical tubing market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. The North American region is expected to hold a prominent share in the medical tubing market during the forecast period, owing to the increasing demand for minimally invasive medical procedures in the region.

Global Medical Tubing Market Growth, by Region 2022-2028

The North American Region is Expected to Hold a Prominent Share in the Global Medical Tubing Market

Among all regions, the North American region is expected to hold a prominent market share during the forecast period. The strong presence of medical tubing market players such as Asahi Tec Corp., Freudenberg Medical Europe GmbH, and others is accelerating the growth of the medical tubing market. Key players are launching new products in the market to stay competitive in the market. For instance, in May 2022, Freudenberg Medical Europe GmbH launched HelixFlex, a high-purity thermoplastic elastomer TPE tubing. It is specially designed for use in pharmaceutical and biopharmaceutical applications. The newly-launched product is welded as per the existing tubing lines and heat-sealed to allow for easy, fast and safe fluid handling, transport, and transfer in biopharma processes. It also can be used in peristaltic pumping applications.

Market Players Outlook

The major companies serving the global medical tubing market include Asahi Tec Corp., Freudenberg Medical Europe GmbH, Hitachi Cable America Inc., Spectrum Plastics Group, TE Connectivity Corp., Teknor Apex Company, Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in June 2020, -Nordson Corp. acquired Fluortek, Inc., a provider of custom dimensioned tubing to the medical device industry. Through this acquisition, the company enhanced its ability to deliver critical components to consumers. It also supports in expanding its footprints and business.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global medical tubing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Medical Tubing Market by Material

4.1.1. Plastics

4.1.2. Rubbers

4.1.3. Speciality Polymers

4.1.4. Silicone

4.1.5. Polyolefins

4.2. Global Medical Tubing Market by Application

4.2.1. Bulk Disposable Tubing

4.2.2. Catheters and Cannulas

4.2.3. Drug Delivery Systems

4.2.4. Other Applications (Peristaltic Pump Tubing,Feeding Tubes, Urological Retrieval Devices)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Asahi Tec Corp.

6.2. ATAG SpA

6.3. Avient Corp

6.4. Elkem ASA

6.5. Freudenberg Medical Europe GmbH

6.6. Hitachi Cable America Inc.

6.7. Lubrizol Corp.

6.8. MDC Industries

6.9. NewAge Industries, Inc.

6.10. Nordson Corp.

6.11. Optinova

6.12. RAUMEDIC AG

6.13. Saint-Gobain Group

6.14. Spectrum Plastics Group

6.15. TE Connectivity Corp.

6.16. Teknor Apex Company, Inc.,

6.17. The Dow Chemical Co.

6.18. Vanguard Products Corp.

6.19. W. L. Gore & Associates, Inc.

6.20. ZARYS International Group

1. GLOBAL MEDICAL TUBING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2021-2028 ($ MILLION)

2. GLOBAL PLASTICS MEDICAL TUBING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL RUBBERS MEDICAL TUBING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL SPECIALTY POLYMERS MEDICAL TUBING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL SILICONE MEDICAL TUBING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL POLYOLEFINS MEDICAL TUBING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL MEDICAL TUBING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

8. GLOBAL BULK DISPOSABLE TUBING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL CATHETERS AND CANNULAS MEDICAL TUBING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL MEDICAL TUBING FOR DRUG DELIVERY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL MEDICAL TUBING FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL MEDICAL TUBING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. NORTH AMERICAN MEDICAL TUBING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. NORTH AMERICAN MEDICAL TUBING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2021-2028 ($ MILLION)

15. NORTH AMERICAN MEDICAL TUBING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

16. EUROPEAN MEDICAL TUBING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. EUROPEAN MEDICAL TUBING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2021-2028 ($ MILLION)

18. EUROPEAN MEDICAL TUBING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC MEDICAL TUBING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC MEDICAL TUBING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC MEDICAL TUBING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

22. REST OF THE WORLD MEDICAL TUBING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

23. REST OF THE WORLD MEDICAL TUBING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2021-2028 ($ MILLION)

24. REST OF THE WORLD MEDICAL TUBING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. GLOBAL MEDICAL TUBING MARKET SHARE BY MATERIAL, 2021 VS 2028 (%)

2. GLOBAL PLASTICS MEDICAL TUBING MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL RUBBERS MEDICAL TUBING MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL SPECIALTY POLYMERS MEDICAL TUBING MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL SILICONE MEDICAL TUBING MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL POLYOLEFINS MEDICAL TUBING MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL MEDICAL TUBING MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

8. GLOBAL BULK DISPOSABLE TUBING MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL CATHETERS AND CANNULAS MEDICAL TUBING MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL MEDICAL TUBING FOR DRUG DELIVERY SYSTEMS MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL MEDICAL TUBING FOR OTHER APPLICATIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL MEDICAL TUBING MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. US MEDICAL TUBING MARKET SIZE, 2021-2028 ($ MILLION)

14. CANADA MEDICAL TUBING MARKET SIZE, 2021-2028 ($ MILLION)

15. UK MEDICAL TUBING MARKET SIZE, 2021-2028 ($ MILLION)

16. FRANCE MEDICAL TUBING MARKET SIZE, 2021-2028 ($ MILLION)

17. GERMANY MEDICAL TUBING MARKET SIZE, 2021-2028 ($ MILLION)

18. ITALY MEDICAL TUBING MARKET SIZE, 2021-2028 ($ MILLION)

19. SPAIN MEDICAL TUBING MARKET SIZE, 2021-2028 ($ MILLION)

20. REST OF EUROPE MEDICAL TUBING MARKET SIZE, 2021-2028 ($ MILLION)

21. INDIA MEDICAL TUBING MARKET SIZE, 2021-2028 ($ MILLION)

22. CHINA MEDICAL TUBING MARKET SIZE, 2021-2028 ($ MILLION)

23. JAPAN MEDICAL TUBING MARKET SIZE, 2021-2028 ($ MILLION)

24. SOUTH KOREA MEDICAL TUBING MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF ASIA-PACIFIC MEDICAL TUBING MARKET SIZE, 2021-2028 ($ MILLION)

26. REST OF THE WORLD MEDICAL TUBING MARKET SIZE, 2021-2028 ($ MILLION)